dk1234/iStock via Getty Images

Japan has been a complicated geography, and the Bank of Japan has refused to raise rates. The Yen is a mess and will probably stay that way, and while financial companies are rocketing in other geographies, Mizuho Financial Group (NYSE:MFG) has more challenges than most. With its smaller transaction-related businesses suffering and it scrambling to grow loan balances to combat low rates in Japan, it has relied on trading-related income and derivatives fees to keep things going. While volatility is somewhat MFG’s friend, we’d stay away from MFG compared to other full-service banks.

Look at MFG

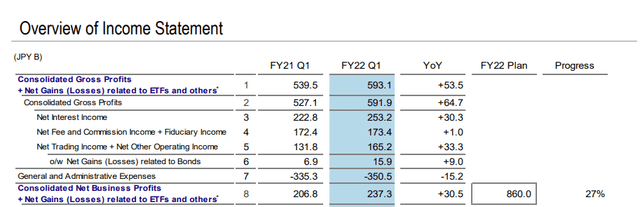

Let’s have a quick look at their statements.

Growth has been pretty good on the surface, but where exactly is it coming from?

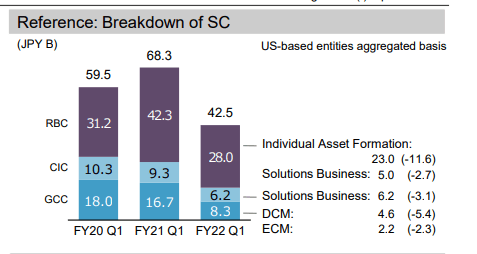

Plenty of businesses are in decline. DCM and ECM, as well as other IB-related businesses – advisory, in general, is suffering a lot.

IB, ECM, DCM (Q1 2022 MFG)

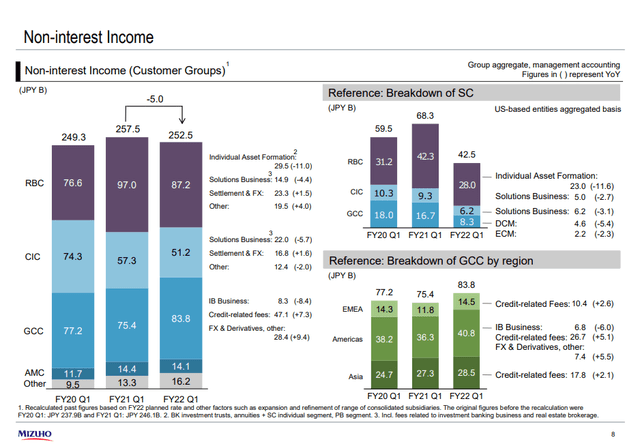

The non-interest income has not risen much in general, including these advisory-related businesses, on account of lowered economic excitement affecting fee and commission-related income streams.

Fee and other Income (Q1 2022 Pres)

The pockets of strength have been in the countercyclical markets, trading businesses exposed to derivatives, hedges and structured products for trading. The businesses in decline were often those with dollar-denominated markets, with a lot of the wallet share of those businesses being in the US. Not ideal when USD flows have become relatively valuable.

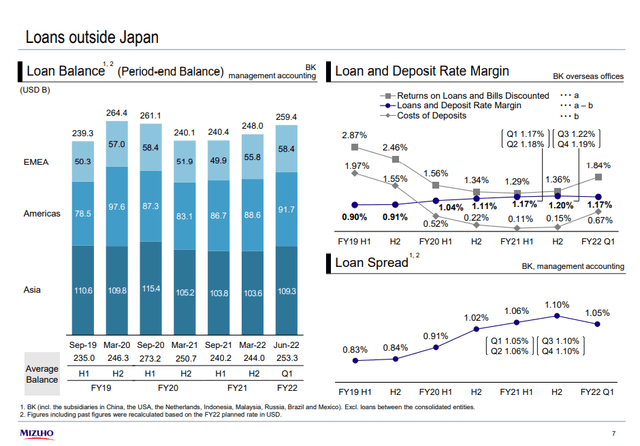

Otherwise, traditional banking-related businesses have been supported by stronger loan balances and in better markets from an FX point of view, with portfolio expansion in Europe and the US as well as other parts of Asia.

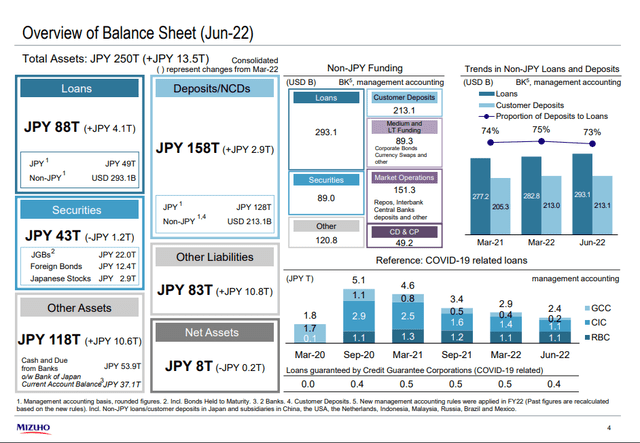

At this point, with the BoJ being one of the very few monetary authorities still committed to easing, and with a demographic situation that actually requires it as opposed to the rest of Asia, any currency other than the Yen is preferable. Still, almost half of the loans are held in Yen to Japanese customers, and in general, those portfolios suffer from the foreign investor’s point of view in both FX and net interest margin terms. It doesn’t help that on the asset side, the company is invested substantially in Japanese government bonds which yield almost nothing, negative in real terms, and have major FX risks.

At least, there is a matching between Yen exposures in the assets versus the liabilities. So net worth won’t be directly hurt by an FX gap. This is essential.

Balance Sheet Highlights (Q1 2022 Pres)

Remarks

MFG trades pretty cheaply, most likely because investors know not to get involved in something that may have a problem with the Yen. The discount to full-service banks in the US is about 25%. Since there’s at least a limited FX gap if any at all, the discount must come from a combination of demographic pessimism, which is justified in Japan, and concerns around the international value of Yen-based businesses. The Yen has fallen 20% from the beginning of the rate-hike regime and could fall a lot further since the US might be only halfway through its rate hikes, with Japan going nowhere. It’s hard to say exactly where fair value is, but a 25% discount seems rather reasonable given that uncertainty. Another 20% decline in Yen-based businesses is possible on FX effects, and it accounts for around 50% of MFG revenue. The rest of the discount could easily come from a longstanding demographic concern. Overall, no reason to hazard money here.

Be the first to comment