BING-JHEN HONG

Easy Growth Is Over As Iron Ore Prices Peak

Mitsui & Co. (OTCPK:MITSY, OTCPK:MITSF) had unusually strong earnings in FY 2022 thanks to the commodity-heavy Mineral and Metal Resources and Energy segments that make up more than half the company’s earnings. The prices of a few commodities including iron ore, gas, oil, and coal are big drivers of Mitsui’s results and outlook. Prior to FY 2022, the company had stagnant growth, even before the pandemic. In the current fiscal year ending 3/31/2023, the company expects to earn less, mainly due to lower iron ore prices.

| Fiscal Year | Profit | Profit | Dividend | Dividend |

| Ending 3/31 | ¥ million | Growth | ¥ per share | Growth |

| 2018 | 418,479 | 70 | ||

| 2019 | 414,215 | -1.0% | 80 | 14.3% |

| 2020 | 391,513 | -5.5% | 80 | 0.0% |

| 2021 | 335,458 | -14.3% | 85 | 6.3% |

| 2022 | 914,722 | 172.7% | 105 | 23.5% |

| 2023 (fcst.) | 800,000 | -12.5% | 120 | 14.3% |

Data Source: Mitsui & Co. Financial Results

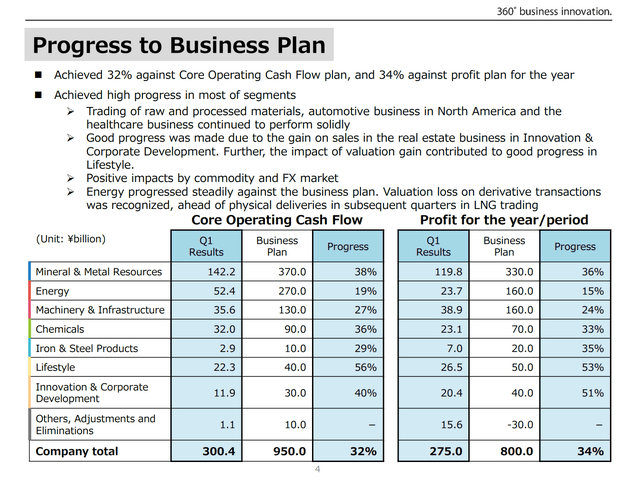

In their 1Q 2023 results released on 8/2/22, Mitsui did not revise the earnings or dividend forecast for the year even though the company has already delivered about one third of the overall full year plan after just one quarter.

Mitsui 1Q 2023 Earnings Slides

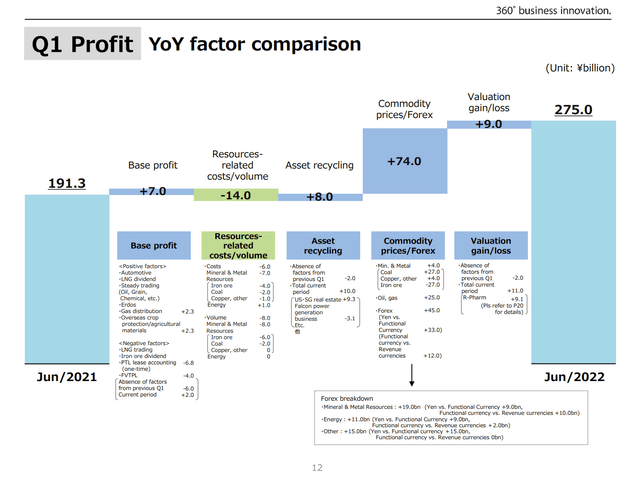

Iron ore was a major tailwind in 2022 but is now a headwind. This was completely offset by much stronger coal prices, which in 1Q were almost double the FY 2022 prices for coking coal and more than triple for thermal coal. Although Mitsui does not disclose their price forecast for these commodities, Trading Economics forecasts continued weakness in iron ore and strength in coal. Higher oil prices also benefitted the company this quarter.

The biggest positive however was the weak yen which makes earnings look better when translated from stronger foreign currencies. Out of the ¥83.7 billion year-on-year earnings improvement in 1Q, oil and gas prices contributed ¥25 billion and foreign exchange contributed ¥45 billion. Unfortunately for foreign shareholders, their share prices and dividends look smaller when translated from a weaker yen into their currency.

Mitsui 1Q 2023 Earnings Slides

Outside of these big factors, Mitsui performed well in trading of grains and agricultural chemicals, although this was offset by higher costs across the company.

Looking forward, the Russia-Ukraine conflict can keep coal, oil, and gas prices high even if they are now a little off their peak values. As long as iron ore does not crash too far on weak demand from China, Mitsui should continue to deliver quarterly profits similar to 1Q. This would lead to an upward revision of the forecast and dividend in the second half of the fiscal year, but nothing like the repeated raises we saw in FY 2022.

While the low P/E anticipates weak commodity prices, Mitsui is still cheap relative to peers. The company has used the past year of strong profitability to get its balance sheet in order and enable it to get through a weaker commodity environment with its attractive dividend intact.

Valuation And Capital Management

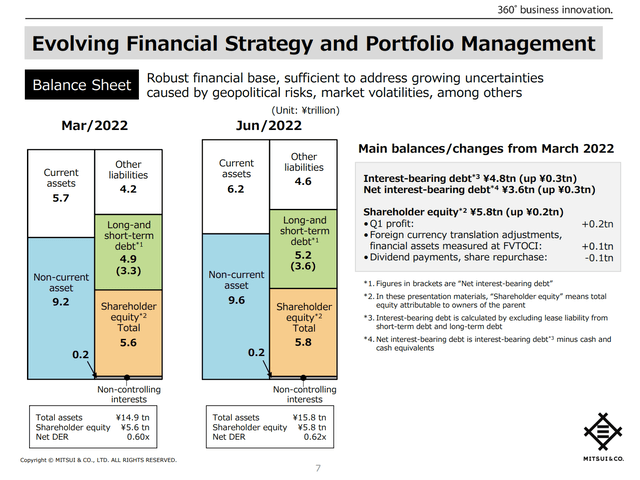

Mitsui’s profit forecast of ¥800 billion is equal to ¥503.79 per ordinary share, up from ¥499.71 at the start of the year due to buybacks. The P/E is down to 5.8 based on the ¥2905.2 closing price in Tokyo on the earnings report date. Book value growth has slowed considerably with shareholder’s equity increasing just 3% in the quarter to ¥5,771 billion or ¥3641.13 per share. It is important to note however that book value was impacted by a write-down of the Sakhalin II Russian LNG project. The current P/B ratio is now 0.80. This remains the second cheapest of the trading companies. Return on equity is still in the middle of the pack, beating Mitsubishi (OTCPK:MSBHF) and Sumitomo (OTCPK:SSUMF) (OTCPK:SSUMY) but less than Itochu (OTCPK:ITOCY) (OTCPK:ITOCF) and Marubeni (OTCPK:MARUF) (OTCPK:MARUY).

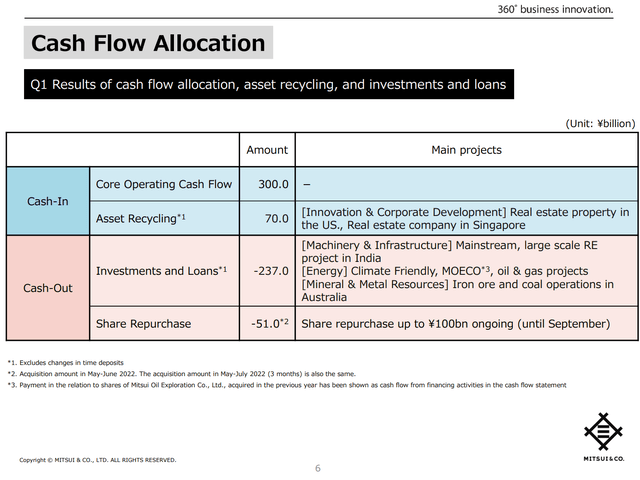

Mitsui left its dividend plan unchanged at ¥120 per share in FY 2023, split in two semiannual payments of ¥60. This is a dividend yield of 4.1%. The company is about halfway through its announced buyback program of ¥100 billion through September 2022 and will cancel the treasury shares this month. The dividend represents a conservative payout ratio of just 23.8%. Planned dividends and buybacks are still below Mitsui’s medium-term plan to return about 33% of the core operating cash flow to shareholders.

Dividends for the full year should be around ¥192 billion, so dividends plus buybacks of ¥292 billion are less than one third of Mitsui’s plan of ¥950 billion core operating cash flow. Even if economic conditions deteriorate in future years, Mitsui should be able to maintain its dividend by first reducing buybacks, then by temporarily exceeding the 33% payout if needed.

Mitsui’s balance sheet did not change much this quarter with equity increasing by only ¥200 billion thanks in part to the Sakhalin write-down. Debt increased around ¥300 billion, so the debt/equity ratio has stopped its recent downtrend but remains low at 0.62, up slightly from 0.60 at the start of the fiscal year.

Mitsui 1Q 2023 Earnings Slides

Mitsui had core operating cash flow of ¥300 billion in 1Q 2023 which is 32% of the plan of ¥950 billion. The company also raised cash through real estate sales in the U.S. and Singapore. This cash covered all investments, capex, and buybacks with ¥82 billion left over toward the next semi-annual dividend.

Mitsui 1Q 2023 Earnings Slides

Longer-Term Risks

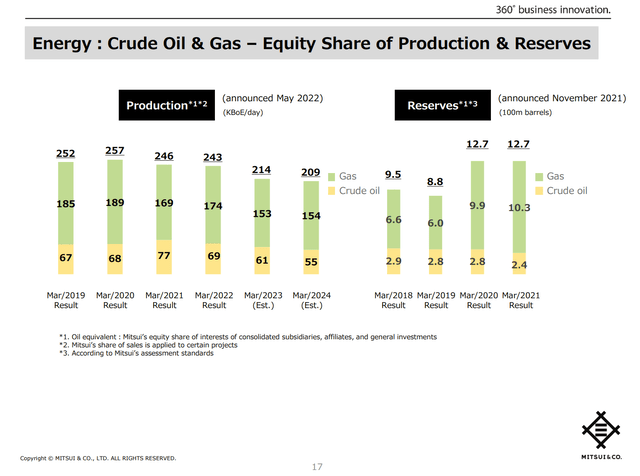

Mitsui has bought heavily into the Environmental branch of ESG with ¥130 billion of investments this quarter into renewable energy and carbon credit projects. This includes a 27.5% stake in the European renewable power company Mainstream, a renewable energy project in India, and Australian “carbon farming” company Climate Friendly. Individuals may decide for themselves if this is a wise, forward-looking pivot to a greener world or an expensive boondoggle. In any case, returns from these investments are likely to be low in the near to medium-term. At the same time, the company’s production of oil and gas has fallen over the past few years, suggesting under-investment in a still-needed resource.

Mitsui 1Q 2022 Earnings Slides

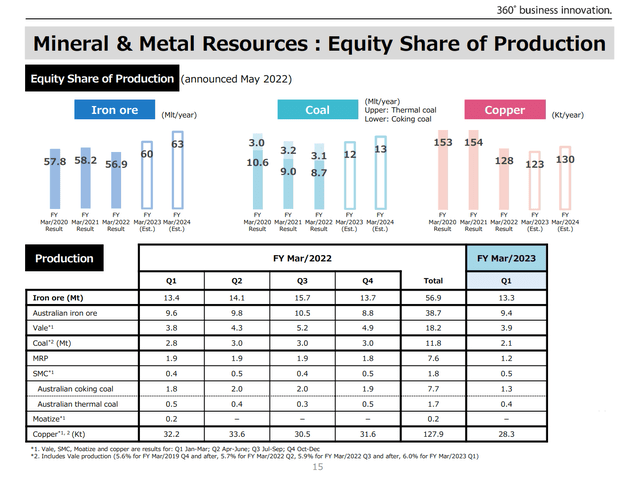

Coal production has also declined 3 years in a row from 13.6 million tonnes in FY 2020 to 11.8 in FY 2022. Volumes are estimates to return to 13 million in FY 2024 but that seems unlikely with 1Q 2023 actual production coming in at 2.1 million tonnes, down from 2.8 last year.

Mitsui 1Q 2022 Earnings Slides

Conclusion

After record results in FY 2022, Mitsui’s growth has slowed as commodity prices are hitting a peak. Nevertheless, the company’s low P/E of 5.8 more than accounts for the commodity outlook. Mitsui is also cheap relative to peers despite a strong balance sheet and well-covered 4.1% dividend. While there was no profit or dividend forecast raise with this quarter’s results, one is still possible if commodity prices do not drop too much further this year.

Longer term, Mitsui’s increasing interest in renewable energy has an uncertain payout at the expense of declining production volumes of fossil fuels. This may ultimately be good for society but creates uncertainty in valuing the stock. However, Mitsui has a low payout ratio of 23.8% and the ability to preserve the dividend in hard times by reducing buybacks. Mitsui remains a good pick for income investors who can deal with share price volatility caused by commodity markets.

Be the first to comment