koto_feja/E+ via Getty Images

When you sell in desperation, you always sell cheap. – Peter Lynch

When you invest in biotech, make sure you have the ultra long view. That way, you can follow a young biotech company from the preclinical stage to commercialization. As you know, the most potential upside comes from early investment at the preclinical stage. Notwithstanding, if the company continues to grow and thereby deliver a blockbuster, you can still gain several more folds (provided that you hold the stock for many years).

Despite the bear market, Mirati Therapeutics (NASDAQ:MRTX) has delivered multiple fold appreciations for shareholders. Now, if its lead medicine (adagrasib) gains FDA approval this year, Mirati would transition into a commercialized stage operator to deliver more upside. In this research, I’ll feature a fundamental analysis of Mirati and share my expectation of this interesting growth equity.

Figure 1: Mirati stock chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Operating out of San Diego California, Mirati is focused on the innovation and commercialization of smart medicines to serve the unmet needs in various cancers. In capturing lightning in a bottle, Mirati harnesses the power of precision medicine to deliver novel cancer treatments that specifically fit the patient’s genomic profiles.

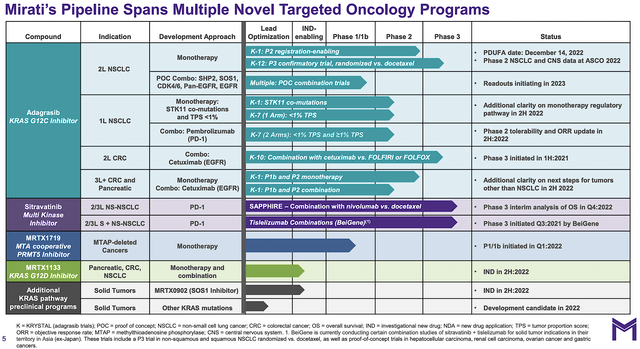

From the figure below, you can see that Mirati is brewing multiple potential blockbusters for various cancer indications. The crown jewels of this pipeline is adagrasib (i.e. Ada). That aside, you sitravatinib (i.e., Sitra) and other earlier stage molecules such as MRTX1719 and MRTX1133 can power long term growth.

Figure 2: Therapeutics pipeline

Oncology Focus

As you can appreciate, Mirati is highly focused on cancer. I like it when a company dedicates its efforts to a particular niche. For Mirati, the company is poised to deliver the answers for various cancer indications. As you can imagine, specialization confers deep expertise, thus increasing the chances of successful innovation.

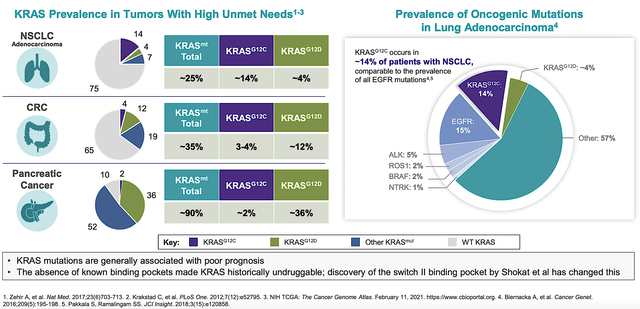

For instance, a carpenter who is keen on woodworking would deliver great furniture. The same applies to a company that specializes in oncology to have the “know-hows” to succeed in making cancer drugs. From the figure below, you can see that the oncology and KRAS mutational focus give Mirati an edge on this development.

By dedicating its efforts to KRAS innovation, Mirati can capture a significant market shares in this niche. After all, many cancers like NSCLC, CRC, and pancreatic cancer have the KRAS mutation. Furthermore, the uniqueness of KRAS gives Mirati product differentiation from other drugs like the immune-checkpoint inhibitors.

Figure 3: Cancers with KRAS mutation

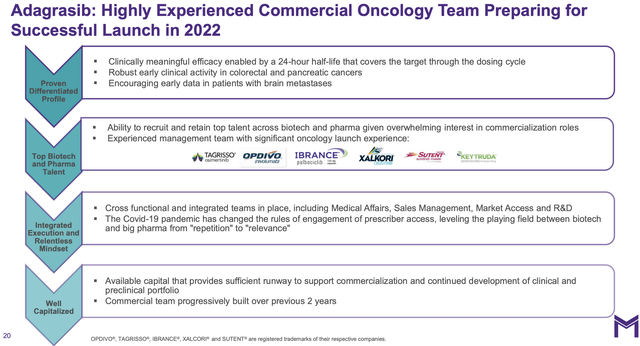

Adagrasib Upcoming Launch

As you know, Ada’s development is crucial to Mirati’s success. On that note, let us take a closer look at this drug’s latest development. Now, the first big milestone is the US FDA acceptance of Ada’s New Drug Application (i.e., NDA) for patients afflicted by NSCLC with the KRAS-G12C mutation back in February this year. Keep in mind, these patients already received at least one prior systemic therapy. Under accelerated review, the agency set the Prescription Drug User Fee Action (i.e., PDUFA) for December 14, 2022.

Interestingly, the application is being assessed using the FDA Real time Oncology Review (RTOR) pilot program. I bring this up, as this program is being tested to see if it can deliver breakthrough drugs to patients more promptly. Due to RTOR, you can expect it to expedite the process while lowering the approval hurdle.

Asides from positioning itself to capture the US market, Mirati announced that the company has already submitted the Marketing Authorization Application (i.e., MAA) for Ada’s same indication with the European Medicine Agency (i.e., EMA) on May 19. Commenting on the upcoming regulatory milestone, the President and Founder (Dr. Charles Baum) remarked,

The submission of our application to the EMA is a significant milestone for Mirati and brings us closer to expanding the potential availability of Adagrasib to patients with KRAS-G12C mutated lung cancer in the European Union, if approved. Therapeutic options for KRAS-G12C-mutated lung cancer are limited, and this submission is an important step forward in our goal to deliver innovative, differentiated therapies in areas of high unmet need. We look forward to working with the EMA to potentially bring this therapy to patients. We also thank the patients and investigators who make our work possible by participating in clinical trials.

Leveraging my Integrated System of Forecasting, I ascribed a 65% (i.e., more than favorable chance) of approval in both the EU and US. I based my forecasting on available data, decades of forecasting experience, and my intuition. Don’t be alarmed by my 65% because my forecasting is categorical data rather than numerical. If you must view it numerically, my 65% would equates to 85%.

Figure 4: Ada’s upcoming launch

Regarding supporting data, Mirati is eager to present the strong clinical results of the Phase 2 KRYSTAL-1 trial at the American Clinical Oncology (i.e., ASCO) Annual Meeting on June 3rd. Again, most of these patients (i.e., 98%) suffering from NSCLC already had one immune checkpoint inhibitor (i.e., a PD-1/L1) treatment. That means they are quite sick.

As testaments to Ada’s power, the drug delivered the 43% objective response rate (i.e., ORR), 8.5 months duration of response, 6.5 months progression-free survival (i.e., PFS), and 12.6 months overall survival (i.e., OS). In addition to the excellent outcomes, Ada was overall well-tolerated.

Other Pipeline Progress

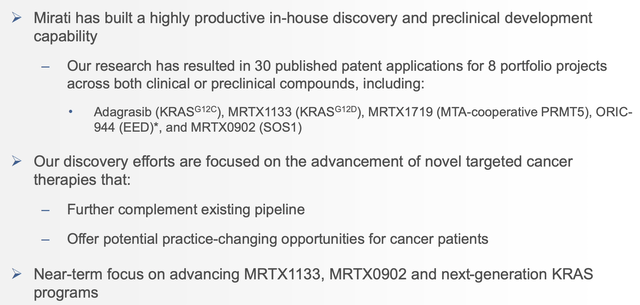

In boosting additional growth, Mirati is advancing a vast number of pipeline molecules. This approach is prudent because the next-generation KRAS-programs (i.e., MRTX1133) would power growth beyond Ada. Then, other drugs that would hit additional cancer targets like the multi-kinase inhibitor or the MTA-cooperative PRMT5 inhibitor (MRTX1719) would drive long-term growth. Commenting on the latest development, the CEO (David Meek) said,

Mirati continues to make significant progress across our pipeline, as we focus on executing our ambitious goals. This includes working toward our first potential commercial launch in the U.S. this year with Ada for the treatment of patients with previously-treated KRAS-G12C-mutated lung cancer and advancing the adagrasib program in earlier lines of therapy and across additional tumors. In addition, we completed enrollment of our Phase 3 trial evaluating sitravatinib in advanced lung cancer, continue to enroll patients in an ongoing Phase 1 study with our MTA cooperative PRMT5 inhibitor, MRTX1719, and continue to advance our novel preclinical programs. These milestones, combined with our strong financial position enable us to continue to invest in the advancement of our broad targeted oncology portfolio and prepare to become a successful commercial stage company.

Figure 5: Mirati’s long-term growth

Competitor Landscape

Regarding competition, Mirati competes with established and emerging cancer drug innovators. The “bread-and-butter” drugs are the chemotherapy, radiation therapy, and the immune-checkpoint inhibitors. That aside, the stronger competitors are the novel cellular therapies like CAR-T, CAR-NK, and CAR-macrophage. Despite the wide availability of cancer drugs, I believe that KRAS inhibitors are powerful medicines that would have their own place in the oncology space. Moreover, there is always a strong demand for novel cancer treatment.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 1Q2022 earnings report for the period that ended on March 31.

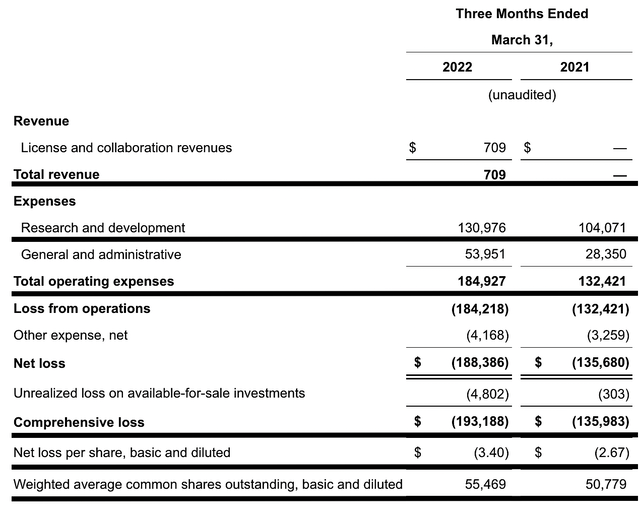

Like other developmental-stage biotech, the revenue for Mirati is insignificant. Here, there’s only $709K licensing and collaboration revenue. As the company launches Ada, this metric would then be meaningful. On that note, let us assess other meaningful metrics.

That being said, the research and development (R&D) registered at $130.9M compared to $104.0M for the same quarter last year. I viewed the 25.8% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $193.1M ($3.40 per share) net losses compared to $135.6M ($2.67 per share) net declines for the same comparison. On a per-share basis, the bottom line depreciated by 27.3%. As you can see, the wider bottom line depreciation is related to the increased R&D investment.

Figure 6: Key financial metrics

About the balance sheet, there were $1.3B in cash, equivalents, and investments. Against the $184.9M quarterly OpEx, there should be adequate capital to fund operations into 4Q2024. Simply put, the cash position is extremely robust relative to the burn rate.

While on the balance sheet, you should check to see if Mirati is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 50.7M to 55.4M, my math reveals the 9.2% annual dilution. At this rate, Mirati easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Mirati to determine how much your shares are truly worth. Before running our figure, I’d like to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 55.4M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Adagrasib |

$8B (estimated from the $180.1B global cancer market by 2030) |

$2B |

$360.10 |

$252.07 (30% discount because Ada is pending on approval in both the EU and USA) |

|

Sitravatinib |

$1B estimate (lower estimate because it is used for later lines rather than first line) | $250M | $45.12 | $27.02 (40% discount because Sitra is awaiting its Phase 3 results in 4Q2022) |

|

Younger pipeline assets |

Will wait for more development |

N/A |

N/A |

N/A |

|

The Sum of The Parts |

$279.09 |

Figure 7: Valuation Analysis

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Mirati is if Ada and Sitra will continue to generate positive data for various oncology franchises. More importantly, the other risk is if Ada can gain the upcoming FDA approval by yearend 2022. Given that the company used Phase 2 trial data for marketing application, it’s risky yet a bold move. Relying on the Phase 2 trial data for approval means that the management is highly confident of its drug. And yet, the FDA might request Phase 3 outcomes.

As I ascribed the 65% (more than favorable) chance of success, I gave a 35% corresponding chance of clinical failure. Furthermore, there is a risk that the younger pipeline assets might not generate positive results. As a young and aggressive growth company, Mirati might grow too aggressively and thereby runs into a potential cash flow constraint.

Conclusion

In all, I recommend Mirati as a buy with a 4.1/5 stars rating. In all, Mirati Therapeutics is a successful biotech investment story. This is a classic growth stock powered by the crown jewel drug, adagrasib. Riding Ada’s robust clinical data and other pipeline developments, Mirati has grown to a $2.2B market cap company. While you can argue that the most aggressive growth is exhausted, there would be more upsides if Ada gains approval in December this year. If so, chances are that the EU approval would follow in 2023. Now, if Ada can prove to become a blockbuster, Mirati would add several more folds to its market cap. Otherwise, the stock would trend down below $500M. Keep in mind, that is my guesstimate based on market observation over the years.

As you know, I stressed the emphasis on Ada, as it has to be successful for Mirati to succeed. Otherwise, other pipeline developments would be meaningless. After all, if Ada can demonstrated to be a success, the stock could appreciate for the company to raise capital to fund other pipeline developments. On this note, while Sitra is not designed to be a first-line drug, it can still add some value to Mirati. Molecules like MRTX1133 can also prove to be an investment bonanza in the long term. But then again, Ada has to prove successful first. And, you’d get to know that by yearend.

Be the first to comment