SrdjanPav/E+ via Getty Images

A Quick Take On MIND C.T.I.

MIND C.T.I. Ltd (NASDAQ:MNDO) reported its Q2 2022 financial results on August 11, 2022, with decreasing revenue and reduced net income.

The company provides a range of billing and customer care software for telecommunications service providers worldwide.

Since management has communicated little of its intentions, other than to pursue M&A opportunities, it is difficult to develop a bullish case for this contracting-revenue company.

I’m on Hold for MNDO for the near term.

MIND C.T.I. Overview

Yoqneam, Israel-based MIND C.T.I. was founded in 1995 to develop software support systems for telecommunications providers of all types.

The firm is headed by founder and Chief Executive Officer Monica Iancu, who was previously Chairperson of the Board until 2012 and is a graduate of Technion – Israel Institute of Technology.

The company’s primary offerings include:

-

Billing

-

Customer care

-

Workflow engine

-

Point of sale

-

Unified communications analytics

-

Call accounting

-

Managed services

The firm acquires customers via its direct sales and market teams and targets all types of communications services providers, including wireline, wireless, cable, IP services and Quad-play carriers.

In the first six months of 2022, MNDO’s customers in Europe accounted for 51% of revenue and customers from the Americas produced 43% of revenue.

MIND C.T.I.’s Market & Competition

According to a recent market research report by Market Research Future, the global market for telecom billing and revenue management is expected to reach $19.7 billion by 2027.

This represents a forecast CAGR of 11.0% from 2022 to 2027.

The main drivers for this expected growth are increased demand for revenue assurance, fraud management and partner & interconnect management requirements.

Also, North America is expected to produce the greatest demand through 2027, followed by the European market, the Asia Pacific region and the MENA/South America combined regions.

Major competitive or other industry participants include:

-

Netcracker

-

CSG Systems International Inc.

-

Oracle

-

Telefonaktiebolaget LM Ericsson

-

Huawei Technologies Co. Ltd.

-

SAP SE

-

Comarch SA

-

Sterlite Technologies Limited

-

Emida

-

Commerx

MIND C.T.I.’s Recent Financial Performance

-

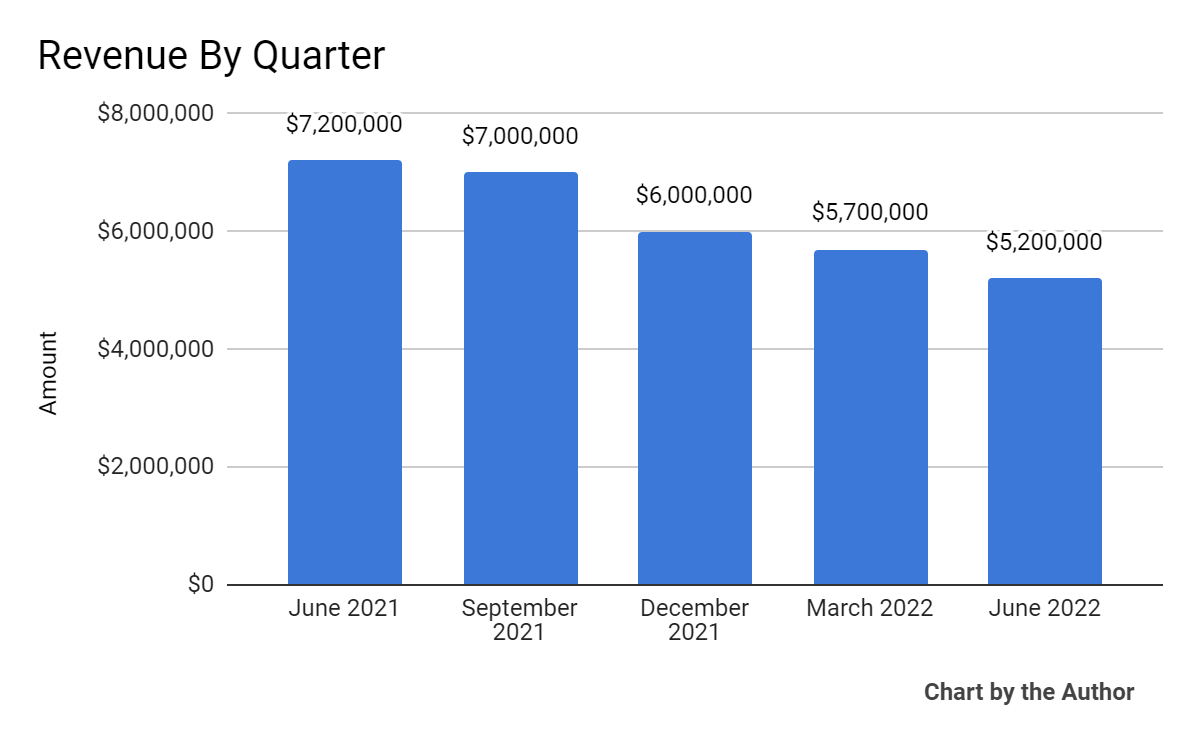

Over the past several quarters, total revenue by quarter has dropped per the chart below:

5 Quarter Total Revenue (Seeking Alpha)

-

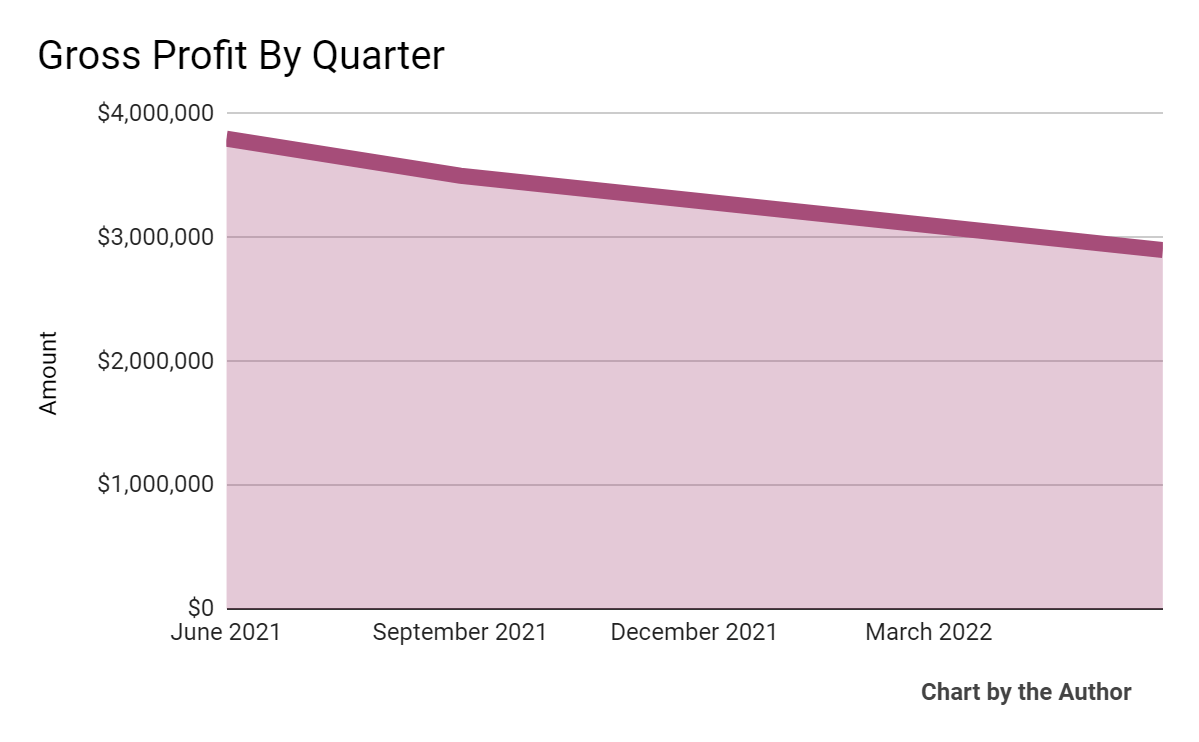

Gross profit by quarter has also fallen materially in the past five quarters:

5 Quarter Gross Profit (Seeking Alpha)

-

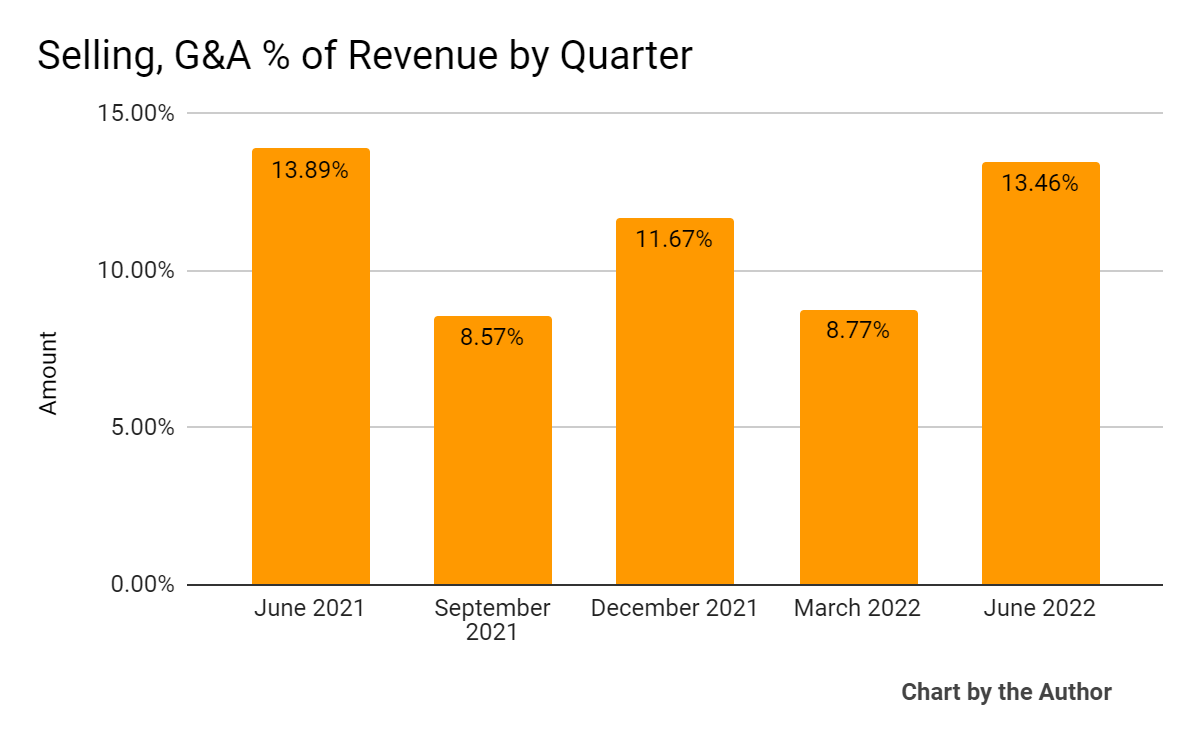

Selling, G&A expenses as a percentage of total revenue by quarter have varied as the chart shows here:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

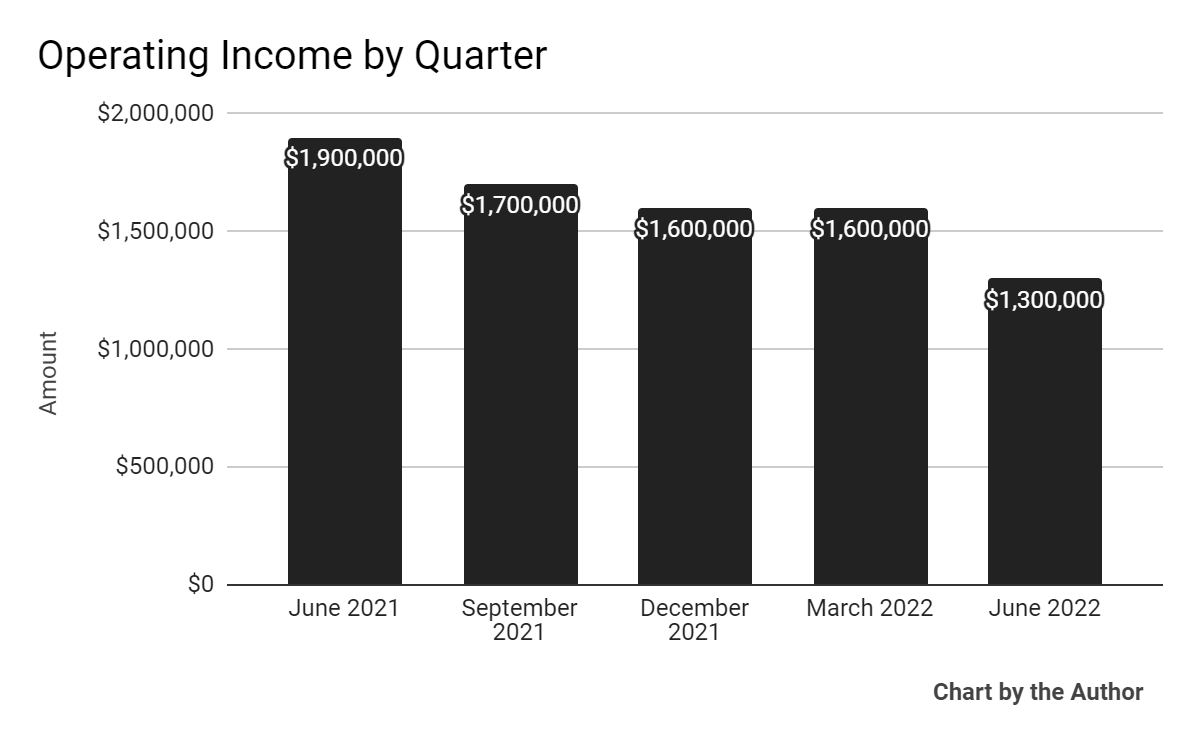

Operating income by quarter has dropped in recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

-

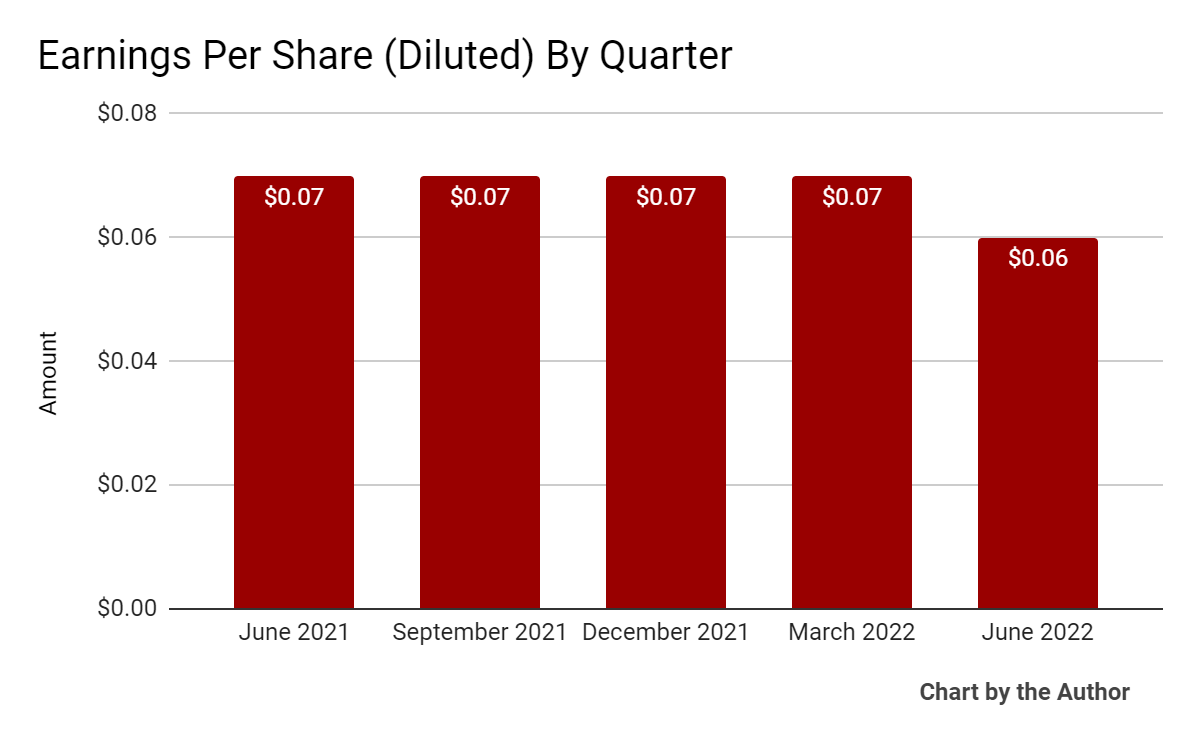

Earnings per share (Diluted) have remained relatively flat to slightly down in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

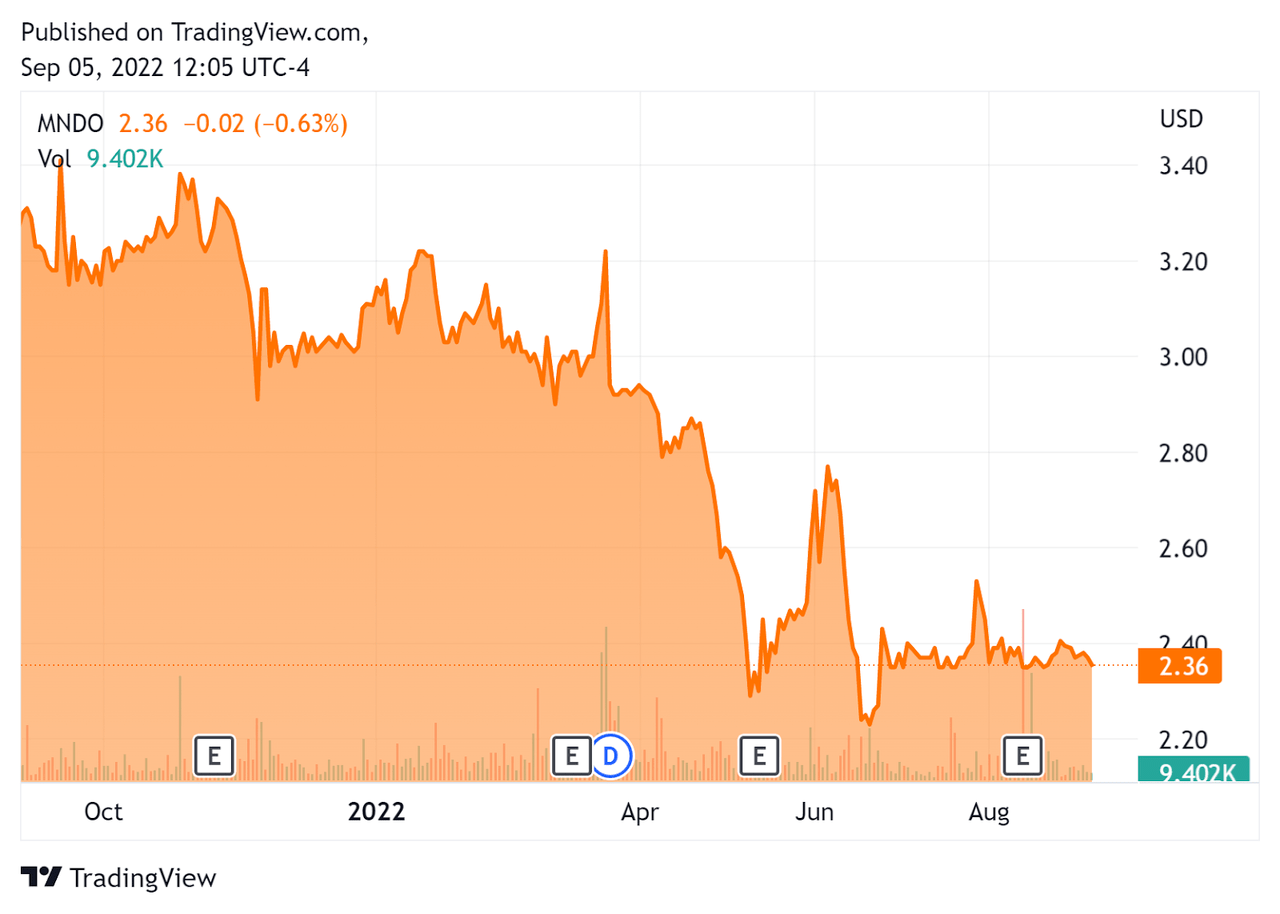

In the past 12 months, MNDO’s stock price has fallen 27.8% vs. the U.S. S&P 500 index’ drop of around 13.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For MIND C.T.I.

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.40 |

|

Revenue Growth Rate |

-4.8% |

|

Net Income Margin |

23.8% |

|

GAAP EBITDA % |

27.1% |

|

Market Capitalization |

$47,350,000 |

|

Enterprise Value |

$33,450,000 |

|

Operating Cash Flow |

$5,180,000 |

|

Earnings Per Share (Fully Diluted) |

$0.27 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be CSG Systems International (CSGS); shown below is a comparison of their primary valuation metrics:

|

Metric |

CSG Systems Int’l |

Mind C.T.I. |

Variance |

|

Net Income Margin |

4.2% |

23.75% |

464.1% |

|

Revenue Growth Rate |

5.1% |

27.1% |

427.3% |

|

Operating Cash Flow |

$84,730,000 |

$5,180,000 |

-93.9% |

|

Enterprise Value / Sales |

2.0 |

1.4 |

-28.6% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

MNDO’s most recent GAAP Rule of 40 calculation was 22.3% as of Q2 2022, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

-4.8% |

|

GAAP EBITDA % |

27.1% |

|

Total |

22.3% |

(Source – Seeking Alpha)

Commentary On MIND C.T.I.

In its last earnings announcement (Source – Seeking Alpha), covering Q2 2022’s results, management noted the significant revenue decrease was in line with expectations, as the previous growth in its messaging segment in 2021 was ‘temporary in nature.’

Also, its billing and related services segment remains challenged and the company lost an important customer of eight years.

The Board declared a $5.2 million cash dividend on March 10, 2022, or $0.26 per share.

As to its financial results, total revenue dropped nearly 28% year-over-year, while operating income also dropped, from $1.9 million in Q2 2021 to $1.3 million.

Operating income continues to trend lower over the past 5 quarters.

For the balance sheet, the firm finished the quarter with $15.1 million in cash, equivalents and short-term investments of $15.1 million.

Over the trailing twelve months, MNDO has generated $5.1 million in free cash flow.

Looking ahead, the firm is focused on a new customer win implementation but management did not provide any forward guidance.

Regarding valuation, the market is valuing MNDO at an EV/Sales multiple of around 1.4x.

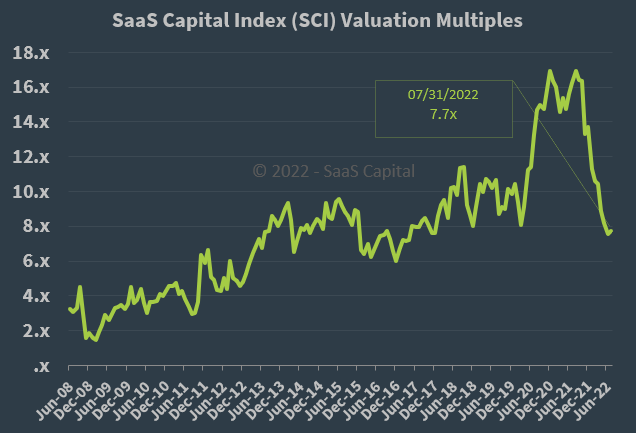

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, MNDO is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of July 31, 2022, although the firm is not strictly a SaaS-only company and operates under various revenue models depending on the customer.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

Notably, as to executive compensation, a recent annual general meeting of stockholders voted to not re-approve the existing compensation policy.

In response, the Board of Directors overruled the shareholder vote to re-approve the compensation policy, upon the recommendation of the compensation committee as being in the company’s best interests.

With the European region appearing to enter a significant economic slowdown and MNDO generating 51% of its revenue from the region, I’m not optimistic about the firm’s growth potential there.

Since management has communicated little of its intentions, other than to pursue M&A opportunities, it is difficult to develop a bullish case for this contracting revenue company.

I’m on Hold for MNDO in the near term.

Be the first to comment