EMILI_VISION/E+ via Getty Images

Intro

Shares of Miller Industries, Inc. (NYSE:NYSE:MLR) (Heavy Duty Towing, Recovery Equipment, etc.) may finally be undergoing a long-overdue bottoming pattern as shares continue to trade well above the stock’s July lows of close to $22 a share. Shares of Miller Industries have lost close to 50% of their value over the past 18 months, meaning value investors will be eyeing up this play, especially when a confirmed bottom is in place. Although Miller’s earnings may not appear that cheap at present, the company’s assets and sales (the very areas that generate earnings) are trading at multiples of 0.96 & 0.36, respectively. Suffice it to say, these multiples look very cheap both compared to Miller’s historic averages as well as the sector in general.

Furthermore, the attractive forward dividend of $0.72 per share, which equates to a dividend yield of 2.95%, adds to the total return potential in this play. Moreover, we see that dividend payments of $8.2 million from a net income tally of $12.4 million equate to a sustainable dividend payout ratio of 66.1%. Although the payout ratio gives the quickest snapshot of whether Miller can continue to pay the dividend (47 quarters and counting…), income-oriented investors need to go deeper to ensure the forward-looking fundamentals of the firm remain on a sound footing.

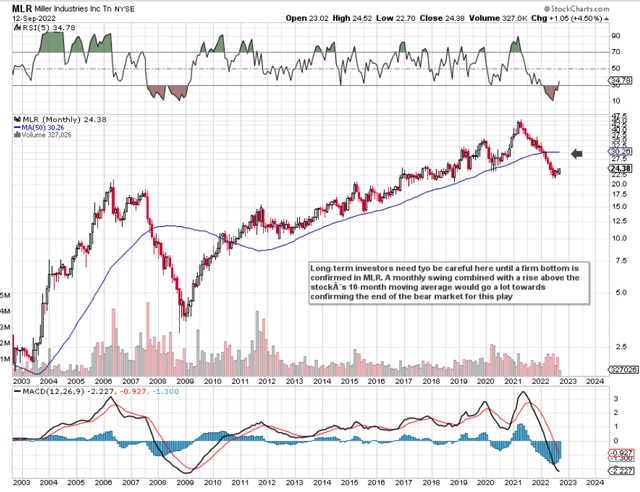

For example, if we look at Miller’s long-term technical chart, we see that the steep downturn in the share price over the past 18 months or so has resulted in shares now trading well below the stock’s 50-month moving average. This is significant in that this is the first time this support level has been breached in a decade. Recent stability, though, may be prompting a bottom, which we see below.

MLR Technical Chart (StockCharts.com)

Margins

Margin trajectory comes in for extra scrutiny in inflationary cycles as the market tries to ascertain how profitability will trend in forthcoming quarters. In Miller’s recent reported second-quarter earnings, the company reported $201.5 million in top-line sales (11%+ year-over-year increase) and a gross profit of $18.4 million. These numbers equate to a gross margin of 9.13%. Although this key metric grew sequentially (7.1% in Q1), it was still well down from the gross margin print of 11.37% in Q2 of fiscal 2021.

Suffice it to say, near-term trends have been promising for Miller, which explains the potential bottoming pattern on the technical chart discussed earlier. Earnings over the first six months of this fiscal year, however, remain well down on fiscal 2021, so it will be interesting to see if it will be more of a consequence of an ultra-low valuation combined with sequential momentum, which will finally make the market begin to price Miller shares higher here.

Furthermore, although supply chain and inflationary headwinds continue to wreak havoc on the costs side, Miller has been increasing the price of its products to compensate. Suffice it to say, it is crucial that customer demand remains strong to ensure those sustained price increases can be absorbed by Miller’s customers. Miller’s net income margin (also having been impacted by higher income expense on the income statement) over a trailing basis now comes in at just over 1.5%. This number has to keep increasing to ensure lower lows do not materialize on the technical chart.

Return On Assets

Miller’s present return on assets comes in at approximately 2.5%, whereas the company’s 5-year average ROA comes in at 7.45%. This in itself demonstrates the potential this company has if indeed its assets can begin to return what they previously did. However, we are living in extraordinary times, and this is particularly evident in how Miller’s balance sheet has changed in recent quarters. The company’s cash balance is down close to $20 million over the four past quarters and both the company’s receivables, as well as inventory, are well up on Q2 in fiscal 2021. In fact, due to working capital requirements, management has been drawing down funds from its credit facility to keep liquidity in check. Management actions demonstrate confidence. Bulls will be hoping the management will end up being right.

Conclusion

Suffice it to say, due to how Miller has continued to invest in itself (which positions Miller to gain significant market share if supply chain conditions improve) through this downcycle, the potential is strong here for a violent rally to the upside if indeed trading conditions can co-operate. We look forward to continued coverage.

Be the first to comment