malerapaso

A Quick Take On Millennium Group International

Millennium Group International Holdings Limited (MGIH) has filed to raise $22.5 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm produces various types of packaging products in China and Vietnam.

Given the company’s very slow revenue growth, legal structure and operating risks within China, my outlook on the MGIH IPO is on Hold.

Millennium Group Overview

Hong Kong, China-based Millennium Group International Holdings Limited was founded to provide inner and outer packaging products to primarily Asian customers.

Management is headed by Chief Executive Officer Ming Yan “Ray” Lai, who has been with the firm since 2007 and was previously a graduate of the University of the Arts London.

The company’s primary offerings include:

-

Corrugated products

-

Offset printing packaging

-

Flexo printing packaging

-

Packaging design

As of June 30, 2022, Millennium Group has booked fair market value investment of $32.1 million as of June 30, 2022, from investors, including YC 1926 (BVI) Limited.

Millennium Group – Customer Acquisition

The company pursues clients needing its paper packaging products and design services via its direct sales and marketing team efforts.

MIGH has the main factory located in Mainland China and is subject to potential lockdown in the event of a COVID-19 outbreak in the area.

Selling & Marketing expenses as a percentage of total revenue have dropped as revenues have increased slightly, as the figures below indicate:

|

Selling & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

FYE June 30, 2022 |

8.8% |

|

FYE June 30, 2021 |

9.7% |

(Source – SEC)

The Selling & Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling & Marketing spend, was only 0.3x in the most recent reporting period. (Source – SEC)

Millennium Group’s Market & Competition

According to a 2022 market research report by Data Bridge Market Research, the Asia-Pacific paper and paperboard packaging market is expected to reach $74.6 billion by the end of 2029.

This represents a forecast CAGR of 5.9% from 2022 to 2029.

The main drivers for this expected growth are growing demand from the healthcare industry for paperboard packaging and increasing awareness of the need for eco-friendly packaging formats.

However, growing competition from flexible plastic packaging is now providing an alternative to paper-based packaging options.

Major competitive or other industry participants include:

International Paper, Westrock Company, Oji Holdings Corporation, Amcor plc, Packaging Corporation of America, DS Smith, Fedrigoni S.P.A., Mayr-Melnhof Karton AG, Mondi, Nippon Paper Industries Co., Ltd., Rengo Co., Ltd., Sonoco Products Company, Stora Enso, Svenska Cellulosa, Aktiebolaget SCA, and UPM.

Millennium Group International Financial Performance

The company’s recent financial results can be summarized as follows:

-

Slow topline revenue growth

-

Reduced gross profit and gross margin

-

Increased operating profit

-

Lowered cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

FYE June 30, 2022 |

$ 66,232,757 |

2.6% |

|

FYE June 30, 2021 |

$ 64,565,269 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

FYE June 30, 2022 |

$ 16,270,964 |

-6.2% |

|

FYE June 30, 2021 |

$ 17,353,358 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

FYE June 30, 2022 |

24.57% |

|

|

FYE June 30, 2021 |

26.88% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

FYE June 30, 2022 |

$ 5,535,582 |

8.4% |

|

FYE June 30, 2021 |

$ 5,100,234 |

7.9% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

FYE June 30, 2022 |

$ 2,968,638 |

4.5% |

|

FYE June 30, 2021 |

$ 5,881,168 |

8.9% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

FYE June 30, 2022 |

$ 2,039,600 |

|

|

FYE June 30, 2021 |

$ 5,340,755 |

|

(Source – SEC)

As of June 30, 2022, Millennium Group had $19.4 million in cash and $25.9 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022, was $1.6 million.

Millennium Group International Holdings Limited IPO Details

Millennium Group intends to raise $22.5 million in gross proceeds from an IPO of its ordinary shares, offering 5 million shares at a proposed midpoint price of $4.50 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $66.9 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 25%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

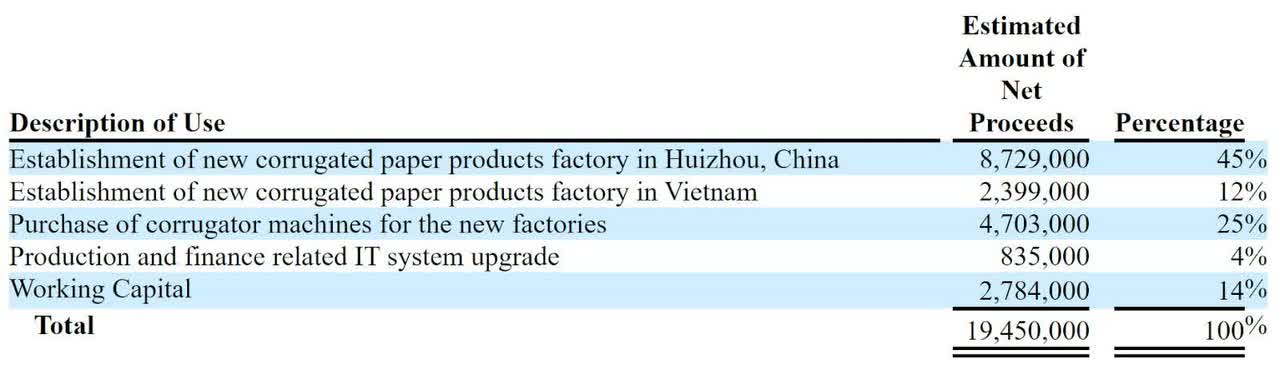

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is ‘not currently a party to any material legal or administrative proceedings.’

The sole listed bookrunner of the IPO is Network 1 Financial Securities.

Valuation Metrics For Millennium Group

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$90,000,000 |

|

Enterprise Value |

$66,915,571 |

|

Price / Sales |

1.36 |

|

EV / Revenue |

1.01 |

|

EV / EBITDA |

12.09 |

|

Earnings Per Share |

$0.14 |

|

Operating Margin |

8.36% |

|

Net Margin |

4.48% |

|

Float To Outstanding Shares Ratio |

25.00% |

|

Proposed IPO Midpoint Price per Share |

$4.50 |

|

Net Free Cash Flow |

$1,570,121 |

|

Free Cash Flow Yield Per Share |

1.74% |

|

Debt / EBITDA Multiple |

2.86 |

|

CapEx Ratio |

4.34 |

|

Revenue Growth Rate |

2.58% |

|

(Glossary Of Terms) |

(Source – SEC)

Commentary About Millennium Group’s IPO

MGIH is seeking U.S. public capital market funding to expand its manufacturing operations and for general corporate purposes.

The company’s financials have shown little topline revenue growth, lowered gross profit and gross margin, higher operating profit but reduced cash flow from operations.

Free cash flow for the twelve months ended June 30, 2022, was $1.6 million.

Selling & Marketing expenses as a percentage of total revenue have dropped as revenue has increased slightly; its Selling & Marketing efficiency multiple was only 0.3x in the most recent year.

The firm currently plans to pay no dividends going forward and to retain any future earnings to reinvest back into company growth initiatives.

The market opportunity for providing paper packaging solutions is large and expected to grow at a moderate rate of growth over the coming year, with stronger growth expected in the healthcare and eco-friendly segments of the industry.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potential significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Additionally, post-IPO communications from management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a general inadequate approach to keeping shareholders up-to-date about management’s priorities.

Network 1 Financial Securities is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 36.3% since their IPO. This is a top-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook as a public company is its operations structure located within the PRC which is subject to lockdown as a result of the government’s zero-COVID policies.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 1.0x, which is below a January 2022 basket of U.S. publicly held packing/container stocks compiled by noted valuation expert Dr. Aswath Damodaran.

Given the company’s very slow revenue growth, legal structure and operating risks within China, my outlook on the MGIH IPO is on Hold.

Expected IPO Pricing Date: To be announced.

Be the first to comment