Sally Anscombe/DigitalVision via Getty Images

Midstream Sector Performance

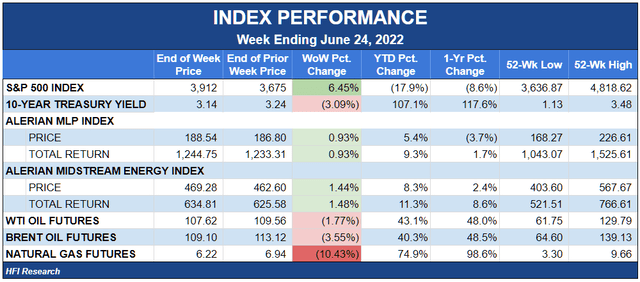

Well, perhaps the midstream shirt wasn’t so dirty. The sector actually ended the week up 0.9% despite a gut-wrenching 3.8% plunge on Thursday that sent nearly every midstream equity in our coverage universe lower. At least on that day, the sector felt pretty dirty.

Midstream did manage to outperform other energy sub-sectors, which truly were dirty shirts. The Alerian (now VettaFi) MLP Index ended the week up 0.9%, whereas the XLE and XOP fell by 2.6% and 5.8%, respectively.

Oil and natural gas prices both fell during the week, continuing their downtrends that partially explain the past few weeks’ energy equity selloffs. But oil and gas prices are still at levels that are extraordinarily positive for energy sector fundamentals.

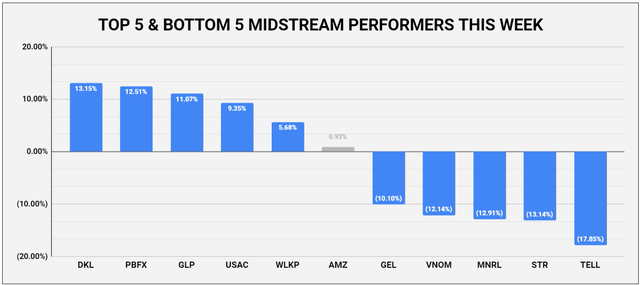

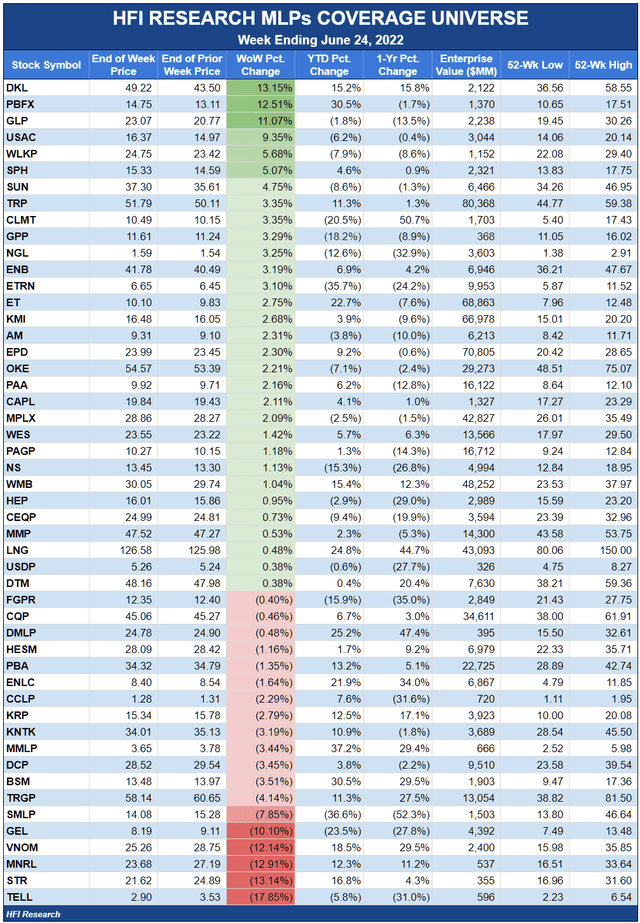

Midstream equity price action amid a supportive commodity backdrop has been puzzling, to say the least. For example, despite the continued bullish operating environment, companies with direct commodity exposures were taken out to the woodshed this week. Three of the sector’s worst five performers were mineral/royalty interest owners, namely Viper Energy Partners (VNOM), Brigham Minerals (MNRL), and Sitio Royalties (STR) (the former Falcon Minerals). All were down more than 12%, far worse than anything justified by commodity prices.

Then there was speculative Tellurian (TELL), which was down a whopping 17.9%. TELL has reportedly begun construction on its Driftwood LNG project even though it has yet to secure the necessary financing. TELL shares plunged even though global LNG market conditions remain bullish. The news on Tuesday that the first German utility agreed to sign a long-term LNG deal with a U.S. LNG producer and then the announcement on Wednesday that Cheniere Energy (LNG) signed a sale and purchase agreement with Chevron (CVX) should have been positive for TELL’s stock. Both events signal that more deals for future Driftwood cargoes could be coming down the pike, thereby moving Driftwood’s project financing efforts in a positive direction. Nevertheless, TELL’s stock got clobbered as if the positive news had never occurred.

Rounding out the bottom five performers, Genesis Energy (GEL) plunged 10.1% for no discernable reason.

By contrast, the biggest gainers during the week were a hodge-podge of companies with completely different economic characteristics. Only PBF Logistics (PBFX) had any news, with its sponsor, PBF Energy (PBF), indicating that it may make a non-binding offer for the 52.1% of PBFX units it doesn’t already own. PBF is making a mint amid today’s record refining margins, and given how cheap PBFX is, we believe that its acquisition by PBF at a steep discount to value would be a good use of capital.

Is a Narrative Change to Blame for Equity Weakness?

Our friends and other sources are telling us that a “narrative change” is afoot in the market. Apparently, over the past few months, large funds have aggressively bought energy stocks not for their bullish cash flow prospects amid high commodity prices, but simply as a way to “play” rising inflation. Once the managers of these macro-oriented funds became concerned that the Federal Reserve might be successful at taming inflation, they dumped their energy stocks en masse.

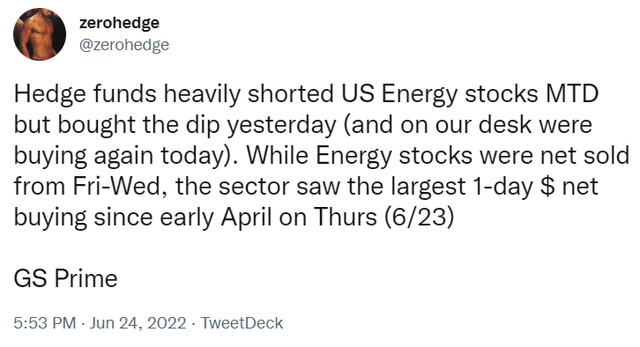

This theory is supported by a report from Zerohedge captured in the following tweet:

So we can speculate that a sort of bear raid forced energy stocks lower. We assume the losses on Thursday that came as hedge funds were reportedly buying energy stocks were attributable to a more generalized panic, perhaps by trigger-happy investors aware of the sector’s notorious volatility both on the upside and downside.

This would explain why the selling in midstream over the past few weeks has been indiscriminate as regards dividend yield, company quality, and market capitalization. It also explains why the selling persisted in spite of a strong commodity backdrop.

As far as we know, these reports could be spot on. But we don’t have a strong view either way. Perhaps the Fed will tame inflation by raising interest rates. But then again, maybe structural commodity supply deficits will ensure that it won’t. In our view, the answer is not knowable. Nevertheless, we believe it’s prudent to embed inflation resistance into our long-term investments to the greatest extent possible, and there’s no better way to do so than by owning high-quality midstream equities run by managements who allocate capital well and put shareholder interests first.

We don’t spend our time speculating on why other people are selling. But we do focus on recognizing when selling is overdone. The recent bout of selling strikes us as extremely overdone. Keep in mind that company-specific fundamentals win in the end, and they’re as positive as they’ve been at any time throughout the midstream sector’s history. Non-fundamental forces that move stock prices come and go-as they did this week-but cash flows ultimately dictate investment returns. Of this, we’re certain.

We believe the price action in midstream equities has been akin to a depressive episode on the part of Benjamin Graham’s “Mr. Market.” Investors who have funds they intend to put to work should capitalize on the silliness taking place in midstream equities and buy high-quality names for the long term.

Weekly HFI Research MLPs Portfolio Recap

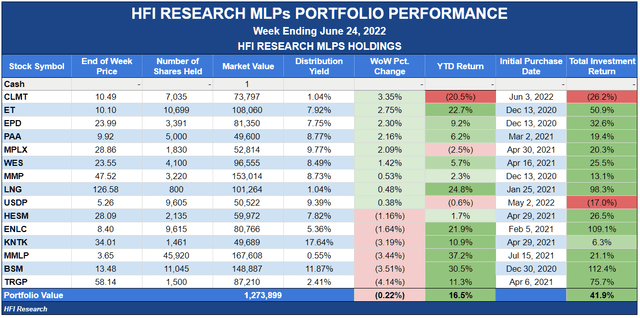

Our portfolio underperformed its benchmark, the Alerian MLP Index, by 1.1%. Our year-to-date outperformance versus the benchmark took a hit during the week and now stands at 7.2%.

Our portfolio was dragged down by our large holdings in Black Stone Minerals (BSM) and Martin Midstream Partners (MMLP). BSM sold off with other mineral interest companies despite an extraordinarily bullish commodity backdrop that shows no signs of abating. We’re not sure why MMLP sold off. We’d note that Treasury yields were up during the week and the high-yield bond market remained challenged. We suspect that these factors may reduce the attractiveness of the terms MLMP is likely to obtain when it refinances its 2024 and 2025 debt maturities. Still, the selloff in MMLP units that came with no change to our fundamental outlook for the company makes them more attractive than they entered the week.

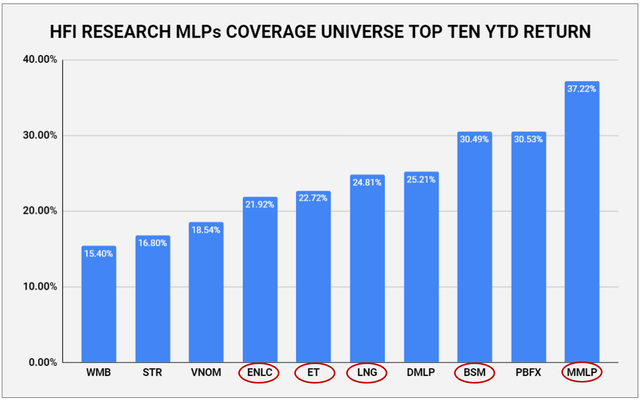

On a year-to-date basis, we’re gratified that five of our fifteen holdings remain among the top 10 performers in the sector.

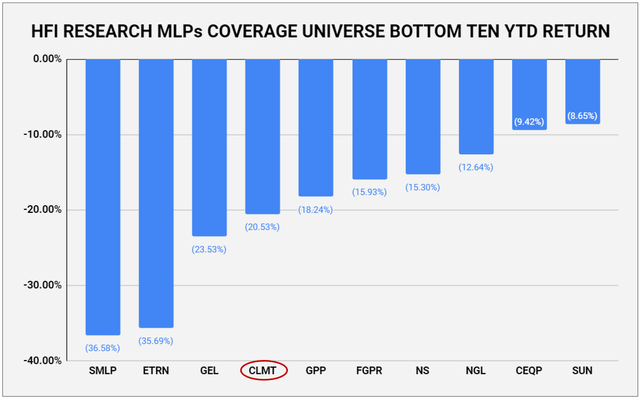

One of our holdings features among the bottom ten, namely Calumet Specialty Products Partners (CLMT). CLMT is our newest holding and has gotten crushed over the past few weeks since we made our initial purchase. The company is highly levered – and therefore sensitive to moves in interest rates – but we believe financial relief is on the horizon as CLMT completes its renewable diesel facility. In short, we think the market is wrong in its verdict on CLMT’s long-term prospects.

News of the Week

It was a slow news week for company-specific fundamentals.

June 22. Cheniere Energy, one of our holdings, announced that it was making a final investment decision to move ahead with expanding its Corpus Christi LNG liquefaction facility. Cheniere said it issued a notice to proceed to Bechtel to continue construction, which began earlier this year. Cheniere also closed on an amendment and restated $4 billion senior secured term loan due 2029 and upsized a $1.5 billion working capital facility due 2027. The FID of Stage III had been telegraphed by management and was therefore expected by the market. The move represents more superb execution by Cheniere management. Corpus Christi Stage III is likely to grow Cheniere’s total LNG production capacity by more than 20%. It is likely to bolster free cash flow in 2026 and beyond, increasing the company’s intrinsic value. Cheniere shares are attractive and cheap at their current price. We rate them a Buy.

Capital Markets Activity

June 22. Targa Resources (TRGP), which we hold in our portfolio, priced an underwritten public offering of $750 million of 5.200% senior notes due 2027 and $500 million of 6.250% senior notes due 2052 at 99.849% and 99.773% of par, respectively. TRGP is benefitting from its new investment-grade credit rating. The company is using the proceeds to help finance its acquisition of Lucid Energy, a gathering and processing operation located in the Delaware Basin. We’re not sure what to make of the acquisition until we get more details, but we believe TRGP shares are priced at a bargain after their selloff during the past few weeks.

Be the first to comment