Ibrahim Akcengiz

Midstream Sector Performance

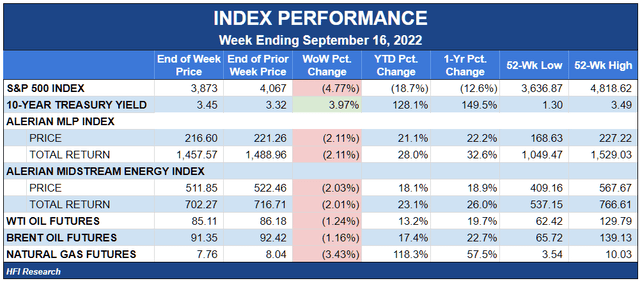

Midstream once again demonstrated its relative resilience amid macro upheaval. During a rough week in which the S&P 500 fell 4.8%, the midstream sector saw a 2.1% decline. The sector was a standout performer in energy as well, outperforming the XLE’s 2.7% drop and the XOP’s larger 4.2% decline.

Midstream’s relative outperformance also came amid the headwind of rising interest rates. During the week, Treasury yields surged higher, with the 10-year yield rising 4.0%. Interest rates responded to a hot inflation reading for August that came even as food and energy prices fell. The reading surprised capital market participants, many of whom believed inflation had cooled off. The inflation news raised concerns that the Federal Reserve will have to hike rates more than expected to tamp down inflation, a move that would decrease the value of virtually all assets.

For yielding securities like midstream equities, the jump in the yields available on “risk-free” government bonds creates competition for investor capital. There is little doubt that high rates will cause capital to flow away from volatile midstream equities and toward income-producing government securities. However, investors allocating to government bonds for the long term risk diminishing their wealth over time, as inflation reduces the real earning power and principal value of Treasury issues that lack inflation protection. And even inflation-protected Treasuries do poorly in a rising interest rate environment. They also tend to trade at higher prices than the Treasuries that lack inflation protection, which offsets much of their inflation protection benefits.

We suspect that as long as inflation remains high, midstream equities will catch a bid that will cushion the impact of rising rates on their market price, at least until Treasury bonds trade at significantly higher yields than today. Midstream equities remain generally underpriced, sport high yields relative to every other income-producing equity alternative, and offer the best inflation protection obtainable. Investors concerned about preserving their wealth would do well to maintain an allocation to high-quality midstream equities.

The Big News in a Volatile Week

This week was a see-saw for all energy stock prices. It was another week with no particular trend among midstream components. Long-haul pipeline operators, G&Ps, royalty trusts, and the more idiosyncratic names were all over the map.

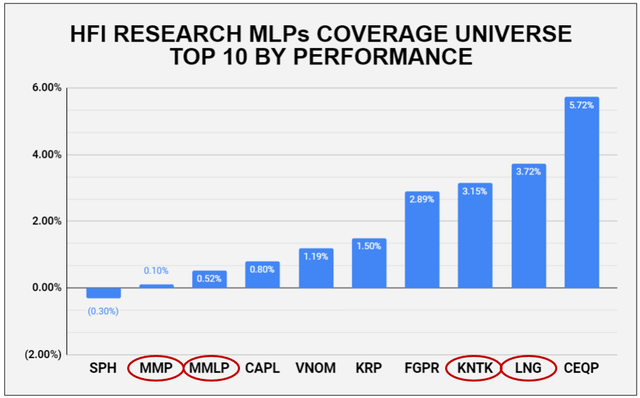

With a stiff headwind of a falling stock market throughout the week, outperformers were driven by positive news. Cheniere Energy (LNG) was the biggest newsmaker as management announced a new capital plan. We discuss it here. Dubbed “20/20 Vision,” the new plan aims to achieve $20 per share distributable cash flow by 2026, lowers Cheniere’s leverage ratio target, boosts its dividend by 20%, and reloads its share repurchase authorization. Management also announced additional operational expansion initiatives beyond its Corpus Christi Stage 3 project, now underway. Lastly, management boosted full-year 2022 guidance due to high margins on spot cargoes, higher lifting margins, and several one-time benefits.

Cheniere’s stock responded to the news by gaining 11% in the two days following the announcement. After giving up some of the gains thereafter, the stock closed the week 4.5% above the pre-announcement level. Cheniere Energy Partners (CQP) rallied even more, ending the week up 5.7%, the top performer in midstream. CQP investors were cheered by management’s guidance boost, as well as the prospect of new Sabine Pass expansion.

Kinetik Holdings (KNTK) was the third biggest gainer after Cheniere and CQP after its anchor customer, APA Corp.’s (APA), management said it might step up drilling in APA’s Alpine High acreage, which is dedicated to KNTK. KNTK’s G&P system on the acreage has significant unused capacity, so any additional drilling that boosts throughput volumes would provide a nice boost to KNTK’s bottom line.

Tellurian (TELL) was the biggest loser during the week, falling 11.6% after Etami Corp., which holds an equity stake in TELL, accused Executive Chairman Cherif Souki of nepotism and charged that he lacks the qualifications necessary to develop Tellurian’s Driftwood LNG project. TELL has begun construction of the project before securing sufficient financing. The continued absence of financing is concerning given the bullish LNG backdrop and long-term agreements available to developers and operators of LNG projects. TELL also recently purchased natural gas-producing properties to provide feedgas for the project. The additional pressure on the company from at least one restive shareholder is not positive for the company’s financial future. We have recommended avoiding TELL stock and continue to do so.

Weekly HFI Research MLPs Portfolio Recap

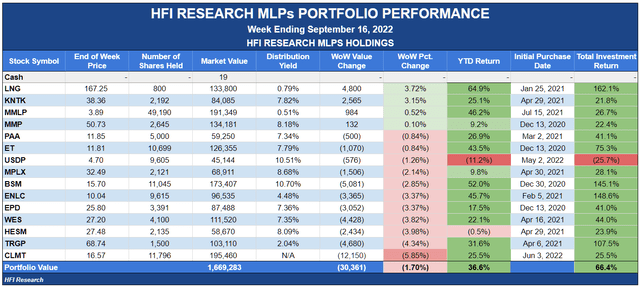

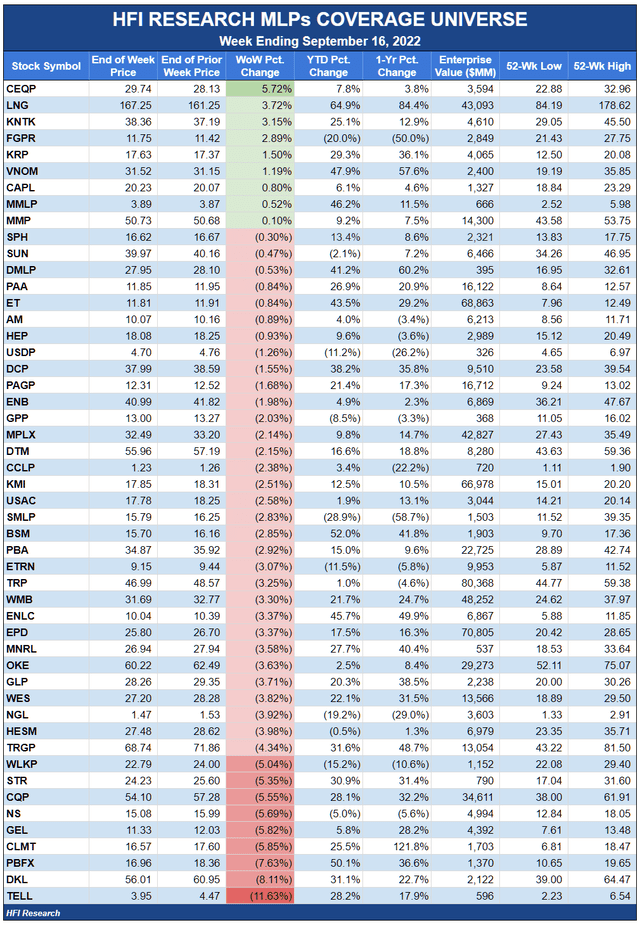

Our portfolio declined 1.7% during the week, outperforming its benchmark, the Alerian MLP Index, by 0.4%.

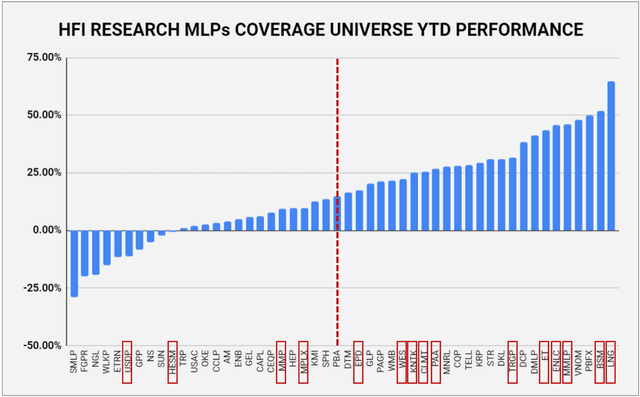

Year-to-date, our portfolio has outperformed its benchmark by 8.6%. We’re pleased that our holdings have skewed toward the top half of performers, some to an extreme degree. Six of our fifteen holdings count among the top 10 year-to-date performers in our coverage universe, as shown below.

This week, four holdings were among the top 10 performers in our coverage universe. The performance of our two biggest gainers, Cheniere and KNTK, was discussed above. Martin Midstream Partners (MMLP) and Magellan Midstream Partners (MMP) were also relatively strong on no news. We rate MMLP and MMP as Buys and believe current prices represent an excellent entry point for long-term investors.

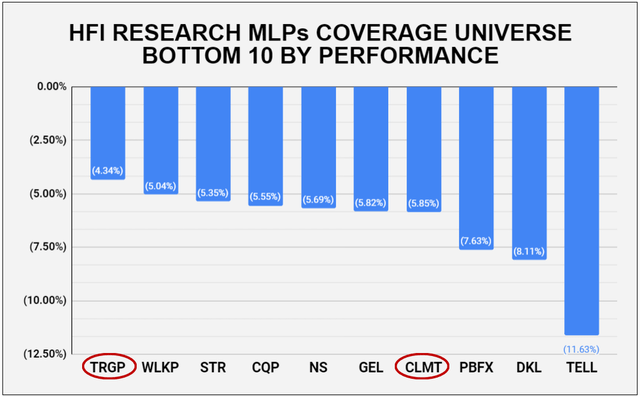

We had two holdings in the week’s bottom 10 performers, also on no company-specific news. Targa Resources (TRGP) was presumably weak on the falling fractionation spread. TRGP is an attractive Buy at current prices. Calumet Specialty Products Partners (CLMT) was our biggest loser, down 7.6%. The company is likely up and running with its newly constructed renewable diesel plant. Commercial production should arrive by the end of the year. With operational risk falling by the week, we rate CLMT units a Buy. Given the increase in cash flow set to begin in 2023, investors should buy in advance of the news to enjoy what we believe will be a good 2023 for CLMT units.

It was a quiet week for our other holdings. The only noteworthy news related to two large insider equity purchases. The first was by Energy Transfer (ET) Executive Chairman Kelcy Warren’s purchase of $36 million ET units at an average cost of $12.00 per unit. ET management is determined to increase the annual distribution to $0.305, and we believe they’ll succeed. We rate the units as a Buy and believe the higher distribution will send them toward our $15.25 price target, 29.1% higher than ET’s $11.81 closing price on Friday.

Tom Carter, Chairman and CEO of Black Stone Minerals (BSM), bought $1.6 million of BSM units at an average price of $16.29. The purchases represent a 4.5% increase in Carter’s BSM holdings. Given BSM’s optionality on its prospective Austin Chalk and Shelby Trough acreage, the potential upside for BSM is enormous if those prospects are economic. BSM management has historically not been big purchasers of units on the open market, with the last purchase made in 2019. Carter’s purchase may be an indication that things are going well with the prospective acreage, which is now in the early stage of development. At any rate, the units ended the week at $15.70. They currently yield 10.8%. Given the company’s looming production growth, potential exploration upside, and geographic diversification, BSM is our go-to among mineral and royalty trusts. We rate the units as a Buy and maintain our $18.50 price target.

News of the Week

Sept. 12. Crestwood Equity Partners (CEQP) announced the divestiture of its Marcellus gathering assets to Antero Midstream (AM) for $205 million in cash. The deal was made at a 7-times multiple, which is low but satisfactory for CEQP given the low rate of growth the assets would have generated under its ownership. This deal was long expected, as Antero Resources (AR), the producer on the acreage, was reluctant to develop it without AM as the midstream operator. The Marcellus is also non-core to CEQP, which in recent years has honed its focus on the Bakken and Permian basins. At $29.74, CEQP units are within our range of value and are pushing up against our $30 price target. We’ve rated the shares a Buy, but we’ll review them for a downgrade to Hold if they meet or exceed our price target.

Sept. 12. CEQP also announced a secondary offering of 11.4 million common units on behalf of Chord Energy (CHRD), formerly Oasis Petroleum. CHRD will receive all the $306.7 million in proceeds from the offering, which was priced at $26.90, a 6% discount to CEQP’s previous closing price. The unit sale does not increase the number of CEQP units outstanding. CEQP intends to purchase $125 million of the offering, presumably with the proceeds of the Marcellus gathering system sale. If so, this would be a good capital allocation move by management.

Capital Markets Activity

None.

Be the first to comment