RyanJLane/E+ via Getty Images

Real estate is often seen as a fixed income surrogate. As with a bond’s coupons, it provides steady, relatively predictable cash flow via rent payments. And because real estate buyers typically borrow at 10- to 30-year maturities to finance their purchases, property values are often correlated with interest rate movements. So perhaps it is no surprise that as interest rates have surged this year, many real estate investment trusts (REITs) have performed poorly. Mid-America Apartments (NYSE:MAA) is no exception to this, with shares having fallen about 31% year to date. However, I think this sell-off provides opportunities for dividend growth oriented investors.

While fixed income and real estate are linked, there is one incredibly important difference. Most bonds pay a fixed interest amount over their life, so in periods of high inflation, their real value is eroded. Conversely, rents can change, and during periods of high inflation, rents, like most things, tend to rise more quickly. As a consequence, real estate can generate more cash flow for investors. So while much of the market is focused on higher interest rates weighing on real estate valuations, I believe investors are underappreciating the fact this headwind is offset by faster rental cash flow growth.

Mid-America Apartments is doing just that. Last quarter, the company reported a 14.3% increase in average effective rent per unit. Because expenses rose by a more modest 8.1%, operating income rose a very strong 17.1%. There have been many articles written about rental rates have increased significantly over the past two years; MAA is a prime beneficiary of this.

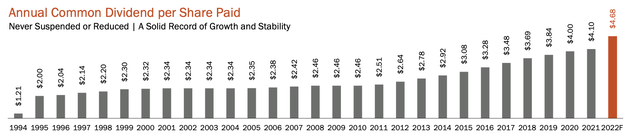

This strong cash flow growth enabled the company to raise its dividend to $1.25, and 2022 dividends will rise about 14% vs 2021.

(Source: Mid-America)

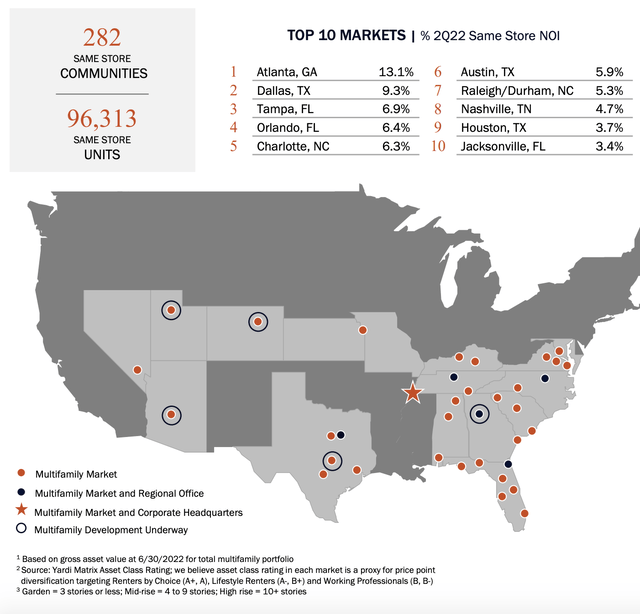

Now, you may agree with me that MAA has been a prime beneficiary of rising rents and has generated steady dividend growth, but with the economy cooling and the Fed trying to cool inflation and the housing market, you may be worried the future is not as bright. I would disagree. First, MAA’s portfolio is concentrated across the sunbelt. States like Florida, Texas, and Georgia are seeing very strong population growth with more businesses and people moving from the North. This will keep demand for housing units in MAA’s core markets strong, which should lead to above-average rental growth.

(Source: Mid-America)

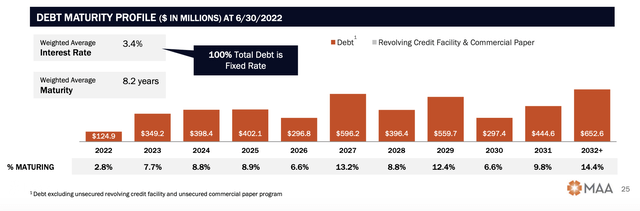

In addition to a good geographic mix, the company has a strong balance sheet with about $4.0 billion in debt, making up less than 20% of its total capitalization. Importantly, the company’s debt is also fixed rate with 8-year average maturity. Less than 20% of its debt matures in less than two years. This helps to insulate the company from rising interest rates, as it will not need to refinance much of its debt at higher coupons. This further helps to insulate the company from rising rate fears.

(Source: Mid-America)

Now, even if you agree that MAA is relatively well positioned in the sector due to its location and balance sheet, you may be concerned that the macro environment is so bad that the company is just a “good house in a bad neighborhood.” Let me attack that concern head on.

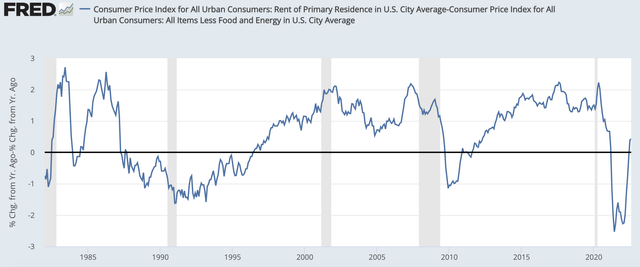

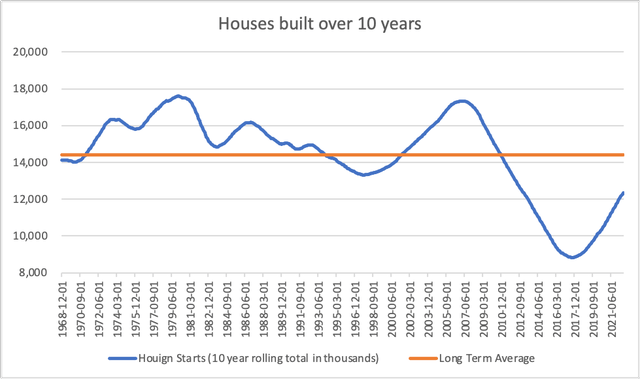

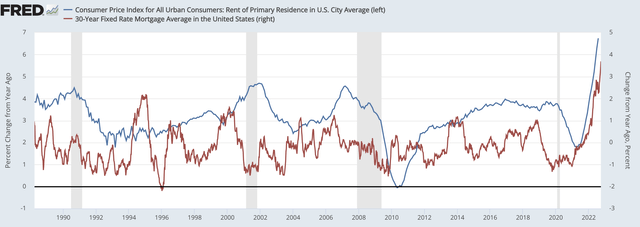

First, betting on rising rents is historically a good bet. As you can see below, for the vast majority of the past 30 years, rents have risen faster than overall core inflation. The immediate aftermath of COVID was an exception as supply chain problems caused goods prices to soar, but rents have again caught up and are running faster than inflation.

(Source: St. Louis Federal Reserve)

A major reason for this is that America simply has built too few homes. Since the 1960s, we have historically built nearly 15 million homes a decade, and while the housing boom saw us build too much, we corrected far too much in the other direction during the 2010s. There was so much damage to the homebuilding sector that construction collapsed and fell all the way to 9 million units.

As a consequence, since 2000, we are about 2-3 million houses below trend, which is why so many markets don’t have enough housing units (to rent or buy) to meet demand. With homebuilders again being cautious amid higher rates, I expect the US housing market will remain secularly undersupplied for the foreseeable future, which gives landlords like MAA plenty of pricing power to raise rents.

(Source: St. Louis Federal Reserve)

On top of this, rising rates make homebuying more expensive. That will force some people who would like to buy a home to stay renters, and that increased rental demand keeps rents high. In fact, in 1999, 2005, and 2021, we saw spikes in mortgage rates, and rental inflation accelerated within 12 months. So again, higher rates are not as scary as they first appear for REITs like MAA.

(Source: St. Louis Federal Reserve)

Put this together, and the investment thesis is compelling for MAA. The company is in the growing part of the country with a strong balance sheet in a rental market that is structurally under-supplied, providing pricing power for continued rental growth that outpaces inflation. This year the company should generate about $8.25 in funds from operations, so at a $1.25 payout, the distribution is about 1.7x covered.

This conservative payout has plenty of room to grow, even before considering rental growth. With solid rental inflation, MAA is well positioned to conservatively grow its dividend by high-single digits over the next three to five years. Given a starting yield of 3%, that creates a medium-term return potential of 10%. This positions the name well as a core holding for investors seeking an inflation hedge and dividend growth.

Be the first to comment