Joe Raedle

Another week in the stock market, another week of risk-off behavior and selling. It’s been rough for most of 2022, but as I continue to remind subscribers (and myself), these selloffs create tremendous buying chances in good assets. I’ve written extensively about Bitcoin (BTC-USD) and the stocks that are heavily involved with Bitcoin in one way or another, and the group is terrific from a trading perspective. There’s no shortage of opportunities on both the long and short side with such volatile assets, and one of those is MicroStrategy (NASDAQ:MSTR).

This company isn’t a miner of Bitcoin, but it does hold the world’s largest cache of the coins on its balance sheet, as far as I’m aware. The company switched roughly two years ago from being an analytics software company to a company that exists to buy and hold Bitcoin. The software business still exists, and it is generating cash, which is useful to the extent that MicroStrategy uses the software business to fund its Bitcoin purchases.

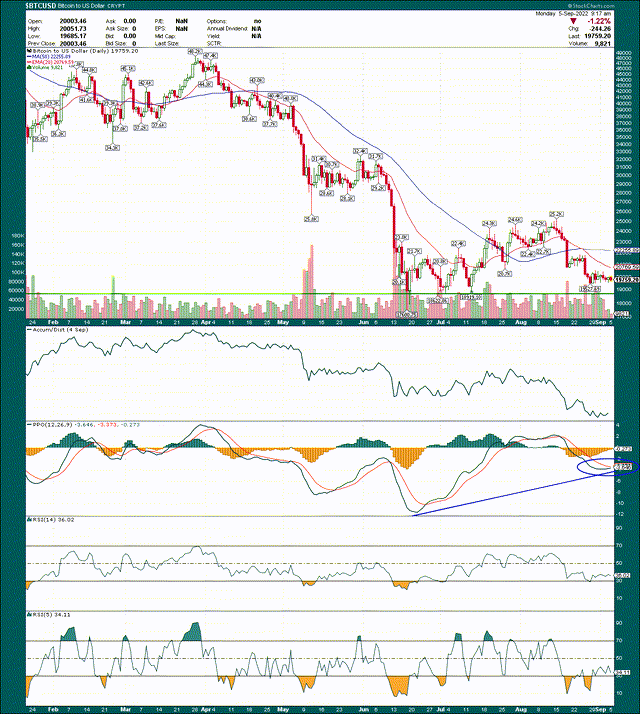

With this in mind, you can think of MicroStrategy as a leveraged way to gain Bitcoin exposure. Let’s start by taking a look at the daily chart.

As we can see, this thing moves around a lot. The stock almost tripled from the May low to the August high, but has fallen about 40% in just the past three weeks or so. This is for aggressive investors that are looking to bet on or against the price of Bitcoin, and stops are critical because if you get it wrong, the consequences could be dire.

I’ve drawn in two lines on the price chart, so let’s take a look at those first. The blue line is the upward trendline from the May low, and we can see it’s just a few dollars below where the stock closed on Friday. That happens to roughly intersect with gap support from July when MicroStrategy was in the midst of its enormous rally off the summer lows. That should give investors a better shot at the ~$215 level holding, but we’ll see.

The odds should increase given how oversold MicroStrategy is as well. The 5-day RSI in the bottom panel has been in oversold territory for about three weeks consecutively, and finished Friday at 8. The PPO has declined more than 10 points during this selling, and the 14-day RSI has gone from 70 to 30. These are big moves in momentum and it gives the bulls a bit more ammunition in the fight given at some point, sellers will become exhausted. Whether we’re there or not remains to be seen, but the odds favor the bulls for the moment.

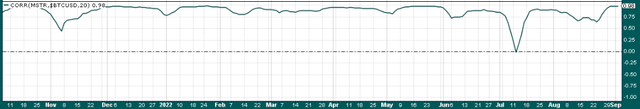

I mentioned the stock is just a leveraged way to get exposure to Bitcoin, and we can see that below. This is the 20-day rolling correlation of MicroStrategy to Bitcoin.

It finished Friday at 0.98, which means the two assets are trading essentially in lockstep with each other at the moment. That makes the price of Bitcoin critical for the price of MicroStrategy, so let’s now turn our attention to the coin itself with a daily chart.

I personally think the chart of Bitcoin looks a bit better than that of MicroStrategy, which is actually good news if you want to own MicroStrategy. If Bitcoin holds support and moves higher, MicroStrategy will as well. That correlation of 0.98 is powerful in that way.

Bitcoin has price support in the area around $19k, and the June spike low of $17.6k. Right now, I don’t think we’re going to get a retest of $17.6k, but if we’ve learned anything in 2022, it’s that risk-off behavior in the market can lead to some selloffs. That’s why stops are so important, particularly if you’re trading things like Bitcoin or MicroStrategy.

Apart from price support, the daily PPO is turning higher and just put in a bullish crossover. That often portends a trend change, and in this case, that trend change would be bullish if it comes to fruition. We have price support just below, but we also have some nice positive divergences on the momentum indicators. For instance, the 5-day RSI in the bottom panel made its low in the middle of August, well ahead of the coin itself. That increases the odds the sellers are exhausted and that Bitcoin is ready to make another rally attempt. Buying with setups like this increases the odds you’ll be right, but it also means the risk/reward is outsized with support just below.

Let’s now take a look at the fundamental situation for Bitcoin, which has changed somewhat in the past couple of weeks.

Bitcoin everywhere

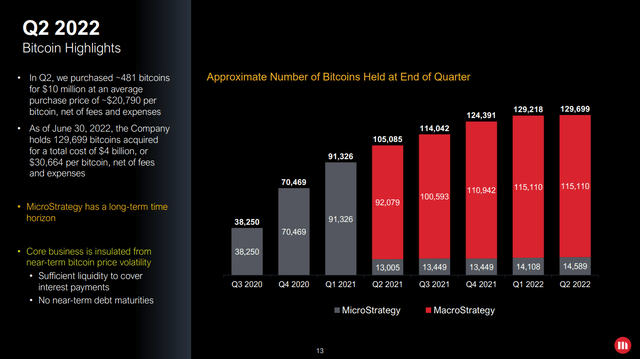

Let’s get right to it with the number of Bitcoins the company owns.

MicroStrategy owned 130k Bitcoins (!) at the end of the second quarter, at a total cost of $4 billion, or $30.7k per coin, on average. There’s no denying that MicroStrategy was early (and/or wrong) in terms of jumping on the Bitcoin bandwagon, and it has cost the company to the tune of the ~$11k average loss on each of its coins, or about $1.4 billion. That’s a lot of money where I come from, and MicroStrategy has written down its Bitcoin holdings on its balance sheet such that its tangible book value has plummeted well below zero. The upside is that if Bitcoin rallies longer-term, as the company says it will, MicroStrategy has an enormous cache of Bitcoin to take advantage. The Bitcoin on the balance sheet that have been written down cannot be “written up” in the event of a rally, as accounting rules don’t allow such things. The balance sheet, therefore, is permanently impaired, so don’t expect the TBV situation to improve.

MicroStrategy has borrowed about $2.4 billion to buy Bitcoin, and its holdings are now valued at ~$2.6 billion. Part of those borrowings famously caused MicroStrategy to be the subject of speculation with regards to a margin call over the summer, which never came to fruition. However, expect chatter of a potential margin call to come back into the stock’s narrative if we see another breakdown to a new low in Bitcoin. It appears to me that MicroStrategy could add unencumbered Bitcoin as collateral to the loan in question over and over again to avoid a margin call, so my feeling on the matter is that it is a non-issue. However, non-issue or not, if people start panicking over it, the share price will feel it.

Finally, news broke last week of the face of the company, Michael Saylor, being sued by the District of Columbia for potential tax evasion (see here and here). Based on the early details we have, it appears the District believes Saylor domiciled in the District while earnings “hundreds of millions of dollars” but never paying income tax. The District is also going after MicroStrategy itself for allegedly helping Saylor evade taxes, which is an unusual move.

Saylor maintains he didn’t live in the District and therefore, owes the locality nothing in taxes. MicroStrategy itself, of course, denies any wrongdoing.

I have no idea how this will play out, but if I play out the worst case scenario where we assume both Saylor and MicroStrategy conspired to help the former evade taxes, there would be fines for both. The fines would likely be immaterial to the wealth of MicroStrategy (Saylor’s personal net worth is of no concern to shareholders), so I’m not sure this is a huge deal, even if MicroStrategy is found guilty. That’s a big ‘if’ and it would also likely take a very long time to play out in court. Companies pay fines for misdeeds all the time and they move on so I don’t really think this is a big deal, other than some potentially bad press.

The point is that the stock was clobbered last week on this news, but it feels like the market has already priced in the worst case. If anything, looking ahead, we could see a positive resolution to this, and removal of the overhang from the stock. We shall see.

Final Thoughts

The stock is valued at $2.5 billion today, which is almost exactly the value of its Bitcoin holdings. Of course, the company also has about that same amount in long-term debt, so the leverage is real with this one. I’ll be clear that if you’re bullish on MicroStrategy, you believe Bitcoin has already bottomed, or is close. If it hasn’t, MicroStrategy’s Bitcoin holdings will lose more value, it will have to write down more of its asset values, and its debt will remain. I’ll reiterate the software business doesn’t matter for shareholders, and hasn’t since the company announced it was going big into Bitcoin, so this is all about a debt-financed way to own exposure to Bitcoin.

The final consideration is that MicroStrategy still faces a mountain of short-sellers. About one-third of the float is currently shorted, which is one of the highest values in the entire market today. Perhaps the shorts are onto something and Bitcoin will break down again and plummet to $10k or something. However, if they’re not, and Bitcoin has seen the worst of its selling, that short interest could fuel another rally like we saw over the summer where MicroStrategy almost tripled in the space of a couple of months.

The upside from here isn’t as attractive as it was in May simply because the price is already a lot higher. However, I think the risk/reward equation favors the bulls right now. I’ll caveat that by saying that if Bitcoin loses price support in the area of $19k, and especially if it loses $17.6k, you have to get out. That’s the risk right now, but the reward is potentially much larger than that if Bitcoin stabilizes and rallies. We’re dealing in probabilities, not certainties, but it looks to me like fortune favors the bulls once more on MicroStrategy.

Be the first to comment