lcva2

This story was published on Sept. 19, 2022, for the subscribers of Reading The Markets, an SA Marketplace service. The story was updated on the morning of Sept. 22, 2022.

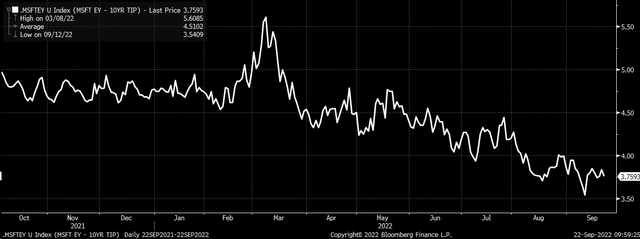

The bearish bets are starting to pile up on Microsoft (NASDAQ:MSFT). The shares have struggled in 2022, having fallen around 30%. Still, that isn’t to say the shares couldn’t fall further because, despite the steep decline, the shares are still expensive compared to the 10-Yr real rate.

Interestingly, for much of 2021 and the first half of 2022, the equity traded with an earnings yield about 4.5% to 5% higher than the 10-Yr real yield rate. But then, in June, as real yield began to rise, Microsoft’s earnings yield did not, which resulted in the spread contracting and is now at its lowest level during this cycle. That would suggest that the stock hasn’t adjusted for the higher real yield rate.

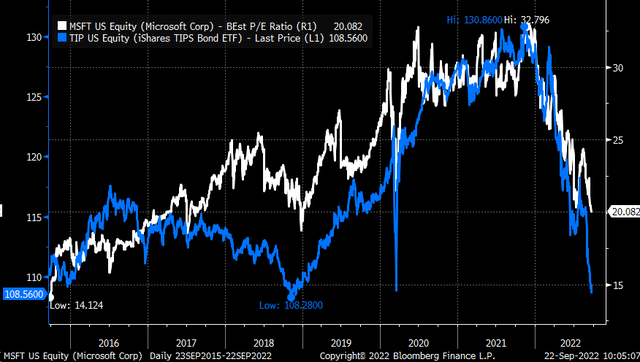

It’s also interesting that the PE ratio using fiscal 2024 earnings estimates of $11.95 per share is now at 20.5, the lower bound of its trading range since the fall of 2018. However, the PE ratio of Microsoft has been very much determined by real yield. The chart below shows that when the TIP ETF (TIP) rises, Microsoft’s PE ratio rises, and vice versa. A rising TIP ETF indicates that real yields are falling, and real yields rise when the TIP ETF drops.

This chart agrees with the spread between Microsoft’s earnings yield and the real yield: Microsoft’s stock has not fallen in line with the move in real yields.

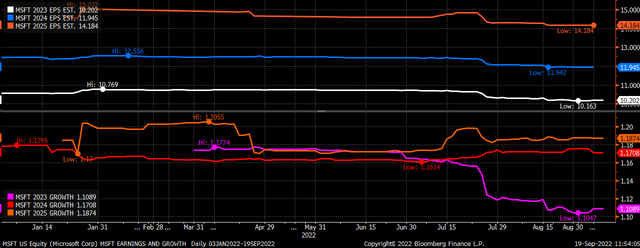

The one reason why the stock may be holding up is that earnings growth rates are still holding up. Earnings estimates have fallen, but analysts are looking for the company to have earnings growth of around 11% in fiscal 2023, more than 17% in fiscal 2024, and more than 18% in 2025. Of course, it isn’t clear whether the company can hit those loft expectations in 2024 and 2025 because the current economic outlook is uncertain. Should those estimates for 2024 and 2025 come down and those growth rates drop, it would likely lead to a further contraction in the PE multiple, as the rising real yields suggest.

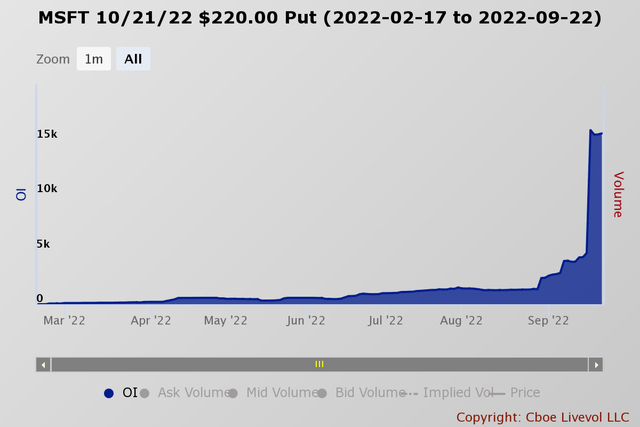

Big Bets Shares Drop

How far the PE multiple should drop is open for debate, but what’s clear is that bears are making bets the stock will fall below $220 by the middle of October. On September 16, the open interest for the October 21 $225 puts rose by almost 26,000 contracts. The data from Trade Alert shows the puts were bought for about $2.58 per contract, suggesting that Microsoft is trading below $222.45 by the expiration day. It is a big wager, with nearly $6.6 million paid in premiums.

Then on September 19, the open interest for the October 21 $220 puts rose by more than 11,000 contracts. Nearly half of the put contracts were bought on the ASK for about $3.10. Separately, a second tranche was traded at $3.10, which was in between the bid and ask, making it unclear if they were bought or sold. But the second tranche was completed around the same time as the first tranche, which makes for a good chance these puts also were purchased. The put contracts would need to fall below $217 if held until the expiration date in October to break even.

Microsoft Stock – Weakening Technical Trends

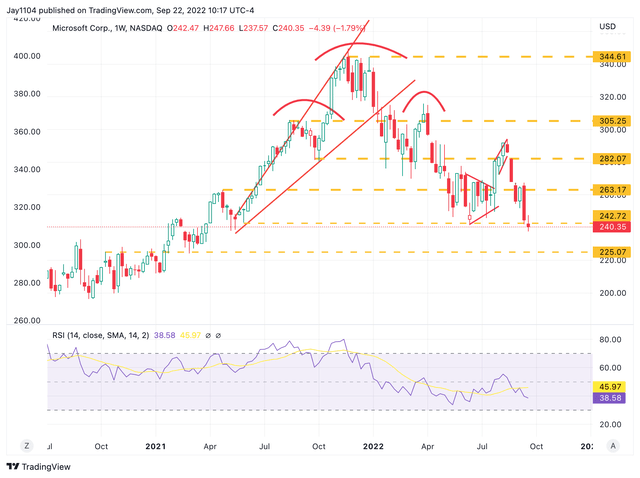

The technical chart shows the stock is close to breaking down and below support at $240. Should that support break, the next significant level of support does not emerge until $225. Of course, this is interesting because that is what the options trader is betting will happen.

The only issue is that the stock is already very oversold with a relative strength index that is 29. Of course, the RSI can go lower, but it may suggest that a steep decline in Microsoft may take a bit longer to develop.

For Microsoft, there’s a significant risk of the stock falling further, but it looks like it will take analysts to take down their earnings estimates for the stock to start that next major leg lower. Still, even if the stock goes through a period of further multiple contraction, this is a leading company, and the long-term outlook is likely to remain solidly intact.

Be the first to comment