DNY59

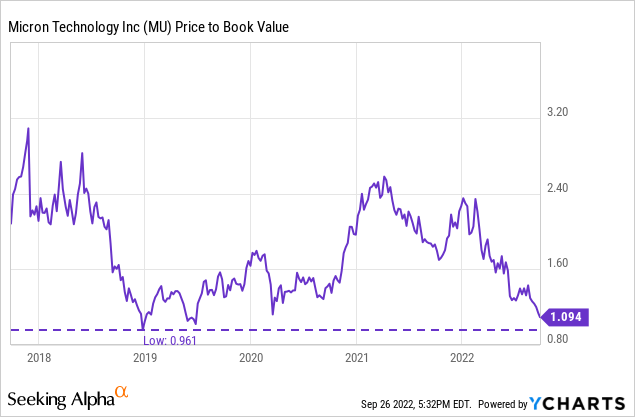

Book value. It’s such a simple accounting calculation, but it might just be the most critical one Micron (NASDAQ:MU) investors can make. Over the decades, Micron’s stock has traversed a rollercoaster, moving near congruently but upward through the stock cycles. And that rollercoaster has ridden on the track of book value. Like clockwork, an investor can buy Micron at the bottom of this valuation metric, kick back, and wait to achieve envious CAGR returns. And this week, the stock has dipped as close to book value as it has in the last several years, and Micron investors who have been in the stock for a while, like me, are waiting like a kid on Christmas to put their next tranche of five-year investment money to work.

Now, if you’re new to the world of Micron motion sickness, you’re quick to think, “How could one think about getting into Micron when there’s blood in the streets everywhere in the market?” Yes, it seems scary, but there are a few things to wet your feet before we get into doing an “automatic” buy at book value.

The valuation metric of price-to-book value is not without surrounding circumstances. The market isn’t acting in a vacuum regarding Micron’s earnings or its medium-term future. The reason Micron is within 10% of book value is not devoid of the weighing machine that is the market. But when taken over the course of years, this see-sawing from book value to a relatively unknown higher P/B value back to book value doesn’t mean the stock isn’t at ground zero each cycle on the chart. On the contrary, riding Micron’s book value from a P/B of one back to a P/B of one over the years nets a curiously high return.

In short, an investment in Micron is an investment in the company’s assets.

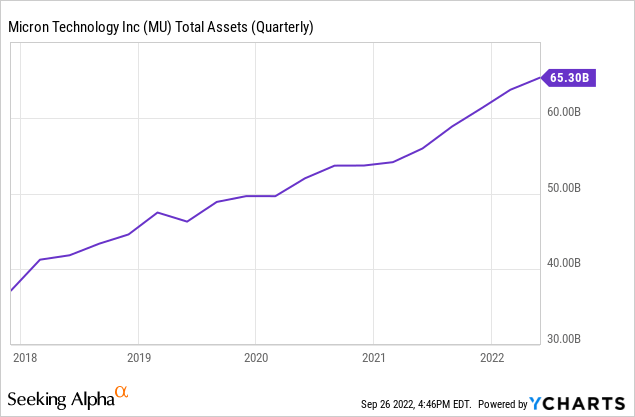

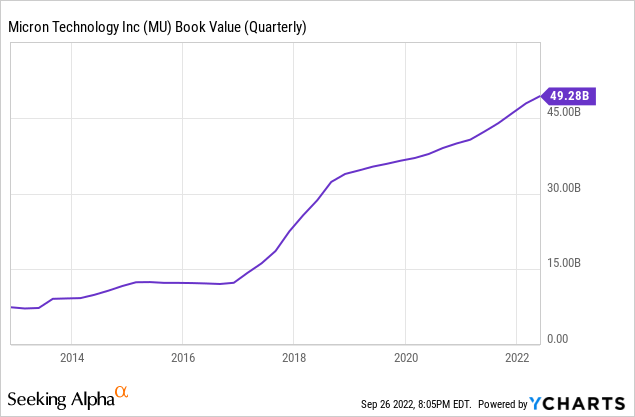

And because Micron’s modern-era management team has emphasized taking costs out of the business while strengthening its balance sheet, its assets have been on an upward trajectory like no other time in company history.

Book Value Provides The Market’s Backstop

You might remember my last article on Micron, where I discussed its downward guide in its preannouncement for Thursday’s report. In it, I said the earnings estimate cuts would begin to form a bottom, but it wasn’t then and there, just that the process was well underway. The article’s idea was it wasn’t the time to sell, but it wasn’t the time to buy, at least not yet. However, the bottom was closer than further away, I postured, as estimates were being steeply cut, a requirement to find a bottom in the Micron cycle story.

This has turned out to be accurate as book value is now within one’s limit order distance.

I expect Thursday’s earnings report to quicken that process further, getting analysts aligned with management’s near and medium-term outlook.

But, in the meantime, the market has taken its usual liberty to bring Micron’s valuation down ahead of the actual bottom. Anyone who reads my articles knows I frequently mention the two-to-three quarter view the market looks ahead, especially for memory players like Micron. This means it sniffs out the bottom before the actual financial bottom while likewise sniffing out the top before the financial top.

So while earnings estimates are being grossly cut for quarters to come, the market is already pricing it in, which is how we arrive at the below chart.

Now, I agree using book value is outdated because the market uses it to denote what the company is worth if it went bankrupt. Micron is not in any way, shape, or form in danger of going bankrupt today; these were concerns in the early 2000s and up to the mid-2000s when its technology was generations behind, and its balance sheet was not pretty and laden with debt. Today, Micron’s balance sheet is pristine with $5B in net cash, a dividend, and share buybacks. Micron is also the first to market with the latest market node for DRAM and NAND.

Micron has never been in a better position.

That said, this is the old guard of the market when it comes to valuing Micron because it cannot get a handle on the cyclicality with good enough predictability. It’s always higher and higher estimates when things are good and lower and lower estimates when things are bad. For all its faults, book value helps investors like us see the bottom of the valuation, regardless of the earnings.

And, if the market is going to use book value to its advantage, I’m going to use it to my advantage.

So About Those Returns From Book Value To Book Value

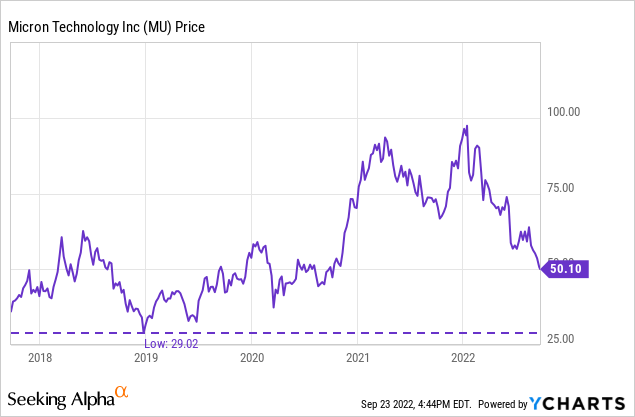

Looking back at the chart above, you might think the lows in late 2018 mean the stock today has returned to 2018 levels. However, you wouldn’t be more wrong.

The stock fell as low as $28.23 during the low period in 2018 when it dipped below book value very briefly, which means if the company arrives back at book value of $44 (I expect book value to be $45 per share after Thursday’s report), the return is 56%. That’s a CAGR of over 12.5% between December 2018 and now.

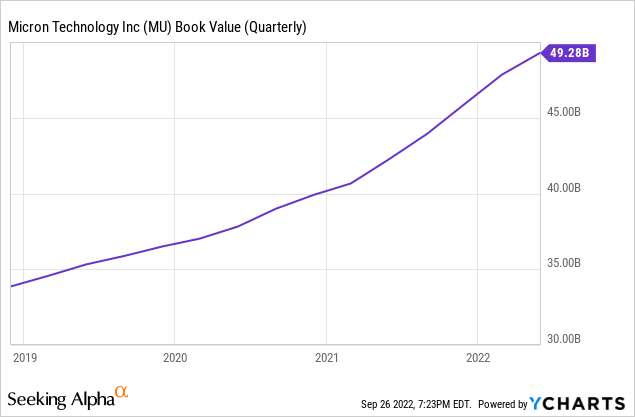

In other words, the worst you would have done is a 56% gain in less than four years by buying at book value. This is the minimum because Micron’s book value looks like this over that time period:

You might now be thinking, “Joe, you haven’t considered any of Micron’s current or future earnings or a decrease in book value.” Micron’s assets include the buildup of its asset part of its balance sheet and the paydown of debt over time. This is how Micron has gone from deeply net debt to deeply net-cash positive.

But on a more practical level, Micron’s earnings allow it to continue building its balance sheet and, therefore, its book value over the years. Sure, book value might slow during weaker earnings periods, but I’m talking about a trough-to-trough movement. By the time one-time book value comes around the next time, the peak part of the cycle will have occurred, and this is where book value increases dramatically.

And for those times when the company isn’t doing well because the memory business is taking a hit due to supply and demand, the above chart shows pretty clearly book value has continued to move even during the weaker times.

Book Value Risks And Calculations

Now, this isn’t to say book value can’t decrease, and thus the goal post moves out, but the book value of Micron has not decreased materially in the last ten years. And it won’t as long as the company maintains at least positive free cash flow for the year, negating any need to use cash on hand to operate the business or go into never-ending debt.

Even in the face of its worst times in the last ten years, book value can barely be seen decreasing between 2015 and 2017. This was also when the balance sheet was at its worst with the toxic convertible debt instruments. But since 2017, book value has continuously increased with massive increases during the best times.

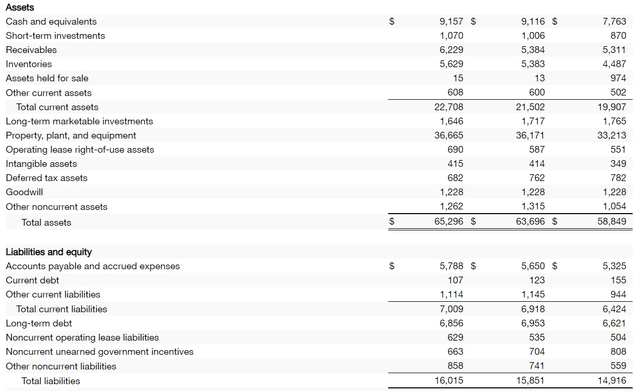

The beauty of this valuation is the calculation is straightforward to do on an ongoing basis – it’s what I’ll be doing on Thursday when the report comes out. Simply look at the balance sheet and find the total assets line and total liabilities line. Then you subtract the total liabilities line from the total assets line to get the company’s book value. Using the FQ3 earnings report, this equates to $49,281M ($49.3B) ($65,296M-$16,015M).

Micron’s FQ3 Earnings Release

Then you divide by the total outstanding shares to get the book value per share (this means share repurchases do help here). As of FQ3, Micron has 1.121B shares outstanding, giving it a book value per share of $44. If Micron increases its book value by $1.2B in the current quarter, it will come in at $45 per share. It increased by $1.44B in FQ3 over FQ2. With the hurting guidance for FQ4, it may not reach my estimate of $1.2B, but it should reach at least $1B, depending on the timing of certain payments for equipment and the current debt line.

Win, Lose Or Draw

No matter the negative outlook for Micron over the next two or three quarters, the valuation the market has chosen to price the stock has the upside of giving us a floor in the stock. It doesn’t mean the stock can’t go below book value, as it has in the past, but it’s very quick and minimal. Considering the strength of the modern-era company, the market has no reason to price it for bankruptcy. But when it does, it has turned out to be the absolute best time to buy shares.

It all funnels down to Micron’s shares being valued at only 11% higher than book value as of Wednesday’s close. In other words, there’s only a 10% downside with the worst of the financials still to come Thursday – meaning the market is ahead of the news. The risk versus reward couldn’t be any more clear for the stock cycles Micron experiences.

Be the first to comment