bfk92/E+ via Getty Images

Driven by a successive mix of skyrocketing consumer demand that was followed by pandemic supply constraints, the traditionally cyclical memory industry moved along a new cycle that started increasing in Q1 2021 and then started decreasing in Q2 2022. The downturn was amplified by a 40-year-high inflation rate and recessionary fears that dampened demand primarily for consumer electronic products.

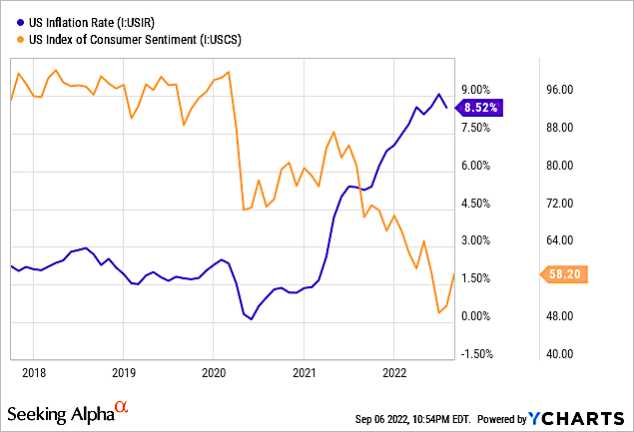

With the Federal Reserve still behind the curve, with an interest rate under 3% despite the much higher inflation rate, currently 8.5%, the length of the downturn could continue through 2023. Consumer confidence has increased as gasoline prices have decreased, and so has inflation, but that will reverse as winter sets in, and heating oil and natural gas prices rise.

Capex Spend Plans

To counter oversupply and high inventory, memory companies have planned to reduce capex spend (combination of construction and equipment). Micron (NASDAQ:MU) indicated it would reduce 2023 capex in an attempt to normalize inventories, but has not been specific on the amount.

I estimate that Micron’s original plan for a $10 billion capex spend in 2023, which incidentally was down 20% from $12 billion in 2022, will drop further to $8 billion in 2023.

At the same time, SK Hynix (OTC:HXSCL) will delay its M17 fab in the central city of Cheongju, Korea. That doesn’t mean SK will stop moving forward in its attempt to increase market share (remember, it bought Intel’s SSD memory business and Dalian fab in China last year). SK Hynix announced it will build a new memory chip fab in Cheongju, North Chungcheong Province by early 2025 and spend $10.9 billion on the new site in the next five years. This new fab is an expansion of the existing M15 line built in 2018.

Likewise, Samsung Electronics (OTCPK:SSNLF) had postponed its P3 fab equipment delivery. P3 is a mixed fab that will manufacture both memory and logic chips. It will manufacture 10nm DRAM made with extreme ultraviolet (“EUV”) process and Gen 7 176-layer V-NAND. It will also manufacture 3nm, with EUV foundry for logic customers. Ironically, in April 2022, before the souring of sales of consumer electronics products, Samsung was meeting with equipment suppliers to speed up delivery of WFE equipment because of supply chain delivery delays. Samsung’s capex in 1H 2022 dropped 13.5% HoH to $15.7 billion.

Capex spend cuts will negatively impact equipment companies. But again, consumer electronics products are filled with logic and processor chips, which means a strong impact on Applied Materials (AMAT) and Lam Research (LRCX), according to The Information Network’s report entitled “Semiconductor Equipment: Markets, Market Share, Market Forecasts.”

Comparative Data From Memory Suppliers

With that as a basic context, the following are comparative charts for the three companies – Micron, SK Hynix, and Samsung. In this article, I discuss ASPs (average selling prices). In my Semiconductor Deep Dive Marketplace newsletter, my more extensive article of the same title also discusses revenues and bit shipments.

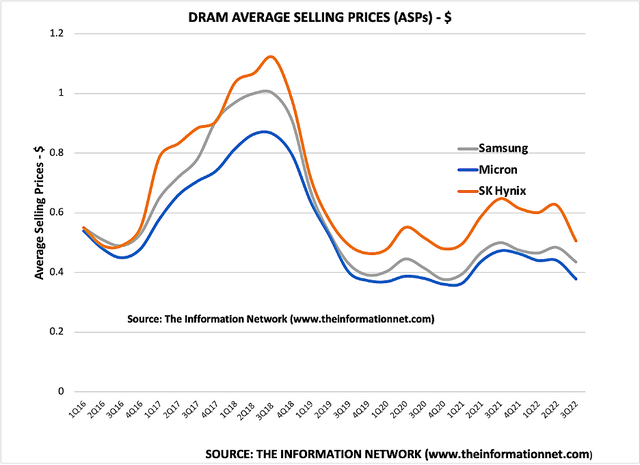

DRAM

ASP (Average Selling Prices)

ASPs for SK Hynix in 3Q are expected to decrease in the high teens as demand drops by both sluggish IT sales and reduced data center investment at hyper-scalers (due to decreased advertising revenue). ASPs for Micron and Samsung are expected to drop in the low-to-mid teens, as shown in Chart 1.

Chart 1

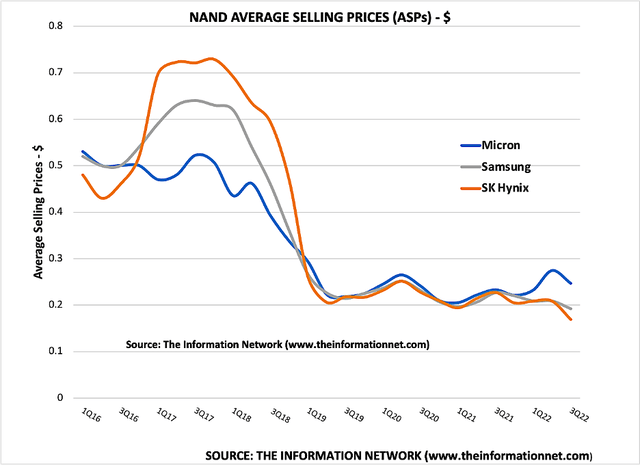

NAND

ASPs

Oversupply of NAND chips, primarily for consumer electronic products, is driving down NAND ASPs. ASP decreases for 3Q range from -8% for Samsung to -19% for SK Hynix, as shown in Chart 2.

Chart 2

WSTS DRAM and NAND ASPs

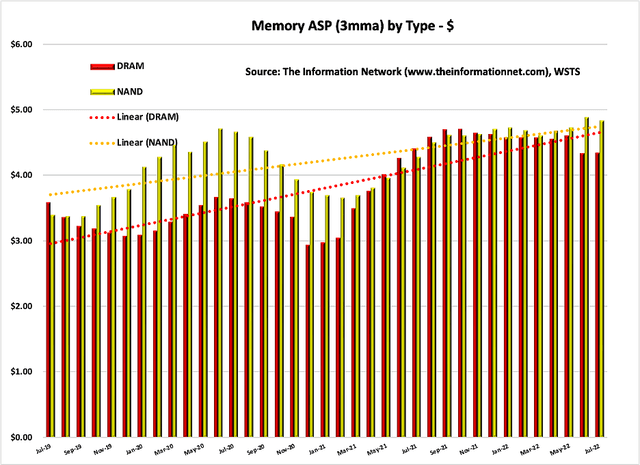

ASPs of DRAM and NAND are shown in Chart 3 on a 3-month moving average for the period July 2019 to June 2022. Memory ASPs decreased 3.2% in July from -3.3% in June following an increase of 1.0% in May. DRAM ASPs increased 0.6% in July from -6.0% in June (+1.2% in May) and NAND ASPs decreased 1.2% in July from +3.5% in June (+1.2% in May).

Chart 3

Investor Takeaway

Macro uncertainties have had an adverse impact on smartphone/PC demand. Shanghai, China lockdowns impacting the supply chain earlier in the year, must not be overlooked as a contributing factor. Delivery delays moved from component shortages to logistics disruptions as the Shanghai port was essentially closed.

Inventory levels at Micron and peers are rising on tepid sales of products such as smartphones and TVs. In an effort to reduce inventory levels, major set makers are trimming back their purchases of parts (including memory chips). Although healthy in 1H22, data center investment demand is likely to start declining visibly in 3Q22 as earnings at global hyperscalers (including Google (GOOGL), Meta (META), and Amazon (AMZN)) are starting to slow.

Chart 4 shows Micron’s share return for the past 1-year period is -23.4% compared to the S&P Technology Select Sector Index (^IXT) which has fared better at -15.9%.

Chart 4

YCharts

When Can We Expect The Start Of An Upcycle

Citi analyst Christopher Danely cut his estimates on Micron and lowered the price target to $75 from $80, but he reiterated his buy rating, noting Micron has shown the three signs of a bottom: it lowered its capex spending; it is trading near trough valuation; and it has most of its downside already in consensus estimates.

In Chart 5, I show the dramatic rise of the US Inflation Rate over a 5-year period that started expanding rapidly at the beginning of 2021 (blue line). It also shows the US Index of Consumer Sentiment (orange line) and the inverse relationship between the two. Consumer sentiment reached a low of 50.00 a few months ago, correlated to a 40-year high in the inflation rate of 9.1%.

An important implication of Consumer Sentiment is that it is an economic indicator that measures how optimistic consumers feel about their finances and the state of the economy. And that’s the key issue of this memory downturn. As prices have risen, consumers had to choose between food, gasoline, or electronic products.

Chart 5

YCharts

Consumer sentiment has risen as gasoline prices have dropped. OPEC is now cutting production, and Russia closed the Nord Stream 2 pipeline. As winter sets in, heating oil prices, which haven’t dropped, and pipeline natural gas will rise. I expect consumer sentiment to decrease, which would be a headwind for the memory industry.

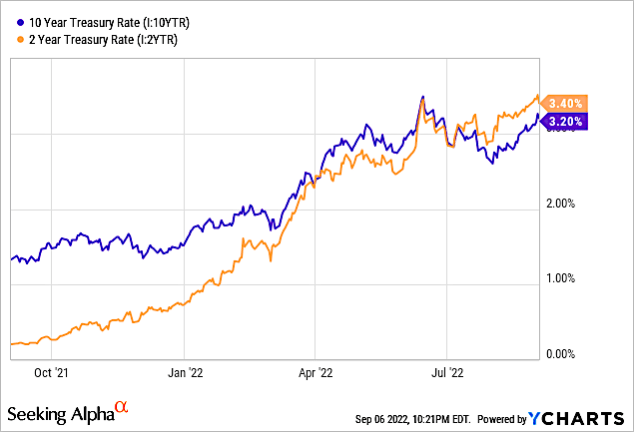

Another uncertain problem is the possibility of a recession. Chart 6 shows the 10-year and 2-year treasury rate. Normally the 2-year is lower than the 10-year rate. However, when it is higher it is called an inverted yield curve.

An inverted yield curve occurs when near-term risks increase. Investors demand relatively greater compensation from shorter-term Treasuries, and long-term expectations for the economy sour.

Chart 6

YCharts

There have been six major US recessions, defined by at least two consecutive quarters of negative GDP growth, since 1976. Represented by gray panels in the below chart, all six recessions were preceded by the 10-2 spread going negative, and each recession occurred less than two years after the 10-2 spread first inverted.

To reset the current memory cycle, memory companies are judiciously adjusting capex spend to reduce inventory overhang and oversupply. However, the industry must overcome the concern of consumers of spending discretionary money on electronic gadgets when non-discretional spend is critical. I don’t expect a recovery in memory through 2023 tied to macro factors and exclusive of escalating geopolitical issues.

Be the first to comment