MGPI continues to add to their inventory, invest in their brands and create shareholder value. ArtistGNDphotography/E+ via Getty Images

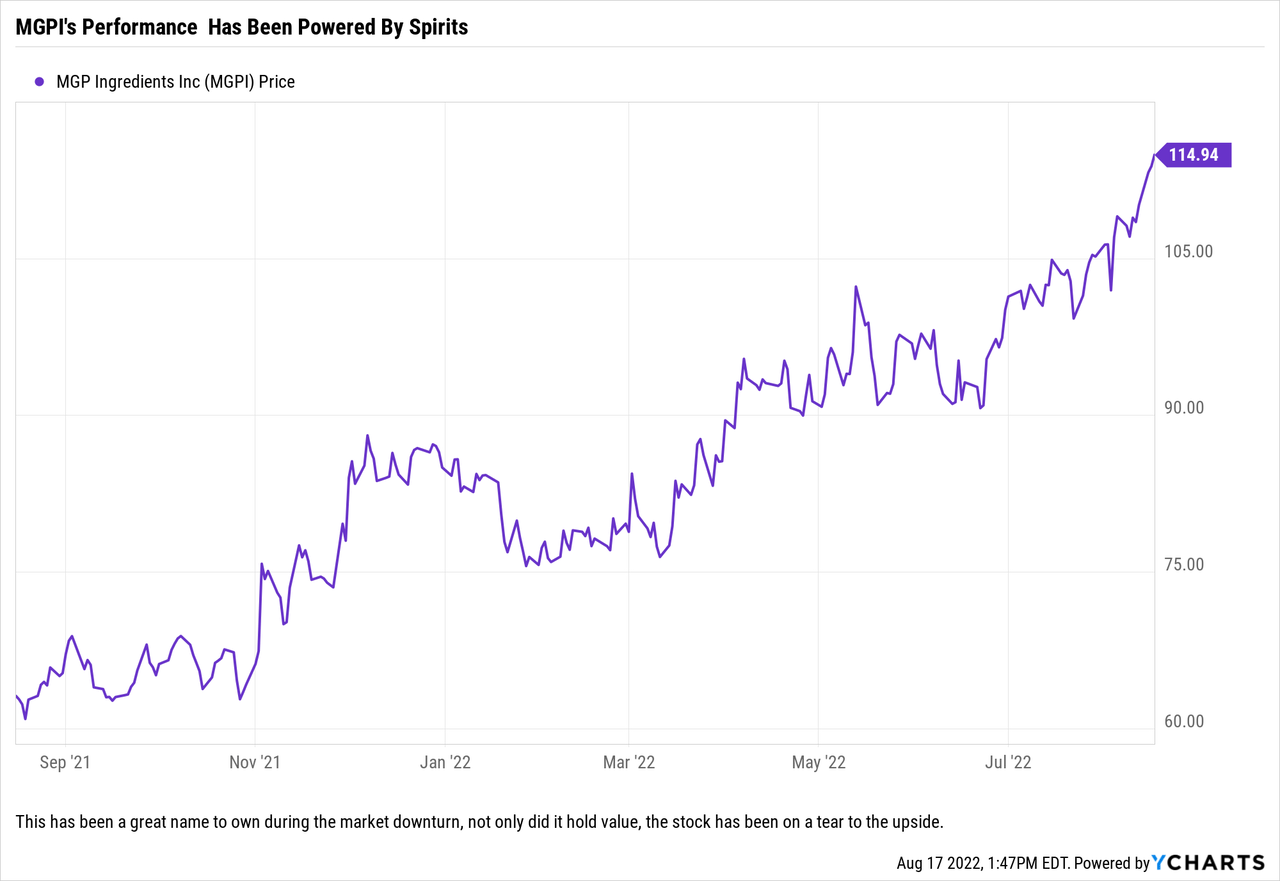

We last covered MGP Ingredients (NASDAQ:MGPI) back in mid-March of this year, rating the stock as a ‘Hold’ and laying out what we believed the company needed to do in order to continue their march higher while creating further shareholder value. Since that article was published, the stock is up 50.67% and has delivered a 50.86% total return (factoring in dividends). For a reference point, the S&P 500 has returned 1.69% over the same period. We will admit that we missed out on some profits, due to the fact that we have less of an allocation to ‘Holds’ in portfolios we run than ‘Buys’ and ‘Strong Buys’, but at the same time have to appreciate the fact that one of our lower conviction plays at that time did return over 50% during a bear market.

MGP Ingredients’ stock has been on fire, especially considering the volatility in the general market. (Seeking Alpha)

The points we made in the previous article, we still stand by them, and we will note that it certainly appears that management is committed to more M&A as we have seen references to M&A in presentations and conversations about it during the conference calls that follow the quarterly results. That is good news for investors, as we think it is one of the best ways for management to continue to grow their branded spirits business.

MGP’s Most Recent Results

Patient investors were rewarded this quarter as the company delivered pretty outstanding results on a quarterly basis and management finally used the strong quarter to increase their full year guidance on revenues, adjusted EBITDA and EPS. MGP’s management announced guidance for revenues for the rest of the year in the range of $745-$765 million, up from $690-$715 million with adjusted EPS ranging from $4.41-$4.65/share which was up from $3.95-$4.10/share. MGP was able to do this because like Q1, Q2 was solid – with sales coming in about $22 million above estimates and EPS almost $0.20/share higher.

While we are very pleased with the results, we think that Truist’s William Chappell, who is pretty familiar with the name after having covered it for years now, had one of the better questions during the quarterly results conference call. Basically, it looks like the company has lowered the bar for Q3 and Q4 with conservative increases to the FY metrics we just discussed (revenues and adjusted EPS) even when those are historically the company’s, and overall industry’s strongest quarters for sales. Simply put, by recognizing the outperformance on the front end, and raising FY guidance by basically the outperformance already realized, management has kept in place their previous guidance for Q3 and Q4. And just as Mr. Chappell thought that it was odd, we do too.

So the key for the rest of the year is truly brown goods; specifically, whether MGP’s wholesale customers will look to purchase new distillate for aging or already aged spirits while taking delivery of those goods inside the 2022 calendar year.

Items To Keep In Mind

For years, we have been on board with the shift from wholesale to branded whiskey, believing it to be one of the more accommodating times to launch bourbon/whiskey brands with respectable age statements and that the process would be aided by MGP’s street credit that they developed among enthusiasts by being the supplier to some of the more sought after brands from non-distilling producers (or NDPs). Over time, the branded segment will provide more predictable sales as the company streamlines processes with distributors, but it does seem that the company is still dealing with the “lumpiness” of orders even after the addition of all of the Luxco brands. Ideally, this would have been less noticeable, but management did say that it had to do with distributors having depleted their stocks during a time of supply chain issues within the industry.

Distilling solutions, the wholesale distillery business, is still the driver of the business as its revenues are roughly double that of the branded spirits business. MGP continues to build out their stable of brands, which is why advertising costs are rising. If you are a believer in bourbon/whiskey’s ability to stay relevant for the long-term, then this will be money well spent as the branded business has the potential to deliver margins that are at least 50% above current levels. Long term, we think that the company may be forced to look at the ingredient solutions business and how that truly fits into a spirits company portfolio that will hopefully continue to grow.

What We See Going Forward

It certainly appears that management has a clear runway to meeting this year’s numbers, even after the raise, but we do think that they should post results that solidly beat estimates and guidance – especially with the industry-wide strength historically seen in Q4. If the historical seasonality of the second half of the year holds, then MGP has some significant upside still left. Investors need to keep in mind that the branded spirits business will not be what drives the upside, but rather the big, lumpy NDP orders of new distillate and aged barrels. The set-up here reminds us of previous times that management has built up momentum only to have timing issues of the distilling solutions business throw cold water on rallies, so yes, even with all of the good news we are still hesitant to jump all in on this name due to the difficulty that the company has had managing orders for NDPs in the past.

Analysts Are Bullish

We have been pleased to see additional analysts show up on the conference calls, especially the Q&A portion. It seems that people are paying attention, and now Wells Fargo (WFC) has initiated coverage (as of this past week) of the company with an ‘Overweight’ rating and a price target of $126/share. Since the earnings release, we have seen five other analysts update their price targets upwards. We would note that Wells Fargo now has the highest price target on the Street.

Back in late June Roth Capital initiated coverage with a ‘Buy’ rating and a price target of $115/share (which was raised after earnings to $120/share), and in May Cowen raised its price target from $99/share to $115/share (now at $120/share after earnings).

Our Take

Even after the run, we still think that this name is one of the more attractive growth stories out there, however upside would appear limited until clarity is provided on management’s ability to deliver in the second half of the year. There is execution risk for the spirits business, management also has to properly manage the stable of brands that they now have (without taking their eye off of the ball and failing to execute on the bigger picture) and as we have seen in the past, one bad quarter can really tank the momentum – both for the stock and the business. We think that this should be a ‘Hold’ – or an equal weight when it comes to our models – due to the strange guidance that management provided for the second half of the year. We suspect that they did not raise the bar for those quarters out of fear of disappointing, so we do appreciate the conservatism there but believe that they should be able to easily meet or beat moving forward, the only question is by how much.

So we will maintain the ‘Hold’ and keep this name as an equal weight for rebalancing purposes, which should allow us to continue to effectively manage the risk associated with the shares after their most recent run-up. We are bullish on the name and the business plan in general, but would like to see management pulling some more levers and proving that they can get their NDP clients to purchase in predictable patterns and not delay or drag their feet on expected orders.

Be the first to comment