tonaquatic/iStock via Getty Images

Mettler-Toledo International (NYSE:MTD) is easily one of the most attractive names in the laboratory and life science space. The company has a history of posting solid growth and the trend should continue as the precision measurement company is leveraged towards secular growth in automation and quality systems. Read on to understand why Mettler is one of the best run companies in the scientific instrumentation space and solid long-term holding.

Business Overview

Best known for their scales that are used in applications ranging from science labs to weighing stations, Mettler has diversified into areas such as automated reactors, in-situ spectroscopy, and tools to improve manufacturing quality. They generate revenues from both the sale of physical products and services. The company’s products are sold in over 140 countries and they generated 38% of sales in the Americas, 29% Europe, 20% China, and 13% from the rest of the world in 2022.

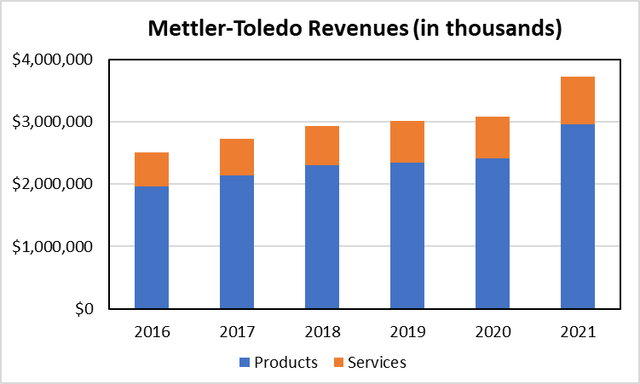

Mettler has grown revenues at a CAGR of 8.2% since 2016, with products generating 8.6% and services 6.6% CAGR. Products represented just under 80% of revenues in 2021 and generated ~60% gross margins, which is in line recent history. Mettler has been able to expand gross margins on services from 44.6% in 2016 to 51.8% in 2021.

Mettler-Toledo Revenues for 2016 to 2021 (Prepared by author)

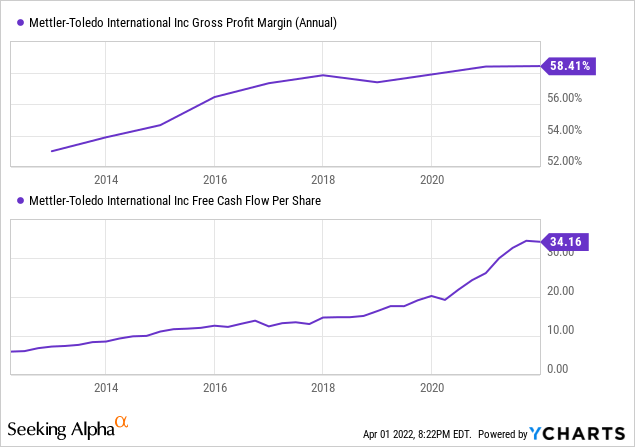

Earnings before taxes have grown at a CAGR of 8.8%, which has been driven both by growth and by curbing expenses. The company has reduced SG&A expenses to 25.4% of sales in 2021 from 29.7% in 2016. Higher sales coupled with improved margins and a robust share repurchase program has resulted in an 18.8% CAGR in free cash flow over the last five years and a free cash flow per share CAGR of 22%, equating to $34.16/share of free cash flow in 2021.

Share Repurchase

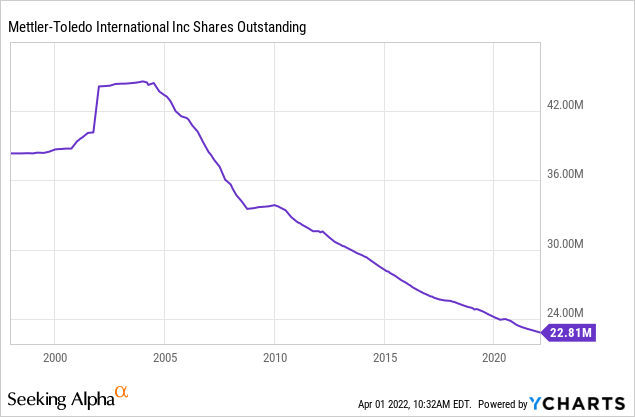

Mettler has used their share repurchase program to consistently reduce the outstanding share count over the last 15 years, eliminating 12% of the float over the last five years. The company has $2.3B remaining on the existing share buyback program and they intend to spend ~$1B on shares in 2022, comparable to what 2021 and would represent ~2.7% of shares outstanding after accounting for exercisable options.

One driver for the impressive share repurchase execution is executive compensation. Former CEO Olivier Filliol, who still serves on the board, received an option to buy 12,678 shares at an exercise price of $397.95 as a result of the company achieving compound earnings growth of 12% per diluted share from 2017 through 2021, or a 76% increase in EPS over the period. The share count reduction provided a 13.9% tailwind to achieve the EPS growth, resulting in options worth over $12MM to Mr. Filliol.

Growth Through Selective M&A

Mettler has made a few strategic purchases in recent years. They acquired Biotix, Inc. in 2017. Mettler paid $115MM for the maker of pipettes, pipette tips, tubes, and reagent reservoirs used in life science labs. The laboratory consumables space has been performing well for the company, and they received a $35.8MM award from the U.S. Department of Defense to increase their pipette manufacturing capacity. The new capacity is scheduled to come online by the end of 2023.

Mettler purchased Mayfair Technology, LLC (PendoTECH) in 2021, acquiring instrumentation used in the fast-growing single use bioprocess space. Mettler paid $192.4MM in upfront cash and may pay up to an additional $20.0 million based on 2022 and 2023 sales. Based on performance to date, Mettler has increased the carrying value of the liability to $20MM, a good sign that the investment is meeting expectations.

In addition to these deals, the company also purchased scale company Henry Troemner for $95.8MM in 2016 and Scale-up Systems Inc., a scale-up and reaction modeling software company in 2021 for $20.2 million plus contingency payments. Clearly the company has a preference for smaller deal that can be financed with cash flow.

Mettler could probably do another small deal in the near future, but I wouldn’t anticipate any large moves. The company has $1.3B in current assets, $1.1B in current liabilities, and total liabilities of $3.2B. They have $649MM available on a line of credit and generated $822MM in free cash flow in 2021.

China – Risk and Opportunity

China has been a significant factor in Mettler’s success, representing 21% of external sales, 36% of production, and 35% of profit in 2021. The company posted 25% sales grown in China on a constant currency basis in 2021, outpacing the already impressive 13% compounded annual growth they have posted in the Asian region since 1999. While the performance in the Chinese market is impressive, it is not without risks. Near-term performance may be impacted by COVID lockdowns, as the company has locations in Shanghai, Changzhou, and Chengdu. Long-term risks in the market are mainly driven by geopolitical risks, with the company calling out nationalization and intellectual property loses as potential outcomes. Exchange rates and restrictions on capital flow are also risk factors to consider, as Mettler intends to repatriate most of their earnings over time to fund their capital allocation plan.

Valuation

Mettler provided preliminary 2022 guidance in their 2021 Q4 earnings release, calling for ~7% sales growth in local currencies and adjusted EPS in the range of $38.15 to $38.50. If they hit the adjusted EPS number, it would represent 12% to 13% growth from 2021. The company’s adjusted EPS numbers have been fairly respectable since 2016, with free cash flow averaging 98% of the reported adjusted EPS over that period. Shares closed at $1,371.63 on Friday, which would equate to 35.8x forward earnings and 2.9 PEG.

Summary

Rarely does one find a company that is as well run as Mettler-Toledo. The company is generating impressive growth while also keeping expenses in check. They are well positioned to maintain their upward momentum in the coming years, and I would be eager to initiate a position in the company at the right price. That being said, the shares look expensive at ~36x forward earnings. I will look to open a position in the company if a market correction presents an opportunity to get in at closer to $1000 per share.

Be the first to comment