GabrielPevide/E+ via Getty Images

3Q22 Review

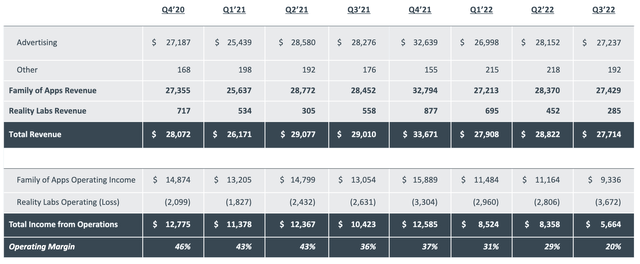

Meta’s (NASDAQ:META) 3Q22 revenue of $27.7 billion (-4.5% YoY/+2% ex-FX) beat consensus estimates by $310 million but GAAP EPS of $1.64 (-49% YoY) missed consensus by 12%. As expected, the core advertising business experienced a material slowdown with revenue contracting 3.7% YoY to $27.2 billion, while FoA (Family of Apps) operating margin fell from 42%/39% in Q1/Q2 to 34% in Q3 which indicates an over-earned 2021.

In advertising, impression grew 17% YoY, offset by an 18% YoY decline in pricing driven by lower monetizing regions, FX impact, and softer advertiser demand. Healthcare and travel were the main contributors to ad growth in Q3, offset by weakness in e-commerce, financials, gaming and CPG. This was largely similar to Google’s (GOOG) (GOOGL) comments on stronger retail/travel verticals and softer financials and gaming (analysis here).

Reels content continued to increase with over 140 billion daily Reels being played across Facebook and Instagram, up 50% vs. 6 months ago. Though still immaterial, Reels (~20% of time spent on Instagram) achieved a $3 billion ad revenue run rate. While Reels still present a negative revenue impact of ~$500 million per quarter, management believes they will turn into a tailwind in the next 12-18 months.

The RL (Reality Labs) division saw revenue drop 49% YoY from $558 million in 3Q21 to $285 million in 3Q22 due to lower Quest sales and delivered the highest quarterly operating loss of $3.7 billion. This brought the company-wide EBIT margin down to just 20% vs. 29% in Q2 and 31% in Q1. Despite continued buybacks of $6.55 billion in Q3 ($17.8 billion remaining), Meta’s earnings almost halved.

Still spending while the top-line is slowing

For 4Q22, Meta expects revenue of $31.25 billion at the midpoint (-7% YoY/flat ex-FX) on a slowdown in digital advertising and a strong dollar. Management updated 2022 total expenses from $85-$88 billion to $85-$87 billion, which implies a 4Q22 operating margin of roughly 23%, a slight improvement from 20% in Q3. However, estimated Q4 EPS of $2.12 (mgmt. guided same tax rate as Q3) would still represent a 42% YoY decline. Further, 2022 Capex is expected to $32-$33 billion vs. $30-$34 billion previously, as Meta continues to make investments in infrastructure and AI capabilities to develop the metaverse, upgrade social feed algorithm and to address challenges from Apple’s (AAPL) privacy policy.

As 2022 comes closer to an end, Meta’s top-line visibility going into 2023 seems rather limited as a potential recession remains a wildcard. Adding insult to injury, Apple just announced that the App Store would take a 30% cut on every boosted ad within the Facebook and Instagram app. Despite the murky revenue outlook, Meta will be incurring total expenses in the range of $96-$101 billion in 2023, up 15% from 2022 at the midpoint. Further, 2023 Capex is expected to be another $34-$39 billion (great news for Nvidia (NVDA)). Altogether, the combined $135 billion in expenses and Capex in 2023 are likely to complicate Meta’s earnings prospects unless top-line growth could recover to double-digit territory.

While management plans to keep 2023 headcount roughly flat with 3Q22 level (87,314), growth in cost of revenue will accelerate due to infrastructure and RL hardware costs (next-gen Quest launch in 2023). This sounds like more operating losses from the metaverse where Mark Zuckerberg believes users will immerse themselves in a virtual platform that takes an almost 50% cut from developers providing various experiences to users. In my view, however, investors should be very skeptical of whether the metaverse will ever become a viable business story (analysis here).

Bottom Line

I maintain my view that shares of Meta remain a value trap as the company is facing headwinds with its core advertising business and margins are literally being destroyed by massive investments in the metaverse, which hasn’t been gaining meaningful traction and will be facing rising competition from Apple and Sony (SONY) in 2023. It’s quite unusual to see a company committing to such heavy investments in the backdrop of a slowing global economy and limited revenue visibility.

As a result, markets are unlikely to find Meta’s forward P/E helpful considering both the top and bottom-line picture is exposed to a wider range of outcome. Perhaps the story will get better in 2024 as Meta gets through the current investment cycle and sees an improving ad market. But investors will likely not place much faith in the metaverse however exciting the prospects may sound. As usual, I continue to see Meta as an earnings contraction story that will see its forward multiples go up as analysts cut future estimates. The majority of sell-side analysts still have a Buy rating (albeit lower price targets), but investors should seriously question the risk/reward profile when the stock looks too cheap to pass.

Be the first to comment