Fritz Jorgensen/iStock Editorial via Getty Images

Meta Platforms (NASDAQ:META) has been trying a number of initiatives to improve its growth runway. The most important effort is within its Reels feature where we are seeing a rapid increase in user engagement. Meta’s success in Reels will be crucial because it shows the ability of the company to rapidly adapt to new trends within the social media industry. The management has announced that Reels makes up more than 20% of the time users spend on Instagram and videos have cornered 50% of the time spent on Facebook. This is a massive change for Facebook.

The monetization of the time spent on Reels is still low as the company is focusing on improving user engagement. However, Meta has shown in the past few years that it can increase monetization in new initiatives despite reservations by Wall Street. This was clearly seen in the Stories feature which was believed to have a low potential for monetization but has turned out to be an excellent platform for advertisers.

The dip in revenue growth in the recent quarters is due to more people moving towards Reels and the fact that Meta has not started monetizing this feature completely. The next few quarters should see higher user engagement in Reels and a rapid move towards monetization which should boost Meta’s key metrics like revenue and profit growth which will improve the sentiment towards the stock on Wall Street. At a P/E ratio of 12, Meta stock is a Strong Buy for long-term investors ready to wait out the current headwinds.

Reels is the future

Meta has made some big changes in its platform over the last few years. It is likely that we will see a massive shift towards video format as users become accustomed to this media. Reels is the key feature that will help Meta move into a video-first platform. Already, Reels has cornered over 20% of the total time spent by users on Instagram. This number can increase rapidly as the company focuses on improving the ecosystem for creators.

There is a big bonus program where Meta has allocated $1 billion for creators who have high engagement on Reels. This program is still fluid but focuses on increasing user engagement. The Verge article mentions that creators have been offered as much as $1,000 for every million views. This is quite a good payout for short-form videos.

Meta has the resources to double down on helping creators increase the user engagement on Reels. TikTok has recently introduced its first ad product and is providing a good revenue share for creators. This is something we should see from Meta in the near future as creators are provided with new opportunities to monetize their videos. It should be noted that Meta is spending massively on Reality Labs with annual losses of over $10 billion. The company could easily spend a fraction of that amount on a successful feature like Reels to increase user engagement and monetization.

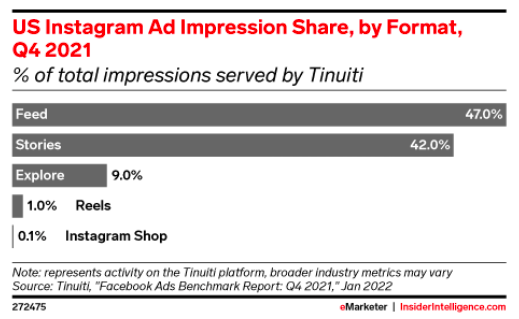

eMarketer

Figure 1: Ad impressions on Reels is still very low compared to Feed and Stories. Source: eMarketer

A recent eMarketer report shows that the ad impressions on Reels is still very low compared to other features. At the same time, user engagement on Reels is rapidly growing. This could be a key reason behind the dip in revenue growth. However, this dip is likely to be temporary as Meta starts ramping up the monetization of Reels in the next few quarters.

Reels vs Shorts vs TikTok

There is a battle among social media Goliaths within the short-form video format. Reels directly competes with YouTube’s Shorts and TikTok. YouTube reported YoY revenue growth of only 14% in the recent quarter compared to analyst expectation of 25%. A big reason for this decline in revenue growth was reported to be the rapid growth in YouTube Shorts. More users spend time on Shorts which reduces the overall ad revenue. TikTok has also moved towards launching ad products. This will lead to strong competition between these rivals to attract more users and deliver more ads to them.

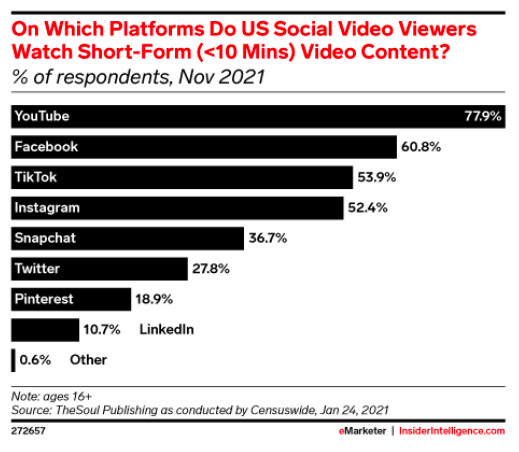

eMarketer

Figure 2: Usage of different platforms to view short-form videos. eMarketer

Reels has a number of advantages against other short-form video platforms. We are still in the early stages of short-form video media. As this format becomes more widespread among users, we should see a more “social aspect” to these videos. Meta has massive data on the interests, background, likings, and other aspects of a user. This should allow the company to build better algorithms to improve user engagement. Both TikTok and YouTube Shorts lack in-depth data about users which Meta has. The network effect will come into play within the short video format also. This will eventually be a major advantage for Meta against other rivals.

Growth potential

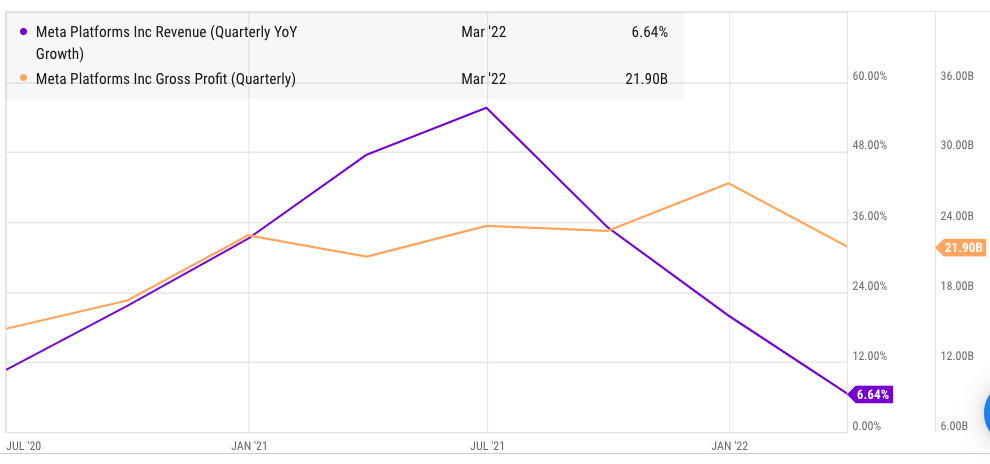

Wall Street is likely underestimating the future scope of Reels platform. We saw a similar caution during the early stages of Stories when most of the analysts questioned the ability to deliver ads on that platform. Meta has the resources and social network to divert more users towards Reels and increase the engagement metric. The current low monetization rate in Reels will certainly lead to short-term headwinds for the top line and bottom-line growth. We have already seen this in the past few quarters.

However, over the next few quarters, we should see a rapid increase in monetization within the Reels platform. This will reignite the revenue and profit growth rate trajectory of Meta and also improve the sentiment on Wall Street.

YCharts

Figure 3: Dip in YoY growth due to tougher comps and growth of lower monetizing platform like Reels. Source: YCharts

Impact on Meta Stock

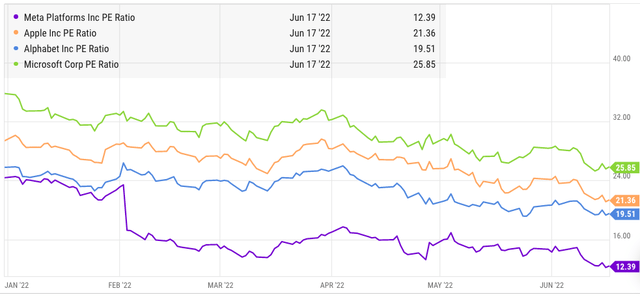

Reels is having a big impact on the direction of Meta stock. It is one of the key reasons behind the dip in revenue and profit growth in the last few quarters. This has soured the sentiment of Wall Street towards the stock. Meta stock has now fallen by close to 50% year-to-date compared to less than 25% decline in other Big Tech stocks like Apple (AAPL) and Alphabet (GOOG) (GOOGL).

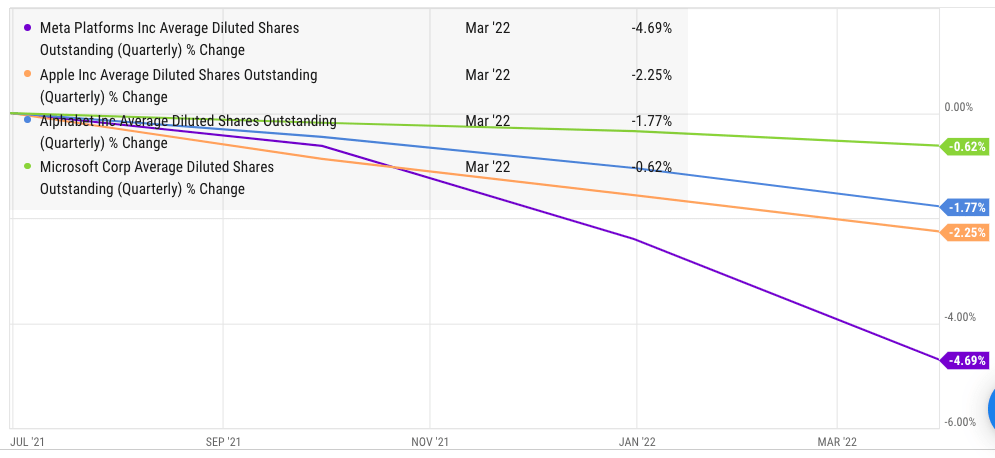

Figure 4: Meta is trading at a big discount compared to other tech stocks. Source: YCharts

The Reels feature might take a few more quarters to show good results. During this time, the revenue growth for Meta will remain challenging. However, long-term investors can take advantage of the rock-bottom price in META stock to gain a better entry point.

YCharts

Figure 5: Meta has expunged close to 5% of its outstanding stock in the last twelve months. Source: YCharts

It is also important to note the trend in buybacks. Meta spent over $50 billion on buybacks in the last twelve months which has expunged close to 5% of its outstanding stock. This is much bigger than Apple, Alphabet, or Microsoft (MSFT). Meta produces $40 billion in free cash flow which should allow it to continue the current pace of buybacks. At the current price level and buyback pace, META could expunge more than 10% of the outstanding stock annually. This level of buybacks can be maintained for a number of years due to healthy FCF and cash reserves.

Long-term investors would benefit from this trend as the EPS of Meta stock increases dramatically over the next few quarters.

Investor Takeaway

Meta is putting a lot of focus and resources into improving user engagement on Reels. The management has mentioned that 20% of user time spent on Instagram was on Reels. The monetization of this feature is still quite low as the company is focusing on improving user engagement. However, Meta is in a good position to build a strong ad revenue stream from Reels due to its current tools.

Meta is at a big advantage compared to YouTube Shorts and TikTok because of its social media platform. The network effect will start showing in short-form videos which will help Facebook build a better algorithm than rivals and improve the user engagement depending on their interest and background.

Meta stock is trading at a big discount compared to other tech majors. We should continue to see headwinds for revenue and profit growth in the near term. But long term investors could get better returns due to the current rock-bottom stock price. Facebook is also undertaking a massive buyback program which should help the company increase its EPS by double-digit annually on a standalone basis. This trend will be a big tailwind for long-term returns on Meta’s stock. The fundamentals of the company are still very strong and the low stock price makes it a Strong Buy for long-term investors.

Be the first to comment