Fritz Jorgensen/iStock Editorial via Getty Images

Meta Platforms, Inc. (NASDAQ: META) is a technology company known to virtually every investor in the world. Formerly known as Facebook, Meta has claimed its place as one of the biggest tech companies in the entire world, with platforms like Instagram and WhatsApp under its belt. However, despite the company’s massive growth over the years, its stock price is way below its all-time high of $384.33. The stock currently trades at less than half of this number – to be specific, a humble $159 at the time of writing this article. Does this represent a buying opportunity, or is there definitely more pain to come?

Advertising and sales

Firstly, let’s establish that Meta is an advertising powerhouse, with advertising revenue making up a large majority of its sales.

2022 Q1 performance

In the first quarter of 2022, the company reported $27b in ad revenue, representing a 6% YoY growth. Total sales were $27.9b, representing a 7% YoY growth. We also see that the daily active users on the Facebook platform is up 4%, and currently sits at a whopping 1.96b. The company has done decently well in the first quarter of 2022. However, the company has mentioned that Q2 sales projections were on the lower side ($28b to $30b), which would represent a YoY decline for the very first time in Meta’s history. Nonetheless, there was rather positive reception in the most recent earnings report, and it seems that the company is still on a decent trajectory.

Growth

Meta’s ability to generate sales through advertising on its platforms has cemented the company as one of the largest tech powerhouses in the world today. However, many questions are being asked about the slowing growth in such metrics.

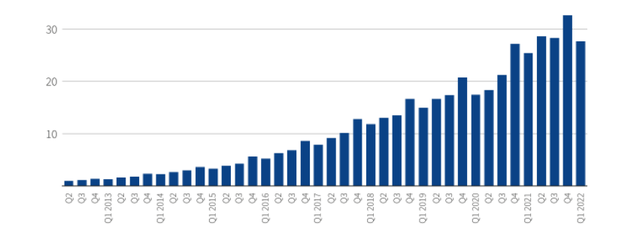

Meta’s Quarterly Ad Revenue (Reuters)

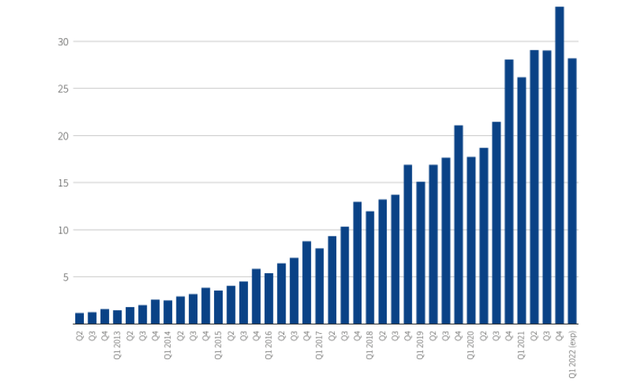

Meta’s Quarterly Revenue (Reuters)

While we see the clear exponential growth in the earlier years, we’re also starting to see slowing growth in ad revenue and total sales in the later years. This is largely due to slowing user growth which may have arisen due to intense competition in the industry, or other possible concerns (more on that later in the article). The fall-off in growth has raised many eyebrows, with analysts downgrading the stock as it no longer seems to be a good value play in the long term.

There’s lots of talk about how people “don’t even use Facebook anymore,” and that “user growth has come to a halt.” I must concede that considering the previous user growth rates that Meta was at, we were bound to see a fall-off – and it’s not just the fact that there are competitors gaining market share, but also because there’s an absolute limit to how far we can go in terms of user growth, because they’re only that many people (with internet access) in the world! Meta has grown to a point where it has almost 2 billion daily users on the Facebook platform, as reported in this year’s Q1 results.

For some reference, there is an estimated total of 5 billion people in the world who use the internet today, which means that 40% of the internet-using global population are on Facebook every day. As such, the company or its platforms are not “dead” by any means, and to say that slowing user growth means that investing in Meta is a bad decision is rather myopic. I would argue that another important metric we could consider is the average revenue per user (ARPU), which can definitely be maximized to get the company’s revenue back on track.

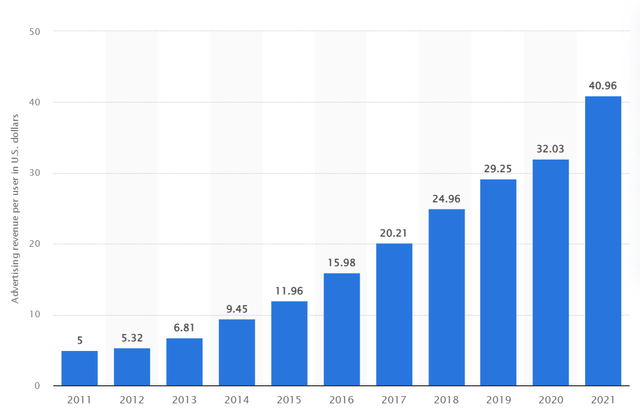

Meta’s Annual Average Revenue Per User (ARPU) (Statista)

We see that the ARPU is still on a steady rise. In other words, the company is earning more from each user, though we may be seeing slowing growth in total sales due to a decline in users. With appropriate steps taken in the direction of research and innovation, Meta could stay on track and gain more in sales despite the slowing user growth. However, whether Meta can do this is a question that remains unanswered. We’ll go deeper into this as we progress through the article.

Competition

With the introduction of many new companies and social media platforms, Meta definitely faces very strong competition. One of the most notable competitors is TikTok, which has taken the world by storm.

About TikTok

TikTok is owned by private Chinese company ByteDance. If you’ve never heard of the TikTok platform, it’s basically a social media platform focused on short videos. However, the extremely user-friendly interface, together with many other features which facilitate content creation and user communication, have caused TikTok to blow up in growth rates. To give you some perspective, an article from Investopedia has reported that:

In 2021, TikTok surpassed 1 billion users, just four years after its global launch—half the time it took Facebook, YouTube, or Instagram to reach that milestone, and three years faster than WhatsApp.”

It’s no wonder Meta is seeing a slump in user growth rates. TikTok’s growth story can almost be described as miraculous, and there seems to be no sign of stopping just yet. In the same report, we also see that

TikTok became the world’s third-largest social network in 2021, behind Meta’s Facebook and Instagram, and is projected to exceed a 20% market share in 2022 and about 25% by 2024.”

The projected market share growth means trouble for Meta, whose market share is already on a decline. The threat presented by TikTok is not negligible by any means.

Meta’s response

In response to the boom of TikTok, Meta has released Reels, which is a feature on Facebook and Instagram that works in a similar fashion to TikTok. The main difference is that Reels is an add-on to Facebook and Instagram which works in conjunction with the platforms’ other features, while TikTok is, in itself, a social media platform. The introduction of Reels has seen considerable success, with the new feature making up over 20% of the time users spend on Instagram, according to an article by TechCrunch.

However, Mark Zuckerberg did point out that it was not easy to monetize this new feature, and considers the monetization of Reels to be a “multiyear journey.” He also mentioned that the company was carrying out R&D to design a better recommendation algorithm, which he believes is the root of TikTok’s massive success. It’s good that we see a clear and tangible plan moving forward, but whether it eventually helps Meta get to where it wants to be is uncertain.

Metaverse

One of the biggest talking points about Meta is its huge investment in the metaverse. For those of you who don’t exactly know what the metaverse is, it is

a network of 3D virtual worlds focused on social connection”

according to Wikipedia.

Metaverse products

So, how does Meta plan to be involved? Meta has invested a massive $10b into the metaverse, and it turns out that Mark Zuckerberg has an entire line of projects planned out as he believes that it will be a huge part of our lives in the future. Let’s go over some of them.

Horizon Worlds

Horizon Worlds is Meta’s virtual reality (VR) social platform, and it functions as a virtual world where users are able to carry out daily activities such as interacting with people, attending meetings, commerce etc. with the help of the Quest VR headset. Meta intends to continue improving the platform by introducing more features and regulating inappropriate actions so that Horizon Worlds eventually becomes a safe space detached from reality where people are able to do things seamlessly in an interactive and customizable virtual world. In February 2022 this year, the platform hit 300000 users, which is a tenfold increase compared to the same number three months prior to that. In addition, Meta plans to release this platform for mobile phone users.

Project Cambria

Project Cambria focuses on the development of a brand new state-of-the-art VR headset. According to an article on Topic Insights,

These new goggles would allow avatars to make natural eye contact and reflect your facial expressions in real-time through sensors.”

The product is dubbed the “Oculus Quest Pro”, a name inspired by the famous Oculus Quest VR headset, which has now been rebranded as the Meta Quest VR headset. Mark Zuckerberg described the new offering to be

a completely new advanced and high-end product”

which will sit

at the higher end of the price spectrum.”

Project Nazare

Project Nazare focuses on the development of Meta’s first full augmented reality (AR) glasses. According to XR Today,

Project Nazare can be defined as an AR glasses device that would allow the wearer to communicate with others on their network, view people as 3D avatars, and interact with them in real-time aided by 3D digital assets, tools, and props.”

Some features of these AR glasses include a wide field of view, an advanced and sophisticated hologram display and multiple embedded sensors.

Long-term feasibility

With all these things lined up for the metaverse, the feasibility of it all raises many question marks. A move towards a virtual or augmented reality in general is a huge paradigm shift, and the extent to which this can be done is still relatively unexplored. Meta’s profit has been dragged down significantly due to its heavy investment in the metaverse, and it’s not certain whether this investment would pay off in the way Meta expects it to. At present, Meta’s projects for the metaverse face the problem of long lead times and high costs. There are also more serious concerns of sexual harassment, as there have been reports of such despicable acts being carried out on Meta’s Horizon Worlds. We’ll need to see if Meta is able to work through these challenges to make their investment worthwhile.

Privacy changes

Since 2021, Apple changed its privacy policy to give users more transparency and control over their data. The company has done so by prompting users if they would like to block the Identifier for Advertisers (IDFA) for mobile applications; in more plain terms, you are now prompted if you would like to opt out of any kind of data tracking or targeting, which was previously conducted automatically, when you are using a mobile application. An article by Forbes states that about 62% of iPhone users have chosen to opt out of sharing their data.

Now, how does this impact Meta? Being an advertising company, Meta has benefitted greatly from acquiring user data to suggest appropriate ads unique to each user. The policy change is a contributing factor to Meta’s relatively poor performance this year, particularly because a large proportion ad revenue earned from the Facebook platform was dependent on data from IDFA. We see that Meta can be vulnerable to such regulations, and it is definitely a point to consider when we decide on a fair valuation of the company.

Valuation

Now, with all these concerns, let’s calculate the intrinsic value of Meta stock. I have decided to go with two different valuation methods for my analysis – an EPS forecast model and a discounted cash flow model.

EPS Forecast Model

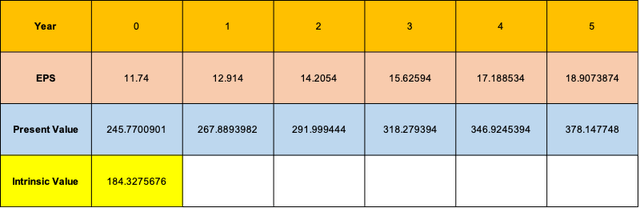

In this model, we will be forecasting Meta’s future EPS over 5 years, with year 0 being this year, and discounting it back to present value based on the company’s weighted average cost of capital (WACC). We will be using analyst estimates obtained from Yahoo Finance to help us in our calculations.

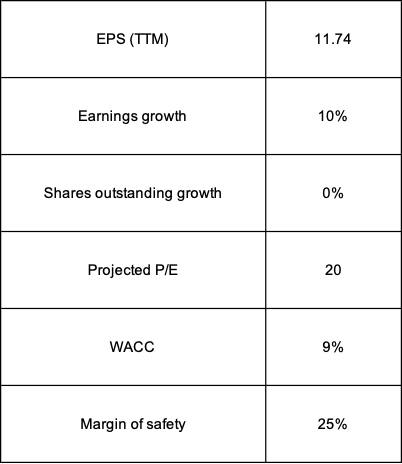

Metrics used for EPS Model (Prepared by author)

I’ve gone rather conservative in my valuation analysis, as I’ve taken into account the various challenges which Meta may face, especially in light of its slowing growth and the uncertainty associated with the metaverse. An important point to note is that the trailing-twelve-month EPS used is based on the average analyst estimate for 2022. I’ve also gone for no growth in shares outstanding – a fairly conservative assumption considering Meta has a history of buying back shares.

As for average annual earnings growth, I’ve gone for a reasonable 10%, which is much lower than the average annual earnings growth of about 25% from 2017 to 2021. In addition, I’ve tagged on a 25% margin of safety, as Meta’s heavy involvement with the metaverse, coupled with the strong competition, suggest that there is now much higher risk involved with investing in Meta stock as compared to the past.

EPS Forecast Model (Prepared by author)

We’ve arrived at a fair value of $184.33 a share for Meta, which indicates that the current valuation is a bargain. At the time of writing this article, Meta stock is trading at about $159 a share. It’s also good to note that my EPS prediction for year 2023 is actually below the average analyst estimate – it is 12.91 based on my model’s assumption but the actual estimated EPS for that year is 13.72. As such, the fact that the intrinsic value is still above the stock’s current valuation indicates that this could be an attractive investment opportunity.

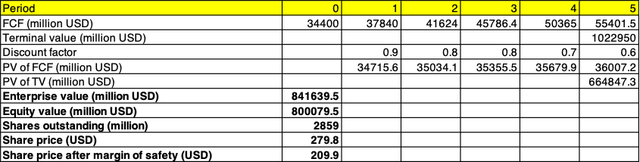

Discounted Cash Flow Model

In this model, we will be projecting Meta’s projected free cash flow over 5 years, with year 0 being this year, and discounting it back to present value based on the company’s weighted average cost of capital. We see that, in Q1 2022, the company generated $8.6b in free cash flow. Assuming that Meta keeps up its free cash flow generation, we have a good chance of seeing Meta do $34.4b in free cash flow for 2022. It is good to note that this is lower than what it did in 2021, which was $39.1b. I am also going to assume no increase in shares outstanding, a perpetuity growth rate of 3.4%, an average annual free cash flow growth rate of 10% and a 25% margin of safety – once again, very conservative assumptions.

Discounted Cash Flow Model (Prepared by author)

We’ve arrived at a price target of $209.90 a share for Meta, which is slightly higher than the number we arrived at in our previous model. However, it still indicates that the company’s current valuation is a relatively attractive one.

Investment decision

In conclusion, while Meta has many challenges lying ahead of it, its current valuation is indeed an attractive one. In addition, considering its free cash flow position and massive user base, the company has a good chance of finding its footing again if it takes the necessary steps in the right direction. My final price target will be the average of the final values obtained from both models, which means that we have arrived at a final price target of about $197 a share. As such, I will assign a “Buy” rating for Meta stock.

Be the first to comment