Lorenasam/iStock Editorial via Getty Images

By Rob Isbitts.

Argentina wins the World Cup, and all I can think about is how to analogize it to the current markets. It is a blessing and a curse, but so it is. Lionel Messi and his teammates lifted the Cup Sunday, and ignited celebrations around the globe. The one in the picture I chose for this article was similar to a scene I witnessed in my own town, shortly after the last penalty kick had crossed the goal line to cement the championship.

Argentina winning was not a big surprise, as least when you consider they were the second-rated favorite before the tournament began (France, who they defeated was third, both behind slight pre-tournament favorite Brazil). But what was a surprised was how they won, in a back-and-forth game that went to overtime and was ultimately settled in the worst way, but the only way in modern soccer: penalty kicks.

Messi Rules The Cup, Messy Rules The Market

This year’s stock market was one in which many observers (including this one) believed that a troublesome year was at least likely, if not an “odds-on favorite.” As the year went on, two things happened that to me, were as shocking and confusing to investors as when I looked at my phone Sunday morning, saw Argentina up 2-0, and thought to myself, “oh, this one’s over.”

First, the stock market fell, but a prime part of it held its own. While the market is broadly selling off across the board into year-end (see this article for more on that situation and its historical precedent), the Dow Jones Industrial Average has fallen “only” about 10%, while the S&P 500 is down 20% and the Nasdaq has cratered by 32%. Gold, much-maligned because it didn’t fight inflation they way some expected it to, is off only about 3% for the year (all figures through 12/19/22 U.S. market close). So, the stock market has been a market of stocks this year, as the old expression goes.

Similarly, 2022 is ending not with a slow, easy glide into Santa’s visit. Instead, it is ending the way it started, with down days piling up like snow in Buffalo. As was the case in 2018, some big investment firm essentially closing up shop, and hedge funds are unwilling to mess with their full-year returns this late in the year by putting capital to risk. In addition, there are plenty of reasons to dump losers to harvest tax losses and have a “clean slate” to start the new year. While I have never really understood or agreed with making every year a “performance contest,” over the decades that concept has become too mainstream to ignore.

But I don’t have to like it. And that’s why I think investors should not focus too much energy on “this year” versus “last year.” Because investing hard-earned wealth is not a game. It doesn’t stop after 90 minutes plus penalty time. There is no overtime, and certainly no penalty kicks. Frankly, there are few things as high-probability in investing than making a penalty kick.

Bonds Rarely Miss The Net, But They Did In ’22

According to TheAnalyst.com, the chances of making a penalty kick in the World Cup is about 80%. Most of the other shots were saved by the goalie, but not all of them. A very small percentage (under 5% of kicks) missed the net entirely. I used to play hockey at a very amateur level, and I can tell you with confidence and evidence, missing the net in hockey happens a lot more often. Especially when I was shooting. But I digress.

2022’s markets brought something to investors that is about is surprising as that rare moment when you see a player on your team miss the goal and the goalie on a penalty kick. Namely, the prices of bond investment dropped. Then, they dropped some more. And, after a brief flirtation with a rally, they are dropping again as we approach New Year’s Eve.

This is something that folks had to get used to very quickly, despite many (including me) warning for years that there would come a point where interest rates would rise. And, since bonds are essentially priced based on math regarding interest rate levels and how long it will be until the bonds mature, the inescapable outcome when rates go from near-zero to 4% higher is a deep decline in bond prices. This was most severe at the “long end” of the bond curve, where bonds of all types have registered losses that rival those of the S&P 500 and the Nasdaq this year.

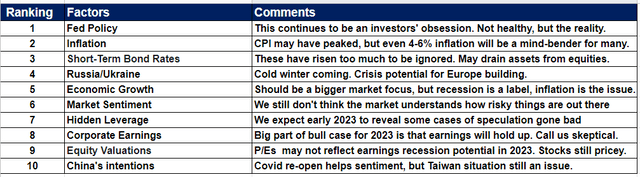

The World Cup timed out, but the markets and investors’ money didn’t. So, what do we focus on going into 2023? Below, I present a grid I update monthly in my subscription service. It simply seeks to identify and provide a one-liner commentary on the 10 factors I believe will be most influential in the months ahead. Given that it is year-end, I wanted to provide what is essentially an annual peak into that analysis, which we affectionately call the Market Outlook Factor Overview (MOFO). So, let’s see what this MOFO has to say about the current market climate.

Modern Income Investor’s Market Outlook Factor Overview (MOFO) as of 12/19/22

The MOFO (ModernIncomeInvestor.com (Rob Isbitts))

These are listed in order of significance, according to me. I’ve been maintaining this list for a few years, and while there is some turnover in terms of which factors are included in the Top Ten, the group has been surprisingly consistent throughout this year. What has changed as the year progressed was the ranking of each factor.

Fed Policy is the top factor going into 2023. If this surprises you, may I suggest you go back and review 2022. It has been a Fed-obsessed market all year, and while I believe the more important thing to investors should be not what the Fed may or may not do, but rather how their money reacts to that information and news, I feel I’m in the minority.

Fed got you down, hopeful or somewhere in between? How about ignoring all of it!

My suggestion for next year: don’t focus so much time on what the Fed may or may not do. Prioritize making money and not losing big on the investment decisions you do make. This is why I love technical analysis so much. Charts don’t care about what the Fed may or may not do, or which way Jerome Powell leaned when he answered a question, or whether he used the same words as last time or, at his somewhat advanced age, what new words he decided to use. Charts care about one thing: price movement. That is also all that one’s investment statement reflects. And that, in turn, is what the investor can spend or invest. The rest is just analysis to feed one’s decision-making process.

If I haven’t lost you by now, here are a few comments on some of the other factors from the current MOFO:

* Inflation is, like the Fed, an excuse to talk about markets ad nauseum. Speculation is everywhere. But in 2023, the key is not whether inflation has peaked, but rather where it will settle for a while. I don’t think today’s investor base is ready to navigate a persistent inflation rate in the mid-single-digits, and I think that’s the most likely scenario the next couple of years. This means that beating inflation will again be an investor priority. And, while T-Bill rates look nice for a while, at some point we’ll need to try to do better than that. That’s why Short-Term Bond rates, which were not even on the MOFO when 2022 started, have zoomed all the way up to number 3 on the list. They are truly competition for stocks and commodities…temporarily. Here too, enjoy the free lunch of sorts, but don’t fall in love with T-Bills for the long-run as the dominant asset in your portfolio.

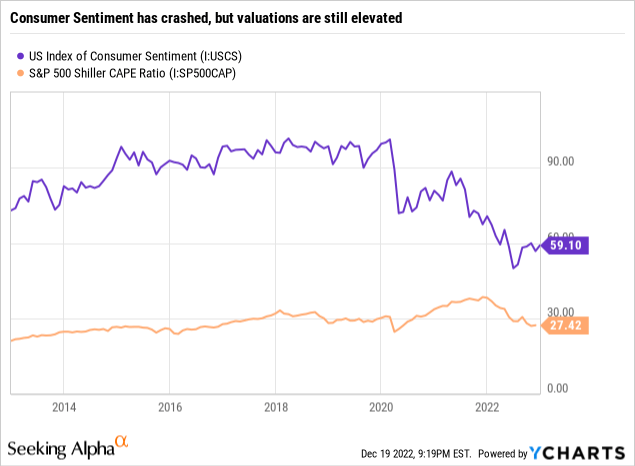

* To me, the ones to watch for upward-mobility in early 2023 are numbers 6,7, and 8 on the MOFO list. Incredibly, market sentiment is perhaps just now getting skittish. As I’ve said before, bear markets don’t end when everyone is calling the bottom or the “Fed pivot.” They end when no one cares about stocks. We are not nearly there.

Hidden Leverage is my way of leaning on history at times like this. Because every bear market cycle seems to have a sudden “oh no” (cleaned up the language there) moment. This is where, as Warren Buffett says, when the tide goes out, you get to see who was swimming naked. In this case it is a big investor that went too far, used to much leverage, tried to get too cute, and caused a dislocation in the financial markets. Maybe the FTX thing is related to that. But historically, it is something more systemic. 2022 was filled with concerns about liquidity and solvency at some key European banks. Whether it is that or something completely out of left field (as it usually is), 2022 is the kind of year that creates such a problem, while 2023 would be when it hits the headlines and impacts markets. We’ll see. Remember, these are potential factors, not predictions.

And then, there’s corporate earnings. Wall Street “buy side” firms love to enter the new year with pie-in-the-sky estimates, which tend to ignore obvious factors like the potential for last year’s rate hikes to crimp consumer behavior and thus corporate earnings in 2023. The risk of earnings disappointments is high, and that could be a headline factor that makes its way from Wall Street to Main Street, rattling investors.

Key Decisions For Investors

Like the old Casey Kasem American Top 40 Music Hits Countdown, the MOFO gathers up market-impact factors, ranks them and tracks them. You don’t need a Top 10 list to make consistently-productive investment decisions. But you do need to take account of the major risk factors discussed above. 2023 will favor those who manage risk first, strongly consider the role (if any) that high-quality, short-term cash alternatives suddenly present, and who are willing to learn and then implement ways to profit from markets other than those which don’t continuously go up.

Some soccer matches are strategic, methodical affairs where the talent rises to the top, an edge is gained, and they win 1-0. Other games are more frenetic. And then, you get situations like 2022’s World Cup Final. Regardless of the situation, your best course of action is to be prepared to win in any environment.

The stock market goes into 2023 as a Sell to me. Same for long-term bonds. That can change in the tactical world I operate in. But rather than wish and hope for the next bull market to come along, be proactive about your process. You don’t want to be sitting here next year at this time, wondering why the market still hasn’t recovered, and what you are going to do about it.

Be the first to comment