Maksim Labkouski

Article Thesis

VAALCO Energy (NYSE:EGY) has agreed to acquire TransGlobe Energy Corporation (NASDAQ:TGA) in order to create a larger, more diversified, more efficient energy company. The deal seems to make sense for both parties, and the combined company will have a strong balance sheet as well as growth potential. With the combined company trading at a very low valuation today, VAALCO/TransGlobe Energy could be a buy, although it is not among the lowest-risk energy names.

The Deal

VAALCO and TransGlobe Energy have agreed to an all-stock merger that will be accretive to earnings per share immediately, according to VAALCO’s management. EGY will pay 0.67 new shares of EGY for each share of TransGlobe Energy, which represents a ~25% premium relative to where TGA traded before the deal announcement. With EGY dropping on the day of the news release, the premium has declined, but TGA’s shareholders will still get shares that are worth more than their TGA shares directly before the deal got announced. VAALCO’s shareholders will own around 55% of the combined company, while TGA’s shareholders will own the remaining 45%. This is thus not a deal where a much larger company acquires a much smaller one. Instead, the two companies are in the same league size-wise, with EGY just a little bit larger than TGA.

VAALCO will also assume all of TransGlobe Energy’s debt and cash. Since TGA has a net cash position of about $34 million, the enterprise value of the deal is smaller than the additional market capitalization added through the acquisition.

A Better, Stronger Company At A Very Low Valuation

VAALCO is a compelling oil company that trades at a very low valuation. That’s why we have liked the company for some time, as showcased in this August 2021 and June 2022 article. Shares are up by more than 80% since then, even when we factor in the recent share price pullback. VAALCO has low break-even costs, a fortress balance sheet, has a strong growth outlook for 2022, and with hedges falling off this year its exposure to the current high oil price environment increases, which should result in compelling earnings growth.

On the other hand, VAALCO’s very dominant exposure to Gabon and Equatorial Guinea resulted in above-average risks, and due to the company being pretty small, liquidity was an issue. That improved to some degree when VAALCO was added to the Russell 3000 index this June, but VAALCO remained an under-the-radar company.

With the deal announced between VAALCO and TransGlobe Energy, that’s about to change. The combined company will have several advantages relative to VAALCO and TransGlobe Energy as standalone companies. First, the combined company will be more diversified. TGA is adding assets in new countries, Egypt and Canada, which will reduce geopolitical risks for the combined company. Even if political or regulatory, or any other macro risk emerged in one of these countries, the more diversified production base should allow the new company to better offset those headwinds compared to a scenario where that happens to either of the two companies while they are “alone”.

The deal also expands the capabilities of the new company, as both companies are strong where the other is weak: VAALCO has offshore expertise, whereas TransGlobe has expertise in fracking and onshore exploration and production. Combined, the new company is more capable to focus on all kinds of potential growth projects and is less limited when it comes to expertise/technical knowledge.

When two companies combine, it’s also logical that there will be some cost synergies. In this case, the CEO and CFO of TransGlobe will move on, cutting redundancies. It is likely that other synergies can be captured on top of that, e.g. when it comes to accounting, regulatory/compliance roles, and so on. Last but not least, the costs that stem from a public listing will be lower compared to the current “double cost” for two publicly listed companies. Importantly, VAALCO has stated that the deal will be accretive to its earnings per share even before those synergies are captured. Forecasted pre-synergies accretion isn’t overly large, at around 5%, but that’s still creating value for shareholders, and the issuance of new shares is already accounted for. Synergies should add meaningfully to the potential future accretion; thus I believe that this deal could add at least 10% to VAALCO’s earnings per share, all else equal.

E&P companies are oftentimes valued based on their EBITDA and cash flow, but investors should also consider the resources an oil company owns. In this case, the acquisition will add meaningfully to VAALCO’s resources. According to its press release (linked above), the combined company will have proved resources of 41 million barrels of oil equivalent. When we add probable resources, the combined company will own 66 million BOE.

If one values each barrel at just $15, that’s a ~$1 billion value between the two companies — the pro-forma market capitalization of the new company is only $560 million, however. Even better, the new company has a current net cash position of $53 million, or $98 million when we account for VAALCO’s April 2022 lifting proceed of $45 million. I believe that net cash can be subtracted from what one pays today, which means that investors are essentially able to buy 66 million BOE of proved and probable resources at an enterprise value of ~$460 million. In other words, each barrel of oil equivalent of the pro-forma company is currently valued at just $7 or so. With oil prices at a high level, and likely remaining elevated for years (potentially rising further, as Goldman Sachs and other claim), I believe it is pretty likely that the actual value per barrel will be significantly higher than what investors have to pay today.

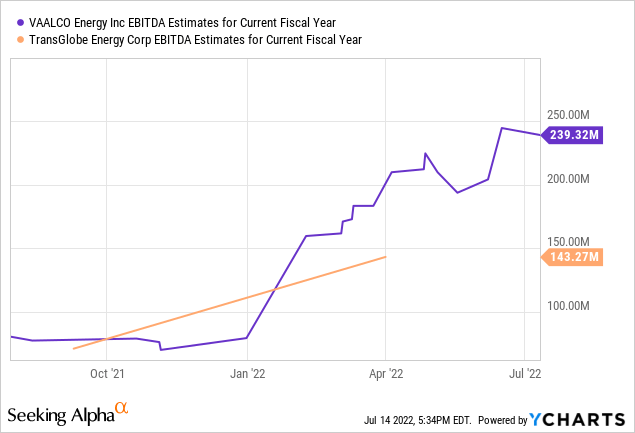

We can also look at the valuation in a different way. The two companies were, on a standalone basis, forecasted to generate $380 million in EBITDA this year:

With the combined company trading at a current pro-forma enterprise value of $510 million (or $460 million accounting for VAALCO’s $45 million cash proceed in April this year), the valuation seems pretty cheap. The enterprise value to EBITDA is well below 1.5, and might even approach 1 once we account for synergies, VAALCO’s April cash proceed, etc. Even if actual EBITDA comes in well below current expectations, e.g. at $300 million, the new company would be quite inexpensive.

Takeaway

The deal makes sense, we believe. The combined company will be stronger, more diversified, more efficient (synergies), will be more liquid and might attract more shareholders due to a larger size and improved trading volume. At the same time, the acquisition will improve technical capabilities as it combines the strengths of both companies.

At current prices, the implied valuation for the new company is incredibly low. A smallish E&P naturally shouldn’t trade like a supermajor, but even if the company’s valuation would expand to just 2x or 3x EBITDA following the closing of the deal and the capturing of synergies, there would be huge upside potential. VAALCO is not a low-risk pick, but we like the company a lot at current valuations, as the upside potential is just so intriguing.

Be the first to comment