industryview/iStock via Getty Images

The Factors Behind the Decline in US-Listed Equities Are Causing Bearish Sentiment Even in Primary Sectors Such As Basic Materials

Following a wave of rate hikes by the US Federal Reserve and other global central banks, except for China where the economy needs support, historical inflation fell in August, but not enough as it is still very far from the 2% target.

The problem, however, is that this time monetary tightening may not be as effective as hoped for fighting inflation. The factors that make the prices of goods and services gallop are not the traditional factors of increasing demand for products. But factors beyond the control of the world’s major monetary authorities.

These factors will continue to fuel inflation as long as the geopolitical battle between the US/EU and Russia/China continues [as they drive up energy costs for fear of getting enough energy for the winter] and hefty spending on weapons erodes the currency’s purchasing power.

And in the meantime, as inflation struggles to return to normal parameters, aggressive monetary policy will propel the economy into another recession after the COVID-19 pandemic, hurting corporate earnings and growth plans.

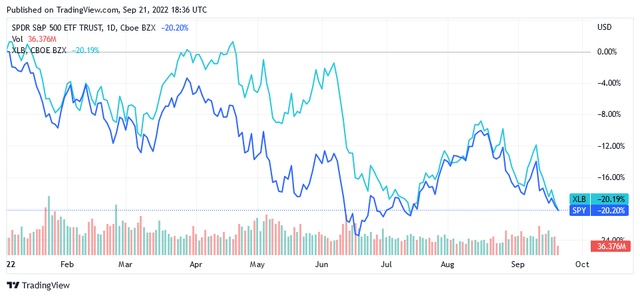

The strong headwinds from the above events have caused major problems for holders of US-listed stocks, as shown in the chart below.

This is shown by the SPDR S&P 500 ETF Trust (SPY) – a benchmark for the US stock market – which has fallen sharply since the beginning of the year, just a few weeks before the start of global geopolitical turmoil, with Russia’s aggression against Ukraine at its peak. Year to date SPY is down 20.20% at the time of writing.

seekingalpha /symbol/SPY vs XLB

Among sectors, basic materials also suffered from severe headwinds, reflected in the year-to-date performance of the Materials Select Sector SPDR Fund (XLB), a benchmark for the sector, which fell 20.2% in line with the market.

Aside from the bearish sentiment that hit basic materials stocks and other sectors as the headwinds intensified, rising borrowing costs driven by higher interest rates have worsened the outlook for specific key end-markets of basic material producers. The slump in the new construction market hits basic material producers hard, for instance.

More expensive borrowing to finance new home purchases or commercial buildings has prompted many consumers and businesses to postpone or downsize their projects, while the looming recession makes them less optimistic about the future.

However, there is a redemptive opportunity within the sector, which makes these stocks still attractive to invest in, albeit with a high degree of risk.

If the catalyst were to be realized, the effects in the form of a price appreciation could be significant. Among the various players, Mercer International Inc. (NASDAQ:MERC) appears poised to take full advantage of the catalyst.

Analysis of Mercer International’s Business, Past Trends and Potential Catalysts That Could Drive the Stock Price Higher

Mercer International, based in Vancouver, Canada, manufactures and sells northern bleached softwood Kraft [NBSK] pulp and wood products in North America and internationally.

The customers of the pulp segment include tissue, specialty paper as well as printing and writing paper manufacturers. The customers of the lumber products segment include dealers, building companies, secondary processors, various retail yards and home center stores.

The two segments together account for around 90% of total sales, of which 75% is pulp and 15% wood products. The company also sells clean energy that it produces from biomass, but that business is still very marginal in terms of share of overall sales.

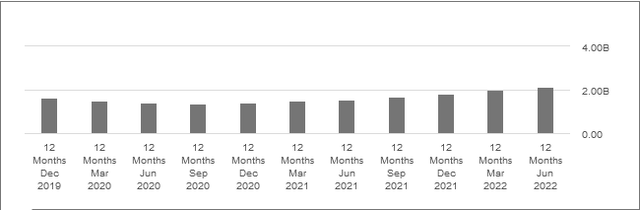

For the 12 months ended June 30, 2022, these segments sold products for total revenue of $2.154 billion, representing year-over-year growth of 39.3%.

After completing the recovery to pre-pandemic levels in June 2021, annual sales continue to grow very strongly.

seekingalpha/symbol/MERC/income-statement

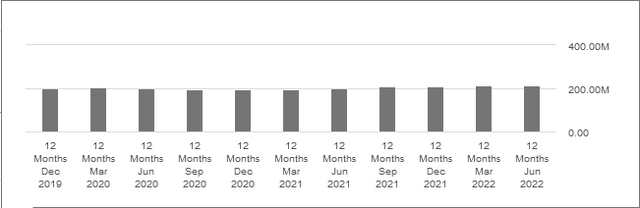

Total operating expenses were $214.2 million, a slight 6.2% increase over the prior year. Operating expenses have remained slightly above pre-pandemic levels in recent quarters, reflecting inflationary pressures on manufacturing inputs and energy costs, as well as higher-than-normal planned maintenance costs at mills. However, the company is exploring the implementation of hedging strategies against higher utility bills and the cost of production inputs. Therefore, the slightly positive trend in operating expenses is expected to disappear in the future.

seekingalpha/symbol/MERC/income-statement

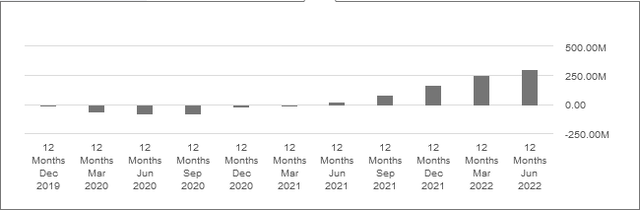

Its trailing 12-month [TTM] net income from continuing operations increased nearly 14-fold year over year to $303.9 million in the June 2022 quarter.

seekingalpha/symbol/MERC/income-statement

The strong increase was made possible by rapid sales growth, which also benefited TTM EBITDA as the item increased to $614.6 million as of Q2 2022 from $261.6 million in the previous year’s quarter.

These improvements helped Mercer International widen the gap against the industry average in terms of a higher TTM EBITDA margin [28.54% vs. 20.84%] and TTM net income margin [14.11% vs. 9.03%]. There is notable upside potential for the share price, poised to break out as market headwinds ease, favoring a return to a risk-taking stance on US-listed equities.

Both prices and sales volumes must remain supportive to confirm profitability at this level.

The price of Kraft pulp should remain at all-time highs for a while due to upward pressure from higher energy bills and input costs, as well as expected increased demand from the paper industry.

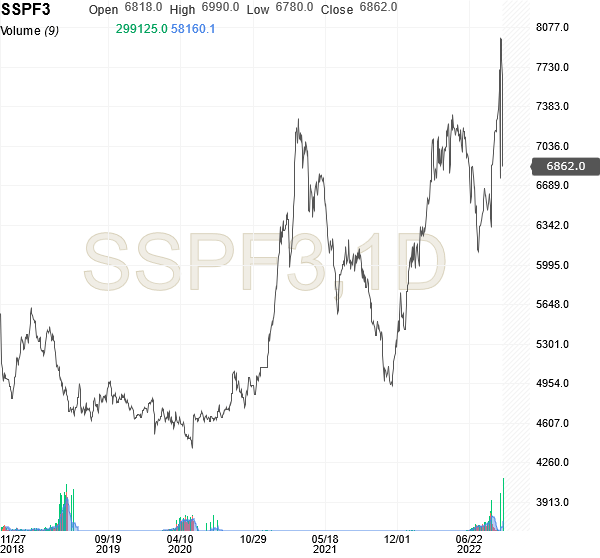

To get an idea of how much Kraft Pulp costs in the market, Bleached Softwood Kraft Pulp Futures with expiration in January 2023 [SSPF3] closed at 6,862 Chinese Yuan [or about $978.10] for air-dried metric tons [ADMT] on September 16, as below chart from Investing.com shows.

investing.com/commodities/shfe-bleached-softwood-kraft-pulp-futures

Mercer International manages to place its product at a price well above the spot market and it’s happening nearly everywhere, in North America at $1,635 for ADMT and Europe at $1,383 for ADMT. In China, the average selling price was $954 for ADMT for the first half of 2022.

Regarding the expected strong demand for paper, a 2021 report by the research firm EMR indicates that global tissue paper consumption should support the growth of the global pulp market’s size [189.42 million metric tons in 2021] at an annual rate of 1.5% over the next 5 years from 2022 to 2027.

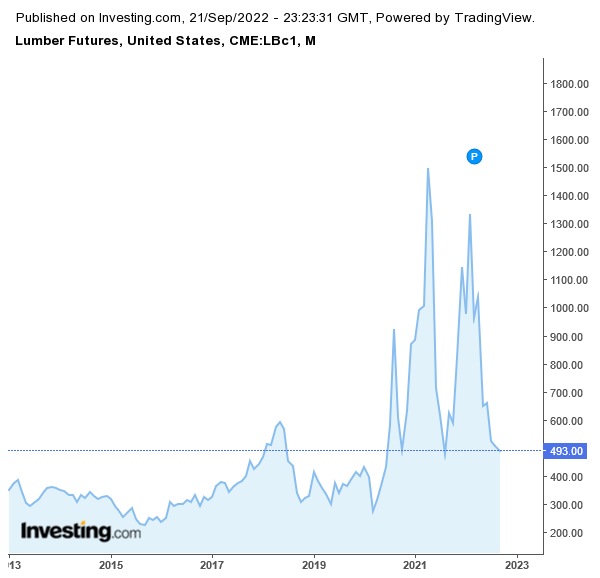

Regarding wood, which was priced at $493 per thousand board feet according to Investing.com chart depicting lumber futures expiring in Nov. 22 [LBc1], analysts expect a lower price going forward as they forecast $386 over the next 52 weeks.

investing.com/commodities/lumber

With the housing market slowing sharply amid rising interest rates, lumber prices could continue trading well below the May 2021 record high of more than $1,700 as the material is primarily used for residential construction and new permits are falling drastically. In August 2022, US building permits fell 10% to an annualized rate of 1.517 million. The value, which is an indicator of future construction activity, fell short of market expectations of 1.61 million.

The future of the index is further clouded by analysts who expect less than 1.6 million construction permits in the United States by 2023.

Many in the market may be expecting such a scenario for the lumber price. If so, it could be weighing on the stock’s valuation at the moment as well.

But it could also turn out differently and very much in favor of the lumber price and Mercer International, according to the following possibility.

It is not said that rising interest rates will affect building permits, provided that tightening credit conditions affect new building purchases.

Assuming that in the fight against expensive energy bills for households and small and medium-sized enterprises, government fiscal policy touts the cooperation of banks to keep medium and long-term interest rates at roughly the same level as government bond yields of the same maturity, the costs of borrowing may still rise, but remain accessible to a larger number of consumers and businesses than expected.

In this case, since the budgetary decisions of households and businesses would not be influenced too much by the increase in monetary costs, local authorities will be prompted to issue more building permits to meet the higher-than-expected demand for new housing. This could lead to a higher demand for wood products and a higher price of lumber.

Therefore, due to some catalysts, the stock price could reverse the negative trend and recover from the current levels, which do not look expensive compared to some technical indicators.

Stock Valuation: Current Stock Price Seems Worth Considering, but The Risk Is High

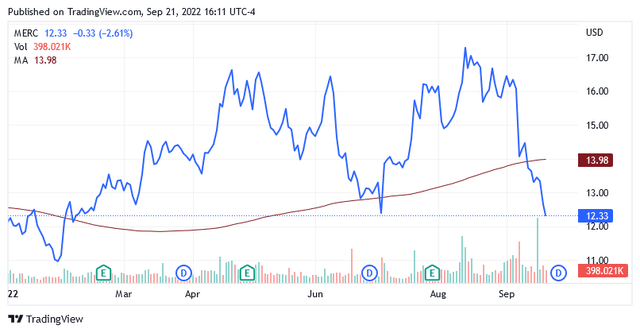

The stock price of $12.38 as of this writing is well below the long-term trend of the 200-day moving average of $13.98 and the midpoint of $13.51 of the 52-week range of $9.51 to $17.50.

The stock has a P/E TTM Non-GAAP of 2.77, down 75.32% from the industry median of 11.22 and a price-to-book [TTM] ratio of 1.11, down 30.47% versus the industry median of 1.60.

Both metrics help make this stock not expensive, even cheap, given the possibility of a strong comeback outlined above.

The stock grants a forward dividend yield of 2.37% as the company is paying quarterly dividends of approximately $0.075 per common share with the next payment to issue on next Oct. 5. This return tops the US stock market by 76 basis points as the SPDR S&P 500 Trust ETF’s Yield [TTM] stood at 1.61% as of this writing.

Investing in Mercer International carries a significant risk as, based on the monthly past 5-year beta of 1.45, the stock could continue to fall faster than the market amid what appears to be no short-lived or small headwinds.

However, it has to be said that the number of traders currently interested in a further decline is unlikely to be as large as the 14-day RSI of 27.52 suggests, hence the pressure from them on the future share price probably shouldn’t be remarkable. The index means that the stock has reached an oversold level.

The Balance Sheet Looks Solid as Evidenced by Some Indicators

The balance sheet also looks solid with total debt of $1.3 billion, which is more than 2.5 times the total available cash of $494.9 million, as of June 30, 2022.

First, 70% of total debt won’t mature before the next 7 years, as that portion is represented by 5.125% interest-bearing senior notes maturing in 2029. 24% of it matures in 4 years as it was created through the issuance of 5.5% interest-bearing senior notes due in 2026. The rest is in a line of credits and financial lease obligations.

Second, the Interest Coverage Ratio of 7 – calculated as most recent TTM operating income of $482.2 million divided by most recent TTM interest expense of $68.7 million – is a measure of a good solvency ratio as it weighs the company’s strong ability to pay the interest expense on outstanding debt.

The ratio should ideally be at least 2 for the company to be considered safe given owners’ claims on current and future debt.

And third, this debt is used efficiently, as evidenced by a weighted average cost of capital of 7.77%, which contrasts with the return on invested capital of 19.79%. The money Mercer International allocates to an investment project generates a positive return that fully offsets the cost of the investment in raising the required capital. This could serve as a strong indicator that the company’s value will continue to grow in the future as long as each new investment continues to fetch more than it costs.

What Wall Street Suggests About This Stock

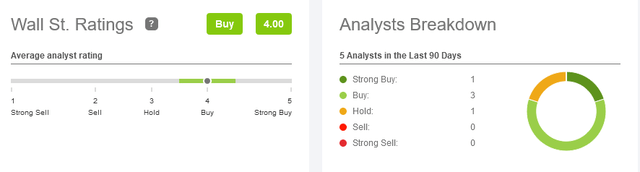

Sell-side analysts on Wall Street recommend a strong buy, three buys and one hold rating, resulting in a medium buy rating.

seekingalpha.com/symbol/MERC/ratings/author-ratings

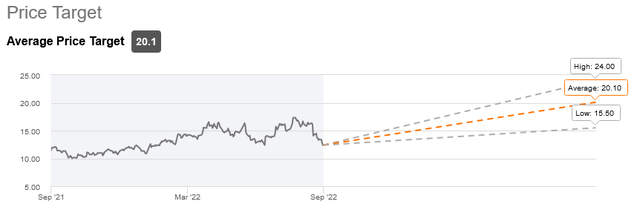

The average target price is $20.10, which falls within the range of $15.50 to $24, reflecting a 62.4% increase from current levels.

seekingalpha.com/symbol/MERC/ratings/author-ratings

Conclusion – Mercer International Inc. Remains a Risky Bet, but a Positive Outcome Could Have More Odds than Expected

This bearish sentiment in US-listed stocks extends to paper and timber producers as well, as rising borrowing costs and other headwinds are seen drastically affecting some of their key markets.

But low market valuations compared to recent history are creating investment opportunities in the industry, with Mercer International standing out as a bet with a possible positive outcome, although it implies a good dose of risk.

Be the first to comment