We-Ge/iStock Unreleased via Getty Images

Daimler is dead, long live Mercedes-Benz (OTCPK:DDAIF) (OTCPK:DMLRY).

Last month we published an article on Daimler Truck, where analyzed the Daimler spin off and the implications for the new company. Today we are focusing on what’s left, or rather, Mercedes-Benz. In case you missed it, we recently analyzed Volkswagen Group, where we acknowledged the presence of short term turbulences given the current market environment, but remained bullish on the stock for the long term.

Daimler spin off

Daimler spun off Daimler truck into a separate entity. This was to “unlock the full potential of its businesses Mercedes-Benz Cars & Vans and Daimler Trucks & Buses in the future.” The allocation ratio of the spin off was 2:1, for every two shares of the old Daimler entity held, one share of Daimler truck was assigned to shareholders. The remaining entity was rebranded as Mercedes-Benz, which retains a 35% stake in the newco.

Prior to the spin off, Daimler group CEO Ola Kallenius said “Mercedes-Benz cars and Daimler Truck are different businesses with specific customer groups, technology paths and capital needs. We believe they will be able to operate more effectively as independent entities, equipped with strong net liquidity and free from the constraints of a conglomerate structure”.

Auto industry today

While we are seeing pressure on the autos sector from the energy crisis, inflationary pressure, supply chain bottlenecks, and industrial obstacles stemming from the war in Ukraine, we are (and it beggars’ belief after this last sentence!) bullish on Mercedes-Benz, at least compared to the rest of the autos sector. This is largely in part to Mercedes’ excellent strength in pricing power, with the news that dealerships are even selling cars above list price, such is the scarcity of components.

The Company exposure to Russia is definitely something which we can’t overlook. The sister company Daimler Truck has a joint venture with Russian truck maker Kamaz and Mercedes itself has a car plant 25 miles northwest of Moscow which employs 1000 workers. Ok it’s not as bad as Renault, but estimated assets at risk in the region are equal to $2.2 billion. Also, we have to consider the Ukraine effect which we also touched upon in our coverage of Volkswagen. Ukraine is a major producer of wiring looms for the European car industry, accounting for up to 10% of production. 2 weeks ago (March 15th) we got news that Mercedes-Benz had cut the number of shifts at it’s production plant in Kecskemet, Hungary from 3 to 2 due to shortages stemming from the Ukrainian conflict.

Auto industry tomorrow

If we look past the short term turbulences, we can see how the car industry is evolving as OEM’s increase their EV offerings. Merc’s EV momentum is already gaining, though currently behind competitors such as Volkswagen, it is planning a 50% EV penetration by 2025 and, should market conditions allow, EV only by 2030.

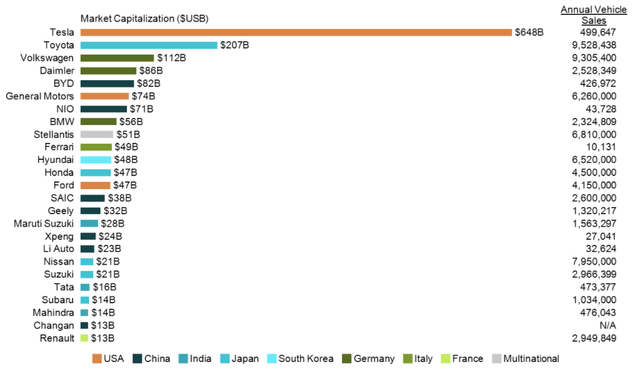

2022 marks an important year for Mercedes-Benz as it releases the hotly anticipated EQS. This car will be the first real competitor in the luxury EV sector, competing with Tesla’s Model S. If we look at Auto OEM’s by market cap we can notice something not quite right.

Auto makers by market cap $ March 2021 (mekkographics)

Here at the lab, we believe that the capital flows into the sector are justified, they just haven’t been properly allocated, but we think that this has more to do with Tesla’s charismatic CEO than what the Company actually offers.

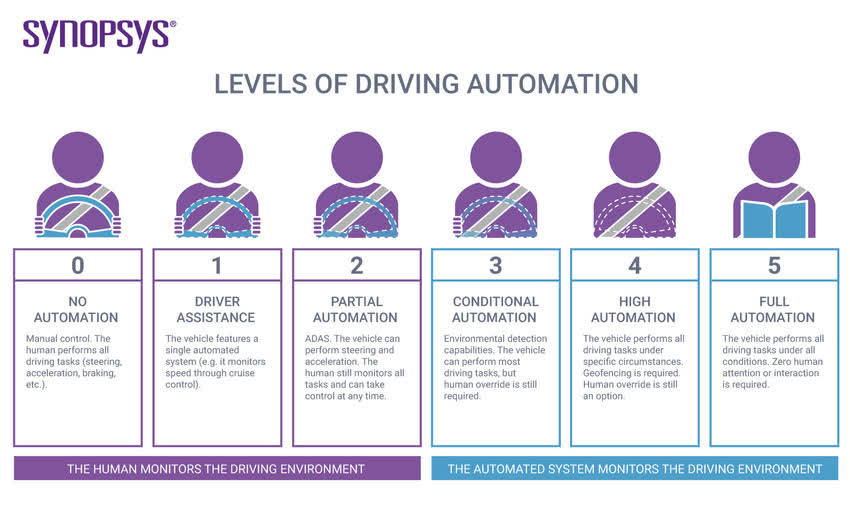

As we mentioned in our coverage of Daimler Truck, the industry holy grail lies with autonomous driving as they can generate recurring revenue for the Group by being sold as a service. However, technology is still in the development phase and there are also large regulatory gaps. Autonomous driving is currently classified in various levels from L0 to L5 with 0 being the lowest and 5 being the highest. Mercedes already has L2 autonomous vehicles which aid the driver with steering and braking on the market, but major OEMs are looking straight to L4 as the next breakthrough.

Levels of driving automation (Synopsis)

Mercedes-Benz has formed an interesting partnership with Nvidia to create “a revolutionary in-vehicle computing system and AI computing infrastructure” which will be rolled out on Merc’s next gen fleet.

Conclusion

Thanks to Mercedes’ relative strength in the face of near term adversities, EV penetration and focus on premium and luxury vehicles, it is currently our top pick in the autos sector. We value the stock using a combination of our SOTP analysis and ’23 EPS estimate. We initiate our coverage with buy rating.

If you are interested in our latest automotive coverage, please have a look at:

- Renault: The Most Exposed Automotive Company In Russia

- Volkswagen: All About The Long-Term Trends

- Ferrari: To RACE Again

Be the first to comment