Felipe Gustavo S Borges/iStock Editorial via Getty Images

Investment Thesis

MercadoLibre (NASDAQ:MELI) is a leading ecommerce platform in Latin America, offering a complete portfolio of services to facilitate transactions both digitally and offline. The company has developed an ecosystem based on six integrated ecommerce and digital payment services: Mercado Libre Marketplace, MercadoPago Fintech platform, Mercado Envios logistics services, Mercado Libre Ads, Mercado Libre Classifieds service, and the Mercado Shops online storefronts solution.

Whilst this company may have started out in the world of ecommerce, often touted as the Amazon (AMZN) of Latin America (no, not that Amazon), the most exciting aspect of MercadoLibre right now is its digital payments service, MercadoPago.

The MercadoPago fintech solution was initially used to facilitate digital payments on the MercadoLibre ecommerce platform, just as PayPal (PYPL) was initially used to facilitate payments on eBay (EBAY). The story continues in a similar vein; like PayPal, it turns out that MercadoPago could find success as a digital wallet and payment facilitator for all sorts of online payments – not just within the MercadoLibre ecommerce marketplace.

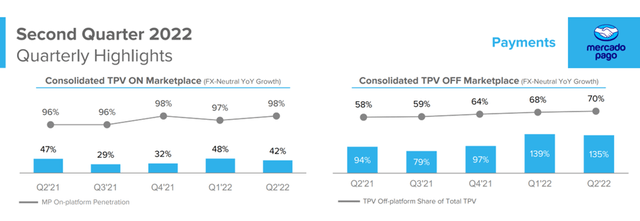

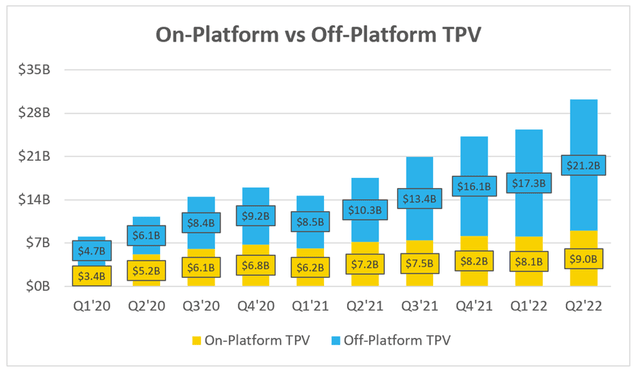

MercadoLibre Q2 Earnings Presentation

In short, my thesis is this: the market opportunity in Latin America is huge, and MercadoLibre has been leading the pack in both ecommerce and fintech for the last decade. There are so many areas for growth within this company, but I am currently looking at MercadoPago’s Off-Platform TPV (i.e. payments that are not on MercadoLibre’s ecommerce platform) growth to continue at its current rapid place, as MercadoPago uses the trusted MercadoLibre brand to become the digital wallet of choice in Latin America.

MercadoLibre certainly executed in line with my thesis back when Q2 earnings were released in August, producing simply stunning results. Yet investing is a forward-looking game, and I for one am intrigued to see just how well MercadoLibre performs in Q3, especially given the difficult macroeconomic environment.

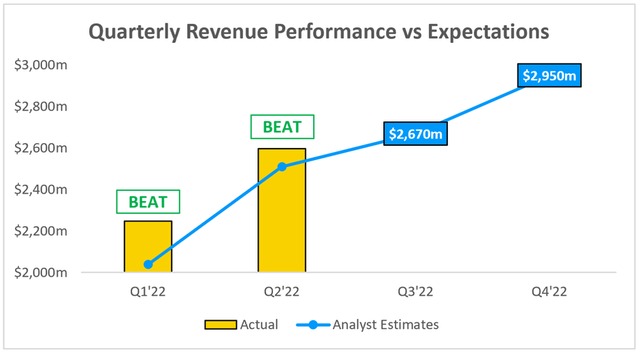

Latest Expectations

MercadoLibre is set to report its Q3’22 results on Thursday 3rd November, and there are a number of things investors should be watching out for. Starting with the headline numbers, analysts are expecting Q3 revenue of $2.67B (representing YoY growth of ~44%) and full year revenue of $10.47B (representing YoY growth of ~48%).

Investing.com / MercadoLibre / Excel

MercadoLibre has consistently beaten analysts’ revenue expectations, and I would be surprised to see anything less in Q3. Whilst the beat in Q2 was less substantial than in Q1, they were both comfortable, and as such I can see MercadoLibre exceeding both analysts’ Q3 and full year revenue estimates.

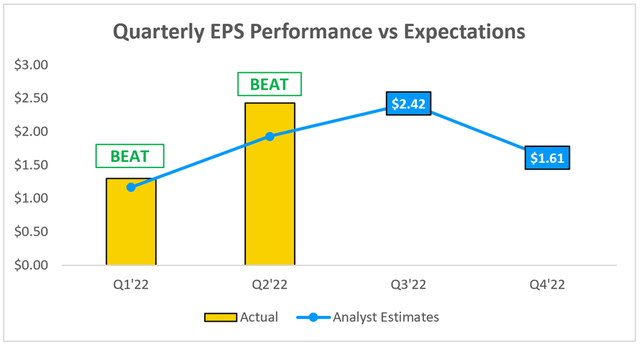

On the bottom line, analysts are expecting MercadoLibre to deliver EPS of $2.42 in Q3, which would once again represent growth from Q2. As with revenue, MercadoLibre has consistently beaten expectations on EPS.

Investing.com / MercadoLibre / Excel

It’s not often that investors have the joy of a company that is both profitable and growing revenues at close to 50%, but that is what you get with MercadoLibre. However, Q3 could prove especially difficult for this company, as it is facing numerous issues that are out of its control.

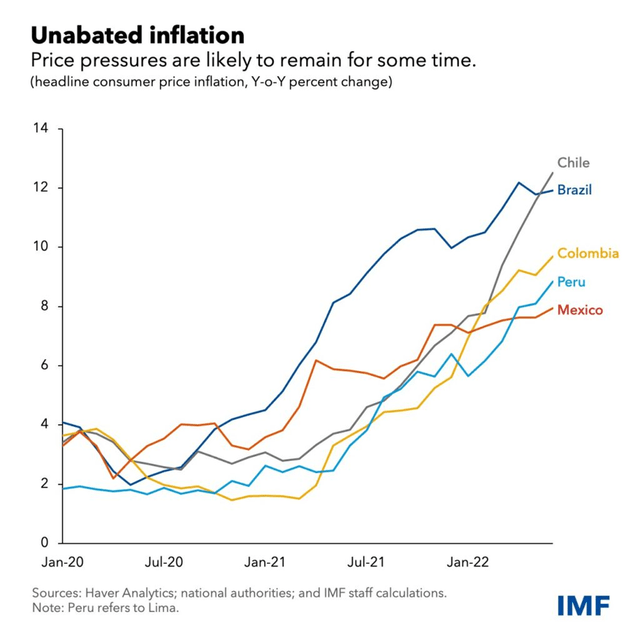

A Host Of Macro Headwinds

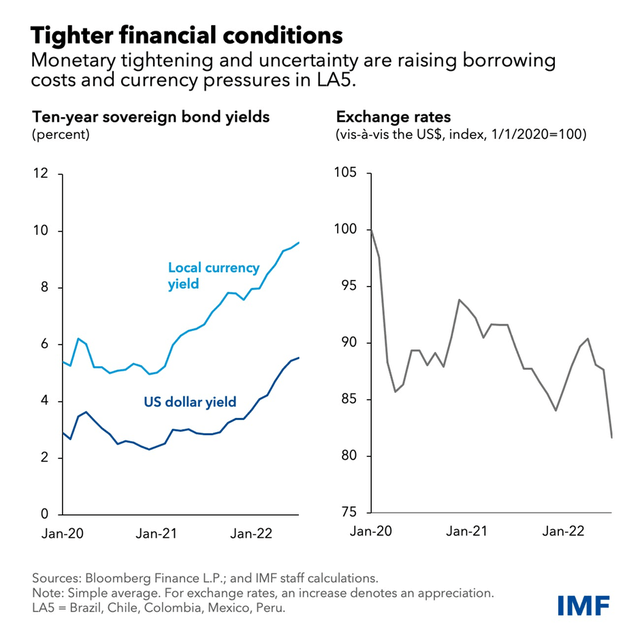

We saw in many earnings reports during Q2 that companies are beginning to feel the economic pinch, whether that be inflation, inventory issues, wavering consumer demand, or a strengthening dollar – and the story in Latin America is no different. Inflation in particular has taken off, with the IMF forecasting inflation of 12.1% and 8.7% in 2022 and 2023 respectively for the five largest Latin American economies.

IMF

Perhaps one positive note is the fact that MercadoPago has also really taken off, and a payment processor that makes money based on TPV (total payment volume) may be more resilient against inflation, as higher priced transactions should result in MercadoPago making more from its fees in absolute terms.

There is another potential headwind that some feel could hurt MercadoLibre when it comes to reporting Q3 results. The company brings in revenue from all over Latin America, but the analysts’ estimates that we just saw are priced in US Dollars – the currency in which MercadoLibre reports its results. Whilst it does provide FXN (FX-neutral) comparisons, Wall Street will still be looking at MercadoLibre to hit their USD-denominated targets.

So, how do the currencies of Latin America’s five largest economies compare to the US Dollar? Well, it’s been a sharp decline since 2020.

IMF

On the plus side, despite the US Dollar strengthening significantly against other currencies over the past twelve months, it actually hasn’t strengthened that much against the likes of the Brazilian Real. In fact, the Real is stronger now than it was 12 months ago against the USD, which is a pleasant surprise!

Google Finance

It appears as though currency headwinds and a strong USD might not actually be as bad for MercadoLibre as first feared. But macroeconomic headwinds are nothing new to MercadoLibre investors, as pointed out by new SA contributor Jonah Lupton in his recent article.

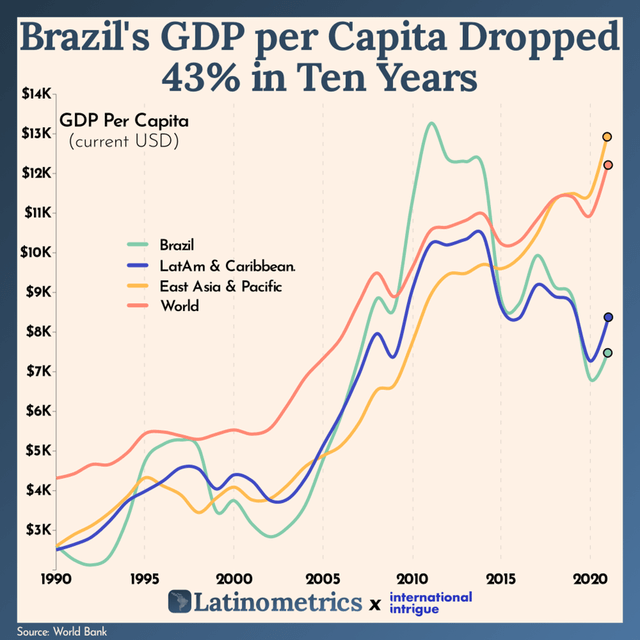

Latinometrics

Despite Brazil’s GDP per capita dropping an astounding 43% in 10 years, and the GDP of Latin America and the Caribbean not faring much better, MercadoLibre has still been able to flourish and succeed. Macroeconomic headwinds are always touted as a concern for MercadoLibre, but quite frankly I can’t think of any company that has shown a prolonged history of handling these headwinds with such aplomb.

That said, I will still be keeping a close eye on exactly how impacted MercadoLibre has been from the less-than-ideal macro climate when it reports Q3 earnings.

Will The FinTech Story Continue?

Unsurprisingly, the other aspect of MercadoLibre that I think investors should be watching is its FinTech performance – specifically, its Off-Platform performance.

The company has seen staggering triple-digital FXN YoY growth in Off-Platform TPV (total payment volume) in both Q1’22 and Q2’22; it had a relatively weak Q3 last year in terms of Off-Platform TPV growth (only hitting 79% FXN YoY growth, pathetic really…), meaning that I could see MercadoLibre delivering yet again another quarter of triple-digital YoY growth.

MercadoLibre / Excel

And, as we can see from the above chart, the numbers are getting more and more significant. At the start of 2020, Off-Platform TPV of $4.7B made up ~58% of MercadoLibre’s overall TPV, yet in its latest quarter Off-Platform accounted for 70% of TPV, amounting to $21.2B. I am hoping and expecting to see this momentum continue, and with figures already being huge and yet still growing rapidly, I could see Off-Platform MercadoPago taking MercadoLibre to a new level in the years that come – with investors being duly rewarded.

Valuation

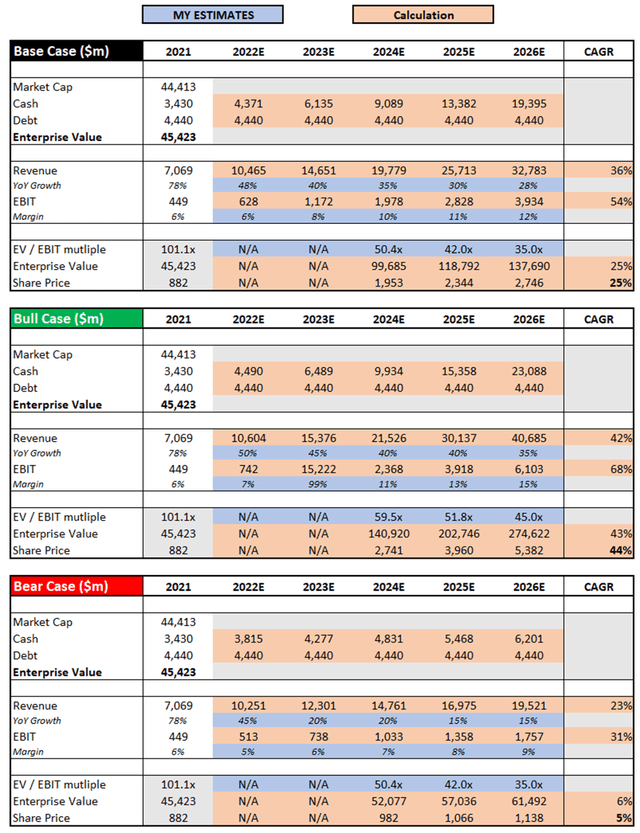

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether MercadoLibre is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

MercadoLibre / Excel

I have slightly changed the format of my valuation model from the previous article, as I believe this better demonstrates the potential upside and downside from the bull and bear case scenarios. It’s worth highlighting that the base case scenario here remains very similar to the base case scenario in my previous article, and so my assumptions used there still apply – the main difference is that I have slightly reduced the 2022 revenue to be in line with analysts’ estimates, even through I do believe this will be outperformed.

My bull case scenario assumes that MercadoLibre is able to maintain its impressive growth rates, which I believe to be very achievable considering the different growth avenues it has within the business – particularly FinTech. With this 42% revenue CAGR comes increasing scale and improved margins, again with FinTech playing a larger role. The bear case scenario effectively assumes the opposite, and that MercadoLibre finally gives in to the macroeconomic turbulence that it has been surrounded by and also the increasing competition trying to eat into its market share.

Put all that together, and I can see MercadoLibre shares achieving a CAGR through to 2026 of 5%, 25%, and 44% in my respective bear, base, and bull case scenarios.

Bottom Line

MercadoLibre truly wowed me when the company released its Q2 results earlier this year, and as a result it is now the third largest holding in my personal portfolio. I believe that it has so much going for it, whilst also having a history of execution come rain or shine.

I for one am looking forward to seeing exactly how well it copes with the latest set of global macroeconomic headwinds in its Q3 results, and once again I am going to have a keen eye on that Off-Platform TPV growth. All in all, I am hoping for another strong, resilient quarter from this high-quality business.

Be the first to comment