Editor’s note: Seeking Alpha is proud to welcome Tom Cunningham as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Editor’s note: Seeking Alpha is proud to welcome Tom Cunningham as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Lemon_tm

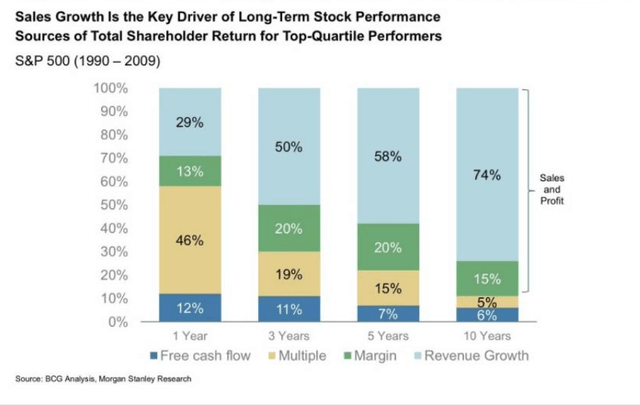

My goal as an investor is to find the best growth companies to hold for the long term and outperform the market. When investing over a long time horizon (five to 10+ years), it’s important to focus on the key factors that drive stock market outperformance. Using the Morgan Stanley study on the key drivers of outperformance in the top-quartile performers as a guide, we can conclude that the two most important factors for long-term stock market outperformance are revenue growth and margins.

Drivers of Long-Term Stock Performance in Top-Quartile Performers (BCG Analysis, Morgan Stanley Research)

This article will focus on these two key metrics (revenue growth and margins) to illustrate why I believe that MercadoLibre (NASDAQ:MELI) will outperform the market over the long term.

About MercadoLibre

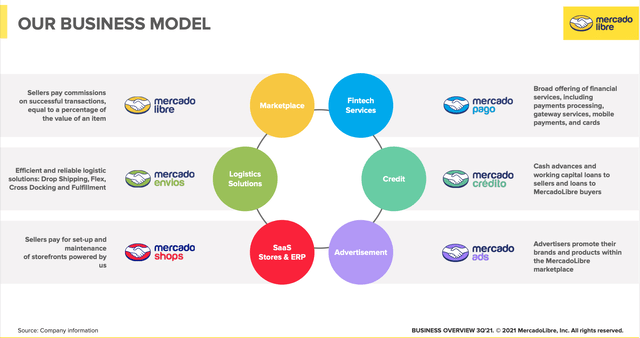

MercadoLibre, often referred to as the “Amazon of South America,” hosts the largest online commerce and payments ecosystem in Latin America. In recent years, MercadoLibre has spent significant capital expenditure to build out its fulfillment network (Mercado Envios). The managed network has helped MercadoLibre offer faster and more reliable shipping than its competitors. The company has successfully utilized the significant web traffic it generates through its e-commerce platform by creating a fintech product (Mercado Pago) to process digital payments – much like PayPal (PYPL) or Visa (V). This fintech division is now the fastest-growing segment and the future growth engine for the company. The fintech division has expanded to include a growing credit portfolio (Mercado Credito), which offers loans and credit products to small businesses and consumers.

MELI Business Model (Company Information)

Robust Revenue Growth to Continue on the Back of the Fintech Division

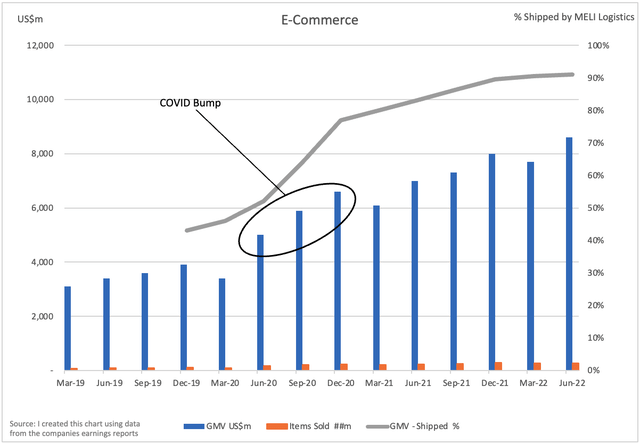

There are several key metrics to track the underlying performance of the company. First, we need to look at the performance of the e-commerce business division:

MELI E-Commerce Performance (Created By Author)

Gross merchandise volume (GMV) grew to US$8.6b in Q2 2022, growing over 26% on an FX-neutral basis despite a tough comparable period. Items sold increased to 275.2m for the quarter, which was an increase of 13% year on year (YoY). Importantly, over 264m of these items (~91%) were shipped through MercadoLibre’s fulfillment network Mercado Envios. This fulfillment network is helping MercadoLibre establish a competitive advantage, with faster shipping at a lower cost than competitors. While establishing this network has required significant capital expenditure, the rollout has been swift with the percentage of items shipped through Mercado Envios increasing from ~50% in mid-2020 to over 90% now, with almost 80% of items delivered within 48 hours as of the recent quarter. One example of this improving network is the expansion of MELI Air, a partnership with aircraft carriers to obtain dedicated planes for the Mercado Envios operation.

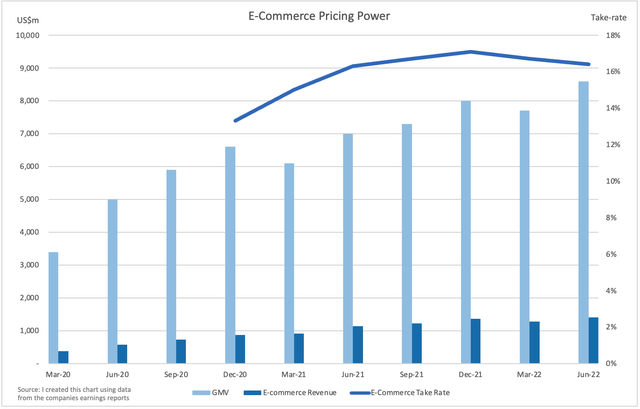

E-Commerce Pricing Power (Created By Author)

E-commerce revenue continues to grow at a healthy rate, with Q2 2022 e-commerce revenue increasing by 23% YOY. This is despite a tough comparable period to Q2 2021 when e-commerce revenue grew over 100% on the back of increased demand associated with COVID-19 lockdowns. Many other e-commerce companies have struggled with this comparison period, including Amazon (AMZN), Sea Limited (SE), etc. The advertising business on the MercadoLibre marketplace is beginning to show impressive results, reaching ~1.2% of GMV penetration, contributing to improving the overall profitability of the e-commerce segment. MercadoLibre has maintained this solid e-commerce revenue growth and GMV expansion despite a gradual increase in take rates. This suggests MercadoLibre is developing pricing power, supported by growth in the on-platform advertising business. The e-commerce take-rate is a key metric to watch moving forward; I expect it to consistently increase over time as costs can be diluted over increasing GMV and through the growing marketing revenue.

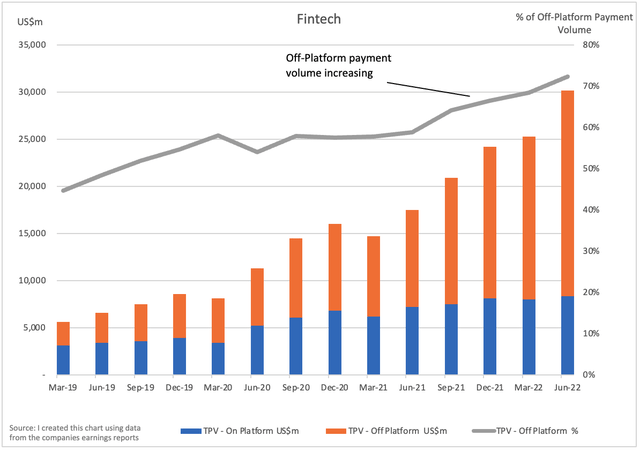

Next, we will look at the key driver of the company’s future earnings, the fintech division Mercado Pago:

Fintech Performance (Created By Author)

The fintech division is growing at a rapid rate, with total payment volume (TPV) growing at 73% YoY. The key metric here is the proportion (70%) of TPV off-platform, meaning customers using the payment solution for transactions unrelated to the MercadoLibre marketplace (e-commerce platform). In Q2 2022 the off-platform TPV continued its explosive growth, growing at 112% YoY compared with 16% growth YoY for on-platform TPV. This is a clear illustration of the network effect at play, which is a powerful moat source. The Mercado Pago payment solution is quickly becoming one of the go-to payment methods in South America. As the proportion of digital payments in South America continues to increase at a rapid rate, expect this to be a tailwind for the company moving forward.

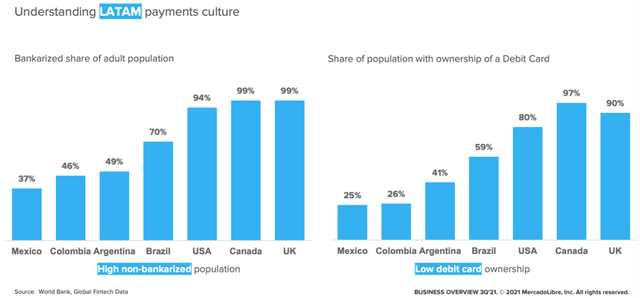

LATAM Payment Culture (World Bank)

The credit business has been a particularly strong performer in recent quarters, closing Q2 2022 with a US$2.7b portfolio. The credit book expanded over 230% YoY and is a significant contributor to operating margin expansion for the Fintech ecosystem. Historically, the credit business has operated with annualized interest margins after provisions for doubtful accounts (IMALs) of over 30%, reaching over 34% in Q2 2022. The credit portfolio is now a meaningful contributor to the company’s revenue with US$225m in IMALs for the quarter (US$529m in revenue). Expect this to be a key growth driver moving forward as the percentage of LATAM using banking products and debit cards (cashless payments) continues to lag that of the developed world, despite growing at an above-average rate.

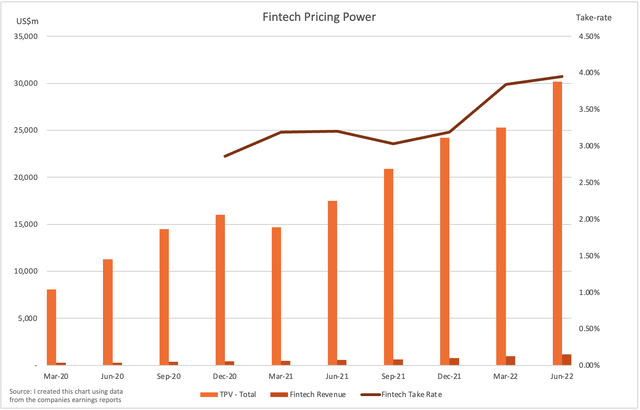

Mercado Pago Pricing Power (Created By Author)

Fintech revenue continues to grow at a rapid rate, surpassing the billion-dollar mark in a quarter for the first time, with Q2 2022 revenue growth of 113% YoY. Mercado Pago has sustained this growth rate while progressively increasing its take rate. I expect this trend to continue as the network effect continues to strengthen, and this will support elevated revenue growth into the future. Unique fintech users grew 26% YoY to 38.2m. These users are sticky due to the broad range of fintech services offered, including PSP gateways, mobile wallet services, consumer credit, and credit cards. As the number of Mercado Pago users continues to increase and as the take rate continues to improve, we can expect revenue growth to continue to grow at a healthy rate into the future.

Continued Margin Expansion Into the Future

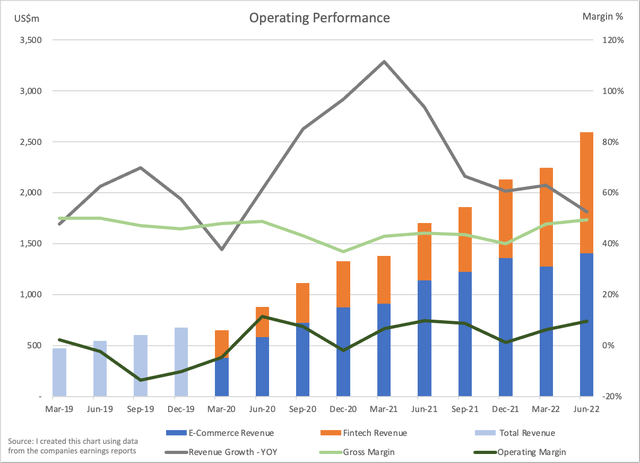

MELI Operating Performance (Created By Author)

MercadoLibre is well placed to see both gross profit and operating profit margin expansion in the coming years. Gross profit margins improved for the second consecutive quarter, reaching 49.4% in Q2 2022, with almost US$1.3 billion in gross profit, compared to 44.3% last year. The e-commerce segment is beginning to see margin improvement as shipping costs as a percentage of total revenue/GMV continue to decline. Additionally, as the proportion of Fintech revenue increases (currently ~45% of revenue), I expect to see margins improve as consistent top-line results generate scale for costs associated with payment processing fees, customer service operations, and fraud prevention investments. As the Fintech division becomes the predominant source of revenues in the coming years, I expect the recent trend of margin improvement to continue.

Summary of Two Key Ingredients for Stock Outperformance

MercadoLibre has two key ingredients for long-term stock outperformance: one, robust revenue growth, and, two, improving operating margins. I expect the combination of increasing e-commerce penetration and the shift to digital payments and banking in LATAM to support continued robust revenue growth. Additionally, as the company continues to benefit from the strengthening network effect and economies of scale, margins should continue to improve in the coming years.

Valuation

MELI Price-to-Sales Ratio (Trading View)

Given the company is not currently optimized for profits, the best valuation metric is the price-to-sales ratio. As of when this article was written, the P/S ratio is 4.64, which is high on an absolute basis, but low for MercadoLibre. It is near the lowest it has been since the global financial crisis (GFC). Given that the company has continued to perform strongly as the valuation multiples have compressed, the current valuation is attractive assuming a long-time horizon. There is likely to be high volatility in the short term; however, with the stock down over 50% from its all-time high and at a historically low valuation, the risk/reward continues to improve.

Other Points to Consider

Other common attributes of long-term out-performers that I look for are founder-led companies with high insider ownership (skin in the game) and a wide moat. MercadoLibre is still led by the founder and CEO Marcos Galperin, whose ownership sits at around 7.7% of the company. Since founding the company in 1999, Marcos has successfully led MercadoLibre through numerous periods of economic turbulence such as multiple currency crises in South America, the GFC, and COVID-19, and is well placed to steer the ship through any upcoming periods of economic uncertainty.

I believe that MercadoLibre has a very strong moat that is continuing to strengthen. The primary source of the moat is the network effect, with both the number of users and the GMV/TPV of the company continuing to increase. Also, the company is developing a durable cost advantage through its fulfillment network which allows cheaper and faster orders than competitors. Morning Star currently assigns MercadoLibre a wide economic moat, meaning it believes that the company has a competitive advantage that will last for at least 20 years, providing qualitative support to my thesis.

Risks

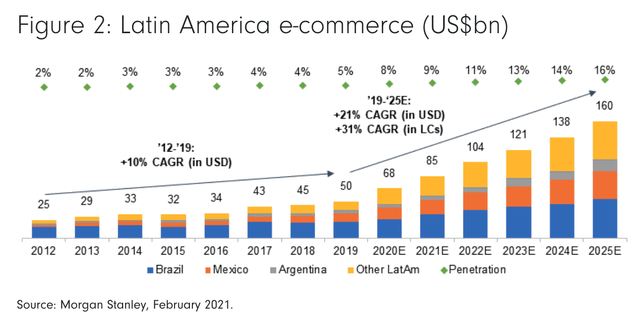

There are high levels of competition in MercadoLibre’s markets, from dominant global giants such as Amazon, relatively new entrants such as Sea Limited’s Shopee, and local competitors such as Magalu. Importantly, MercadoLibre has managed to expand its market share in the face of this competition. E-commerce penetration in Latin America is expected to reach 16% in 2025, which translates to a vast runway for growth. MercadoLibre has the brand strength, network effect, and logistics network to ensure that it continues to capture market share and ride this tailwind into the future. Importantly, MercadoLibre also has optionality through its fintech product, which continues to go from strength to strength.

Latin America e-commerce (US$bn) (Morgan Stanley, February 2021.)

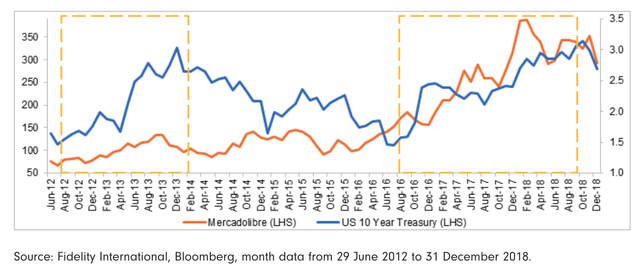

In recent weeks, as U.S. Treasury yields rise, there has been a market rotation and compression of valuations disproportionately affecting growth stocks that trade on high multiples such as MercadoLibre. History shows that periods of rising U.S. rates do not preclude internet-related and tech stocks from performing well. Two instances of sharp and sustained increases in yields in the past decade highlighted below illustrate that MercadoLibre performed strongly. While the current rate rising cycle is far more aggressive than the previous two instances and the Fed is now fighting persistently high inflation, it does illustrate that there is room for optimism over a long-time horizon if the underlying business continues to perform strongly.

MercadoLibre Performance in Rising Yields Environments (Fidelity International, Bloomberg, month data from 29 June 2012 to 31 December 2018.)

Conclusion

MercadoLibre is a founder-led company that has outperformed the broader market since its IPO in 2007, with an annualized return of ~27%. The company is well placed to continue this outperformance on the back of its growing fintech division and leading South American e-commerce platform. Expect volatility in the short term with long-term outperformance.

Be the first to comment