Leonidas Santana

Investment Thesis

MercadoLibre, Inc. (NASDAQ:MELI) is a leading ecommerce platform in Latin America, offering a complete portfolio of services to facilitate transactions both digitally and offline. The company has developed an ecosystem based on six integrated ecommerce and digital payment services: Mercado Libre Marketplace, MercadoPago Fintech platform, Mercado Envios logistics services, Mercado Libre Ads, Mercado Libre Classifieds service, and the Mercado Shops online storefronts solution.

Whilst this company may have started out in the world of ecommerce, often touted as the Amazon (AMZN) of Latin America, the most exciting aspect of MercadoLibre right now is its digital payments service, MercadoPago.

The MercadoPago fintech solution was initially used to facilitate digital payments on the MercadoLibre ecommerce platform, just as PayPal (PYPL) was initially used to facilitate payments on eBay (EBAY). The story continues in a similar vein; like PayPal, it turns out that MercadoPago could find success as a digital wallet and payment facilitator for all sorts of online payments – not just within the MercadoLibre ecommerce marketplace.

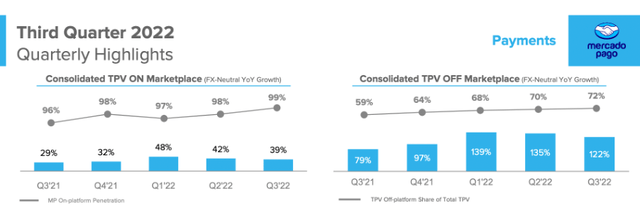

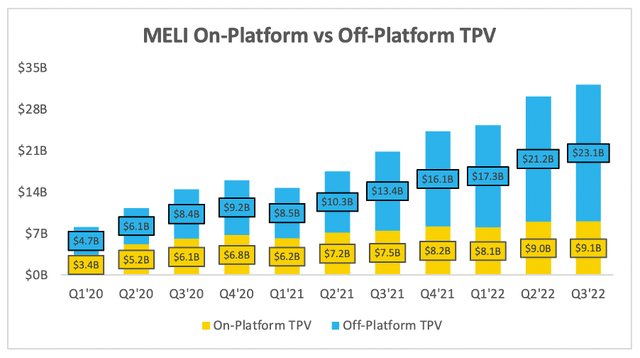

MercadoLibre Q3’22 Investor Presentation

My personal thesis is this: the market opportunity in Latin America is huge, and MercadoLibre has been leading the charge in both ecommerce and fintech. There are so many areas for growth within this company, but I am currently looking at MercadoPago’s Off-Platform TPV (i.e., payments that are not on MercadoLibre’s ecommerce platform) growth to continue at its current rapid pace, as MercadoPago uses the trusted MercadoLibre brand to become the digital wallet of choice in Latin America.

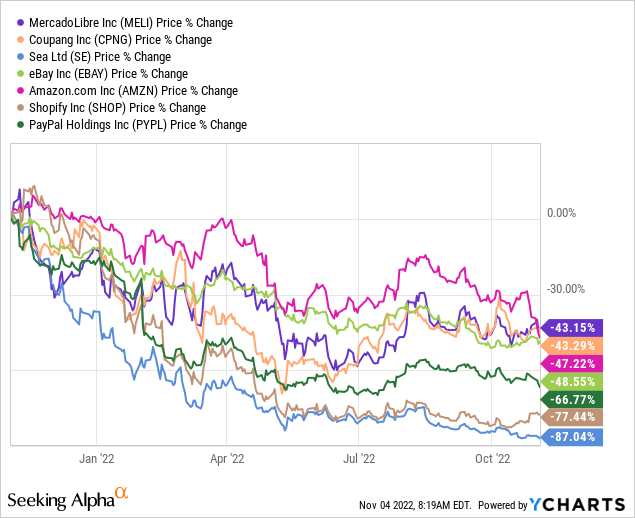

Despite the quality of this business, it has by no means been an easy 2022 for ecommerce companies as a whole. Businesses in this industry have come up against a double whammy of headwinds, facing difficult YoY comparisons against a stellar 2021 (thanks to stimulus and lockdown tailwinds) combined with a deteriorating macroeconomic environment in 2022.

Given all these factors, it’s amazing that shares of MercadoLibre are only down by 40% over the past twelve months, performing substantially better than some of its peers.

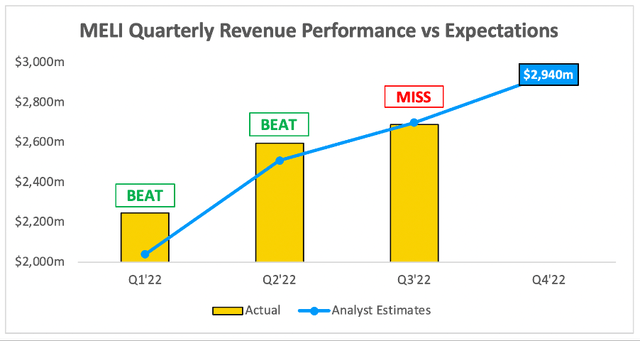

Investors were looking ahead to MercadoLibre’s Q3 earnings, released on Thursday, hoping that the company would show the similar strength to its Q2 results earlier in the year.

So, how did MercadoLibre perform? Let’s take a look.

MercadoLibre Q3 Earnings Overview

Starting from the top, MercadoLibre’s Q3 revenue grew 45% YoY to $2.69B, coming in very slightly below analysts’ estimates of $2.70B. I’m not concerned about this small miss, as 45% YoY growth in the current environment is staggering – but it gets better.

MercadoLibre reports in U.S. dollars, but it brings in revenue from a bunch of different Latin American countries, so a strong U.S. dollar negatively skews MercadoLibre’s results. On a constant currency basis (stripping out the impact of changes in exchange rates), MercadoLibre’s revenue grew an incredible 61% YoY in Q3.

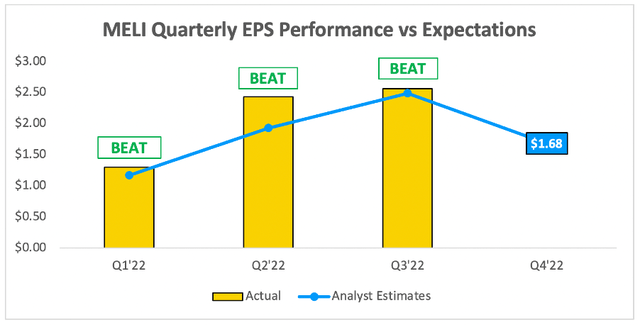

On the bottom line, MercadoLibre continued to pleasantly surprise investors and analysts, by posting EPS of $2.56, ahead of analysts’ estimates of $2.49.

The company pointed out in its Q3 investor presentation that it achieved a record quarterly EBIT of $296m, highlighting its commitment to delivering sustainable and profitable growth. In a market where growth-at-any-price has been thrown out of the window, a hypergrowth, profitable business like MercadoLibre is a gift for investors.

So, yet another great quarter from this company when it comes to the headline numbers, but how is the underlying business performing?

Pretty damn well.

MercadoPago Shines Once Again

I highlighted in a previous article just how incredibly well MercadoLibre’s payment solution, MercadoPago, was performing. In fact, MercadoPago is my number one reason for investing in MercadoLibre (although there are plenty of others); more specifically, MercadoPago’s expansion outside of MercadoLibre’s ecommerce platform.

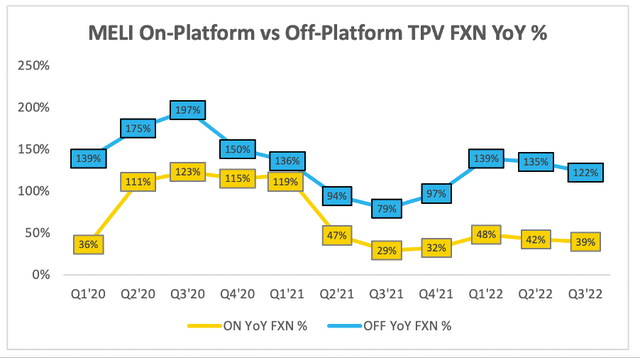

MercadoPago has seen astounding triple-digit YoY growth in its Off-Platform TPV (total payment volume) in recent quarters, which represents growth in the total payments using MercadoPago that happen outside of the MercadoLibre ecosystem (think PayPal outside of eBay).

I’m pleased to say that this trend continued once again in Q3, as MercadoPago’s Off-Platform TPV grew a mind-blowing 122%, marking the third consecutive quarter of triple-digit YoY growth. Compare that to On-Platform TPV growth of 39%, and it’s clear to see where the future of MercadoPago lies.

The below graph demonstrates just how much of an Off-Platform story MercadoPago has become over the past few years. Since Q1’20, On-Platform TPV has grown at a 48% CAGR (still impressive) whereas Off-Platform TPV has grown at an astonishing 89% CAGR. As a result, Off-Platform now makes up 72% of MercadoPago’s total payment volume, a substantial increase from its share of 58% back in Q1’20.

What’s more, the future continues to look bright for MercadoPago, as it expands and reaches more and more customers with more and more solutions. As Investor Relations Officer Richard Cathcart said on the Q3 earnings call:

On our path to democratize financial services across the LatAm region, we launched many products over the last 18 months. This includes debit and credit cards, savings and investments, crypto wallets, insurance, personal loans and many other products.

We now have a complete offering tailored to the needs of our users, allowing 36 million people to manage all of their financial services within our ecosystem, whether they are individuals or small, medium and large entrepreneurs. That enables us to position Mercado Pago as a digital bank, as we are now communicating in our more recent campaigns in Brazil. This is not just happening in Brazil, as the approval of our IFPE license in Mexico allows us to begin to market Mercado Pago and actively offers its tools to the country’s large unbanked and underbanked population.

Perhaps the most notable item here is the fact that MercadoPago is now able to offer more services in Mexico after having its IFPE license approved, so I think the growth for this side of MercadoLibre’s business is far from over.

Don’t Forget MercadoLibre’s Ecommerce Marketplace

Whilst it’s easy for me to focus solely on MercadoPago, let’s not forget that there is another fantastic Amazon-esque business in MercadoLibre’s ecommerce marketplace.

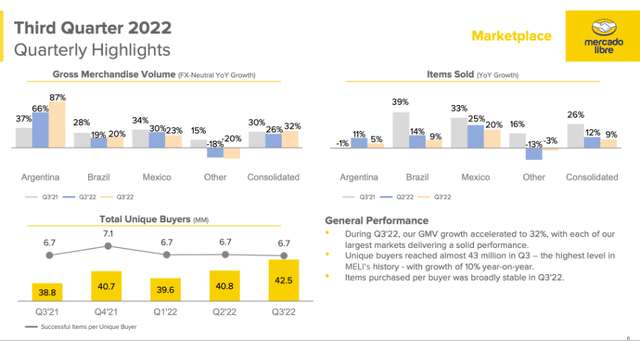

Unsurprisingly, this business is seeing a slowdown after a stellar 2021 that boosted many ecommerce companies. Yet it’s still putting up some solid numbers, with GMV (gross merchandise volume = total value of merchandise sold on the platform) increasing by 32% YoY on a constant-currency basis, accelerating from 30% in Q1’22 and 26% in Q2’22.

MercadoLibre Q3’22 Investor Presentation

Total revenues for the commerce side of MercadoLibre grew 33% on a constant-currency basis, as the company continues to increase its take-rate (the amount of revenue it extracts from its marketplace) courtesy of increased revenues coming from its advertising business.

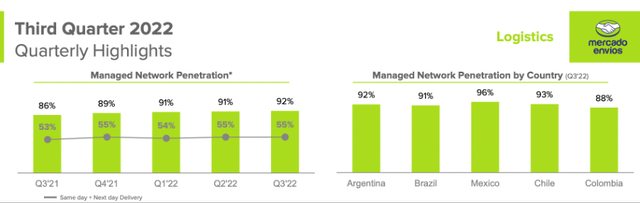

Another exciting part of this company for investors to watch is its logistics network, MercadoEnvios. In Q3, 92% of MercadoLibre’s logistics were fulfilled by its MercadoEnvios network, a substantial increase from 86% in Q3’21.

MercadoLibre Q3’22 Investor Presentation

This gives MercadoLibre much more control over the customer experience, and we’ve already seen with Amazon just how powerful an advantage a logistics network like this can be – especially when the logistics network is quick and more effective than the existing offerings. In Q3, 55% of deliveries using MercadoEnvios were made same-day or next-day, with almost 80% of deliveries being made within 48 hours.

All in all, despite the global downturn in ecommerce, MercadoLibre continues to build out a formidable offering. Once the macroeconomic conditions ease up, the combination of MercadoLibre’s ecommerce marketplace and MercadoEnvios should provide a strong boost to MercadoLibre’s overall financial position.

It’s almost scary to think how well MercadoLibre is executing this year despite the ecommerce business being a drag to overall results; just imagine what the recovery might be like…

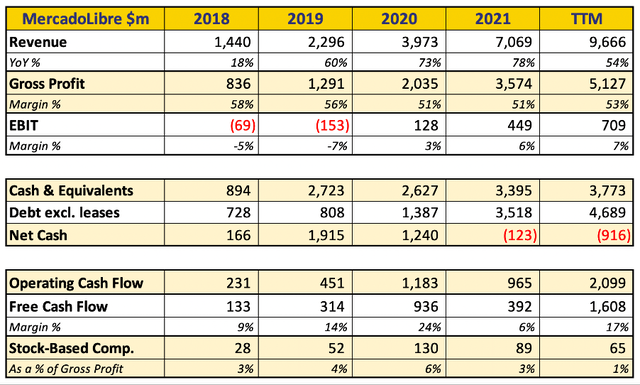

Quick Take: MercadoLibre’s Core Financial Metrics

I won’t spend too much time here, but I wanted to quickly look at MercadoLibre’s financials. In particular, I think investors should focus on the strong EBIT margin improvement that the company is seeing; up from -5% in 2018 to 7% over the past twelve months.

Again, I should point out, this is with the marketplace side of MercadoLibre not benefitting from the same boost to revenues that it saw in 2020 and 2021; I really feel like it could be a coiled spring, ready to boost MercadoLibre to new heights in 2023 and beyond.

Overall, it’s clear that the financial profile of MercadoLibre is just getting better and better as the years go on. Gross margins are improving, EBIT margins are improving, revenue growth is stellar (albeit slowing due to ecommerce headwinds), and it makes free cash flow in abundance despite running a capital-intensive logistics network.

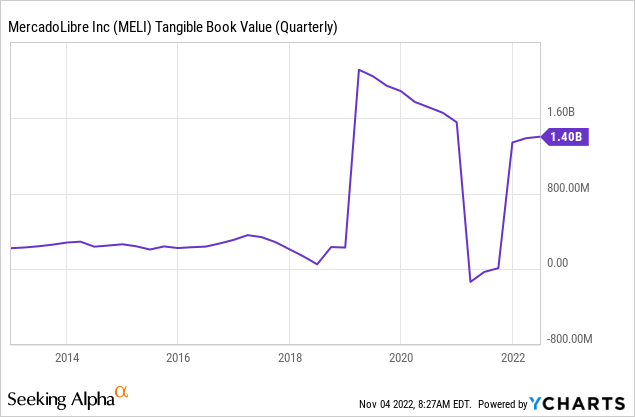

The only thing that may scare investors is the fact that MercadoLibre’s balance sheet is no longer in net cash territory. Unfortunately, MercadoLibre’s balance sheet got a whole lot more complicated as it waded into banking, and specifically MercadoCredito.

In order to check that the balance sheet as a whole isn’t underwater, it’s worth taking a look at the tangible book value – which clearly demonstrates that MercadoLibre is keeping its assets healthily above its liabilities.

The net debt position isn’t too much of a concern anyway, as MercadoLibre can easily cover any debt payments with its current levels of profitability.

MELI Stock Valuation

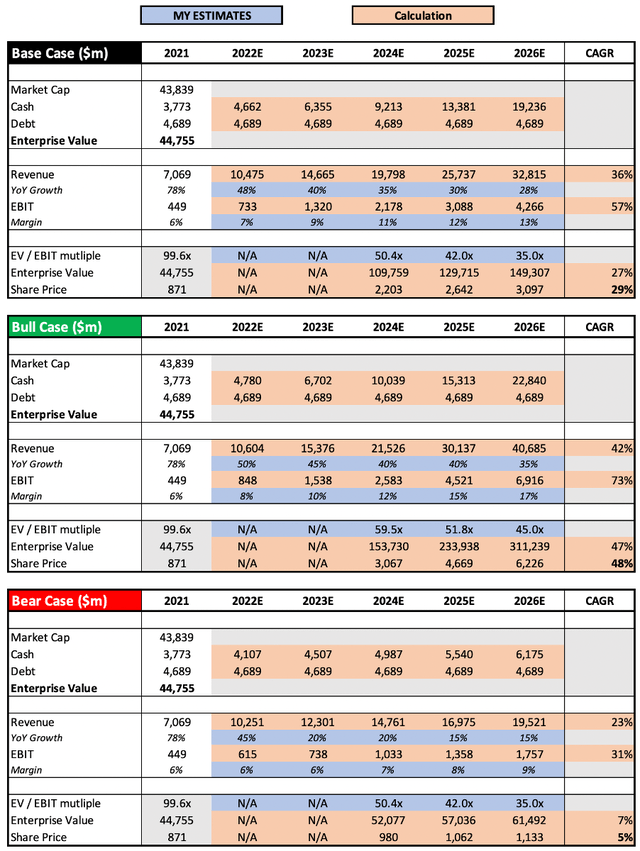

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether MercadoLibre is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have made very few changes from the model in my previous article, with the main change being a slight increase in EBIT margins as MercadoLibre has shown its ability to drive margin expansion, even without all aspects of the business firing on all cylinders.

Put all that together, and I can see MercadoLibre shares achieving a CAGR through to 2026 of 5%, 29%, and 48% in my respective bear, base, and bull case scenarios.

Bottom Line

Sometimes investing is complicated, and sometimes investing is simple. There are plenty of businesses within my portfolio that frequently give me reason to doubt my investment thesis, and there are some that continue to deliver no matter what.

I think MercadoLibre belongs in this class of high-quality businesses with an outstanding track record of execution, combined with substantial growth. I believe that the sky truly is the limit for this $44 billion company, and I have no reason to doubt management’s ability to get it there.

MercadoLibre delivered for shareholders once again in Q3, and I look forward to seeing what the future holds. Unsurprisingly, I will reiterate my previous “Strong Buy” rating.

Be the first to comment