Leila Melhado

Investment Thesis

MercadoLibre (NASDAQ:MELI) consists of various business segments, primarily its FinTech arm, Mercado Pago, e-commerce platform, MercadoLibre, its own logistic provider, Mercado Envios, and numerous more. However, I attempt to dive deeper into Mercado Pago, covering its background, business model, product offerings, financials, and key operating metrics, as I find it to be a truly fascinating and high-quality business. Hopefully, at the end of the article, readers will have a better understanding of its business.

Spotting a Blue Ocean

Back in 2003, the management was quick to spot the underpenetrated Latin America (“LatAm”) region, where most of the population was underbanked or unbanked. SMEs and consumers do not have easy access to financial or banking services, and cash was the primary form of usage. In the past, banks were also reluctant to loan to SMEs primarily because they lacked the information required to access their credit health, and more so when merchants are using cash to transact. Even if possible, securing a loan is extremely inefficient, making it difficult for SMEs to do so. This effectively means that SMEs are being neglected, and this is where Mercado Pago fits into the picture.

Mercado Pago is a FinTech arm of MercadoLibre. Like early pioneers such as Alibaba (BABA), expanding into digital financial services is a natural extension of an e-commerce platform. This is not a new model with peers such as Sea Limited (SE) and GoTo following suit today. Since they mainly serve SMEs and have control over the transactions that flow through the platform, this provides them with data insights into how much sales merchants are making, and control how much sales they will be receiving. These are critical data most incumbents (i.e. traditional banks) lacked in the first place to provide credit to these SMEs. Furthermore, MercadoLibre has access to merchants living in rural areas where traditional banks could not as they are bound by its inability to scale by building out physical branches (due to huge CAPEX). Spotting this massive opportunity, Mercado Pago was born.

Overview of the Business Model

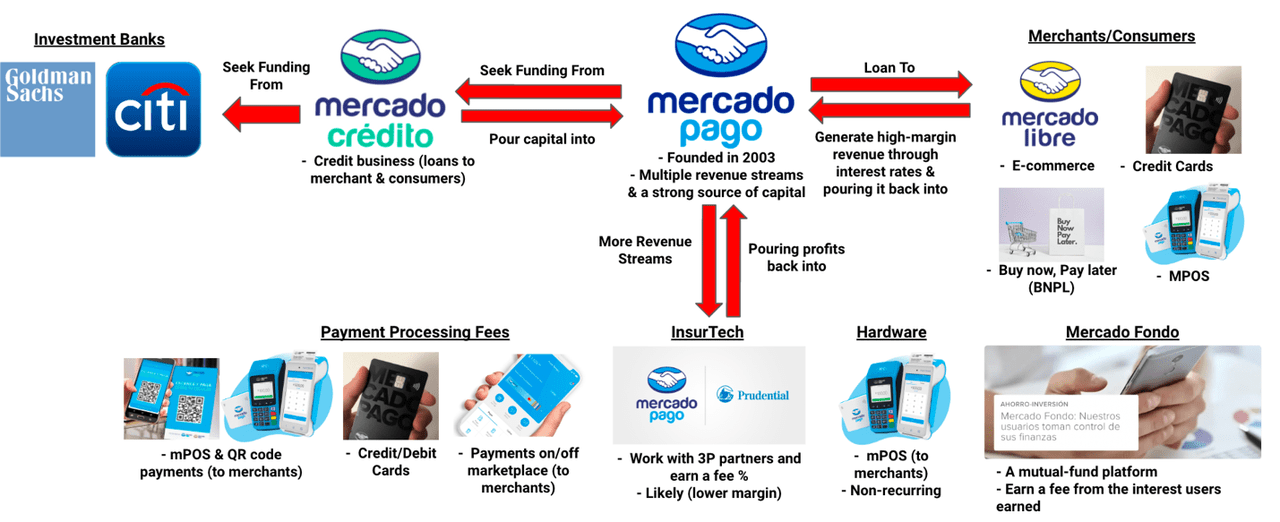

Author’s Image

This is an overview of Mercado Pago’s business model. Here, I attempt to show how its multiple revenue streams and a strong source of capital from its credit business allow it to fund its own business with little-to-no capital. Yes, you heard that right. It has a self-funding business model.

It was first developed to help consumers and merchants on and off (i.e. 3P merchants) its platform facilitates online payment transactions. Over time, the management clearly has a bigger goal which explains the full suite of product offerings they have today.

Walkthrough of Its Product Offerings

To understand the role of each product/service offering, I’m going to walk you through the features of each one of them, and they enable Mercado Pago to fund its business without needing much capital on its own.

Digital Wallet

- Enables users to store their money in a virtual wallet and have access to Mercado Pago’s services such as making payments via QR codes, paying bills, money transfers, access to credits/loans, and many more. I’d argue that money stored in the digital wallet serves as a form of float for Mercado Pago. This might be recorded as “fund payables” as shown in the balance sheet, as I am unsure how the management accounts for these.

Mercado Credito

- Credit is an extremely profitable business. It seeks financing from investment banks such as Citibank and Goldman Sachs and loans those capital out to merchants in return for higher interest rates. For Mercado Pago, the cost of financing is incredibly low as compared to the interests they are charging. The risk lies in how they can properly manage non-performing loans. They need to have a high leverage ratio to withstand the weak economy. This was introduced in 2013.

Buy Now Pay Later (BNPL)

- Breaking down large purchases into fixed-monthly installments, and making purchases more affordable for consumers. Merchants will bear the cost of interest payments charged by Mercado Pago. Like Mercado Credito, these are highly profitable revenue streams as the cost of financing is low. Merchants are willing to pay up as BNPL drives larger and more transactions, translating into more revenue and profits for their business.

Mobile Point-of-Sale/QR code

- Introduced in 2015, credit card terminals or (and) QR codes are provided to offline merchants to enable them to accept digital payments. Unlike cloud-based POS platforms like Toast (TOST) and PAR Technology (PAR), they do not offer a full suite of services that offline merchants need and act only as a pure payment processor. Through this, they earned payment processing fees charged to merchants. Rolling these solutions out in the early days helped Mercado Pago to land many tier-1 restaurants such as McDonald’s and Burger King. The underlying goal, though, is to offer loans to these merchants through Mercado Credito are higher margins.

Mercado Fondo

- Introduced in 2018, the company came up with a mutual fund platform to encourage consumers to invest their money. Unlike SeaBank, it is not a savings account and Mercado Pago does not have access to customers’ deposits. Rather, they worked with banks to help manage customers’ funds, and they received a fee for interest that customers earned.

InsurTech

- Mercado Pago works with partners such as Prudential to offer insurance products to its users. This is a win-win partnership where partners can tap into MercadoLibre’s massive user base, while Mercado Pago increases its value proposition by working with established companies to offer products users need. I believe these are lower-margin revenues as they do not develop their own insurance offerings.

Credit/Debit Cards

- This was introduced in 2021. Like mPOS, Mercado Pago charged merchant fees when users use its credit/debit cards to transact. They also earn through interest payments, as well as loans provided to merchants (e.g. advance cash provided to purchase inventory, and a certain % of monthly sales is used to repay the loans). In some circumstances, I believed they also earned through chargebacks, although it is less significant. As this is a relatively new product, the key is how they could drive frequent customer usage. According to management, this segment is not profitable yet.

Here, we can see how Mercado Pago has evolved from a pure payment processor into a full-fledged digital finance service provider. I like to call this an octopus-like model due to its ability to expand into multiple product offerings.

Superior Flywheel Effect Drives Adoption

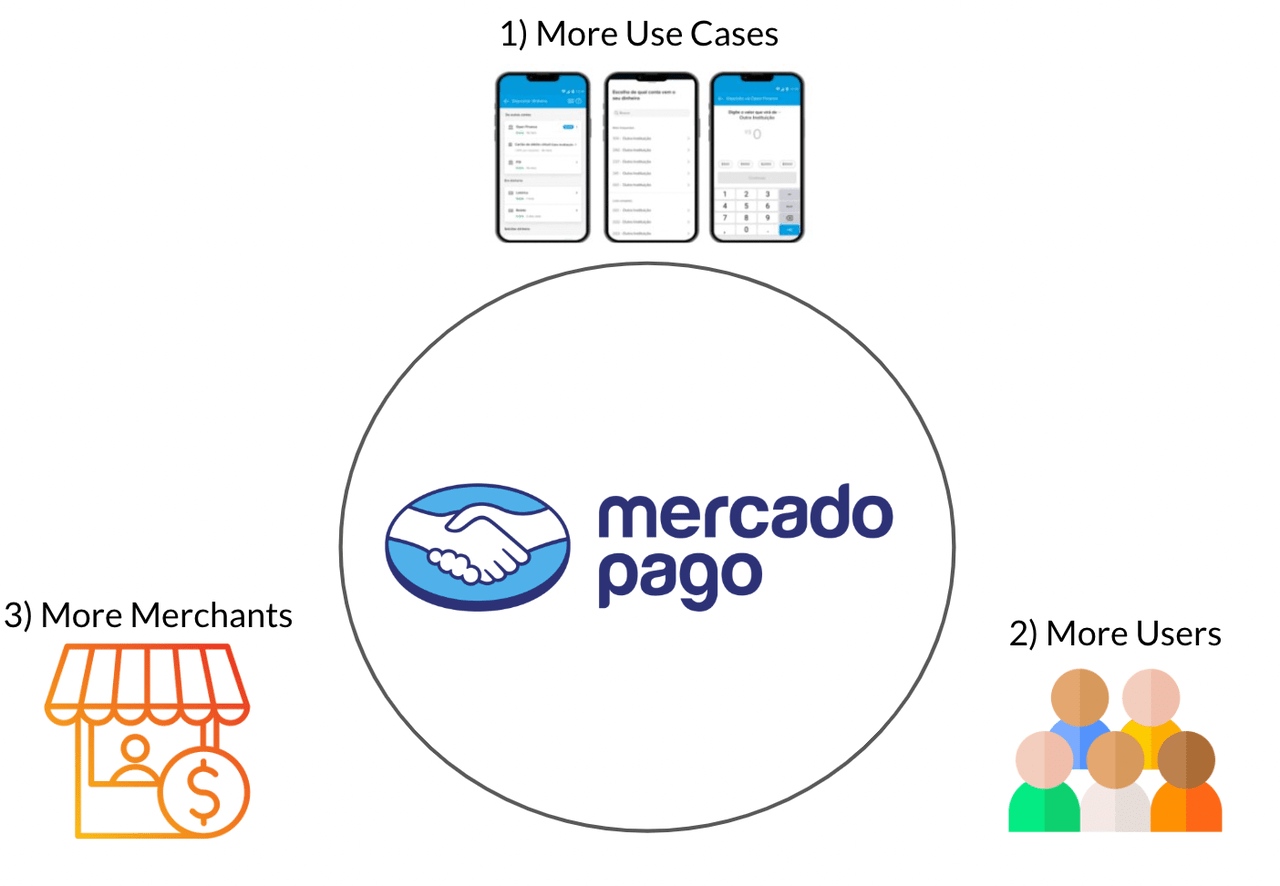

Author’s Image

Altogether, these products introduce more use cases, thus, increasing the frequency of usage. Recall that Mercado Pago is integrated into MercadoLibre and with third-party merchants, so frequent shopping will drive more transactions for Mercado Pago. This synergy between both of them (i.e. Mercado Pago and MercadoLibre) helps to create a superior flywheel effect, driving adoption on both sides of the platform. For instance, more customers transacting using Mercado Pago entices more merchants to adopt Mercado Pago and vice versa.

Financials and Key Operating Metrics

Growing Total Payment Volume (TPV)

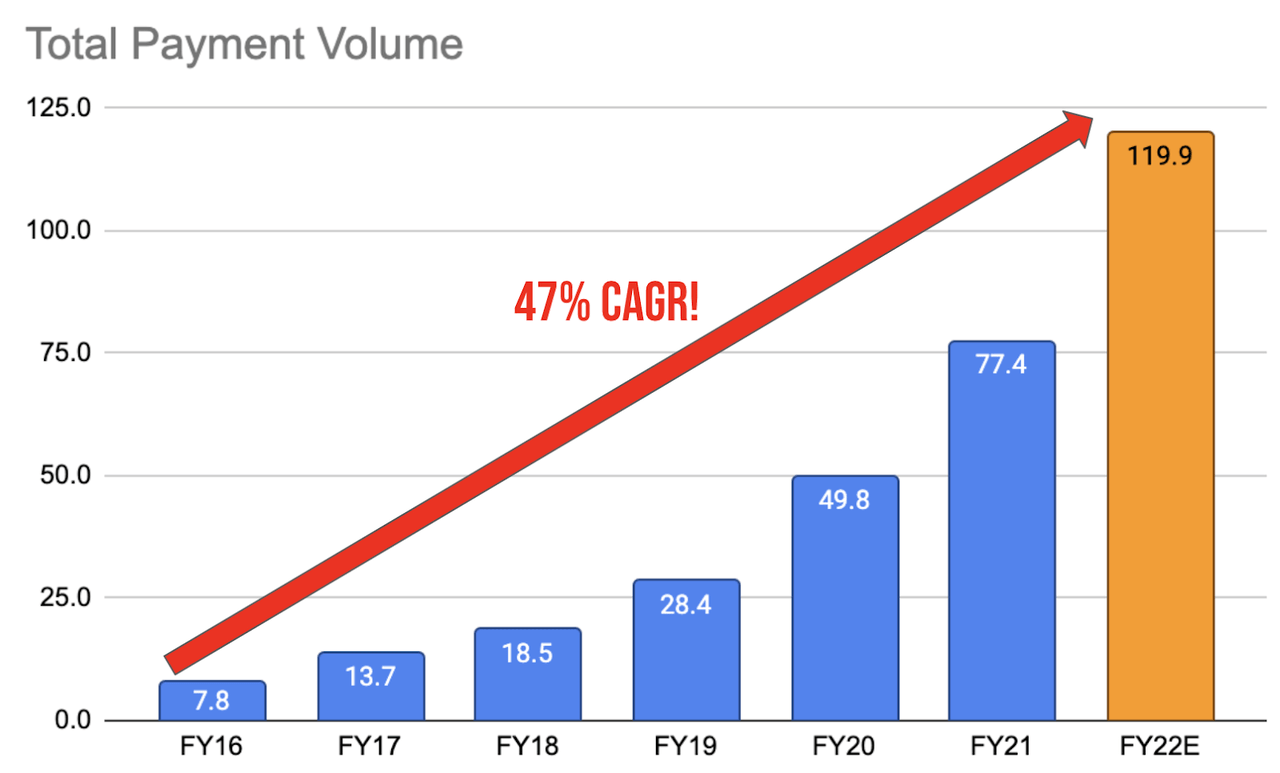

MELI 10-Q & 10-K

TPV consists of the amount of all transactions that take place using Mercado Pago (excluding credit business). During 3Q22, it reported a TPV of $32 billion, and since the next quarter is a strong quarter, I’ve come to an estimated TPV of $119.9 billion by FY22.

This means that, since FY16, its TPV compounded at 47% annually, driven by off-and-off marketplace transactions, including mPOS business, digital wallet, and credit/debit cards. At the beginning of FY22, the management deliberately reduced incentives that are used to gain adoption, and despite pulling back on spending, it continues to exhibit strong TPV growth rates, showing how sticky users are:

“…this has been a year where we decreased the incentives we have been giving users to use our products…mostly in the first and second quarter. In the past, we were offering more incentives and discounts for people to try our QR codes or pay utilities with or top their mobile phones using our wallet. We stopped pretty much doing all of that. And so I would say that it’s more organic, the growth we are seeing now. And the focus has been mostly on increasing engagement, increasing principality, and having our users come and try different use cases and the larger possible amount of product flows.”

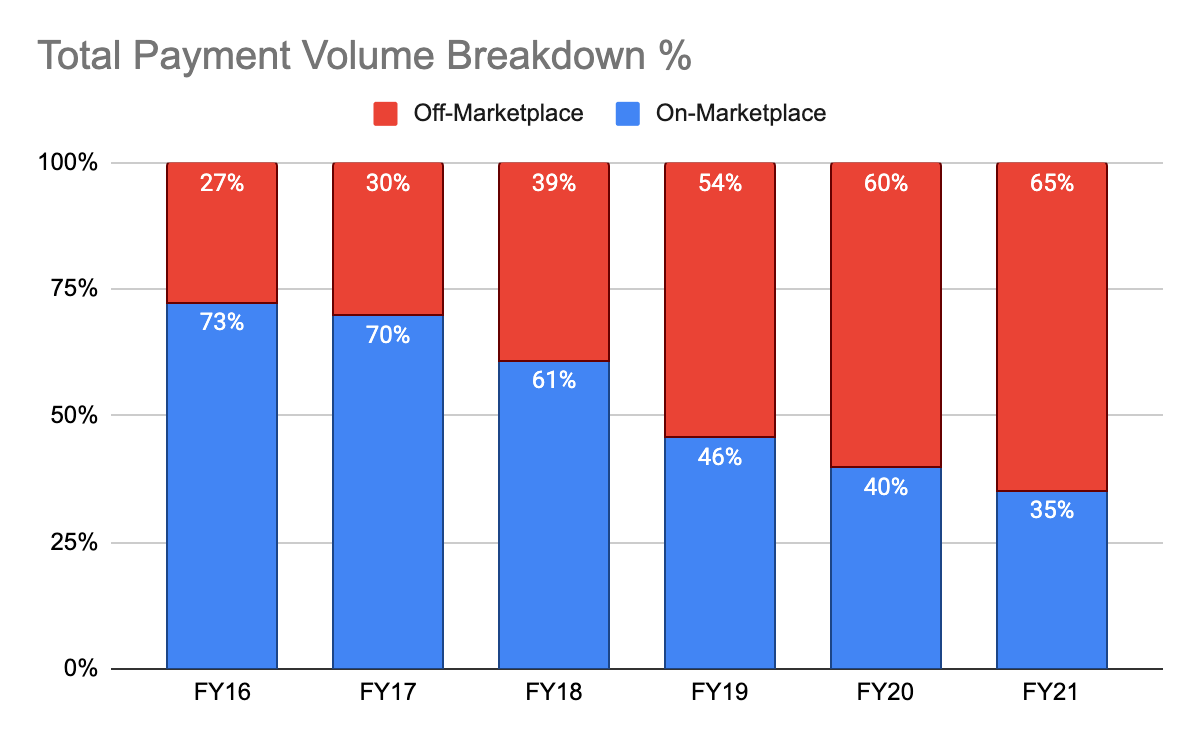

MELI 10-Q & 10-K

Impressively, its off-marketplace TPV has also been making up a higher overall mix, increasing from 27% in FY16 to 65% in FY21. This shows how faster its off-marketplace TPV is growing than its marketplace, and how increasingly embedded Mercado Pago is to third-party merchants, driving its overall TPV. During its latest 3Q22 results, its off-marketplace TPV grew 72% Y/Y, excluding the impact of FX market conditions. Looking back, it is smart how management has seized the opportunity to expand into third parties, increasing its overall market share and runway.

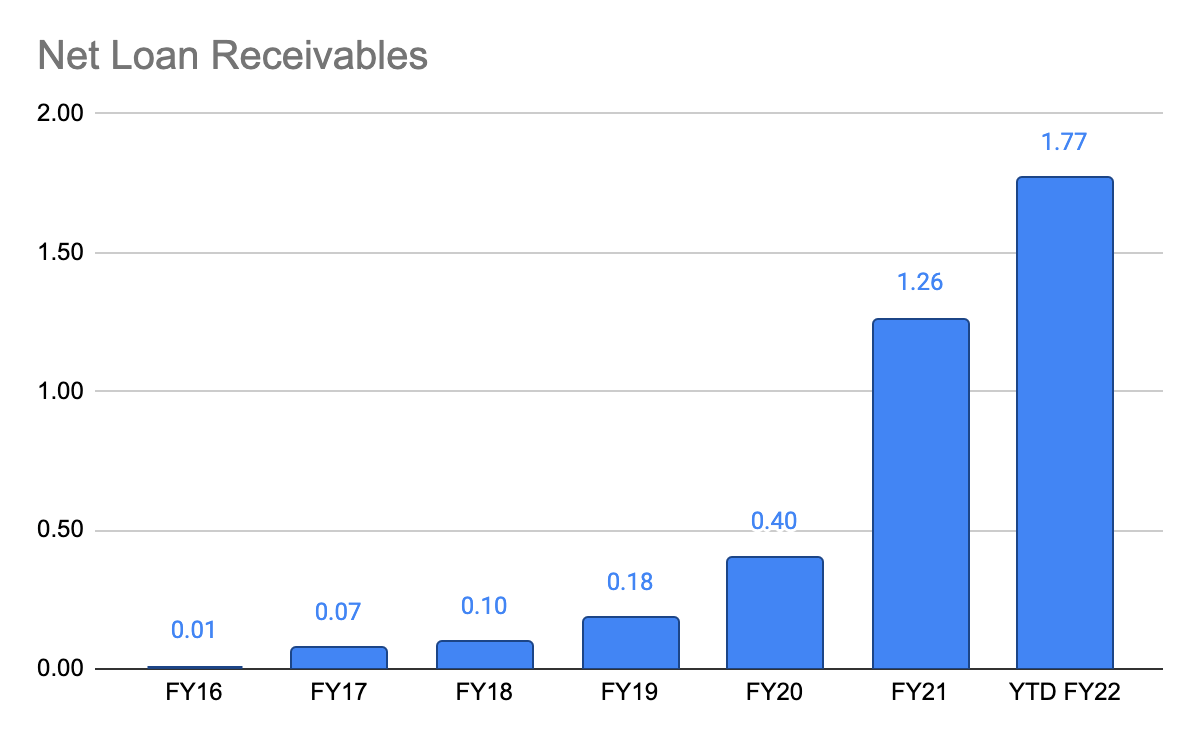

Mercado Credito’s Loan Receivables Growth, High Margins, and Increasing Non-Performing Loans

MELI 10-Q & 10-K

Revenues from its credit business make up its core revenue streams. Since FY16, its loan receivables grew from a mere $10 million to $1.77 billion in 3Q22, almost doubling every year. Loan receivables refer to loans that have not been repaid, and this serves as an indication of how revenues will be growing as Mercado Pago earns high-margin revenue from interest payments. As of 3Q22, its reported interest margin after losses (“IMAL”) is 37.2%.

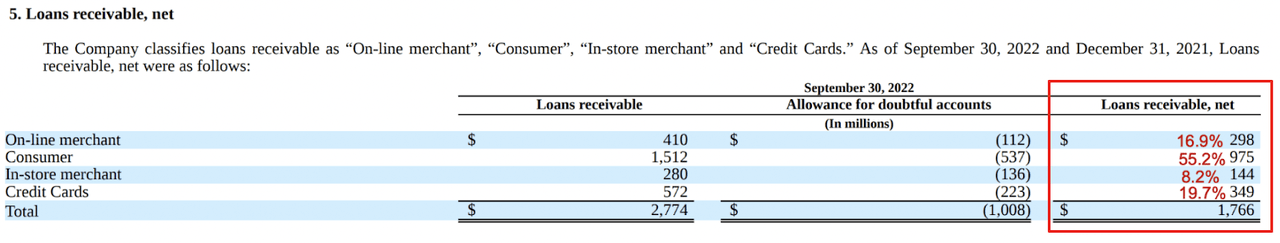

MELI 3Q22 10-Q

Among its loan receivables, consumers loan makes up the largest proportion of the overall mix, followed by credit cards, online merchants, and in-store merchants. Recall that credit cards were only introduced during FY21 and yet it has already made up 19.7% of the overall mix as of 3Q22. However, its credit card segment is still unprofitable having only launched last year, and according to the management in the 2Q22 earnings call, they are seeing improved profitability.

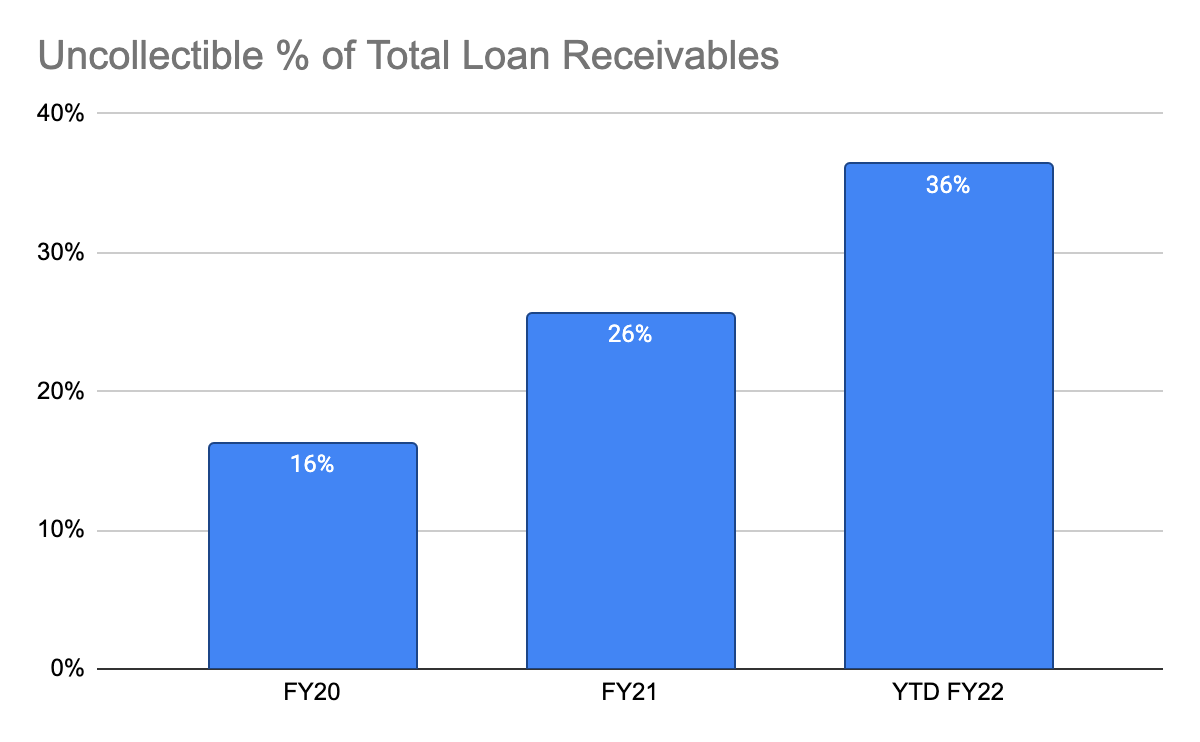

MELI 10-Q & 10-K

While it is impressive how quickly the loan receivables are growing, the concern is how quickly the uncollectibles (i.e. loans that cannot be repaid) is growing as a proportion of gross loan receivables. It rose from 16% in FY20 to 36% in 3Q22, primarily due to the higher-than-anticipated default risk in a weaker lending environment, particularly in Brazil:

“We took a deliberate decision to slow originations as we recognized the risks associated with a weaker lending environment, particularly in Brazil…The portfolio’s total non-performing loan (NPL) ratio rose to 37.0%….The combination of writing off delinquent loans at 360 days, with a portfolio where a majority of loans have a duration of less than three months, and the slowdown in originations means that delinquent loans from prior periods have a greater weight in our portfolio sequentially. All of the sequential rise in the NPL ratio has come from the over-90 day bucket…seeing a higher probability of default among our customers, but the actions taken during the quarter to reduce exposure to certain cohorts and to limit access to certain products, have mitigated this risk.”

As the credit business is sensitive to the economy, managing credit risks is extremely important.

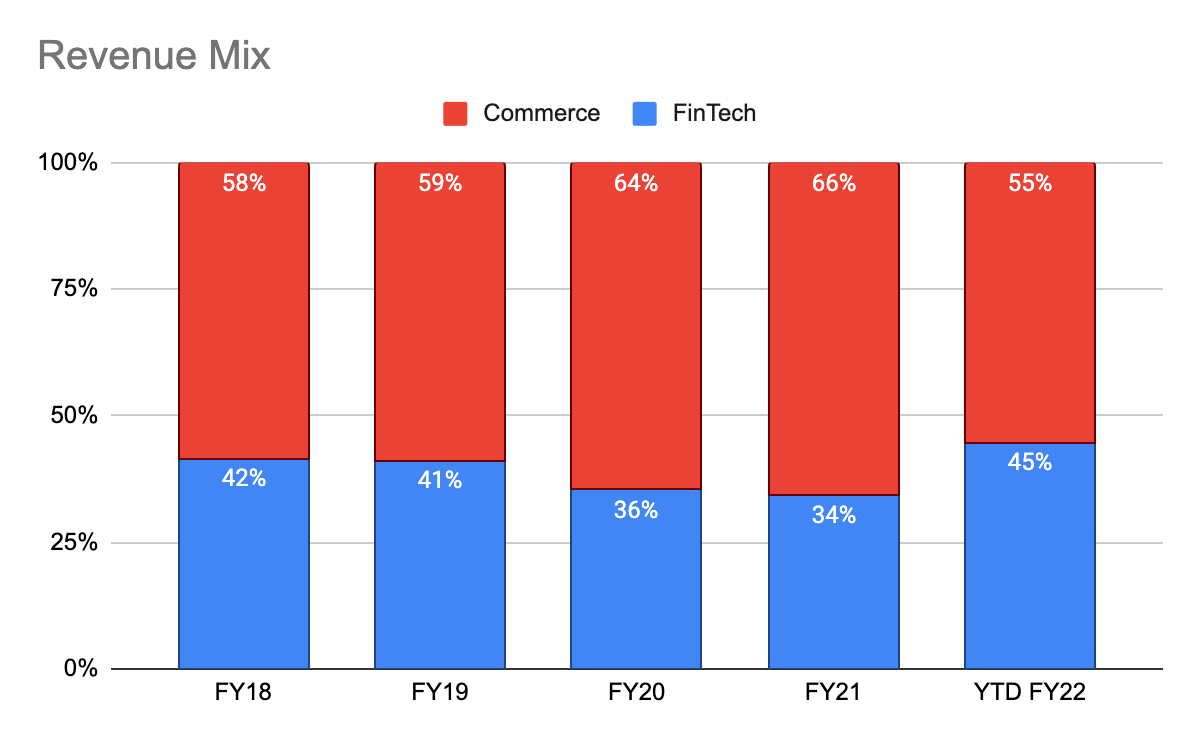

Increasing FinTech Revenue Mix

MELI 10-K & 10-Q

With Mercado Pago’s multiple product offerings, and multiple revenue streams, as well as its growing credit business, it is increasingly making up a higher overall revenue mix for MercadoLibre.

Concluding Thoughts

Thinking back, I would have imagined that investors would not have thought Mercado Pago could grow into the business it is today, but it sure did and exceeded many expectations. We saw this in pioneers like Alibaba and Kakao (KRX: 035720), and modern players like Grab (GRAB), Sea Group, and GoTo are following suit. Observing these successful players has also led to one observation – how each of them owns a business that is the market leader in its own rights. For Mercado Pago and Alibaba, is their e-commerce platform, while for Kakao, its KakaoTalk.

I’ve touched on multiple aspects of Mercado Pago, how it came about, and an overview of its business model. What initially was thought to be brief research has turned out to be a deep dive into its business, and hopefully, readers would benefit from this research as much as I did.

What are your thoughts on Mercado Pago? Let me know in the comment section below!

Be the first to comment