A heap of U.S. $100 banknotes. mgkaya

Growing rich as an investor isn’t nearly as complicated as many in the money management industry would have you believe. I have found that the simplest approach is arguably the best one in investing. Your job as an investor is to buy quality businesses, avoid overpaying for an ownership stake, and hold for the long haul. That’s it. It’s that simple at its core.

The weight loss and nutrition company, Medifast (NYSE:MED), fits the requirement of being a quality business in my opinion. Let’s dig deeper to better understand my argument behind this assertion and to demonstrate just how undervalued the stock appears to be at the current valuation.

The Dividend Is Safer Than You May Think

At first glance, you would think that Medifast’s 6.09% dividend yield is a yield trap. After all, it is more than four times the personal services industry average yield of 1.49%.

Medifast generated $13.89 in adjusted diluted EPS in 2021. Against the $5.39 in dividends per share paid during that time, this equates to a 38.8% adjusted diluted EPS payout ratio.

A temporary decline in adjusted diluted EPS in 2022 will push that payout ratio higher. According to analysts, the company’s adjusted diluted EPS will fall to $12.28 in 2022. Stacked against the $6.34 in dividends per share that will be paid this year, this is equivalent to an adjusted diluted EPS payout ratio of 51.6%.

Even with its 15.5% dividend hike earlier this year and the dip in adjusted diluted EPS, the payout ratio is still well-covered. And with analysts anticipating a 25.9% growth rate in adjusted diluted EPS in 2023, the payout will soon be even more protected.

Along with the expectation of 20% annual adjusted diluted EPS growth for the next five years, this should conservatively translate into 7% annual dividend growth over the long run.

Medifast Will Overcome The Short-Term Noise

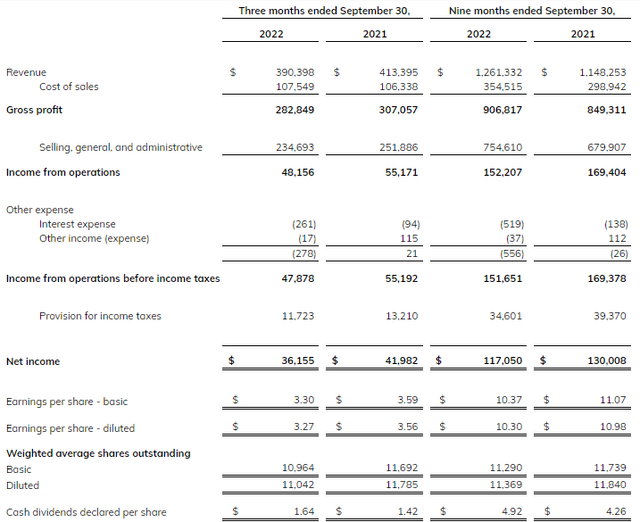

Medifast Q3 2022 Earnings Press Release

Medifast recorded $1.3 billion in revenue through the first nine months of 2022. This represents a 9.8% year-over-year growth rate (details sourced from Medifast Q3 2022 earnings press release).

As it turns out, helping customers to achieve and maintain significant weight loss through the formation of healthy, lifelong habits again paid dividends for the company. And more of Medifast’s clients of its weight loss service called Optavia were compelled to become active-earning coaches in their own right.

This is how the company’s active coach count rose 10.7% over the end of 2021 to 66,200. This was partially offset by the inflationary environment, which is what caused Medifast’s revenue per active earning coach to dip over the year-ago period (info according to Medifast Q3 2022 earnings press release and Medifast Q4 2021 earnings press release).

Excluding the company’s donation to support the Ukrainian relief effort, Medifast has reported $10.81 in adjusted diluted EPS year to date. This works out to a 1.5% year-over-year decline. Increased raw material and shipping costs for the company’s products have weighed on its profit margins. This was neutralized, in part, by a 4% decline in Medifast’s weighted average share count to 11.4 million year to date (figures per Medifast Q3 2022 earnings press release).

Operating in a nearly $200 billion global weight loss market with proven weight loss and management programs, the company has immense growth potential beyond the near term.

And if that wasn’t enough, Medifast also has a balance sheet with no long-term debt and $69.7 million in cash and cash equivalents (details sourced from Medifast Q3 2022 earnings press release). This will allow further share buybacks moving forward and generous dividend boosts.

Risks To Consider

As inflation recedes, Medifast is an excellent company that will regain its footing after this year. But the company still has risks that investors must know before buying the stock.

With a global recession being a near-certainty in 2023, customers could have less discretionary income available to commit to Optavia’s coaching services and meal plans. This is largely baked into forecasts already. But if the recession is deeper and more prolonged than is currently being predicted, this could be more of a headwind to Medifast.

In such a large and growing market, there will also likely be many more competitors that arise in the years to come. If Medifast isn’t able to properly execute and adapt to shifting consumer preferences, the company could be adversely impacted.

The Stock Is Criminally Undervalued

Medifast’s future is promising. And yet, my inputs into a couple of valuation models show it to be potentially deeply undervalued.

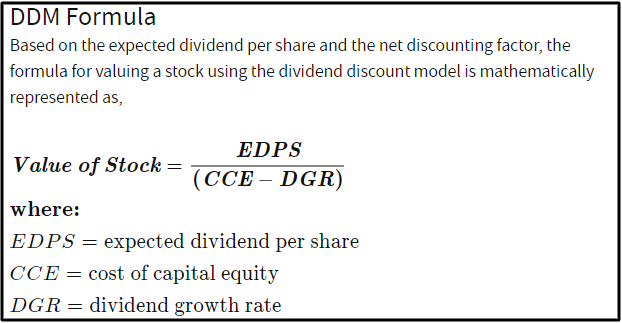

Investopedia

The first valuation model that I will use to value the shares of Medifast is the dividend discount model or DDM. This consists of three inputs.

The first input into the DDM is the expected dividend per share, which is a stock’s annualized dividend per share. Medifast’s annualized dividend per share is currently $6.56.

The next input for the DDM is the cost of capital equity, which is simply the annual total return rate required by an investor. Since my personal preference is for 10% annual total returns, that is the amount I will use for this input.

The final input into the DDM is the annual dividend growth rate or DGR. I will use a 7% annual dividend growth rate for this input.

Using these inputs for the DDM, I come out at a fair value output of $218.67 a share. This implies that Medifast’s shares are trading at a 50.8% discount to fair value and offer a 103.1% upside from the current price of $107.64 a share (as of November 4, 2022).

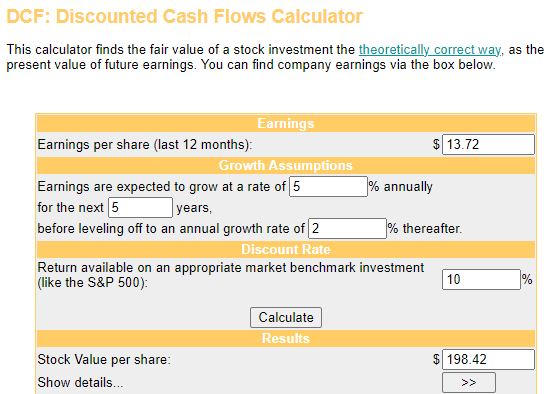

Money Chimp

The second valuation model that I’ll utilize to estimate the fair value of shares of Medifast is the discounted cash flow or DCF model. The DCF model also has three inputs.

The first input for the DCF model is trailing twelve months adjusted diluted EPS. Medifast’s TTM adjusted diluted EPS is $13.72.

The second input into the DCF model is growth assumptions. I’ll factor in a modest 5% annual growth rate in adjusted diluted EPS over the next five years for Medifast. And I’ll assume a slowdown in growth to 2% annually in the years that follow.

The third input for the DCF model is the discount rate. I’ll again use 10%.

When using these inputs, I get a fair value output of $198.42 a share. This suggests that Medifast’s shares are priced at a 45.8% discount to fair value and can provide 84.3% capital appreciation from the current share price.

Upon averaging these two fair values together, I compute a fair value of $208.55 a share. This demonstrates that the shares of Medifast are trading at a 48.4% discount to fair value and offer a 93.7% upside from the current share price.

Summary: Medifast Is A Rare Trifecta Of Yield, Growth, And Value

Since initiating its dividend six years ago, Medifast has delivered an astonishing 68% annual dividend growth rate. The law of large numbers dictates that this won’t be able to continue. But with the dividend payout ratio currently in a reasonable position and double-digit annual earnings growth poised to persist, I would expect many more raises similar to the 15.5% announced earlier this year. On top of a 6%-plus dividend yield, this is an unheard-of pairing of yield and growth.

And Medifast tops it all off by currently trading at a nearly 50% discount to its fair value. This is what makes it one of the strongest buys on the market today.

Be the first to comment