Inside Creative House/iStock via Getty Images

Medifast, Inc. (NYSE:MED) has had stellar returns that have attracted positive headlines. The company recently announced an acceleration of its stock buyback program. Medifast authorized purchases of $100 million, which could result in the company buying back approximately five percent of the company’s outstanding shares.

Medifast was also named one of Fortune Magazine’s fastest-growing companies. It was the third consecutive year the company was named to the list, which focuses on revenue growth and earnings per share growth. Medifast is the only health and wellness company appearing on the list.

But not everyone is confident in the sales model that is fueling Medifast’s growth. Some medical ethicists are raising questions about whether it’s appropriate for doctors and other healthcare workers to endorse Medifast’s products. In some cases, those healthcare workers are directly profiting by selling the products via the company’s multi-level marketing sales program which rewards coaches and influencers who are also quasi sales representatives.

When considering these current stories about Medifast, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price.

The revenue increases driven by the company’s multi-level marketing program could have a long-lasting impact on growing profits, but could also draw increased scrutiny that poses a threat to the success of program.

While current news stories, good or bad can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if MED is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

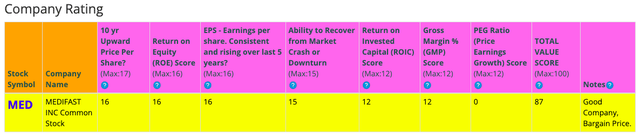

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. It shows a score of around 87/100. Therefore, Medifast is considered to be a good company to invest in, since 70 is the lowest good company score. MED has high scores for 10 Year Price Per Share, ROE, Earnings per share, Ability to Recover from a Market Crash or Downturn, ROIC, and Gross Margin Percent. It has a low score for PEG Ratio. A low PEG Ratio score indicates that the company may not be experiencing high growth consistently over the past 5 years. In summary, these findings show us that MED seems to have above average fundamentals since all but one of the categories produce good scores.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

BTMA Stock Analyzer (BTMA Stock Analyzer)

Fundamentals

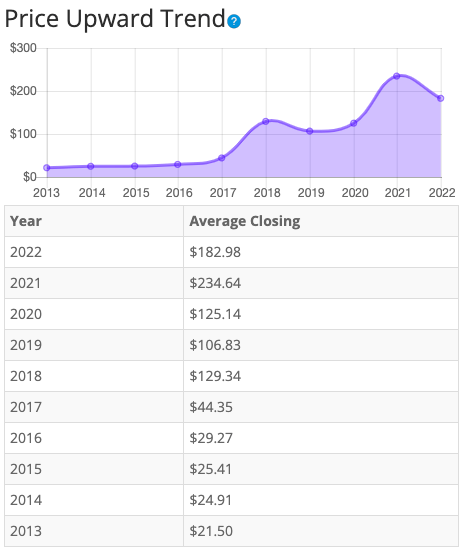

Let’s examine the price per share history first. In the chart below, we can see that price per share has been mostly consistent at increasing over the last 10 years, with only two years where average share price has declined. After five years of increases, average share price declined in 2019. Price rose again in 2020 and 2021, before dipping in 2022. It’s also worth noting two dramatic surges in price in 2018 and 2021. Overall, share price average has grown by about 751.07% over the past 10 years, or a Compound Annual Growth Rate of 26.86%. This is an excellent return.

BTMA Stock Analyzer

Earnings

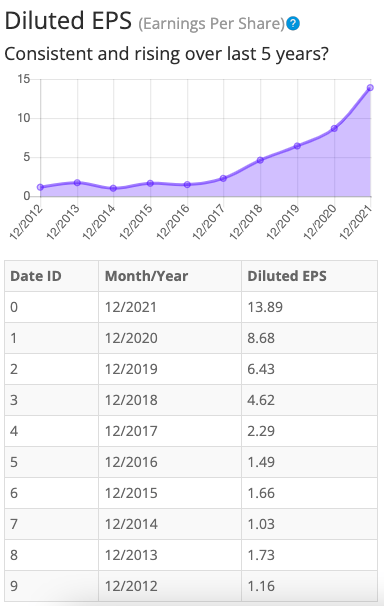

Looking closer at earnings history, we see that earnings have grown consistently over the past 10 years. The earnings grew gradually from 2012 to 2017, with one dip in 2014. Earnings momentum greatly increased from 2018 to 2021.

Medifast’s earnings story mirrors a change in its business model in 2017. Medifast manufactures and distributes weight loss foods and supplements directly to consumers. In 2017, the company added wellness coaches who worked directly with customers, which improved customer engagement that directly drives product sales. The company often recruits new coaches from its loyal customer base. Another big boost to sales came in 2021 in the wake of the COVID-19 pandemic. More Medifast consumers adapted healthier habits and ordered more in-home meals and products.

Consistent earnings make it easier to accurately estimate the future growth and value of the company. So, in this regard, MED is a good candidate of a stock to accurately estimate future growth or current value.

BTMA Stock Analyzer

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

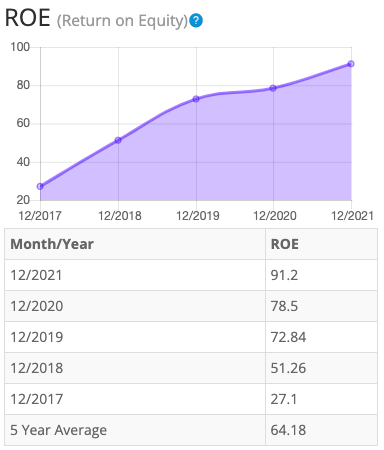

Return on Equity

The return on equity has been high and consistently increasing from 2017 – 2021. Five-year average ROE is very good at around 64.18%. For return on equity (ROE), I look for a 5-year average of 16% or more. So, MED easily meets my requirements.

BTMA Stock Analyzer

Let’s compare the ROE of this company to its industry. The average ROE of 118 Household Products companies is 35.95%.

Therefore, Medifast’s 5-year average of 64.18% and current ROE of 91.27% are well above average.

Return on Invested Capital

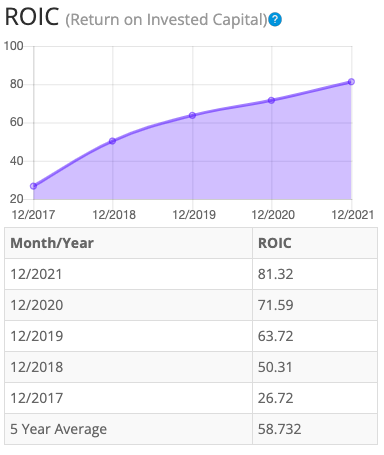

The return on invested capital has been stable and consistent. Five-year average ROIC is very good at around 58.73%. For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, MED easily passes this test as well.

BTMA Stock Analyzer

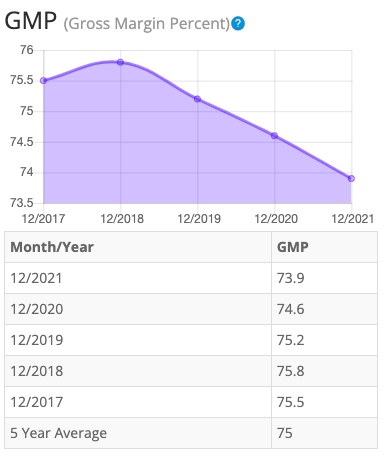

Gross Margin Percent

The gross margin percent (GMP) has slightly decreased over the last five years. However, even with the declines from 2018 to 2021, five-year GMP is very good at around 75%. I typically look for companies with gross margin percent consistently above 30%. So, MED has proven that it has the ability to maintain acceptable margins over a long period.

It’s worth noting that adding wellness coaches in 2017 added costs and did begin to shave away some of the company’s margins. But those margins are still strong and have remained steady, between 73% and 76% during the past five years.

BTMA Stock Analyzer

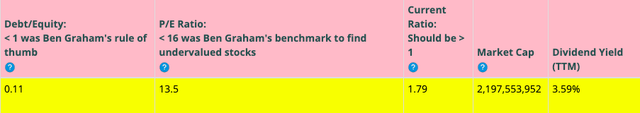

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than 1. This is a good indicator, telling us that the company owns more than it owes.

MED’s Current Ratio of 1.79 is satisfactory, indicating that it has an adequate ability to use its assets to pay its short-term debt.

Ideally, we’d want to see a Current Ratio of more than 1, so MED exceeds this amount.

According to the balance sheet, the company appears to be in good financial health. In the long term, the company seems strong in regards to its debt-to-equity. In the short-term the company is generating enough free cash flow to easily cover its obligations.

The Price-Earnings Ratio of 13.5 indicates that MED might be selling at a low price when comparing MED’s P/E Ratio to a long-term market average P/E Ratio of 15. The 10-year and 5-year average P/E Ratio of MED has typically been between 22.3 and 22.8, so this indicates that MED could be currently trading at a low price when comparing to MED’s average historical P/E Ratio range.

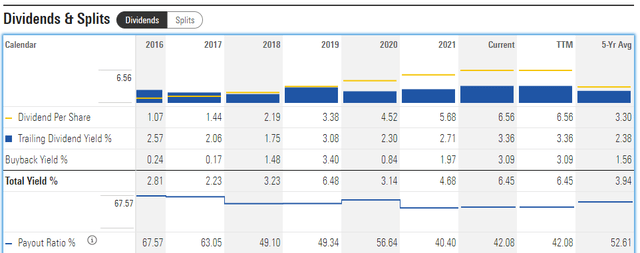

MED currently pays a dividend of 3.7% (or 3.59% over the last 12 months).

The Story Behind The Dividend

In regards to dividend history, I’m first interested in knowing if the payout ratio is sustainable. At this time, it’s around 42%, which means that there is still sufficient room to grow the dividend. Also notice that MED has a regular history of buying back shares, which contributes to higher payout ratios.

If we look only at the dividend yield, we see a range of 1.75% to 3.36%. This stock pays out a hefty dividend. Dividend payouts and yields have increased somewhat consistently over the 5 year period, therefore this stock may be desirable for some dividend investors.

If I were currently interested in buying MED now for the dividend, I would be trying to buy when the dividend yield was highest relative to its past. From the chart below, we can see that the dividend yield is near a somewhat high point relative to the past 6 years. Therefore, it’s a fairly good time to buy now if my priority is a better-than-average return through dividends.

GuruFocus

Overall, the dividend situation with MED is better than average. On the positive side, the stock pays a hefty and consistent dividend. The dividend yield has been increasing over the years. It seems that Medifast aims to regularly return value back to shareholders through buy backs. In addition, the dividend yield is near a somewhat high level when compared with the past 10 years. Finally, the payout ratio leaves room for more dividend growth.

I couldn’t find any obvious negatives for Medifast’s dividend situation.

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

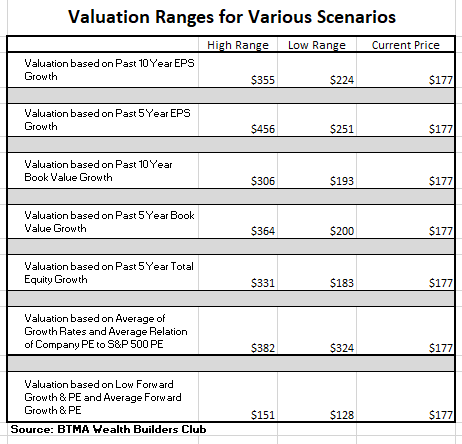

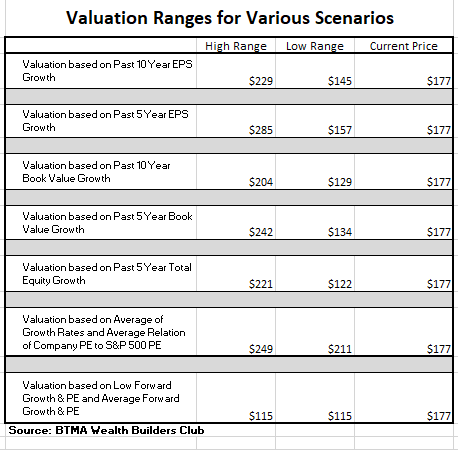

For valuation purposes, I will be using an adjusted diluted EPS of 13.89. I’ve used various past averages of growth rates and P/E Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

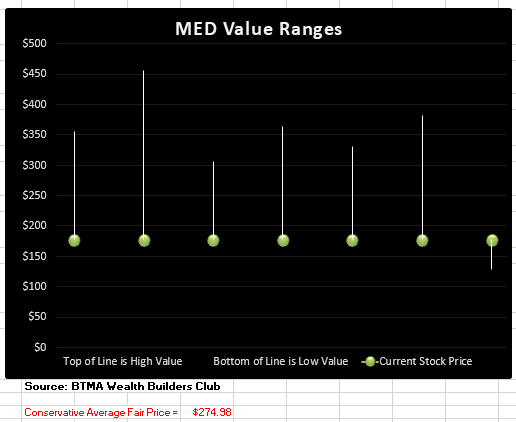

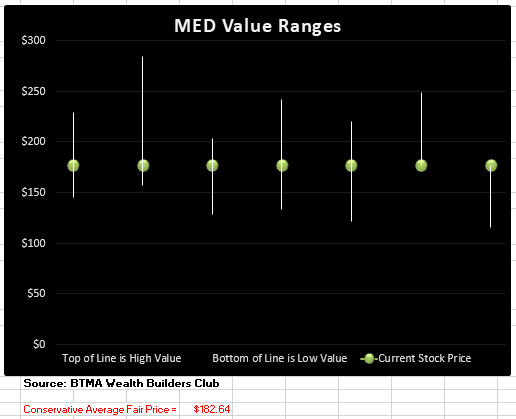

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club BTMA Wealth Builders Club

This analysis shows an average valuation of around $275 per share versus its current price of about $177. This would indicate that Medifast is undervalued.

Because of increased sales and earnings during COVID, this valuation analysis is likely not a good indicator of the current valuation during normal operating times.

Therefore, I have done another valuation analysis, which has aimed to remove the effects of COVID. This valuation understands that the past 7 years average annual earnings growth rate was around 27%. Therefore, to be even more conservative, I have applied a 20% Year-Over-Year growth rate from the 2019 earnings data to present day. The valuation below tries to show what the current valuation would be if the company was operating under normal pre-COVID conditions during 2020 – 2022.

BTMA Wealth Builders Club BTMA Wealth Builders Club

According to this adjusted valuation analysis, MED is about fairly priced.

- If MED continues with a growth average similar to its past 10 years earnings growth, then the stock is about fairly priced at this time.

- If MED continues with a growth average similar to its past 5 years earnings growth, then the stock is undervalued at this time.

- If MED continues with a growth average similar to its past 10 years book value growth, then the stock is about fairly priced at this time.

- If MED continues with a growth average similar to its past 5 years book value growth, then the stock is about fairly priced at this time.

- If MED continues with a growth average similar to its past 5 years total equity growth, then the stock is about fairly priced at this time.

- According to MED’s typical P/E ratio relation to the S&P 500’s P/E Ratio, MED is undervalued.

- If MED continues with a growth average as forecasted by analysts, then the stock is overpriced.

This adjusted analysis, which aims to remove the effects of COVID, shows an average valuation of around $183 per share versus its current price of about $177, this would indicate that Medifast is about fairly priced.

Forward-Looking Conclusion

According to the facts, Medifast, Inc. is financially healthy in a long-term sense in having enough equity as compared with debt, and in the short-term because the current ratio indicates that it has enough cash to cover current liabilities.

The company is fundamentally solid on every level including ROE, ROIC, Gross Margins, and EPS.

The dividend situation is better than average as the company pays a hefty dividend with a yield that has been steadily increasing over the past 5 years.

Lastly, my adjusted valuation analysis, which aims to remove the increased earnings of COVID, shows that the stock is about fairly-priced.

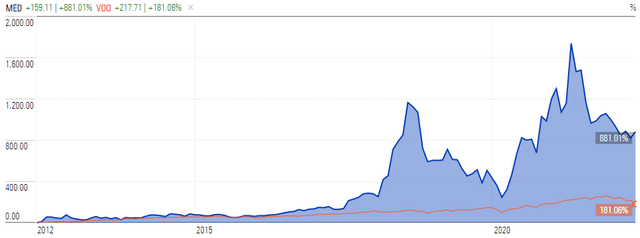

Now, let’s compare Medifast’s performance vs. the passive U.S. stock market benchmark of the S&P 500 (SPY). From the chart below, we can see that Medifast has easily outperformed the market during the majority of the past 10 years. A drawback is that Medifast doesn’t offer the diversity of the S&P 500, so that could add some risk and more volatility. But as an investor, you will need to decide if the exceptional possibility of gains are worth the added risk of less diversification.

Predicted Growth

“Over the next five years, the analysts that follow this company are expecting it to grow earnings at an average annual rate of 20%. This year, analysts are forecasting an earnings increase of 10.9% over last year. Analysts expect earnings growth next year of 22.7% over this year’s forecasted earnings” (Source: Forecast Earnings Growth)

If you invest today, with analysts’ forecasts, you might expect about 20% growth per year. Plus, we’ll add the current 3.7% forward dividend. This brings the annual return to around 23.7%.

Here is an alternative scenario based on MED’s past earnings growth. During the past 7 years prior to COVID, the average EPS growth rate was about 27%. Plus, the average 5-year dividend yield was about 2.38%. So, we’re at a total return of 29.38%.

But when considering cash flow growth over the past 10 and 5 years, the growth has been 14% and 26%, respectively. Plus, the average 5-year dividend yield would give us a total return of 16.38% to 28.38 %. Therefore, when considering an average of all these return scenarios, our annual return could likely be around 23% – 24%.

If considering actual past results of Medifast, Inc., which includes affected share prices, and long-term dividend yields, the story is a bit different. Here are the actual 10 and 5-year return results (prior to COVID)

______________

10 Year Return Results if Invested in MED:

Initial Investment Date: 6/20/2009

End Date: 6/20/2019

Cost per Share: $8.99

End Date Price: $129.20

Total Dividends Received: $5.70

Total Return: 1400.56%

Compound Annualized Growth Rate: 31%

_______________

5 Year Return Results if Invested in MED:

Initial Investment Date: 6/20/2014

End Date: 6/20/2019

Cost per Share: $31.58

End Date Price: $129.20

Total Dividends Received: $5.70

Total Return: 327.17%

Compound Annualized Growth Rate: 34%

_________________

From these scenarios, we have produced results from 31% to 34%. I feel that if you’re a believer in MED, and its existing products (weight loss meals and nutritional services), you could expect MED to provide you with around at least 15% annual return with more significant returns into the mid 20% range for patient investors, who reinvest their dividends.

As a comparison, the S&P 500’s average return from 1928 – 2014 is about 10%. So, in a typical scenario with MED, you could expect to earn a much higher return result as compared with an S&P 500 index fund. But you would also need to be confident the company, since you would have less diversification.

For me, the choice is certain. I would take an objective look at this company and realize that Medifast, Inc. is a well-run business with extraordinary fundamentals. It is a strong long-term dividend-hold investment. My adjusted valuation analysis shows that the stock is about fairly priced. Therefore, I’d want to wait until the price falls further for a better margin of safety.

Overall, I feel that Medifast could be a good addition to my portfolio (if bought at a slightly better price), but one concern I have is the lack of moat among current and future competition. I feel that most people don’t follow one weight loss program their entire life. It’s very likely that they will try various programs and even if Medifast works for them, they may eventually “fall off the wagon” or try another program for variety.

The company doesn’t have a strong brand loyalty vibe in my opinion. Instead, it’s more of a multi-level marketing company. Former Medifast customers often get trained to become coaches. They buy a business kit for around $200, they make a website, and they sell Medifast products to customers. Coaches can also get paid for recruiting other coaches.

I personally have a cringey feeling towards multi-level marketing companies. I always doubt whether the representatives from these companies really believe in their products or if they are simply trying to sell their friends/family and acquaintances products and referrals to make a buck.

One thing is undeniable; multi-level marketing (MLM) companies can be very profitable. Companies like Amway, Avon, Herbalife, and Mary Kay come to mind. I feel that certain MLM companies have a good reputation, but in the back of my mind it’s always an inner struggle for me to personally invest in these companies.

My objective side knows that this company has proven itself fundamentally and through ongoing profitability. But my gut tells me to only invest if it’s at a very attractive price, and to only invest a small portion of my portfolio in this company. This will help compensate for risks associated with investing in any MLM company, which critics often accuse of being “pyramid scheme” companies. Even if these allegations are false, they can be very damaging to the stock price. This exact situation happened to Herbalife, thanks to accusations by Bill Ackman.

In closing, I will consider investing a small portion in this fundamentally strong company when it’s selling at a significant discount to my adjusted valuation of $183.

Be the first to comment