DNY59

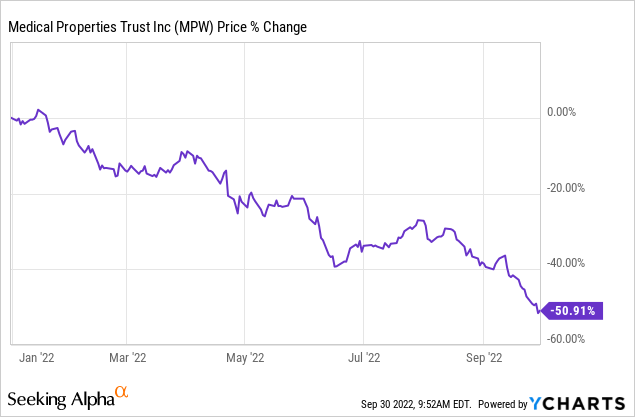

Medical Properties Trust, Inc. (NYSE:MPW) is a high yielding real estate investment trust (“REIT”) whose share price has gotten pummeled in the current bear market as recession fears soar. In fact, year-to-date the REIT has lost more than half of its equity value:

While it is true that hospitals have some recession sensitivities and its balance sheet has a decent bit of leverage and lacks an investment grade credit rating, we believe MPW holds high quality assets that are destined to not only survive but thrive over the long-term. As a result, we believe that the market’s sentiment on MPW is not only too bearish but bordering on the ridiculous. In this article, we will discuss our reasons for thinking this.

Why Mr. Market’s Treatment Of MPW Is Ridiculous

MPW was trading near all-time highs as 2022 dawned, but since then the stock has lost more than half of its value, with the stock gapping down particularly aggressively in recent weeks, down over 20% in just the past month.

Why is this? The two main reasons – beyond the general market bearishness that is hitting just about every single stock hard in the current environment – are:

- Hospitals – while mission critical assets and somewhat recession resistant – do typically suffer a loss of business during recessions. This is because elective procedures are often postponed or even avoided altogether as people try to save money during downturns. Furthermore, cheaper medical alternatives are often pursued over the more expensive conventional treatments provided by hospitals.

- MPW’s largest tenant – Steward – is reportedly struggling financially and there is concern that – should a meaningful recession hit – it would push Steward into financial distress, potentially threatening their leases with MPW and ultimately hurting MPW’s cash flows. Given that MPW is not investment grade rated and the rising interest rates, it could also put pressure on MPW’s balance sheet and force it to slash its dividend.

While these are both valid concerns, and in fact, MPW did see funds from operations (“FFO”) per share decline and also cut its dividend during the last major recession (2009-2010), there are a few other important notes to consider before completely throwing the baby out with the bathwater.

Today, MPW is much better diversified than it was back in the last recession and its balance sheet is in better shape. Furthermore, it was not covering its dividend in the leadup to that recession, as its FFO payout ratio was over 100% in both 2006 and 2007. Today, its FFO payout ratio is a more conservative 63.7% and its AFFO payout ratio is 82.3%, so it could see its rental income take a moderate hit and still cover its dividend.

On top of that, MPW recently sold some hospitals with Steward as the tenant at a low 5.8% cap rate. As a result, the idea that Steward is on the verge of going bankrupt is clearly not being priced into the private markets in the same manner in which it is weighing on MPW stock. Last but not least, MPW raised the dividend yet again this year by the same amount as it has in recent years. This seems to communicate clearly that management remains optimistic about the business and its prospects.

It is also important to keep in mind that MPW has very conservative triple net leases on its hospitals that are designed to weather bankruptcies from tenants. Furthermore, they have inflation-linked escalators attached to those leases and the profitability of its individual assets is generally quite good. As a result, whether inflation is running high or a recession is threatening the financial strength of its tenants, MPW is well positioned to keep up with the macroeconomic trends. Even if Steward does go bankrupt, MPW should ultimately emerge with the leases still intact. However, in a worst-case scenario in which Steward defaults on its lease and is evicted from the property, the profitability of its properties and their mission-critical nature mean that MPW should be able to release them before too long.

Regarding its CPI-linked lease adjustments, management said during MPW’s recent Q2 earnings call:

We estimate that our cash rents will increase in 2023 over 2022 by about $57 million as a result of our inflationary escalators. That’s an average increase across the portfolio of approximately 4.4%. Applying an estimated and arbitrary blended capitalization rate of 6.5% to this incremental cash results in the equivalent of about $875 million of additional leased real estate, for which we have 0 cost of capital.

So in capital markets that are temporarily squeezing investment spreads, we are very pleased with the built-in improvements in yield that we expect beginning early in 2023. And of course, that’s on top of the previously disclosed 2022 escalation.

Is MPW a risk-free or even a low-risk investment? No. Its lack of an investment grade credit rating and its mild recession sensitivity prevent it from taking that title. Furthermore, the uncertainty surrounding Steward’s finances adds additional risk to the mix.

However, given its phenomenal track record of dividend growth and its incredibly cheap valuation, we think that the market’s continued battering of the share price is getting ridiculous and MPW is now a very attractive investment opportunity. In fact, MPW is now very cheap on both a comparative basis as well as relative to its own historical averages. Its EV/EBITDA of 12.19x is well below its five year average of 14.47x. Furthermore, its price to FFO ratio is 6.64x at the moment, below its five year average of 11.28x, its price to AFFO ratio is 8.42x compared to its five year average of 13.92x, its forward dividend yield is 10.14% which is significantly above its five year average of 6.09%, and its price to NAV is 0.65x, way below its five year average of 1.16x.

Investor Takeaway

We understand Mr. Market’s increased bearishness on REITs in general given the one-two punch of increased interest rates (which should push cap rates higher in response) and the increasing inevitability of a meaningful economic downturn (which will likely pressure occupancy and rental rates). However, in the case of MPW, we believe Mr. Market has reached a level of being ridiculous.

MPW continues to grow its dividend, is benefiting from its inflation-linked triple net leases and is fairly well positioned to weather any financial challenges that Steward may experience.

Granted, this investment is not risk-free as MPW lacks an investment grade balance sheet and its tenants could face difficulties during a fierce recession. However, it has plenty of liquidity to survive, owns highly valuable real estate, and trades at incredible discount to Wall Street consensus private market value estimates as well as its historical cash flow and dividend yield averages. As a result, we rate this opportunity as a speculative Strong Buy where investors can follow Warren Buffett’s advice to be greedy when others are fearful.

Be the first to comment