Viktor Hladchenko/iStock via Getty Images

Investment Thesis

The issue with Medical Properties Trust’s (NYSE:NYSE:MPW) tragic valuations is the probable bankruptcy of its largest tenant, Stewart. The latter had infamously encouraged rumors of cash flow issues, due to the perceived inability to pay its IT vendor for $18.2M, combined with the notoriety of its Medicare fraud fines of $4.73M. MPW’s situation is worsened, since another tenant, Pipeline Health, confirmed investors’ fears and sought bankruptcy protection in October 2022, adding further fuel to the growing blaze. Therefore, it is no wonder that the stock has catastrophically plummeted to its current levels to its 10Y lows at the time of writing.

Though recessionary chances have been upgraded to 100%, we are less concerned for now, since the September CPI continues to show an elevated spending Index on medical care services at 0.7% sequentially and YoY growth of 6.5%. Spending on healthcare insurance remains robust as well, with a 2.1% sequential growth and 28.2% YoY growth. Thereby, highlighting Mr. Market’s overly pessimistic outlook, instead of the fundamental consumer demand for hospital services.

MPW’s Dividends Remain Safe, Though Deleveraging May Slow Down Ahead

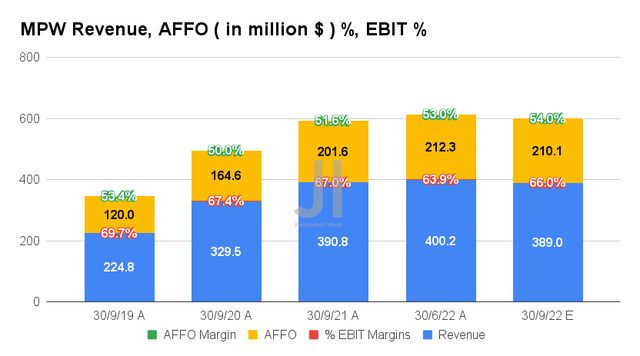

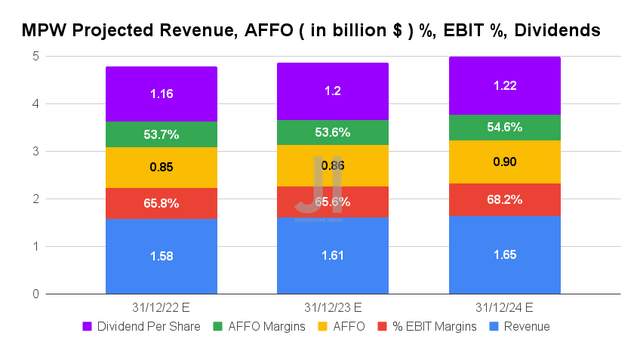

For its upcoming FQ3’22 earnings call, MPW is expected to report revenues of $389M and an EBIT margin of 66%, indicating a notable decline of -2.79% though an improvement of 2.1 percentage points QoQ, respectively. Otherwise, relatively in line YoY. Naturally, there will be minimal changes to its profitability, with the projected AFFO of $210.1M and an AFFO margin of 54% for the next quarter, in line QoQ, though notably an excellent increase of 4.21% and 2.4 percentage points YoY, respectively.

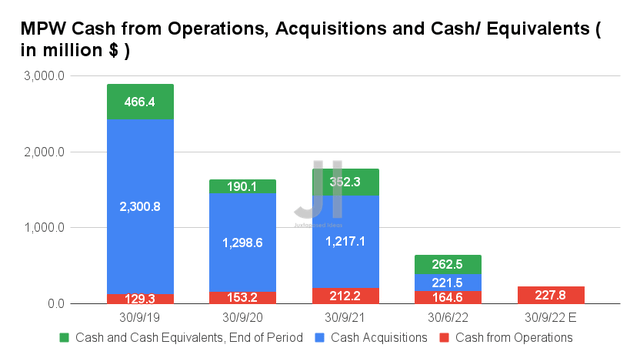

In the meantime, analysts expect to see increased cash from operations ahead at $227.8M in FQ3’22. It indicates an increase of 38.39% QoQ and 7.35% YoY. The MPW management is also projecting a rather ambitious $1B in immediate liquidity, attributed to the upcoming sale of the Connecticut Hospitals and other proceeds. Thereby, boosting its cash and equivalents ahead during the worsening macroeconomics.

This also directly contributed to MPW’s new share repurchase authorization of up to $500M, expiring on October 2023. We reckon that it would aid the company in saving more cash in the long run, due to the continued increase in its total dividends payout thus far.

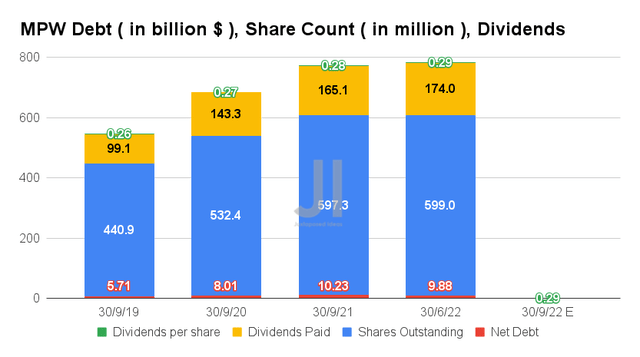

MPW has continued to grow its shares outstanding at a CAGR of 10.75% over the past three years, partly attributed to its expanding Stock-Based Compensation (SBC) of 15.03% at the same time. For example, the company reported 440.9M shares in FQ3’19 and SBC of $32.19M in FY2019, compared to 599M in FQ2’22 and $48.99M in the last twelve months.

Combined with MPW’s increase of its annual dividends per share at a CAGR of 4.38% between FY2019 at $1.02 and FY2022 at $1.16, it is natural that MPW has been stretching its finances relatively thin. The company reported an aggressive growth in dividend payouts at a CAGR of 19.41% at the same time, from a total of $411.70M in FY2019 to a projected sum of $701.04M by FY2022, compared to its AFFO growth of 23.25% from $453.68M in FY2019 to $849.32M by FY2022.

This naturally explains why there has been a minimal reduction in MPW’s long-term debts thus far, from its peak levels of $10.91B in FQ4’21 to $9.88B by FQ2’22. Nonetheless, we are encouraged by the -9.44% decline thus far, combined with the management’s guidance in deleveraging ahead from its $1B liquidity. Furthermore, assuming that the stock continues trading at this level and the $500M repurchases are fully exercised, we are looking at a notable reduction of 48.92M shares. It indicates an excellent moderation of $56.75M in annual dividend payouts moving forward, further freeing up capital for acquisitions/ deleveraging ahead.

MPW Debt Maturity

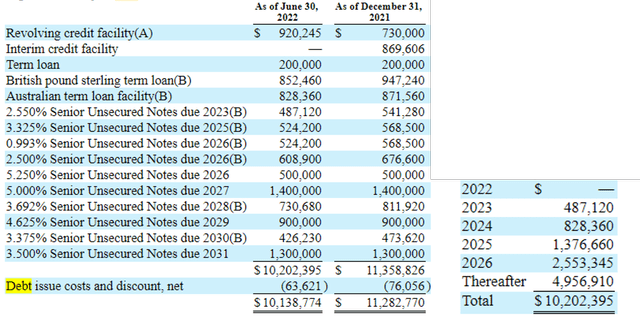

Furthermore, MPW investors must also note that only $1.31B of its debts will be due over the next two years. Assuming that the management clears the 2023 debts from its recent proceeds, there are minimal issues from its elevated debts indeed, since the bulk of it is well staggered through 2031. Given its improved profitability, the company can easily afford the $367.03M in annual interest expenses as well, with an operating income of $1.1B over the last twelve months.

Over the next three years, MPW is expected to report revenue and AFFO growth at a CAGR of 2.33% and 3.53%, respectively, slower than pre-pandemic levels of 16.43%/14.98% and pandemic levels of 22.78%/23.25%, respectively. This is naturally attributed to its elevated acquisition growth of 23.34% and 21.70% then, compared to the slowing acquisition volume of approximately $1.2B in FY2022 at 10.26% against the original projection of up to $3B. We believe that this strategy will prove prudent during the impending recession, due to the elevated interest rates and the limited availability of equity through 2023, if not 2024.

We also agree with consensus estimates that MPW will likely further rely on debts/asset sales to fund its expanding operations, with a notable deceleration in dividend growth of 2.55% through FY2024. Therefore, its net debt would likely remain elevated over the next few years, with analysts projecting $9.86B of net debt by FY2022 and $10.42B by FY2024, compared to current levels of $9.88B in FQ2’22.

Is that a concern? It depends on individual investors, really, since the company’s forward profitability remains robust with no signs of dividend safety buckling for now. Naturally, this is assuming no tenant bankruptcies and default issues in the face of the recession’s full force through 2023. Thereby, pointing to the stock’s highly speculative position in the worsening macroeconomics, we think it is only suitable for those with a higher risk tolerance and long-term trajectory.

So, Is MPW Stock A Buy, Sell, or Hold?

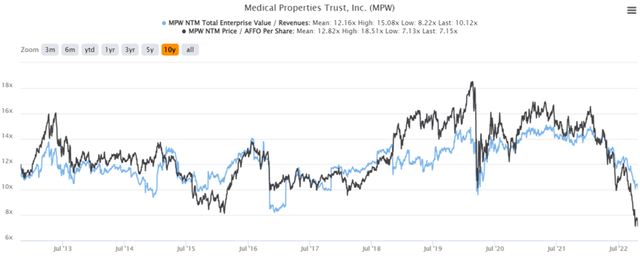

MPW 10Y EV/Revenue and Price/FFO Per Share Valuations

MPW is currently trading at an EV/NTM Revenue of 10.12x and NTM Price/FFO Per Share of 7.15x, lower than its 10Y mean of 12.16x and 12.82x, respectively, notoriously with the latter trading at its lowest point ever. The stock is also trading at $10.22, down -57.64% from its 52 weeks high of $24.13, nearing its 52 weeks low of $9.90. Nonetheless, consensus estimates remain bullish about MPW’s prospects, given their price target of $18.50 and an 81.02% upside from current prices.

MPW 10Y Stock Price

Naturally, with the surprisingly sticky September CPI/PPI and robust September labor market, it is painfully evident that the Fed will likely sustain its hawkish stance through 2023. 95.3% of analysts are already projecting a 75 basis points hike in the upcoming November meeting, and likely again in the December meeting. With the Feds also increasingly likely to raise its terminal rates to over 5%, beyond the original projection of 4.6%, we are in for more pain ahead indeed. The S&P 500 Index has already tragically plunged below its June low thrice, though Mr. Market seems quietly optimistic for now, with a 4.66% recovery at the time of writing. We shall see.

Now, where does this place MPW, since the stock has tragically suffered a -56.42% plunge YTD to reach its lowest point in 10Y? Well, we reckon that places it in a very unique position for those who are willing to weather some short-term volatility ahead. The stock currently yields a very attractive dividend yield of 11.93% by FY2024, compared to its 4Y average of 5.71% and sector median of 4.3%. Assuming another earnings miss ahead as it did for the past two quarters, we may see the stock further retracing to potentially single digits, triggering more uncertainty ahead. However, that would also boost MPW’s dividend yields to a record high of 13.55% then, assuming no dividend cuts, of course.

Therefore, we rate MPW stock as a Buy only for dividend hunters with a lead-lined stomach for massive volatility. Enjoy the contrarian dividends for now and leave the worries behind in this time of maximum pain. Of course, investors should also size their portfolios appropriately in the event of dividend cuts and extreme volatility ahead. Good luck, all.

Be the first to comment