halbergman/iStock via Getty Images

Since July 1, 2022, here on Seeking Alpha, there have been 53 articles written on Medical Properties Trust, Inc. (NYSE:MPW). Somewhat surprisingly, the REIT has captured the fancy of a broad swath of the SA readership. Specifically, over that almost six-month stretch, 46 MPW articles rated this REIT as a ‘Strong Buy’ or ‘Buy’, 6 articles had a ‘Hold’ rating and 1 article rated MPW a ‘Sell’. I simply don’t chase yield, as I view it as a very poor way to generate superior risk-adjusted long-term returns. Therefore, I’ve never been long MPW, but I’ve been intrigued by the strong interest in this REIT. And to cover all of my bases, I have never been short MPW, and nor do I have any intentions of shorting this REIT.

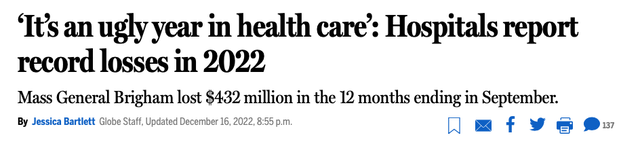

The genesis for writing this article was a December 16, 2022 Boston Globe article: ‘It’s an ugly year in health care’: Hospitals report record losses in 2022.

This Boston Globe article is action-packed with details on the deteriorating financial health of the Massachusetts hospital sector, over the past fiscal year, ending September 30, 2022.

Within the piece, it mentions that Mass General Brigham lost $432 million, in FY 2022, ending September 30, 2022.

For perspective, this was the largest loss for Mass General in its 28-year operating history. There were a number of factors that drove the losses, notably and highlighted throughout the piece, was the (severe) shortage of nurses and other front-line and well-paid medical professionals.

Moreover, the major losses weren’t isolated to MGH, instead, they appear to be structural headwinds, as in FY 2022, Massachusetts’ second-largest health system, Beth Israel Lahey Health, lost $200.7 million, Tufts Medicine lost $398.6 million, and UMass Memorial lost $38.3 million (but generated a one-time windfall profit from selling its stake in Shields Health Solution, for $189 million).

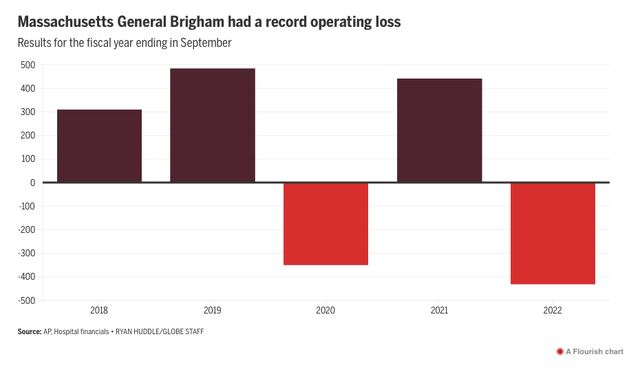

In case you are curious and don’t live anywhere near Massachusetts, Massachusetts General Hospital was ranked as the third-best hospital in the nation! Brigham and Women’s Hospital (also owned by Mass General Brigham) held the 9th slot. MGH is Harvard Medical School’s largest teaching hospital! For perspective, in the 2021 Newsweek survey, Beth Israel Deaconess was ranked 31st, and Tufts Medical Center was ranked 50th.

Just to be clear, we are talking really high-caliber hospitals. And depending on the illness, some people come from all over the world for certain treatments.

In addition, and detailed in Jessica Bartlett’s Boston Globe piece, she noted that Massachusetts hospitals generated these major losses despite healthy levels of state and federal funding. In other words, without the federal and state aid, the operating losses would have been higher!

Many hospitals continue to receive state and federal funds to offset some of the losses. In November, the state approved another $350 million package for hospitals. To date, Massachusetts hospitals have received $681 million in ARPA funding, on top of billions in other federal relief money.

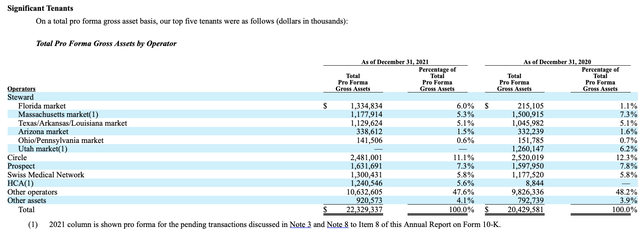

So this brings me to Steward, MPW’s largest tenant, representing 18.5% of MPW’s gross assets, per its FY 2021 10-K.

Arguably, one of the biggest red flags, when it comes to MPW is that Steward has refused to publish annual financial statements (a 10-K), such that current and prospective MPW stakeholders can assess its financial health and solvency risk.

Moreover, in this October 4, 2019 article, ‘Steward Has Lost $592 Million in Two Years, but Revenue is Up’, written by Will Maddox, in Dmagazine.com (‘D’ stands for Dallas), we learned of big operating losses, in both FY 2017 and FY 2018.

Steward sued the state in 2017 to keep its financial data secret, The Boston Globe reports.

The report showed that most health systems in Massachusetts was profitable, but singled out Steward as the health system with the lowest margin as well as the owner of the hospital with the worst margins. The system experienced a loss of about $270 million in 2018 and $322 million in 2017.

Since we don’t have current audited financials, we have to look back in time to gain some perspective on how Steward is as an operator.

In addition, there are also a number of negative articles, only a few Google searches away, including a few Bloomberg articles, suggesting that Steward is a poor operator and its former private equity owner, Cerberus Capital Management, extracted outsized profits by financial engineering. However, those articles are beyond the scope of today’s piece.

Therefore, I would argue that if Steward was losing money, in much healthier times, well before anyone ever heard of Covid, and well before the really acute labor shortages for skilled healthcare professionals, not to mention the sharp rising in interest rates and higher cost of debt capital, one might reasonably hypothesize Steward’s FY 2022 results won’t be very good. As after all, MGH and Beth Israel, two of the nation’s best-ranked and most prestigious hospital systems generated record operating losses, in FY 2022 (ending September 30, 2022).

Yet remarkably, on MPW’s Q3 FY 2022 Conference Call, which took place on October 27, 2022, MPW revealed that Steward would generate $65 million (mid-point) in FY 2022 Unadjusted EBITDA and that the company is forecasting $350 million of unadjusted EBITDA in FY 2023!

And before turning the call over to Steve, let me outline the strong operating performance that Steward is reporting to us. Unadjusted EBITDA for the second quarter was approximately $51 million. The third quarter is expected to be more than $30 million. Fiscal year 2022 unadjusted EBITDA is projected to be between $50 million and $80 million. Contract labor in Q3 fiscal year 2022 has decreased 30% from Q1 FY 2022 run rate and is expected to decline an incremental 20% in Q4, resulting in a 50% decline since the first quarter of this year. Steward is also forecasting unadjusted EBITDA of more than $350 million for fiscal year 2023. Steve?

If Steward’s FY 2023 Adj. EBITDA outlook is so strong then why hasn’t the company filed audited FY 2021 financial statements? Secondly, if Mass General and Beth Israel had their worst year of losses, in FY 2022, how is a vastly inferior Steward dramatically bucking the trend?

Moreover, on MPW’s Q3 FY 2022 conference call, management was upbeat on the recovery and underlying fundamental strength of its hospital operators.

See here:

Thank you, Charles, and thanks to all of you for joining today on our third quarter 2022 earnings call. While economic uncertainty and inflationary pressures continue to weigh on investors and businesses worldwide, we are seeing some positive trends over the last couple of months within the health care sector that are worth noting. Volumes have fluctuated throughout 2022, but August saw increasing volumes which have provided a good boost in revenues.

So while our trailing 12-month coverages may see marginal declines as grant funds roll out of the prior periods, we’re seeing positive trends in quarter-over-quarter and August over July discrete coverages. As we have previously discussed, our operators, especially the general acute care facilities have experienced the same general conditions and environments as have all hospital systems including HCA Tenet and others.

Our operators have been executed on initiatives to reduce contract labor utilization and at the same time negotiate more favorable pricing for contract labor that remains in place due to short staffing. In February of this year, our operators experienced the highest level of contract labor, but have subsequently seen a decline through the month of August. A similar decline has occurred in overall salaries, wages and benefits.

So I’m trying to work out how the entire Massachusetts hospital system, including the best in class, and a world renowned system, like an MGH, experienced its worst financial performance in 28 years, and yet, MPW is so upbeat and optimistic on the fundamentals of the hospital industry in the broader U.S.

Also, as an aside, on MPW’s Q3 FY 2022 conference call, Raymond James analyst, Jonathan Hughes, had a number of direct questions asking about the lack of communication. Notably, we were referring to the bankruptcy filing of Pipeline, as MPW had exposure to this hospital system. That said, and to be clear, MPW expects they will receive all of the rent, during and post bankruptcy, as it is their understanding that the driver of the bankruptcy filing was Pipeline’s Illinois system, and MPW has no exposure to those big money losing hospitals.

MPW Q3 FY 2022 Conference Call

MPW’s Unsecured Debt Is Trading Poorly (9% YTW)

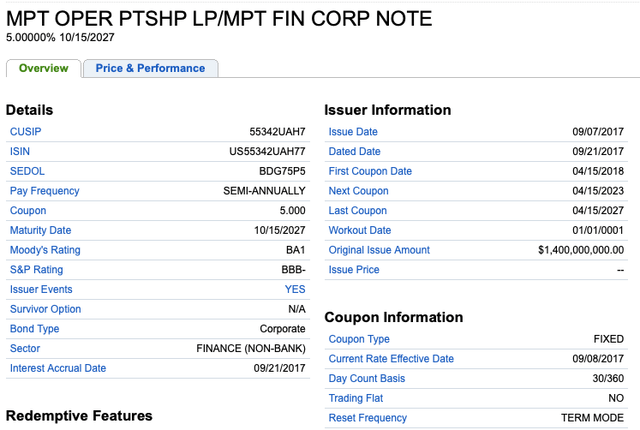

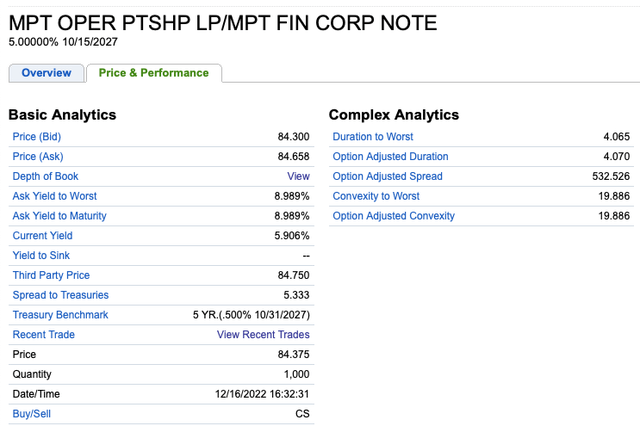

Another item that I want to point is that, as of last Friday, December 16, 2022, as a proxy of the market’s perception of MPW’s credit risk, MPT Operating Partnership LP, 5.00% 10/15/2027 unsecured notes were trading at nearly a 9% yield to worst.

Again, this is less than a 5-year bond, has a healthy 5% coupon, and it is trading in institutional size (at least blocks of $1 million bonds), at less than $85 cents on the dollar! A 5% coupon, 5-year bond, for a high-quality issuer should be trading less than a 6% yield to worst, and closer to 5%. So clearly, the bond market isn’t exactly buying MPW’s rosy colored glasses narrative.

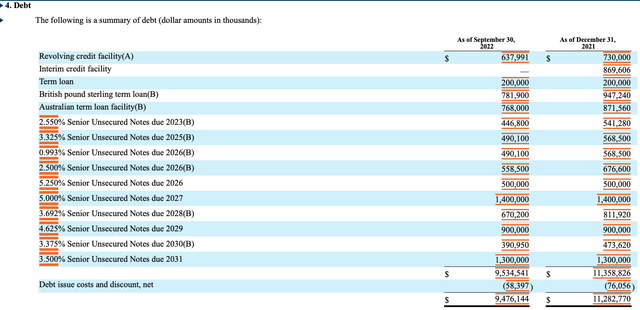

Secondly, and relatedly, if you look at the composition of MPW’s debt, although it is termed out and laddered, look at how reliant the company has been on issuing low coupon and unsecured debt to fund its business.

In a rising rate environment, and arguably with a higher current credit risk profile, just look at where MPW’s largest and most liquid unsecured bond is trading, as shown above, this is another risk. Keep in mind that the company’s cost of both equity and debt capital is now much higher than a few years back. Although certainly not as pressing, at least in the short term, given the maturity date laddering, this is a headwind for the equity.

Putting It All Together

As there have been 46 ‘Strong Buy’ or ‘Buy’ rated articles on MPW, since July 1, 2022, I wanted to write a more cautionary piece, based on relevant risks and share other factors retirees might want to consider before buying this REIT. At $11.39 per unit, the company’s distribution equates to just north of a 10% yield. That said, it is really hard to generate superior long-term and risk-adjusted returns by chasing yield. This company has a $6.8 billion market capitalization and enterprise value north of $16 billion! In other words, it is well covered by both the sell side and the fixed income community. The fact that the company’s 5.00% 10/15/2027 bond, a bond that is highly liquidity, is trading at less than 85 cents on the dollar suggests credit risk.

Secondly, I would love to learn more about how Steward is miraculously generating positive unadjusted EBITDA in FY 2022 and how the company is forecasting FY 2023 unadjusted EBITDA of $350 million. Lastly, I would argue it is a bit of a red flag that Steward is so guarded and seemingly unwilling to file an audited annual report. It will be interesting to see if Steward is able to roll over its ABL.

Be the first to comment