Lorado

If there’s one thing that the past few months have taught me, it’s that the market can be irrational for an extended period of time. Although my portfolio is still outperforming the market over the past year by nearly 10%, a big source of discomfort has been Medical Properties Trust (NYSE:MPW). Despite strong fundamental performance achieved by management, concerns about the financial health of those operating the company’s properties, combined with a general malaise concerning the market, has resulted in shares falling precipitously. At this point, some investors may have thrown in the towel. But when you factor in the company’s stability, as well as other signals, then the picture is not as bad as many fear – there is little to conclude other than that the market is behaving in an insane fashion when it comes to this particular firm. All things considered, I cannot help but keep my ‘strong buy’ rating on the enterprise for now, reflecting my belief that it’s likely to significantly outperform the market for the foreseeable future.

A lot of pain as of late

The last time I wrote an article about Medical Properties Trust was back in the middle of August of this year. In that article, I talked about how the market seemed to be reacting in response to management failing to keep up with the expectations that analysts had set for the firm. At the same time, however, I felt that shares were cheap enough to warrant material upside from that point on. At the end of the day, I ended up keeping my ‘strong buy’ rating on the company, reflecting my belief that it should do incredibly well moving forward. But since then, shares have taken a beating, generating a loss for investors of 36.6% at a time when the broader market was down 13.5%.

You would think that the company had come out with some awful fundamental data since the publication of that article. But the fact of the matter is that no further quarterly data has been released. Of course, this is not to say that we haven’t had some developments. For instance, on August 29th, management announced that it had reached an agreement with LifePoint Health (LPNT) whereby that company had decided to acquire a majority interest in Springstone Health Opco from the current management group based on an enterprise value of $250 million. This particular deal, which is slated to close next year, will allow Medical Properties Trust to be paid $200 million as compensation for the $190 million investment that the company made in Springstone in October of 2021, most of which was made in the form of a loan. as part of the arrangement, Medical Properties Trust still gets to keep its minority equity interest in that enterprise, giving investors the opportunity to generate further upside from those assets moving forward.

Medical Properties Trust

Another deal was announced by the company on September 7th. That deal involves a scenario where the company has been able to re-lease its Watsonville Community Hospital to Pajaro Valley Health Care District Corporation in a move that brings Medical Properties Trust an immediate capital injection of $30 million As repayment for financing that it provided to allow that hospital to remain open during bankruptcy proceedings of its prior tenant. The company also, on that day, announced that it had sold 11 assets, nine of them being general acute hospitals, and the other two being medical office buildings, to a firm called Prime Healthcare in a deal worth $360 million on a net basis. But of course, the largest transaction came on October 6th. In short, Medical Properties Trust decided to sell three Connecticut hospitals to its current lessee and the hospital operations from Prospect to a separate party. The sale of the hospitals is being done at a price of $457 million, more or less matching the price the company paid for them in August of 2019. And the lease involved $104 million in rent being paid to it.

Medical Properties Trust

All of these things combined should result in roughly $1 billion worth of liquidity accruing to the company as the deals closed. But one thing that those who are bearish about the company will point to as a reason to not be happy is the company’s exposure to some assets that are questionable in nature. The most recent example of this can be seen by looking at the decision of one of its tenants, Pipeline Health, to file for Chapter 11 bankruptcy protection on Monday of this past week. However, Pipeline Health isn’t really material for the company since it is only mentioned twice in the company’s annual report and only involving the $215 million sale-leaseback agreement that Medical Properties Trust entered into with the firm last year. On its own, it’s not material to the enterprise.

Medical Properties Trust

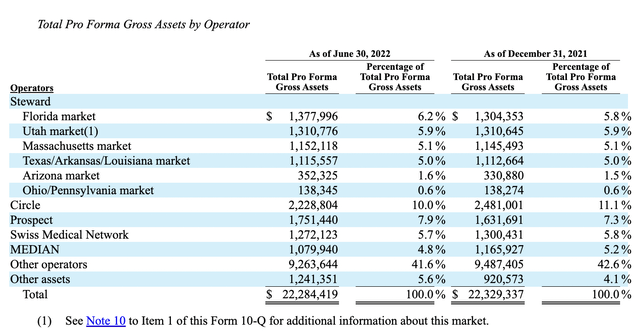

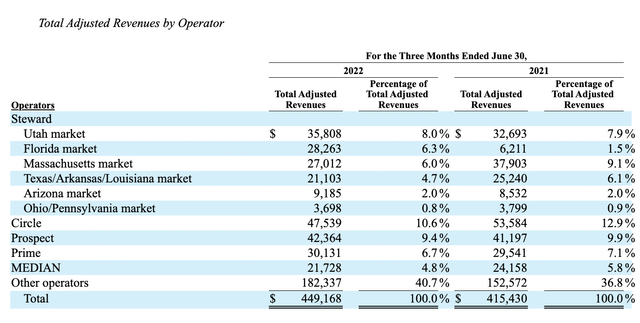

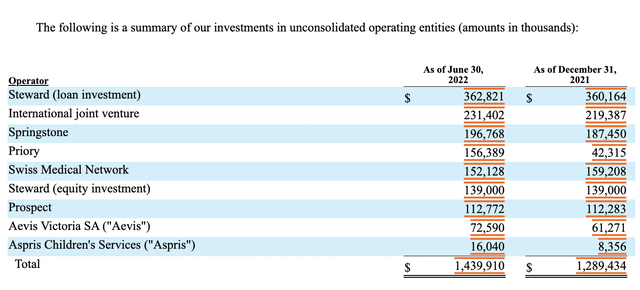

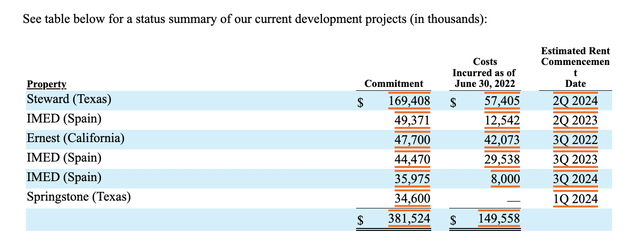

The bigger issue seems to be the company’s relationship with Steward Health Care System. As of the end of the company’s 2021 fiscal year, Steward leased 39 facilities across six different markets pursuant to a single master lease agreement between it and Medical Properties Trust. Based on the most recent data available, data from the second quarter of the company’s 2022 fiscal year, 24.4% of its gross assets and 27.8% of its revenue is tied to Steward. Concerns about the financial condition of Steward have left investors wondering what might happen if that enterprise declares bankruptcy. There’s more to the picture than just leased assets and revenue exposure, however. As of the end of the latest quarter, Medical Properties Trust also has loans valued at $362.82 million and an equity stake in Steward worth $139 million, at stake. On top of this, Medical Properties Trust is also developing some additional assets, totaling $381.52 million in all. Of these assets, $169.4 million involves a Steward property, with only $57.4 million having been incurred so far.

Medical Properties Trust

There is no denying that a bad scenario regarding Steward would prove painful for Medical Properties Trust. Having said that, there are also some really good signs to pay attention to. First and foremost, in March of this year, Medical Properties Trust struck a deal with Macquarie Asset Management (also known as MAM), a subsidiary of the massive Macquarie Group, whereby MAM agreed to take up a 50% interest in 8 Massachusetts based general acute care hospitals owned by Medical Properties Trust and operated by Steward. This particular move took place at a $1.7 billion valuation, resulting in Medical Properties Trust receiving $1.3 billion, plus keeping an equity interest worth $408.7 million, in the venture. In all, Medical Properties Trust recorded a $600 million gain on the real estate involved in the transaction. Although investors may not have much insight into the health of Steward, it’s difficult to imagine Macquarie making such a sizable move without fully understanding the risks involved.

| Company | 2022 | 2021 |

| Price / Operating Cash Flow | 7.9 | 7.5 |

| EV / EBITDA | 8.9 | 9.7 |

On top of this, there’s also the fact that shares of Medical Properties Trust just look very cheap right now. Using the same cash flow estimates as when I last wrote about the company, but adjusting for the firm’s current market value, we end up with the business trading at a forward price to operating cash flow multiple of 7.9 and at a forward EV to EBITDA multiple of 8.9. These numbers stack up against the 7.5 and 9.7 readings that we get, respectively, using data from the 2021 fiscal year. Shares are not only cheap on an absolute basis, they are also cheap relative to similar firms. As part of my analysis, I compared the company to five similar businesses, with a price to operating cash flow multiple for these firms ranging from a low of 8.3 to a high of 24.5. Meanwhile, the EV to EBITDA multiples for these firms was between 12.6 and 32.5. In both cases, Medical Properties Trust was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Medical Properties Trust | 7.5 | 9.7 |

| Sabra Health Care REIT (SBRA) | 8.3 | 32.5 |

| Omega Healthcare Investors (OHI) | 10.0 | 12.6 |

| Healthpeak Properties (PEAK) | 24.5 | 26.9 |

| Physicians Realty Trust (DOC) | 17.0 | 20.5 |

| Healthcare Realty Trust (HR) | 19.4 | 20.2 |

Special Note

Subsequent to the writing of the rest of this article, news broke that Medical Properties Trust had initiated a $500 million share buyback program. Should management follow through on share purchases, this should add further confidence to the argument that shares are likely meaningfully undervalued and that management is not worried about key areas of exposure that bears have pointed to.

Takeaway

At this moment in time, I remain amazed at how far shares of Medical Properties Trust have fallen. I understand the general market pessimism. I also understand that investors are worried about the Steward relationship. At the same time, however, even the worst-case scenario is unlikely to have a disastrous impact on our prospect. And more likely than not, a collapse of Steward would more likely than not allow the company to lease its properties to other parties or sell them for a sizable sum. When you add in the vote of confidence the company received from MAM earlier this year, as well as the company’s recent liquidity-enhancing maneuvers, I don’t believe that a doomsday scenario that many seem to think will come to pass is likely.

Be the first to comment