Sezeryadigar

This article was coproduced with Wolf Report.

Last week I visited Birmingham, Ala., to meet with Medical Properties Trust (NYSE:MPW) CEO, Edward Aldag. During this one-hour interview I asked Ed about the macro-mindset for hospital investments, and he said:

“I’ve seen a lot of cycles. Hospitals do well in good times and bad times. Elective surgeries. When the economy goes down, grandmas and grandpas can move back in (with parents), but they have to go to the hospital.”

That’s certainly true, while I own shares in Omega Healthcare Investors (OHI), the value proposition for skilled nursing and hospitals is distinctively different. Or simply said, hospitals are mission critical.

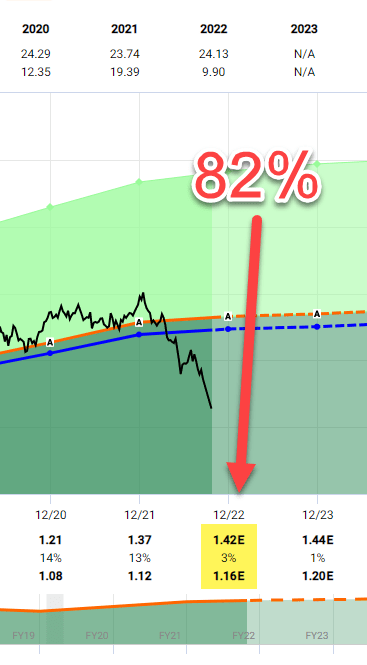

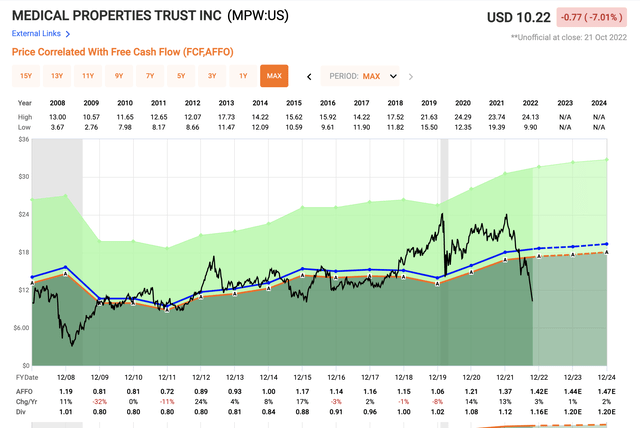

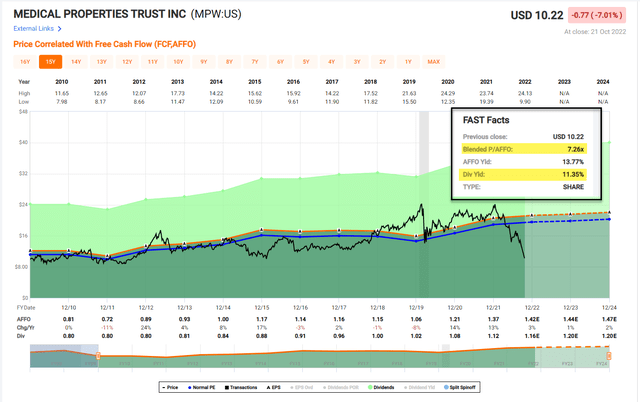

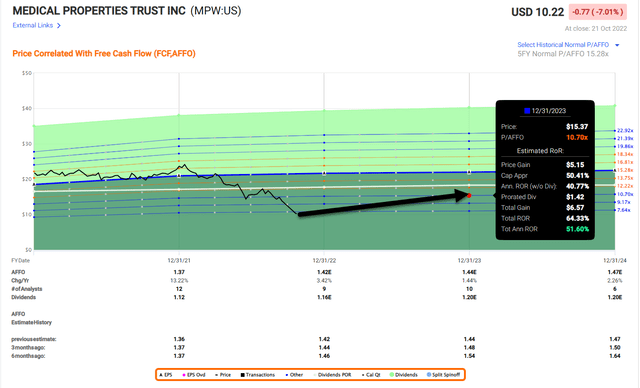

Nobody can argue with the fact that MPW is cheap, not matter what metric you decide to use. As seen below – MPW is trading at 7.3x P/AFFO with a dividend yield of 11.4%.

MPW is set to report Q3-22 earnings on October 27th, so we thought it would be helpful to provide an update sooner. Also, it seems as though several of the short sellers are using social media to get their point out, so we thought that another bullish article wouldn’t hurt.

Updating on Medical Properties Trust

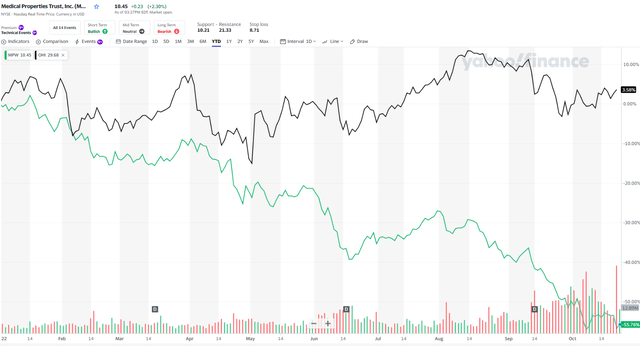

Any investor worth his or her salt has had the sort of pick that MPW currently is. The sort of company that we “know” is good, where fundamentals are solid, but where the market simply isn’t agreeing with us at all.

Knowing the quality of the company we cover, we stick to our guns and focus on fundamentals – but it can be hard in the face of what seems like a never-ending decline, such as the one that MPW has recently been on.

MPW is a healthcare REIT that manages hospitals/healthcare real estate.

Hospitals account for a majority of operator income, and MPW’s target is to focus on things like Rehab Centers, Imaging Centers, FSEDs, ASCs, Labs, Managed care networks, MD offices and outpatient clinics, all strategically placed to hospital real estate.

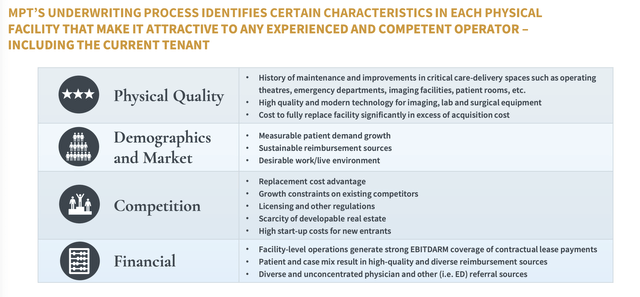

Underwriting is core to MPW. The company needs to be able to identify and purchase attractive assets at good prices in a way that means they can lease it to operators at a good profit. They do this in a variety of ways and by measurements.

MPW IR

MPW has a well-established history of working partnerships with good operators. The company’s history with profitable operators is not in question when we look at MPW.

Instead, it’s no secret that MPW has been struggling – at least somewhat – for some time here. A good indicator is that the company fairly recently announced the sale of several hospitals followed by share repurchases.

In addition, the company hasn’t had the easiest time of things in terms of its operators. The COVID-19 pandemic stopped profitable operator procedures, instead focusing on emergencies from patients that weren’t as able to pay for care as the operators might have liked, and the overall pandemic changed at least for a time the way hospitals operated, which they’re now recovering from.

It’s not strange, therefore, that the company has been, and is still somewhat struggling.

As I said, the fundamentals of the company aren’t in question. Hospital real estate is usually stays leased for extensive periods of time, and they’re considered inflation-protected cash flows, due to permanently increased cash lease rates in any year when the inflation escalation exceeds the minimum contractual increase.

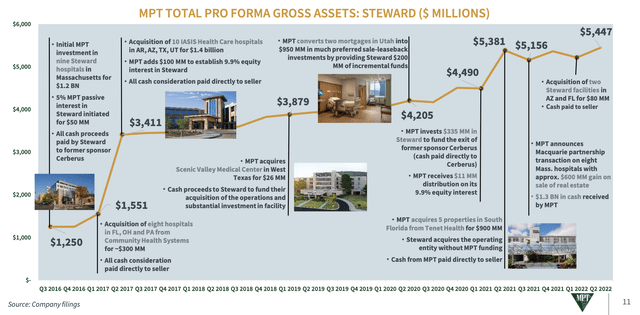

To be frank with you, if the company didn’t have a 25%-plus exposure to Steward Health Care, I doubt we’d have even seen half the current drop. The Steward exposure is the main concern that we need to discuss here because the relationship between the two is fairly complex.

MPW has continually pushed capital to work, with closing on $85M just during 1H22, with $150+ more committed into Texas. The fact is, MPW has made promises to assist with near-term financial need for Steward, and with the 25%+ tenant concentration it doesn’t take a math degree to understand that the company’s relationships are mutually impactful – i.e, if something were to happen to Steward, MPW would be in more than a little trouble.

It would be like Simon Property (SPG) or Realty Income (O) if we want a net lease REIT, agreeing to help with tenant financing. There’s a good reason why this sort of relationship or mutual dependence is usually kept at a minimum.

This is not the case for MPW – and that is (one reason) why the stock is down.

MPW has gone out of its way to assure investors that their interests with Steward are well protected. They point to the collected cash rent since 4Q16, gains in asset sales, valuations in real estate based on conservative cap rates, debt investments/equity, and how MPW is set to grow as a result of Steward’s growth. They also point to a very strong trend for the company. All of these are facts, and none of them can really be argued with.

MPW IR

They also make clear that Steward operations are substantially improved going into 2H22, with volume metrics up, EBITDAR increases in “the majority of reasons,” expense reductions, outperformance in 2Q22, and positive YTD comps. Again, many facts.

However, the fact is that investors are likely more dissatisfied with the sheer exposure to the actual operator here – and that’s what the company needs to be dealing with.

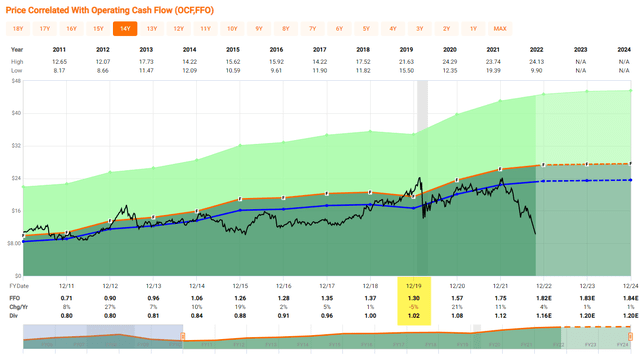

Because cash flow trends are solid. On an FFO level, the company has only had a single year of declining FFO since 2010 – and that was in 2019, when FFO dropped 5% (followed by 21% growth in 2021).

So we don’t need to argue about the company’s actual results – they’re fine, and in a completely opposite direction to where the valuation suggests the company is going.

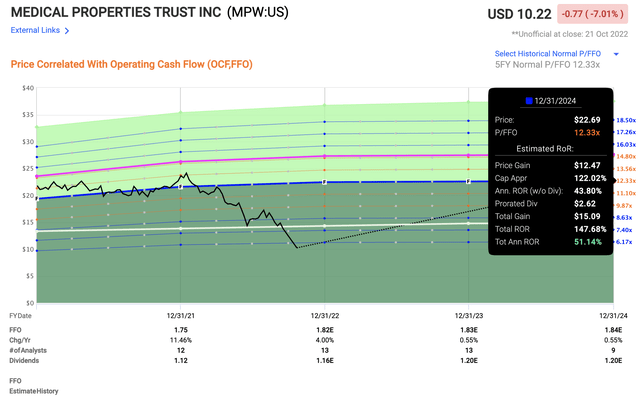

Management also maintained guidance for up to $1.82 in FFO per share, representing a 4% YoY increase. This would allow easy coverage of the 11%-plus yield while leaving ample of room for whatever the company needs to do.

The second reason for the recent abysmal company results is the bankruptcy of Pipeline Healthcare – but I view this as extremely overplayed, given the relative size of the company’s assets next to MPW’s portfolio. The only issue would be, as I see it, if this was the beginning of a trend.

There’s nothing in a recent communication that suggests this is the beginning of a trend.

Again, we focus on the hard data and numbers.

Even if we were to look at the company not on FFO, but on AFFO, the company’s yield is extremely well covered, and the trend does not have the sort of plunging quality that would be suggested by the current share price trends.

FAST Graphs

The way the market is treating MPW reminds me of several profitable value investments I’ve made over the past five years, all resulting in triple-digit RoR.

The two common things in these investments were:

- The companies were being incredibly punished by the market, trading down more than 30%-50%.

- However, there was no corresponding identifiable drop in earnings, revenues, or margins that would justify the drop.

I see the same things here.

It’s important to realize for investors that the short-selling pressure on MPW is significant, due to not one, but several short/bearish cases made against the company. While short-selling reports may indeed have substance, and I do keep an eye on them, what I will say is this:

I don’t see the company, with or without Steward as part of its portfolio, being worth 50% less, or being worth only 5.6x P/FFO because of potential issues with operators like Steward. I don’t see the implications of a widespread domino effect against hospital operators, despite how they suffered during the pandemic. The fact is that recovery seems to be well on its way.

This creates a situation where despite the company’s performance, the vast majority of analysts, including mine, are “bullish” on the company and we do have “BUY” stances.

Investors, especially new ones, may look at the company and wonder if there really nothing to the trend that’s hounding the company.

My answer is: Yes, there are reasons. But those reasons aren’t as bad or as significant as the current trends make them out to be.

Let me crystallize this for you.

MPW’s Valuation

MPW now trades at the “wrong end” of the valuation spectrum (or right, depending on how you want to view it). The company has not traded at this multiple since the financial recession back in 08 – back when earnings were actually in danger of falling and did fall by 30%-plus.

No such indicator is visible today.

FAST Graphs

The company has 54 operators and has been able to increase the overall exposure to Steward Healthcare, and the underlying quality of its assets enables the company to run at an average weighted lease and loan maturity of close to 18 years – an incredible high when looking at the broader market.

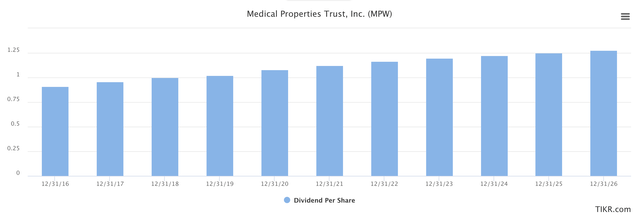

The basic stats being that good and the forecasts being as good as this – by the way, these forecasts don’t shift much when you look at various analysts and what they’re expecting MPW to do. The dividend is absolutely expected to be upheld – take a look.

MPW dividend forecasts (S&P Global/TIKR.com)

Basically, MPW has gone from being uninteresting to kinda-sorta interesting, to “Hmm, better check that out”, to very interesting, to undervalued, to extremely undervalued, to where we now are, which I would coin as being “This is insane.”

I say that the company is currently trading down for the short-selling interest, for the troubles in Steward, and for the fallout from one bankruptcy. All of those trends and expectations are very understandable. But whenever the market starts going a certain direction, especially weighed up or down by concerns/impulses as this company is, you can expect a degree of excessiveness.

In this case, it’s gone much too far.

MPW bears watching to make sure that things don’t go “down south” fundamentally, but there’s no reason to devalue the company like this.

Current analyst PTs from S&P Global call for the company to trade at a range starting at $10 on the low end to $21 on the high end, averaging $17/share. That’s an upside of 66.3%, and at $10.22, the company is trading at less than 0.55x to NAV.

Again, it’s too far.

I expect the company to at least maintain its AFFO/FFO and perhaps grow it by single digits over the next few years. Such a feat alone will guarantee ample room to pay out the current yield, beating inflation, and add the potential for reversal, which combined comes to an upside for 2024E of almost 150%, only on a 12.3x P/E.

I view this as neither unrealistic nor strange in the long run – just as any recovery for a qualitative company with good fundamentals is strange.

FAST Graphs

I mean, just what exactly do bears expect here?

For the need of hospital properties, even in the case of operator bankruptcy, to completely collapse?

For the time-tested, 20-plus year underwriting process MPW has to completely collapse?

The price development for MPW has lost all reason at this point – just as the price development in undervalued plays usually does when things go too far.

That’s a good time to “BUY”.

Closing Thoughts…

Once again, pointing to the interview with MPW’s CEO and Steward’s ABL (asset backed loan) – a secured type of financing, secured by hospital receivables:

“Steward’s ABL matured at the end of September and was then restated, amended and extended until September 30 of 2023 – Steward made clear however in its press release that it is required to complete certain documentation by December 15 to achieve that 9/30/23 maturity. Steward is highly confident that it will complete the documentation.”

Just to debunk one (of many) short thesis claims…

Once again, we’re not on Twitter every day pumping out buy recommendations on MPW (like the shorts), but with more than 100,000 followers on Seeking Alpha, I know value when I see it. I’ll end with a few timeless quotes from the legendary value investor, Benjamin Graham:

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

“The stock investor is neither right or wrong because others agreed or disagreed with him; he is right because his facts and analysis are right.”

“It is our argument that a sufficiently low price can turn a security of mediocre quality into a sound investment opportunity-provided that the buyer is informed and experienced and that he practices adequate diversification. For, if the price is low enough to create a substantial margin of safety, the security thereby meets our criterion of investment.”

“Staying humble about your forecasting powers.”

I like the last quote… so my humble 12-month total return forecast for this beaten down healthcare REIT is 50%.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment