Ninoon

(Note: This article appeared in the newsletter on September 21, 2022.)

Medical Properties Trust (NYSE:MPW) has become a stock where it looks as though, at least temporarily, the current fundamentals do not matter. There is a bull and bear argument about the fundamentals that could win in the future. However, as David Dreman notes in his book “Contrarian Investment Strategies – The Psychological Edge” the institutional crowd often falls into “groupthink” mode. So, if one of them heads towards the exit, then more soon follow to form the chart that is shown year-to-date:

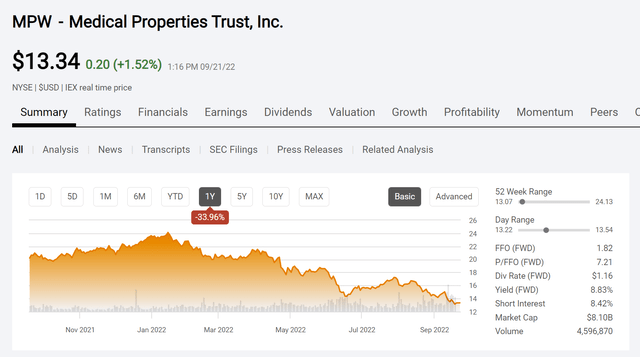

Medical Properties Trust Common Price History And Key Valuation Metrics (Seeking Alpha Website September 21, 2022)

What happens whenever there is a big decline like this is the institutional holdings become dangerous to the individual investor that worries when a stock declines 10% or so. The institutional crowd often has benchmarks and the “keep up with the Joneses” has a very strong pull for investment decision. This often accounts for the institutional tendency to head for the exits all at one time.

Investors need to keep in mind that great returns have been easy to obtain for the better part of a decade. All a professional had to do was load up on the FAANG type stocks (also known as one decision stocks). No research was needed as those stocks were sure to go higher and outperform the whole market.

But like all good things (they never last), the market cycle moves on and what worked in the past is liable to not work in the future. All of a sudden it is much harder to find a stock that “keeps going up” than it was before. Therefore, a stock like this one is very dangerous for an institution to hold. The institutional equivalent of musical chairs ensues with a potentially costly outcome when the music stops.

At this point fundamentals are secondary to a lot of large holders because the longer they hold a stock like this, the more the losses have grown. Now for a buy and hold investor, this may not be a threat because that investor has determined that they will give the company five years or more. Some investors never sell. So, they are not worried about what happens as they have faith in the company.

But many investors also get shaken-up by the technical “runaway train” that is forming on the chart shown above. For that reason alone, it is best to just stay out of the way until the dust settles. The common stock is obviously down quite a bit from the highs and is in bargain territory. There is nothing wrong with purchasing a bargain, properly diversifying, and the hanging on for the potential outcome. The problem is that many investors do not have the fortitude for such a strategy.

Antero Resources Technical Runaway Train

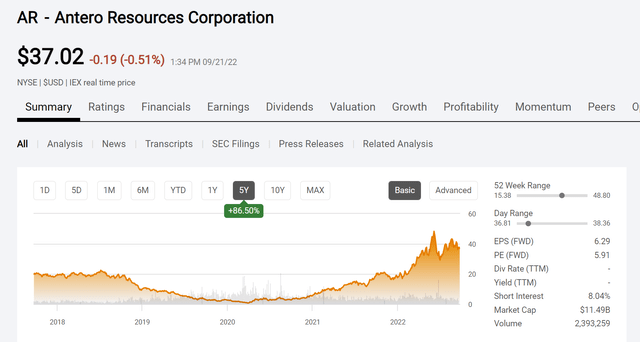

Antero Resources (AR) stock had this situation a few years back. The situation has clearly turned out ok. But the question remains that as a stockholder during the “runaway train” from a technical viewpoint, would you as a shareholder have hung on or would you have sold for a loss and moved on?

Antero Resources Common Stock Price History And Key Valuation Measures (Seeking Alpha Website September 21, 2022)

The end of the technical “freight train” as institutions rushed to leave the stock is shown above. That rush to the exits drove the stock price below $1. The shorts who were screaming the company would go broke clearly had time to make a generous profit. But they also missed out on a great run from the low price unless they switched gears.

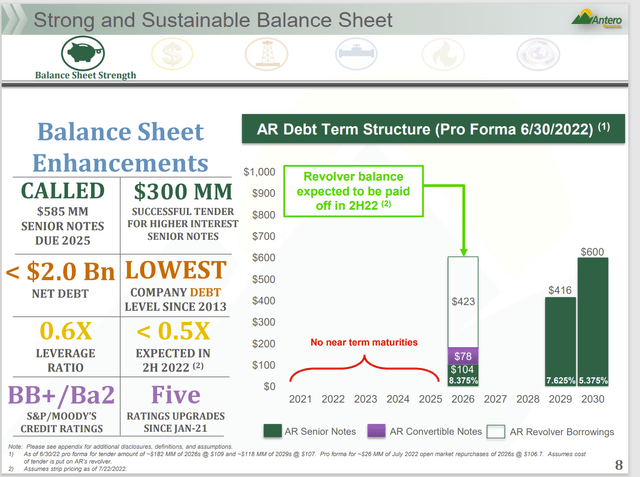

I cannot tell you how many people wrote to me and told me this stock was finished. The fundamentals were clearly to the contrary. That included a financial strength rating that was in speculative territory as a B. But it never ever declined into the high-risk junk area where most of the defaults occurred.

Antero Resources Debt Structure And Financial Strength Rating (Antero Resources August 2022, Corporate Presentation)

In fact, the company, which has had multiple financial ratings increases since going public, has continued that trend with more financial ratings increases to the one shown above.

Similarly, the high-cost argument died as the market came to realize that the company sells a matrix of products and the breakeven price for natural gas is dependent upon the sales price of other products produced from the rich gas.

Where We Are Now

The main hospital business is recovering from the strain of a pandemic. But the big deal is that the main operator of the businesses is still standing. So many times, the early recovery is ugly. As with the case with the publicly cyclical companies the market often lacks faith early in recoveries until the recovery is firmly established in the eyes of the market. That often makes for a lot of volatility early on.

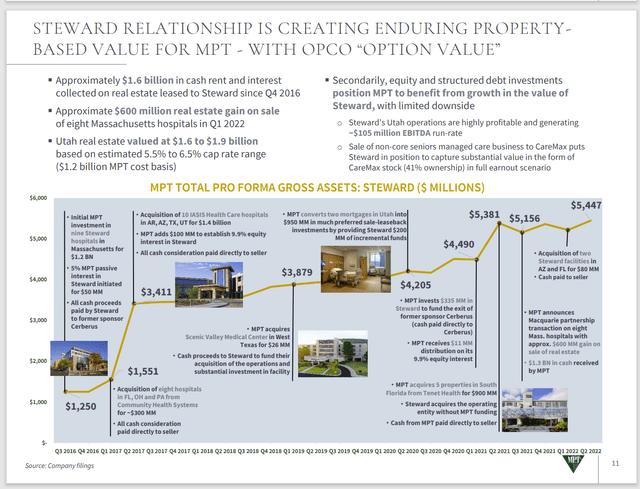

Medical Properties Trust Inc HIstorical Record Of Main Operator (Medical Properties Trust August 2022, Corporate Presentation) Medical Properties Trust Presentation Of Current Steward Position As Relayed To The Company (Medical Properties Trust August 2022, Corporate Presentation)

Now all that is really available is the management disclosure. So far, management feels that no additional disclosure is necessary. Generally, the accountants are aware of the situation even though they do not usually audit quarterly reports. Public accountants are regularly hauled into court. So, they take additional measures to be sure they stay out of court, when possible, even when they are not auditing statements. So as far as the bears argue that more disclosure is warranted, first of all more disclosure is always better. But so far it does not appear to be required.

Secondly, the lack of faith in the improvement of Steward is about par for the course given the newness of the recovery and the ongoing events around the pandemic. As an accountant, I have been through this more times than I can count. The recovery can derail, and it would not be the first time that happened either. But for the time being, things are on track. The longer they stay on track, the better this whole combination of organizations can handle future surprises (and the pandemic was definitely a surprise).

As far as what can happen from disclosure, all one has to do is look at a public disclosure. I wrote about Warner Bros. Discovery (WBD) taking the initial steps to “whip the acquisition inline” and the stock was pummeled. Anyone who looked at the cash flow knew a thorough housecleaning was required and management probably knew that as well before the acquisition was made. But when the impairments were disclosed and EBITDA was adjusted for an essentially zero free cash flow improvement when the acquisition was included, the market panicked.

This market will not initially reward disclosure as it is very much occupied or even over-focused upon risk. We are coming out of a period when it was easy to make money. Now rising interest rates are probably going to lead to a lot of pink slips on Wall Street in January. That makes for a lot more market jumpiness when compared to the boom times of the past.

The Future

Clearly with the pandemic, the risk level of what was a routine business has risen. It is just as clear this group of companies would not survive a second pandemic type situation without some more recovery time. Then again something like that (a rapid repeat) rarely happens. Therefore, investors can expect a very rocky start to the recovery until a whole lot of market apprehension fades.

That means that the current price of this trust can easily go down more. The chart shown early in the article not only shows the stock price heading down. It probably reflects the growing panic of a bunch of institutional holders already having a bad year without this price action “on top of it”. There is very likely to be an institutional panic to the point where bids literally disappear.

Because that possibility exists, it may behoove all those investors who worry about 10% declines or even 20% declines to steer clear until the chart levels out similar to what happened with Antero Resources.

I do believe that the stock is cheap and has been for some time. So, anyone who holds the stock should do ok. I also believe in the potential of institutions to panic at the decline of the common stock. We have all heard of window dressing. Having lived through Antero Resources heading under $1 with absolutely no logical reason to be there, nothing would surprise me about the future price here (even though I think it’s worth every penny of the current price).

The stock market can do some weird things in the short term. If you are not afraid of that, then this is definitely a value deal. But if you are someone who is likely to get “stopped out”. Then by all means wait for the dust to settle. It cannot hurt and the stock is well into bargain territory. This bargain is not going anywhere soon because there is too much technical damage as shown on the stock chart.

Be the first to comment