Stanislau Kharytanovich

Intro

Lately, I often see bullish articles about Medical Properties Trust (NYSE:MPW), which continues to dive deeper despite the optimism of the authors. It was the weak momentum, despite the fund’s fairly low valuation levels and a high dividend yield of now over 10%, that caused MPW to drop to 7th place out of 14 funds that make up the Health Care REITs industry (on Seeking Alpha). So I have been wondering – is Medical Properties Trust really an “average” REIT in its quality, or are we just seeing unreasonable mispricing that has every chance of reversing in the medium term and bringing investors abnormal returns? This article is dedicated to answering this question.

Mispricing And Its Cause

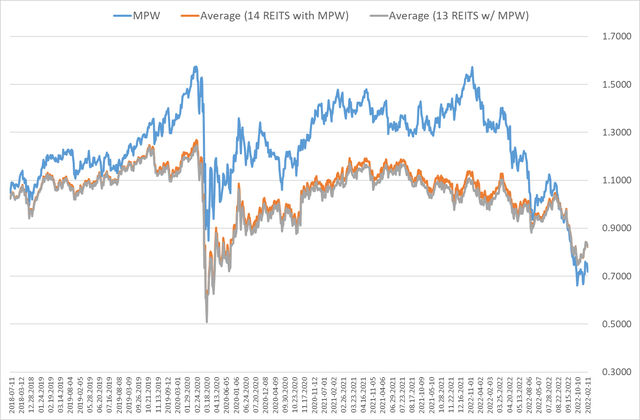

First, I uploaded the time series of all 14 REITs, including MPW itself, to see if there is a clear discrepancy between Medical Properties’ stock price dynamics and those of its closest peers. Based on historical price changes (dividends are excluded), I derived 2 indices for comparison – with and without MPW within the structure. Here, you can see how the performance of MPW compares to the drawn indices:

Author’s calculations, Investing.com’s data

Excluding dividends, $10,000 invested in MPW on November 3, 2018 – well before Covid – would have given a hypothetical investor a negative return of 28.23% (with dividends, that loss would have been 9.65%). At the same time, if this same investor had invested equally in 14 REITs at once, or in 13 REITs without MPW, he would have received a negative return of 17.83% and 17.58%, respectively (again, without dividend accounting).

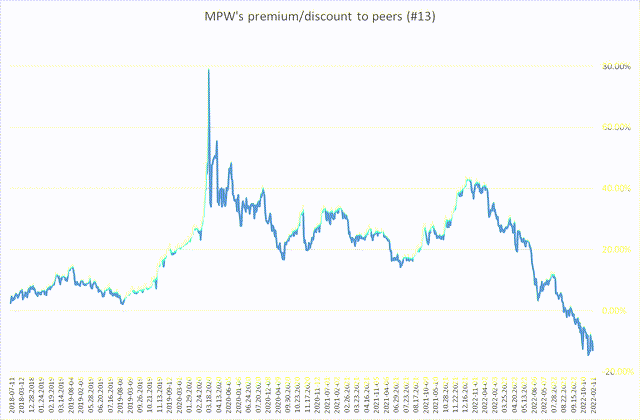

However, the attentive reader has probably noticed what a large premium Medical Properties Trust had compared to the whole industry. In fact, over the past 4 years, this premium has averaged 20.34% (median = 22.2%). Now, however, due to a terrible sell-off, that premium has turned into a discount that is almost 13% as of yesterday’s close:

Author’s calculations, Investing.com’s data

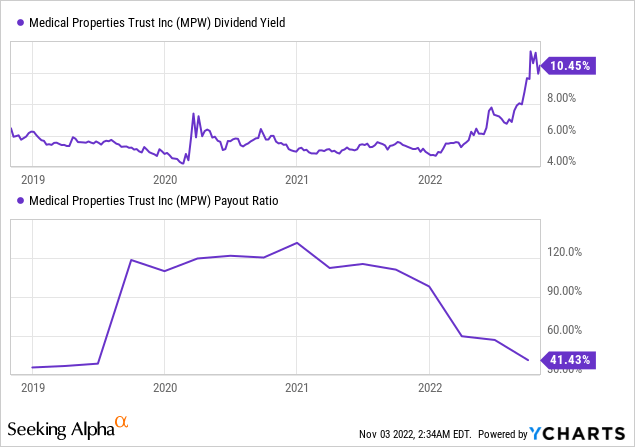

MPW’s dividend yield rose to a multi-year high, while its payout ratio fell to near all-time lows:

The second attribute above – the payout ratio – suggests that the company as a whole is comfortable paying its quarterly dividends, which in theory should remove doubts about the risk of a payout cut in the near future. But YCharts arguably calculates MPW’s payout ratio based on the classic ratio of dividends to net income, which is not correct in this particular case because Medical Properties pays dividends out of its funds from operations. But even if we look at dividend-to-FFO, we see no reason to doubt MPW’s forwarding yield.

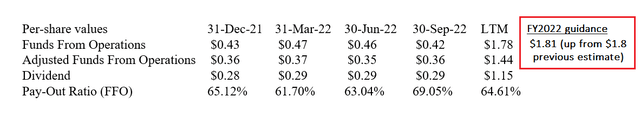

Author’s calculation, based on On the Pulse’s (SA fellow) article

Continuing our comparison of MPW with its peer group, you should note that while momentum and dividend yield are very important, it is far from the only criterion you should pay attention to. The mere fact that the fund’s price has fallen 53% YTD, and now it yields over 10% does not give us the right to shout “buy the dip!” if there are clear fundamental reasons to expect a continuation of the storm in the medium term. The total return of -9.65% over the last 4 years speaks for itself, you know.

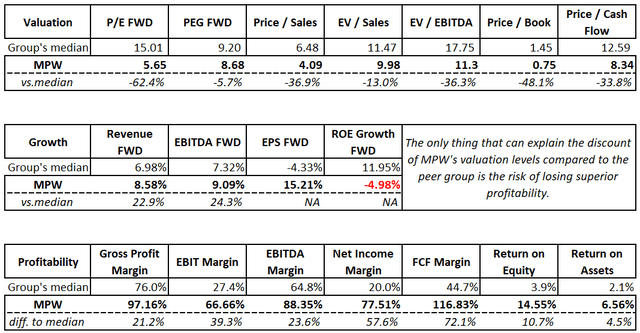

Therefore, I decided to conduct a cross-sectional analysis of valuation multiples, growth rates, and profitability ratios to see to what extent the identified mispricing can be explained by the underlying expectations.

Author’s calculations, based on Seeking Alpha

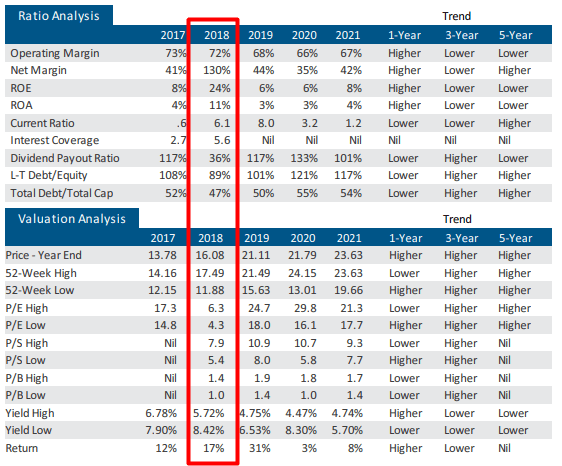

As you can see from the table above, which I manually compiled from SA’s screening tool, MPW is significantly cheaper than the rest of the sample on all key multiples, and at the same time, the profitability of the REIT looks qualitatively better. Forwarding growth rates are also better, with one exception – ROE is projected to decline by ~5% over the next year, while the median growth of the group is ~12%. The overall picture is very reminiscent of what happened with MPW in 2018 – peak profitability and the sharp multiple contraction, marking the beginning of the next bull cycle:

Argus Research, author’s notes

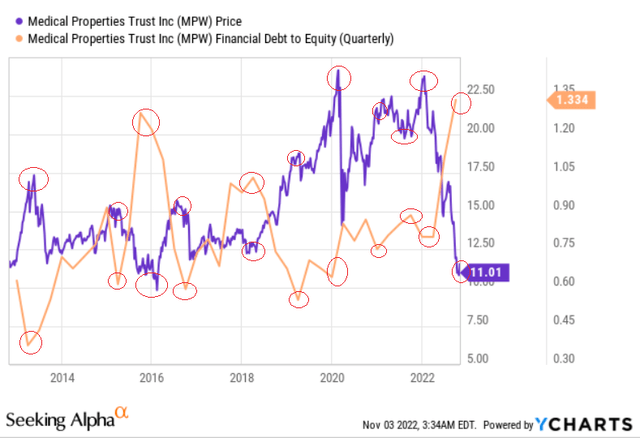

In my opinion, the only important catalyst for the recovery of Medical Properties Trust’s quotes is the decline in financial-debt-to-equity, which is inversely correlated with the MPW price and whose growth in recent months well explains the depressed price action and the resulting discount to the peer group:

As you can see in the chart above, we already saw a similar increase in debt to equity in late 2015 and early 2016, and then (like now) the stock fell precipitously. Once that issue was resolved, MPW returned to its previous local highs very quickly.

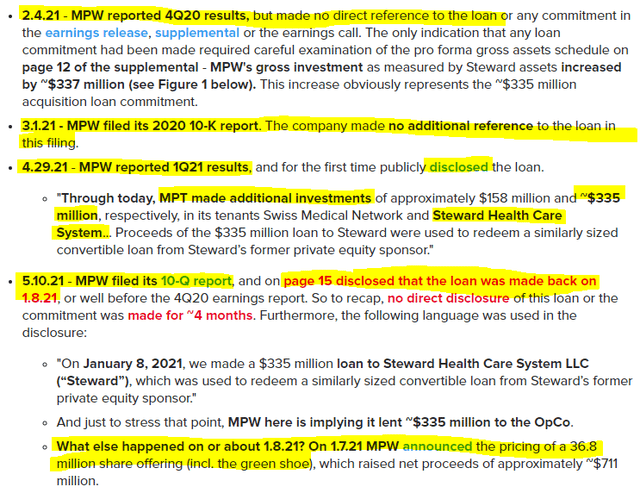

This time, the situation is further complicated by the company’s business practices since late 2020 – I cannot help but share a note from Hedgeye accusing MPW of wrongdoing.

Hedgeye even hired photographers to diligence the company’s funded projects – here is what they think MPW’s $50 million investment in Wadley Texarkana looks like today: https://twitter.com/HedgeyeREITs/status/1587820407196946433

I cannot say exactly how true this is – there’s a possibility that Hedgeye is trying to promote their sell thesis via Twitter because they have a short position (then the question arises – why did they pick exactly MPW?). There are many pitfalls in this story, and MPW’s continued fall against a backdrop of very strong financials creates a field for discussion – which is why my article is the 26th on SA since early October.

Bottom Line

As a result of my little research, you have seen that the discount at which MPW is currently trading is not normal (at least historically).

We have seen before how peak margins and profitability led to a sharp multiple contraction – that was in 2018. At the same time, the company was under the influence of the leverage it was able to reduce, so the quotes rose rapidly within a few months.

Now the situation is again reminiscent of 2018 – multiples have shrunk sharply against the backdrop of MPW’s strong financial position that far exceeds those of its competitors. However, what exacerbates the situation now are the potential risks of inconsistency between what we read in financial reports and hear from management and the actual situation in the business operations.

I have not found enough arguments against the bears’ theses, so I cannot recommend MPW for purchase in either of our model portfolios. However, if you are willing to take such a risk, the current decline looks good to go long.

Thanks for reading!

Be the first to comment