Edwin Tan/E+ via Getty Images

Thesis

Barings Corporate Investors (NYSE:MCI) is a fixed income closed-end fund (“CEF”) first offered to the public in 1971. Barings LLC, a wholly-owned indirect subsidiary of Massachusetts Mutual Life Insurance Company is the CEF’s investment adviser. As per the fund’s literature, MCI’s…

investment objective is to maintain a portfolio of securities providing a current yield and, when available, an opportunity for capital gains. The Trust’s principal investments are privately placed, below-investment grade, long-term debt obligations including bank loans and mezzanine debt instruments. Such private placement securities may, in some cases, be accompanied by equity features such as common stock, preferred stock, warrants, conversion rights, or other equity features. The Trust typically purchases these investments, which are not publicly tradable, directly from their issuers in private placement transactions. These investments are typically made to small or middle market companies. In addition, the Trust may invest, subject to certain limitations, in marketable debt securities (including high yield and/or investment grade securities) and marketable common stock.

Private placements are a type of capital raising that involves using pre-determined buyers rather than going through a public registration of the securities. Private placements are very common in the middle market loan space due to the heavy negotiations that usually go into establishing debt covenants, capital structures and liens in order to get the best yield possible on the raised debt. To this end, in our mind, MCI is very reminiscent of a BDC (business development company). As per Investopedia:

A business development company is an organization that invests in small- and medium-sized companies as well as distressed companies. A BDC helps the small- and medium-sized firms grow in the initial stages of their development. With distressed businesses, the BDC helps the companies regain sound financial footing.

Many BDCs make investments in private companies and sometimes in small public firms that have low trading volumes. They provide permanent capital to these businesses by taking advantage of a wide variety of sources, such as equity, debt, and hybrid financial instruments.

MCI is down more than -14% year to date and is currently trading at a historic high discount to NAV of -19.7%. On a long-term basis (5- and 10-year lookback periods), the fund has posted annualized returns north of 10% (on a NAV basis) indicating the outstanding ability of the portfolio managers to choose good credits and underwrite sound businesses. The fund has a 10-year Sharpe ratio of 1.56 (extremely unusual for credit funds to post Sharpe ratios above 1) and a standard deviation of 6.47.

While we are of the general opinion that a mild recession is in the cards for late 2022/early 2023, we do not think it will be credit driven. We feel the Fed is set to increase rates to fight inflation, although the supply side of oil and commodities is not controlled by the Fed. This will result in the tightening of financial conditions and a deceleration of the economy. Yes, some highly leveraged unprofitable companies will go bust, but it will generally not be a credit Armageddon. We feel that when everybody runs away from credit and there are historic discounts to NAV a savvy investor should not follow the herd but buy. We are thinking about a layered approach where the total target is staggered into weekly for five to six weeks. We, therefore, rate MCI a Buy.

Performance

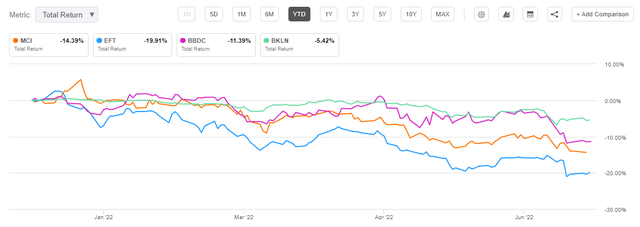

The fund is down only -14.39% year to date:

YTD Total Return (Seeking Alpha)

We are comparing here the fund’s performance versus an unleveraged floating rate loans vehicle – Invesco Senior Loan ETF (BKLN), versus another leveraged loan CEF – Eaton Vance Floating Rate Income (EFT) and lastly a BDC from Barings itself, namely Barings BDC (BBDC). Essentially, MCI is a leveraged vehicle composed of floating loans issued by middle-market companies via direct placement rather than wide syndication.

We can see that MCI has performed extremely admirably, outperforming EFT, and only modestly being behind the Barings BDC. The unleveraged floating rate loan vehicle BKLN has fared the best due to its structure, being down only -5.42%.

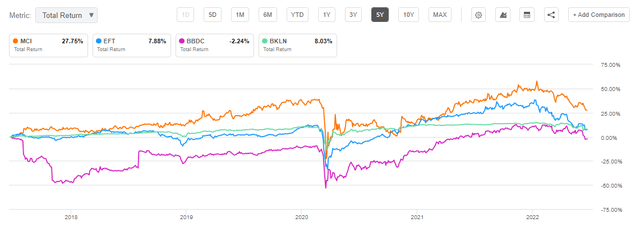

On a 5-year basis, MCI is by far the best choice from a total return perspective:

5 Year Returns (Seeking Alpha)

We can see how, even after factoring in the awful 2022 performance, the CEF has an outstanding 5-year total return, beating all the competition.

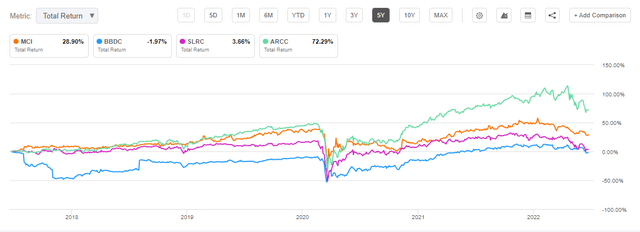

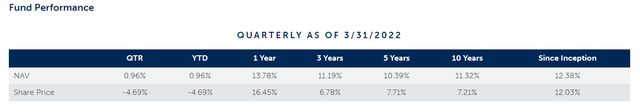

The fund has an outstanding annualized long-term performance:

We can see that the long-term annualized performance is north of 10% on a NAV basis for both a 5- and 10-year lookback period.

5-Year Total Return (Seeking Alpha)

Holdings

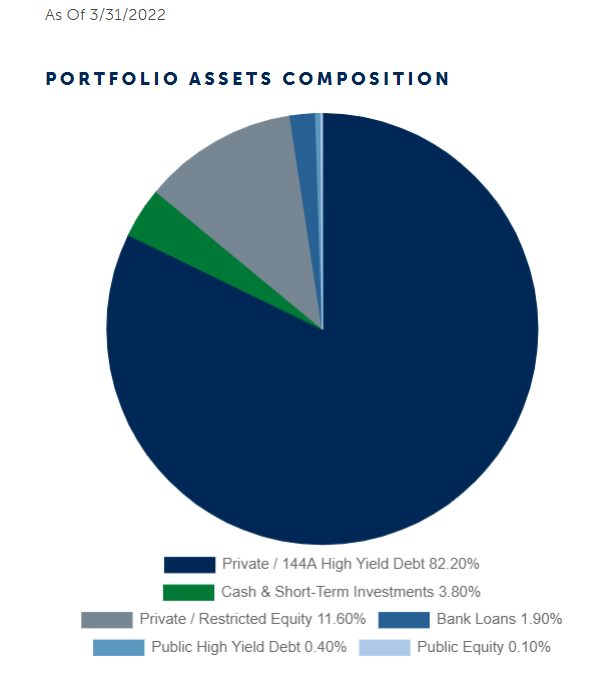

More than 80% of the portfolio is invested in private placements:

Assets (Fund Fact Sheet)

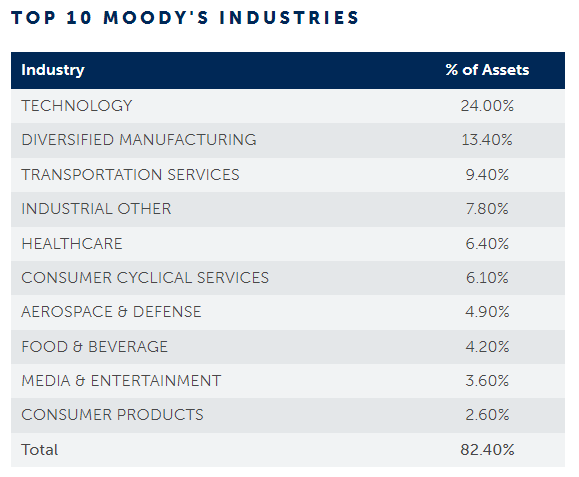

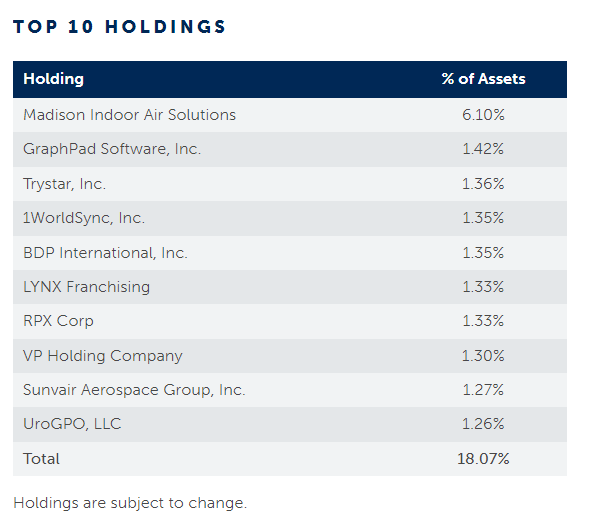

The largest sector of the asset base is composed of technology companies:

Industries (Fund Fact Sheet)

In the top holdings, we see a large concentration in Madison Indoor Air Solutions:

Holdings (Fund Fact Sheet)

As opposed to widely syndicated loans which are usually rated by the rating agencies the portfolio at hand is a bit more opaque on metrics. To a certain extent, an investor needs to trust the manager’s track record in the space, which is very extensive.

Premium/Discount

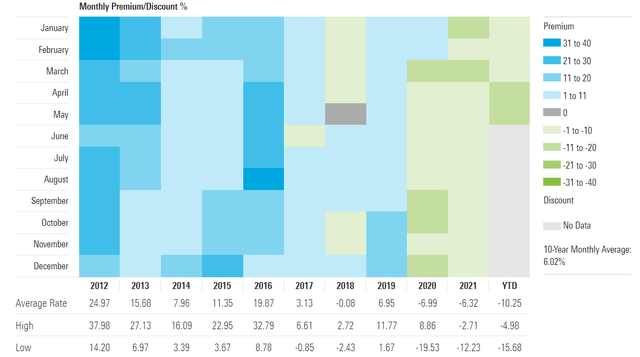

The fund is now trading at a discount to NAV after having spent most of the past decade trading at a premium to net asset value:

Premium/Discount (Morningstar)

The current discount to NAV is -19.7% and is a historic high as per the Morningstar data. Only by looking at the above table, we can see that the fund prior to the 2020 Covid-19 collapse had always been trading at an average premium to NAV of over 3%. If the potential upcoming recession is mild and credit spreads normalize an investor can get close to a +20% return just by the fund trading close to net asset value.

It is also worth noting that many of the underlying investments are illiquid, hence the current discount to NAV incorporates the fact that in a stressed market environment an exit is highly unlikely from an investment.

Conclusion

MCI is a CEF focused on fixed income and specifically privately placed middle market loans. The fund has been in existence since the 70s and has been wildly successful, posting annualized trailing returns north of 10% in the past decade (5- and 10-year lookbacks). The CEF is down more than -14% year to date and has a historic high discount to net asset value, after trading at a premium to NAV every year before 2020.

While a mild recession is in the card for later this year/beginning of 2023, we do not think it will be credit-driven. We like the wide credit spreads here and the fund manager’s track record, hence, when the herd is running away we are of the opinion that it is a good time to Buy MCI.

Be the first to comment