VCG

The Thesis

iShares MSCI China ETF (NASDAQ:MCHI) is trading at 11x what could be trough earnings in China. Alibaba Group Holding Limited (BABA, OTCPK:BABAF) CEO Daniel Zhang recently called the economic environment in the country the worst he’s seen in decades:

Economic headwinds often present huge opportunities. In the decade ahead, we project returns of 12% per annum for the iShares MSCI China ETF .

Dark Days In China

Dark days linger in China, and many of the issues circle around Chinese president Xi Jinping. Xi has imposed data privacy laws and anti-monopoly fines on companies like Alibaba and Tencent (OTCPK:TCEHY, OTCPK:TCTZF). At the same time, he’s insisted on a zero-COVID policy that causes entire cities to be locked down. His government has created geopolitical fears around Taiwan, with its “One China” policy, and failed to stop the speculation and rampant debt of the country’s property sector.

These are the four unique factors causing economic hardship in China:

- COVID-19 lockdowns

- Government regulation

- Geopolitical and supply chain issues

- The winding down of property sector and corporate debt.

Thus far, earnings in China have been hit hardest in the technology sector as fines were levied, goodwill impaired, and investments written-down. We’d expect most of this to dissipate in the years ahead in this fast-growing sector.

Chinese banks, on the other hand, have not yet seen their earnings decline. This is probably coming soon as the corporate and property sectors have far too much debt. Evergrande, the huge property developer, has over $300 billion of liabilities and has been teetering on the brink of bankruptcy for months.

Then you have the geopolitical threats surrounding Chinese equities. Many of the stocks in this exchange-traded fund (“ETF”) are owned through a VIE structure, meaning you own the profits contractually. With conflict over Ukraine, we saw Russian assets blacklisted. If a world war broke out, Chinese equities could face similar risks. As for delisting fears, we’re not too worried; many of these companies are dual-listed in Hong Kong and could always trade over the counter. Mainland Chinese citizens could soon own stocks like Alibaba, which would be a long-term positive.

Demonstrably Cheap

Chinese equities are demonstrably cheap compared to their U.S. counterparts:

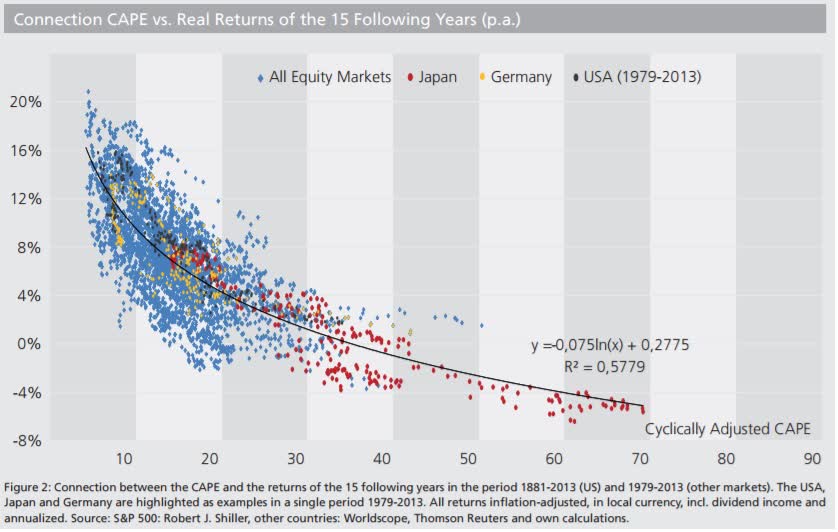

Earnings are a very mean reverting figure, and can skew the P/E and ROE ratios. If you look at MCHI’s price to book and cyclically adjusted price to earnings (CAPE) ratio, it’s quite clear it’s about to crush the S&P 500 in the decade ahead. A CAPE ratio of 12 implies inflation-adjusted returns of 9% per annum for MCHI, whereas a CAPE ratio of 31 implies inflation-adjusted returns of just 2% per annum for the S&P 500:

CAPE vs. Real Returns (Lyn Alden)

World Class Tech Businesses

The Communication and Consumer Discretionary sectors house this ETF’s fastest-growing enterprises. These two sectors make of 48% of the ETF’s holdings. Within these sectors are amazing technology companies such as Tencent, Alibaba, Meituan (OTCPK:MPNGF), JD.com (JD), Baidu (BIDU), BYD (OTCPK:BYDDF), NIO (NIO), and Pinduoduo (PDD). These businesses are positioned to benefit from the rapid growth of e-commerce, home delivery, electric vehicles, search, cloud computing, and artificial intelligence within emerging Asia.

Long-term Returns

Our 2032 price target for MCHI is $144 per share, implying returns of 12% per annum with dividends reinvested.

- MCHI has earnings per share of $4.66. The ETF’s fast growing tech businesses should combine with its slow growing stalwarts to deliver EPS growth of 7.5% per annum. This gives us 2032 EPS of $9.60 per share. We’ve applied a terminal multiple of 15x earnings.

Conclusion

We have a “buy” rating on the iShares MSCI China ETF and certainly prefer it to the S&P 500. It’s demonstrably cheap. The CAPE ratio points to inflation adjusted returns of 9% per annum for MCHI versus just 2% per annum for the S&P 500. The ETF’s world-class tech businesses should carry it through a difficult period of deleveraging in China. The geopolitical threats worry us most, and for this reason, we prefer the broad diversification and similar upside of emerging market ETFs. For more on this, check out my articles:

Be the first to comment