Igor Kutyaev/iStock via Getty Images

Introduction to MCHI

iShares MSCI China ETF (NASDAQ:MCHI) is an exchange-traded fund that enables investors to get exposure to Chinese equities; mid- and large-cap. The fund was introduced on March 29, 2011, and its present benchmark is the MSCI China Index. As of February 10, 2022, net assets under management were $6.64 billion, which reflects fairly high popularity.

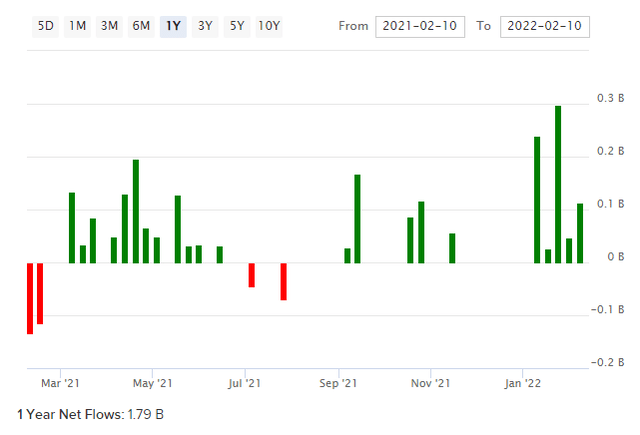

As illustrated below, fund flows have been positive over the past year or so; MCHI has been a recipient of circa $1.79 billion of net inflows.

MCHI and Risk Sentiment

I have been both bearish and bullish on MCHI, most recently bullish, and this has been predominantly based on valuation. However, it is always worth revisiting as the data can change. In a sense, it is quite perverse to invest in an equity market whose country’s governance is communistic, although the CCP (government of China) has borrowed concepts and structures from capitalism to help support the past few decades of growth (especially since the turn of the twenty-first century). Nevertheless, given the country-specific risks, Chinese equities are likely always going to be viewed as risky.

As a result, not only are equity risk premiums likely to be higher, but the volatility in the equity risk premium for China is likely to fluctuate too. ERPs affect valuations directly. The volatility in the implicit Chinese ERP, or more fully the implied “cost of equity”, is likely to heighten during global risk-off periods, as well as during periods of unrest and political uncertainty in Asia-Pacific. China-Taiwan relations are an ongoing source of investment risk.

In any case, while the curve for MCHI has been positive since the fund’s inception (overall), most recently risk sentiment has been negative if price action is any indication. The chart below illustrates MCHI’s price action since inception of the fund in the first quarter of 2011.

Since inception, the price of MCHI shares are actually barely changed (up 20.60% over almost 11 years, which is an annualized price-only return of 1.74%). However, buying at local bottoms has been a relatively good short- to medium-term strategy, as the fund has been able to continue to register new highs over time after each cyclical low.

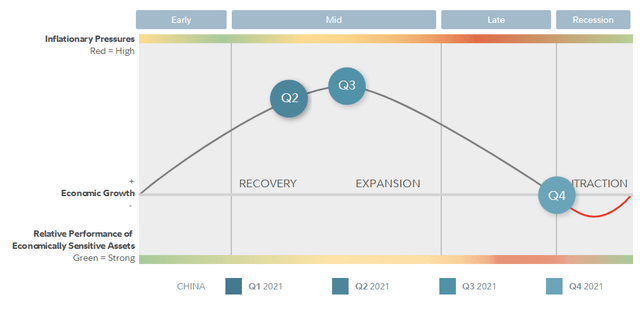

MCHI’s Cyclical Positioning

Besides the cyclicality of the price of MCHI shares itself, we should understand the fund’s cyclical exposures in terms of sectors and the Chinese business cycle. Starting with the latter, research from Fidelity would suggest that the Chinese economy (as of Q4 2021) is likely entering into a contractionary or recessionary phase. This is based on factors such as falling business activity, possibly falling credit creation giving rise to higher credit creation (and attempts to ease/loosen monetary conditions), and a decline in corporate profits (following falling sales and inventories).

However, if stock markets are a leading indicator, upside for MCHI may therefore be in store, if recession has already been fully priced in after recent declines. After recession, you have the early part of the following short-term business cycle to look forward to (potentially). Timing is always an issue, but with MCHI shares well off their highs (by 30% to 40%), there could be opportunity.

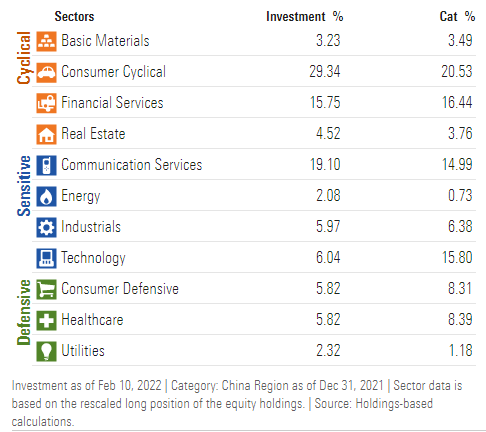

MCHI’s sector exposures favor cyclical economic bounces; as illustrated below, about 53% of the MCHI portfolio is invested in a combination of Basic Materials, Consumer Cyclical, Financial Services, and Real Estate. These are all sectors that Morningstar categorize as being cyclical sectors, so the upside volatility could be strong if/when China begins to forge ahead economically (post recession). Also, Fidelity’s research suggests Western economies such as the United States are behind China in their economic cycles; so, diversification into potentially undervalued Chinese (and APAC) territories could prove to be a profitable strategy.

Morningstar.com

Short-term Valuation of MCHI

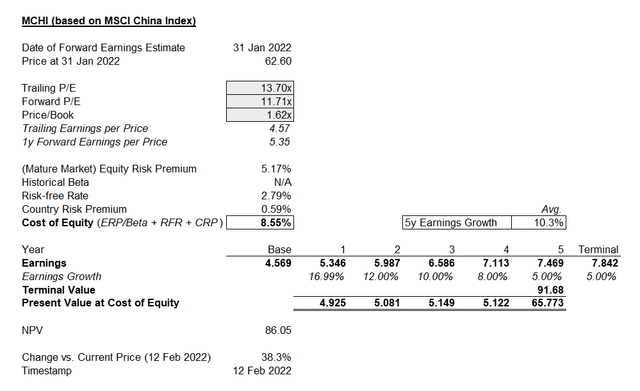

Morningstar place the potential three- to five-year earnings growth rate for MCHI’s portfolio at 9.76% at present. We can apply this to base implied earnings provided by MSCI using a recent factsheet for MSCI China Index upon which MCHI’s capital allocation decisions are based. As of January 31, 2022, MCHI’s index carried a trailing price/earnings ratio of 13.70x, a forward price/earnings ratio of 11.71x, and a price/book ratio of 1.62x. So, the forward earnings yield was about 8.54%, which is pretty high especially given that Chinese interest rates are not so distant from the West’s rates.

For instance, the 10-year Chinese bond yield was recently 2.794%; that compares to the U.S. equivalent of 1.939%. The current equity risk premium for mature markets might be in the region of 5.17% (as of February 2022). And using Professor Damodaran’s country risk premium data, China probably deserves an additional premium of circa 0.59%. Perhaps that understates the risk, but we can use this as a base. Summing the 10-year, mature market ERP, and country risk premium, we arrive at an implied MCHI cost of equity of 8.554%. Using all this data, I arrive at the following short-term valuation.

My estimate of potential upside is circa 38%, about in line with my last estimate in late November 2021. Since then, MCHI shares have fallen slightly, but so have practically all major equity markets recently into 2022. I think that the valuation here would suggest that there is still potential upside to be had, and that even with higher interest rates than the prevailing ones, it is unlikely that we will see a protracted global equity bear market.

The reason is because current valuations seem to already imply higher long-term rates. On the above valuation, which includes not-unreasonable earnings growth rates, to solve for fair value (0% upside or downside against the current MCHI share price) we would need to raise the cost of equity from our 8.55% to 11.61%. So, in theory, the Chinese 10-year could rise to as high as 5.85% before the fund would start to look overvalued (which would be a very large and unlikely hike in interest rates). Either that, or investors are pricing in a much higher country risk premium, but that risk priced into the market is potentially an individual investor’s profit (if one holds MCHI shares for the long run, and assuming country-specific risks go mostly unfounded).

I quite like the cyclical nature of MCHI’s price action, and I think that on balance the shares remain undervalued. While Chinese equities should definitely be viewed as further out on the risk spectrum for most investors, I think the Chinese equity market is quite an interesting way to diversify internationally and capture some alpha/out-performance as the Chinese business cycle remains ahead of the West (asynchronously).

Be the first to comment