nicolas_

We believe MaxLinear (NASDAQ:MXL) is a strong sell. MXL is primarily a radio-frequency communication, 5G wireless infrastructure, and connectivity company that has recently announced it will acquire Silicon Motion (SIMO). While consensus on MXL is buy-rated, we believe MXL stock will not work in the near term because of demand headwinds. We also do not believe MXL’s acquisition of Silicon Motion will help its prospects in the near term; instead, we believe the company has taken a step in the wrong direction with the purchase. We do not believe MXL will accelerate its revenue growth meaningfully through the acquisition. SIMO is highly exposed to PC and smartphone markets facing declining demand due to weakening consumer spending. We believe MXL will likely drop further and recommend investors sell at current levels.

We believe MXL growth will slow down.

MXL is a semiconductor company that operates in broadband, WiFi and connectivity, infrastructure, and industrial markets. We believe the company’s business will likely face demand headwinds as the pandemic ends. The company grew exponentially during COVID due to the increased demand for broadband and connectivity needs to accommodate the work-from-home environments. The stock appreciated around 289% since the pandemic began in March 2020 and is now in decline. We believe broadband growth will slow down as demand retracts to pre-COVID levels. We also believe the company’s industrial/multi-market segment is facing risks of double ordering, similar to other analog semiconductor companies. We believe MXL is not immune to the current semiconductor slowdown and do not believe the company will grow meaningfully with current semiconductor demand trends.

We do not believe SIMO will accelerate MXL’s revenue growth.

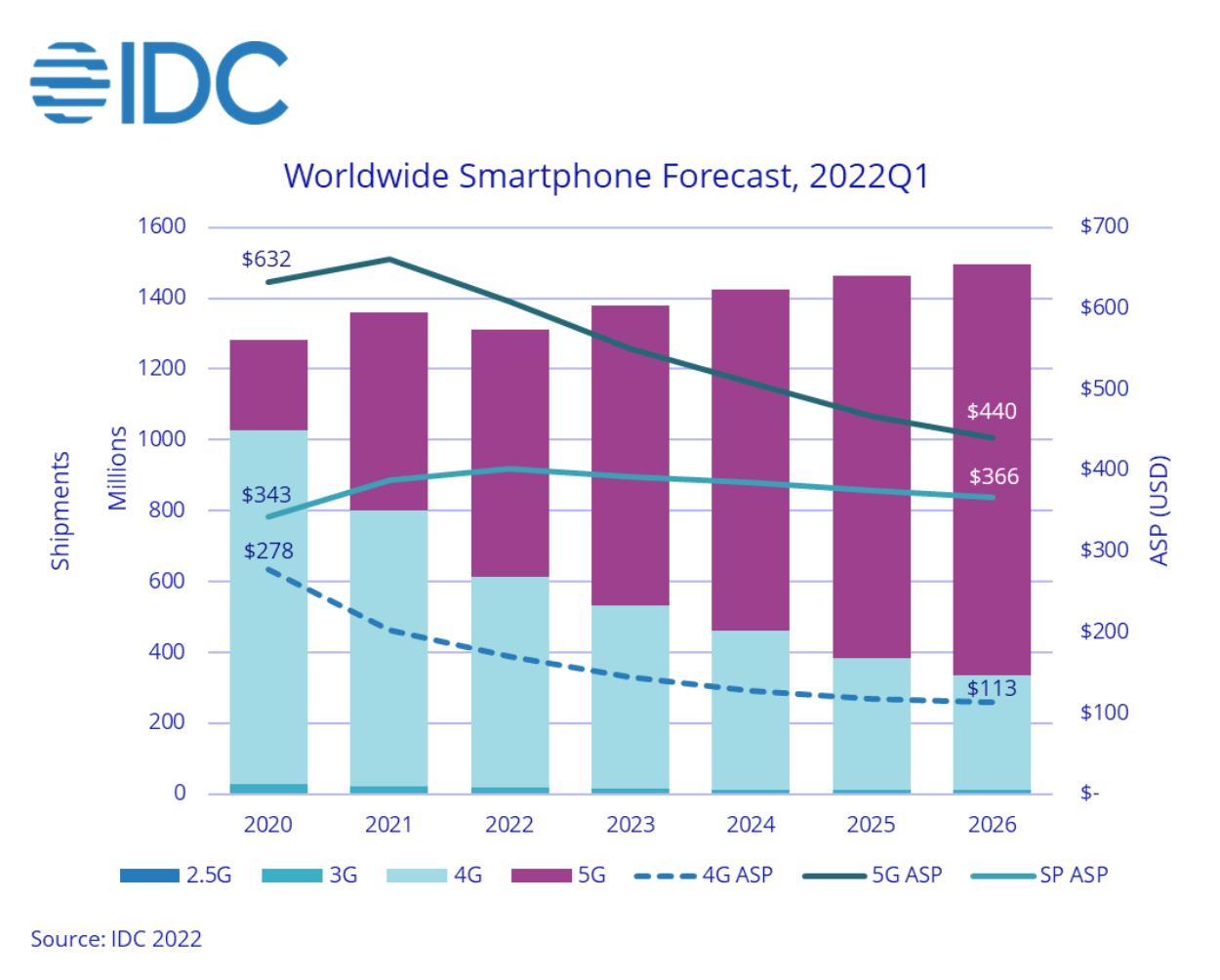

Contrary to what MXL management reports, we believe the company will not achieve meaningful revenue growth with the purchase of SIMO. SIMO is a semiconductor company that focuses on NAND flash memory. In simpler terms, the company manufactures Solid State Drives (SSDs) used in PCs and smartphones for fast and efficient data storage. In theory, the acquisition is excellent since SSDs are a growing market for consumer electronics, estimated to grow at around a CAGR of 15% until 2028 by Market Watch. The catch, however, is market demand trends themselves. SIMO’s revenue is reliant on PC and smartphone sales. PC and smartphones account for 80% of the company’s revenue. Weak consumer spending directly affects PC and smartphone demand. According to IDC, smartphone shipments are forecasted to decline by 3.5% in 2022. The graph exhibits the demand headwinds on smartphones.

IDC

The same downward slope applies to PC demands. Gartner forecasts worldwide PC shipments to decline 9.5% in 2022, accounting for the sharpest decline in nine years. We believe SIMO’s growth will slow down due to weakening consumer spending. We believe MXL’s decision to purchase SIMO under current market trends creates unnecessary risks for MXL.

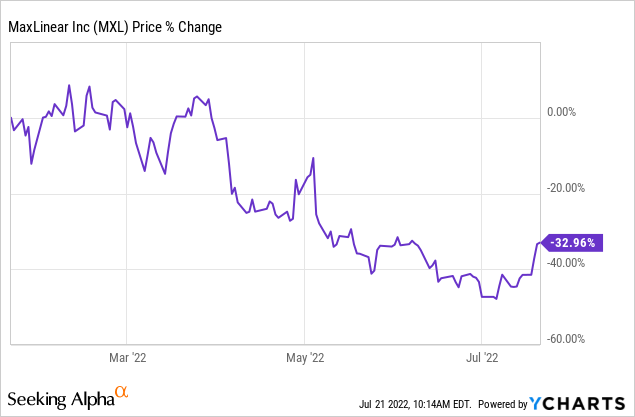

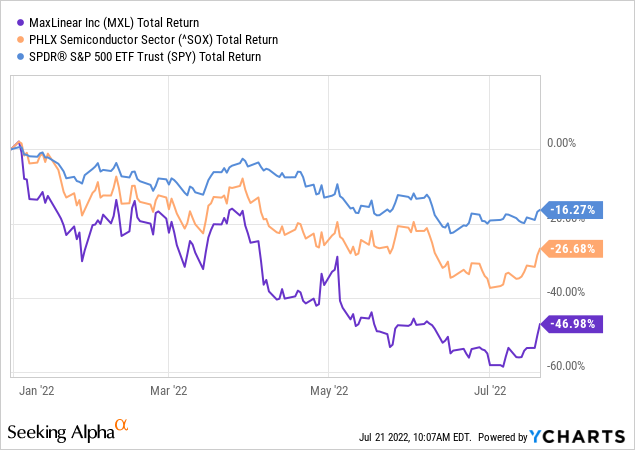

Stock Performance

MXL stock has had a less than impressive run over the past five years. The stock appreciated by 47%. The stock has been down 7% over the past year. YTD, the stock has dropped 48%. We expect the stock will continue to pull back closer to MXL’s 52-week low of $30. We believe the pandemic-incited growth is over and believe consumer spending is weakening. We recommend investors sell the stock at current levels. The following graphs show MXL’s stock performance:

Ycharts Ycharts Ycharts

Valuation

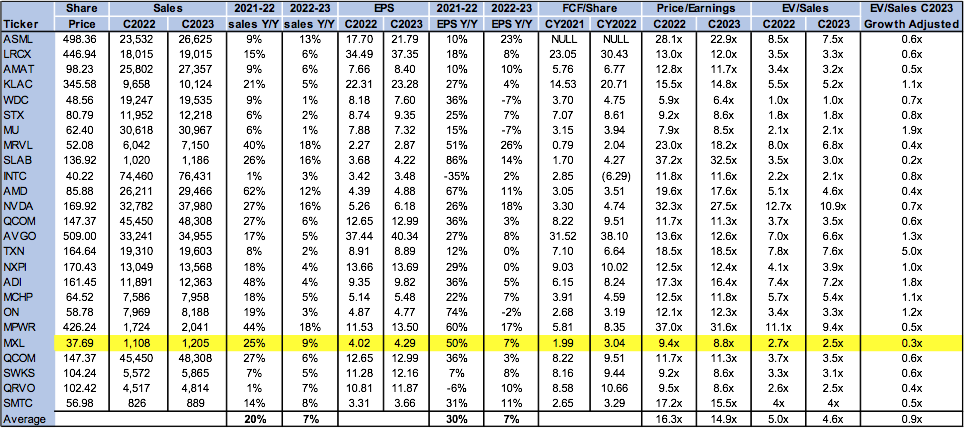

MXL is a relatively cheap stock, trading at $38. On the P/E basis, MXL is trading at 8.8x C2023 EPS $4.29 compared to the peer group average at 14.9x. The stock is trading at 2.5x EV/C2023 sales versus the peer group average of 4.6x. Adjusted for growth, MXL is trading at 0.3x compared C2023 to the group average of 0.9x. The following chart illustrates the semiconductor peer group valuation.

Tech

Word on Wall Street

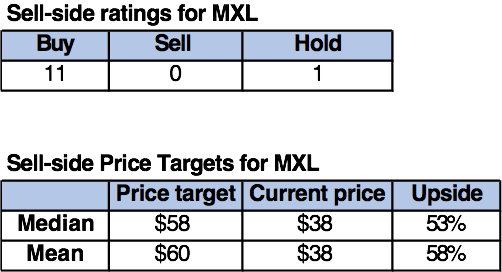

Wall Street is an overwhelming buy on MXL. Of the 12 analysts, 11 are buy-rated, and one is hold-rated. We attribute analyst optimism to the company’s recent announcement to acquire Silicon Motion. We believe that optimism is misplaced. The stock is currently trading at $38. The median sell-side price target is $58, and the mean price target is $60 leaving room for a 53-58% upside.

The following chart indicates MXL’s sell-side ratings and price targets:

Techstockpros

What to do with the stock

We believe MXL does not provide an attractive risk-reward situation. We believe the company’s acquisition of SIMO will cause the stock to pull back further. The stock is already down almost 37% over the past six months since the announcement of the SIMO acquisition. We believe MXL’s acquisition was a step in the wrong direction because SIMO is highly exposed to PC and smartphone markets, which are declining with weakening consumer spending. We believe MXL growth prospects will worsen before they get better and recommend investors sell the stock.

Be the first to comment