metamorworks/iStock via Getty Images

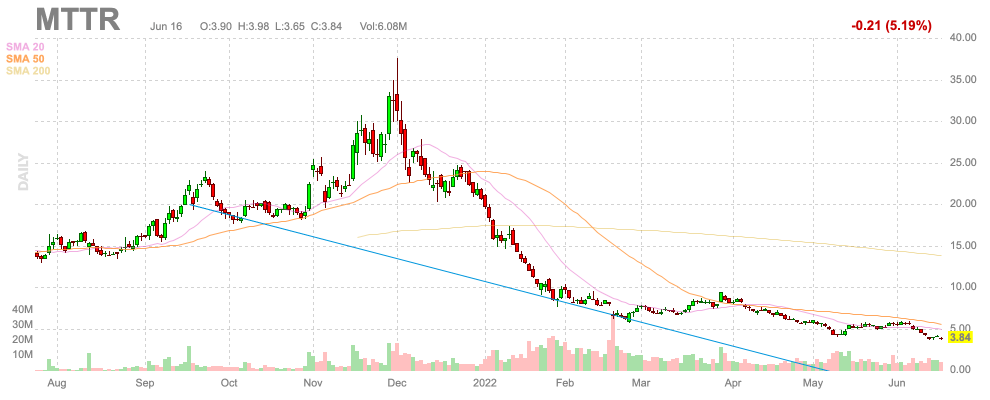

Just about any stock that went public through a SPAC has fallen hard in the last year. Despite Matterport (NASDAQ:MTTR) being the future of monitoring real estate spaces, the stock is now below $4 after once trading above $30. My investment thesis is now ultra-Bullish on the business with the market in full panic mode on business models without profits.

FinViz

Focus On User Growth

In a way, the company is like a social media play where the focus should be on users. Once Matterport reaches scale via millions of users, the business can shift to focusing on profits.

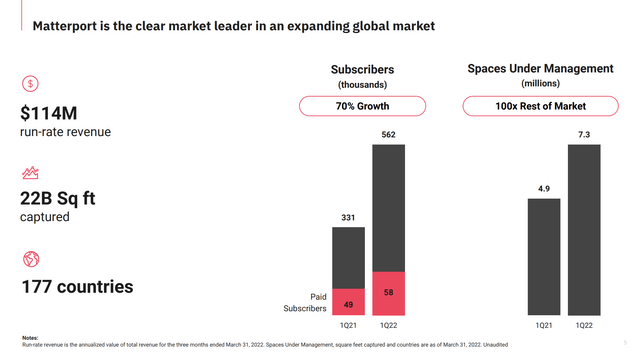

The digital 3D spaces platform saw Q1’22 subscribers (mostly free users) jump 70% to reach 562K, but the key paid subscribers total isn’t growing at the same clip. The launch of an Android app has continued the growth in the free-to-starter subscriptions, but paid subscribers were only up 9K from last year to 58K.

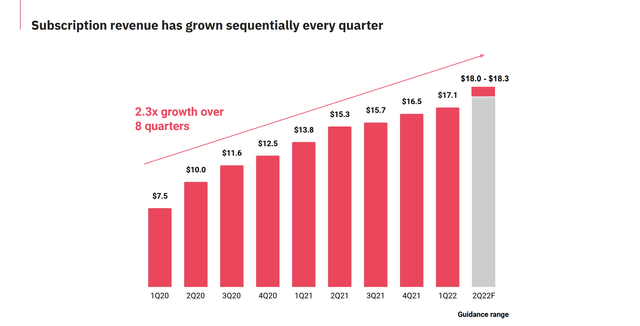

The business funnel remains very strong which should ultimately lead to a solid bump in paid subscriptions. Matterport guided to a sizable jump in subscription revenues in Q2’22 to at least $18.0 million. Remember, a lot of the new subscribers will continue to expand the Spaces Under Management (SUM) as additional spaces are captured which is exactly why this category outgrew paid subscriber growth at 49%.

The biggest quarterly gain in subscription revenue the last year was the $0.8 million boost in Q4’21 to reach $16.5 million. The CFO guided to subscription revenue growing at least $0.9 million in the current quarter and up to $1.2 million at the high end.

The product revenue remains the hiccup to the growth component. The company forecast revenues bouncing above the $28.5 million record level in Q1’22, but products remain a headwind due to a lack of camera supply and a shift towards capturing revenues from smartphones reducing the need to buy a camera.

Product revenues are expected to dip by $1 to $2 million sequentially in the quarter. The new Capture Services along with the Matterport Axis product connected to a smartphone reduces the need for camera purchases, yet the company still has the largest backlog in history.

The market should really focus on the subscription revenue growth with a target for up to 20% growth in Q2’22 and the amount surging to 34% for the year to reach at least $80 million. In addition, the services revenues were predicted to reach $5 to $6 million in the quarter providing more growth in the categories that matter with higher margins.

Such growth isn’t assumed by the markets, or the stock wouldn’t be trading below $4. Subscription revenue of $20.0 million in Q3’22 would require Q4 revenues of $24.9 million to reach just the low-end $80.0 million subscription target for the year.

Matterport would enter 2023 with annualized subscription revenues of $100 million and far lower reliance on products. An expanding subscriber base will be far less reliant on the purchase of new cameras either due to the use of smartphones apps or the further rollout of Capture Services option allowing for a service provider to provide on-demand coverage for clients wanting a professional touch of a certified technician.

Focus On TAM, Not Profits

The market is really doing an injustice to firms with strong balance sheets and no profits. Matterport has $600 million in cash due to raising funds into a strong equity market last year.

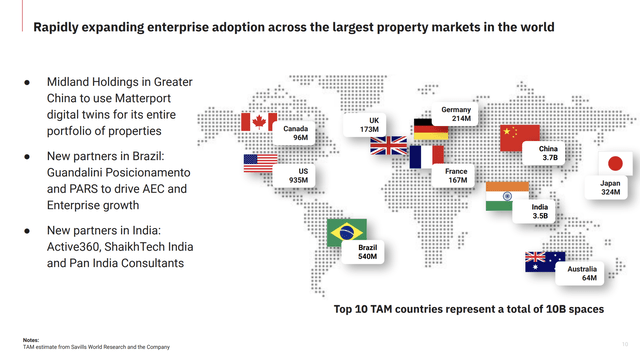

The company forecasts large losses for the next year or more, but the strong balance sheet and massive TAM opportunity fully support this move. The global market has 10 billion spaces with 15,000 new buildings being built every day.

The company is still talking about low-single-digit millions of SUM while the largest global markets have billions of spaces each. Even the US alone has 935 million spaces while the company is only managing 7 million now. Matterport hasn’t even captured 1% of just the US market.

Clearly, this isn’t the time to reign in investing for the future when the balance sheet has $600 million in cash. Matterport needs to continue pushing forward with more subscriptions with 75% gross margins. The operating expenses amount to ~$42 million leading to a quarterly operating loss in the $27 million range. The number sounds like large, but subscriptions growing at a 30% annual clip will jump from $80 million this year to $104 million next year and $135 million in 2024 ultimately providing over $100 million in gross profits alone.

Matterport forecasts a loss of ~$140 million for the year. The digital spaces firm will need to cut losses next year, but investors shouldn’t sweat further spending here to capture this market while competitors likely lack the funds to compete in this recessionary environment.

Takeaway

The key investor takeaway is that Matterport only has an EV of ~$450 million here. With a building subscription business in digital spaces, the stock will be a winner over the long run.

Matterport is out of favor now, and this is exactly when investors should load up on such promising technologies that make work in the real estate management space more efficient.

Be the first to comment