ivanastar/iStock Unreleased via Getty Images

I would recommend investors take a look at Mattel Inc. (NASDAQ:MAT), as its business has been historically stable, even during recessionary periods like the financial crisis. There are significant entertainment related catalysts in the next few quarters that can validate management’s IP monetization strategy. Mattel’s valuation is cheap relative to peers and the market.

Introduction To Mattel

Mattel is a leading global toy company, with iconic brands such as Barbie, American Girl, Hot Wheels and many others. Founded in 1945, Mattel’s toys can be found in over 150 countries and have provided hours of entertainment to millions of children across the world.

Historically Stable Business Tripped Up In 2017

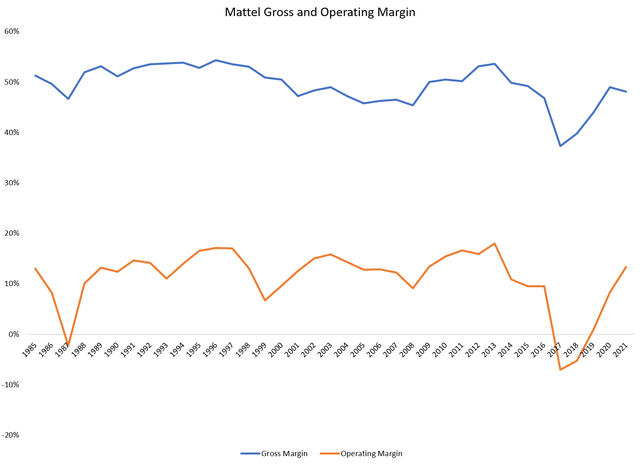

Historically, Mattel’s business had been very stable. It has enjoyed an average gross margin of 49% over 35 years, and has an average operating margin of 11% (Figure 1). Aside from a brief dip in 1987, Mattel had been profitable even during the dotcom bust in the early 2000s and the Great Financial Crisis in 2008, as parents continued to buy toys for their children.

Figure 1 – Mattel gross and operating margin (Author created with data form roic.ai)

However, the business tripped up between 2015 to 2018. Mattel fell into the red in 2017, with the company reporting a net loss of $505 million, partly on the back of Toys “R” Us’s bankruptcy, but also because of poor anticipation of consumer trends. Gross margin in 2017 fell to 37.3%, the lowest in its history.

New CEO Sparked Operating Turnaround

Current Mattel Chairman and CEO Ynon Kreiz was appointed CEO in April 2018 to lead a turnaround of the struggling toy manufacturer. Between 2018 to 2021, Mr. Kreiz led a restructuring of Mattel by shedding costs and refocusing the company on developing and monetizing its Intellectual Property (“IP”).

Gross margins under Mr. Kreiz’s leadership recovered to 48.1% in 2021, and operating margin was 13.4%, the highest since 2013. While overall revenues were the same in 2021 and 2016 at $5.5 billion, operating income was $116 million or 15% higher in 2021 compared to 2016.

Mandate To Fully Monetize The IP

Aside from stabilizing and restructuring the core toy business, another key part of Mr. Kreiz’s mandate was to fully monetize Mattel’s vast trove of IP.

Mr. Kreiz has extensive experience in the entertainment business. Prior to joining Mattel, he was the Chairman and CEO of Maker Studios, a leading YouTube short-form video content creator that was acquired by The Walt Disney Company (DIS) in 2014. Before Maker Studios, he was also Chairman and CEO of Endemol Group, one of the largest independent television production company behind hits like Big Brother and Deal or No Deal. Mr. Kreiz also co-founded Fox Kids Europe, a fast growing pay TV channel in Europe that was sold to The Walt Disney Company in 2002.

With Mr. Kreiz’s extensive entertainment experience, he appears to be the ideal CEO to help Mattel fully monetize its IP. Why should investors care about IP monetization? Investors should care because properly monetized IP can be a large business.

Disney/Marvel Is Best Example Of IP Monetization

The best example of IP monetization has to be Disney’s acquisition of Marvel Studios in 2009. While the $4 billion price tag Disney paid to acquire Marvel was steep, the rewards were also incredibly large. Up to June 2021, Disney had produced 23 blockbuster movies based on the acquired Marvel IP, generating a cumulative $22.6 billion in box-office receipts, not to mention the uncounted billions in ancillary toy and merchandising revenue.

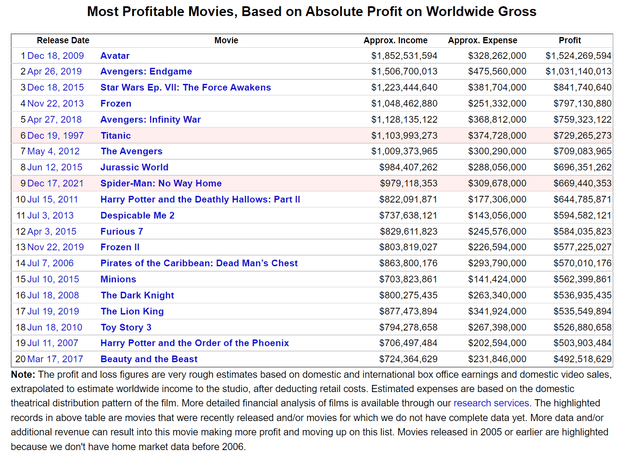

In fact, from just 3 movies, Avengers: Endgame, Avengers: Infinity War, and The Avengers, Disney is estimated to have reaped $2.5 billion in profits (Figure 2) versus the $4 billion purchase price.

Figure 2 – Most profitable movies of all time (the-numbers.com)

Hasbro’s IP Is Another Good Example

Another good example of IP monetization is Mattel’s key competitor, Hasbro Inc. (HAS). Like Mattel, Hasbro has many toy franchises like the Transformers, G.I. Joe, and My Little Pony. To date, those three franchises have brought in $5.6 billion in combined box-office receipts from hit movies.

In particular, My Little Pony: The Movie, grossed $61 million on a $6.5 million budget. While the absolute number may be small, the profitability is eye-catching. Movies in general are profitable when its worldwide gross is 2.5x to 3x its budget. So on that basis, My Little Pony: The Movie probably generated over $40 million in profits.

The My Little Pony franchise is a good comparison for Mattel as Mattel’s main franchises (Barbie, American Girl) are not suitable for big action movie adaptions like Transformers and G.I. Joe, but can be turned into consistently profitable movies and TV shows.

Mattel’s IP Is Set To be Showcased In 2023

After fixing the toy operations, we are now coming close to an inflection point where we will begin to see Mattel’s IP monetization efforts pay off.

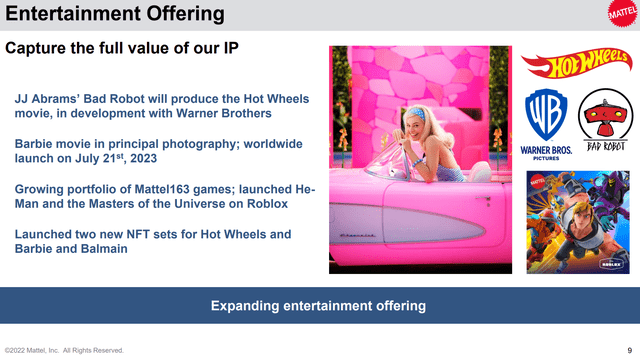

Esteemed director and producer J.J. Abrams is contracted to develop a Hot Wheels-based movie, and the Barbie movie starring Margot Robbie is set to hit theatres in July 2023 (Figure 3). While both movies are co-developed with Warner Bros., meaning Mattel will not see all of the benefits if they are successful, it will still be a good litmus test for Mattel’s IP. It also lessens the financial risk to Mattel, in case the movies are not successful.

Figure 3 – Mattel set to monetize IP (Mattel investor presentation)

Mattel Valuation Is Cheap

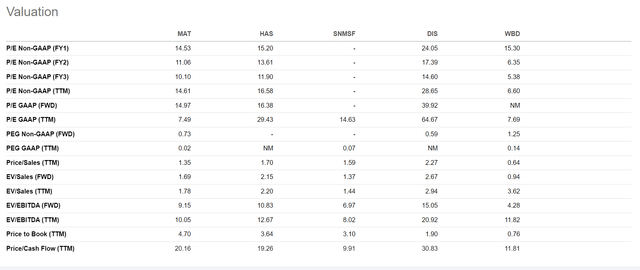

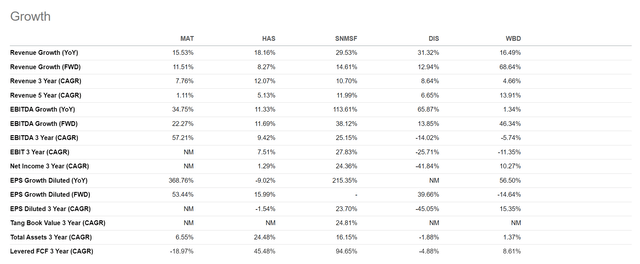

On most valuation metrics, Mattel is cheap. It trades at a 14.5x 2022 P/E, and 11.1x 2023 P/E, which is a discount to the S&P 500’s 16.4x forward P/E (Figure 4). It also trades at a 1 to 2x multiple discount to Hasbro, even though the two companies are very similar and Mattel actually has a higher forward revenue growth rate of 11.5% versus 8.3% (Figure 5).

Interestingly, as Mattel proves out the value of its IP portfolio, there is an opportunity for multiple expansion towards that of media companies such as Disney and Warner Bros., which trade at 24.1x and 15.3x 2022 P/E respectively.

Figure 4 – Mattel valuation comps (Seeking Alpha) Figure 5 – Mattel growth comps (Seeking Alpha)

Technicals

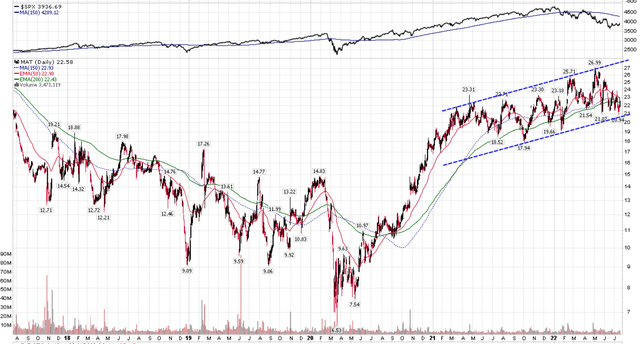

While the S&P is down 20% YTD, Mattel is flat, significantly outperforming. On the positive side, Mattel is trading at the lower-end of a rising up-trend. Risk/reward-wise, investors can consider buying at current levels for a play towards the top end of the up-trend near $28, with a stop loss just under $21 on a break of the up-trend (risking $1.60 for $5.40 gain). A technical negative is that the stock has recently slipped below a flattening 150DMA, indicating a potential turn in momentum.

Figure 6 – MAT in an uptrend (Author created with price chart from stockcharts.com)

Risks To Mattel

The biggest risk to Mattel is a slowing economy and rising inflation that could potentially hurt demand for toys and gross margins. Already, we have seen some retailers such as Target (TGT) announce plans to mark down inventory, as they had mis-read demand and ordered too much. Whether that slowdown will spread to soft consumer goods such as toys remains to be seen.

On the margin issue, management acknowledged inflation was an issue during its Q1/2022 earnings call and said that:

“We expect the negative gross margin impact of inflation will be mostly offset by the benefits from pricing, including the incremental 2022 actions, fixed cost scale benefit from top line growth and anticipated savings from the Optimizing for Growth program.”

– Quote from Anthony P. DiSilvestro, CFO, Q1/2022 Earnings Call

We give management the benefit of the doubt for now in their ability to manage gross margins through price actions in 2022.

Conclusion

In conclusion, I recommend investors accumulate shares of Mattel as I believe the company is a solid consumer stock that historically performs well, even during recessions. The company has restructured its business and is generating strong gross and operating margins. Valuations are cheap relative to its peers and there are significant IP related catalysts in the next few quarters that can re-rate the stock higher.

Be the first to comment