yalcinsonat1/iStock Editorial via Getty Images

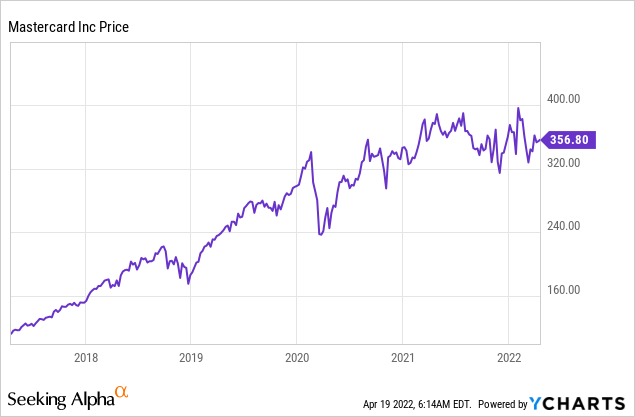

Mastercard (NYSE:NYSE:MA) is one of the leading card providers globally and their business model has dominated for decades. Their share price chart shows one of the smoothest uptrends I have ever reviewed which is testament to the strong, consistent cash flows the company generates. During early 2020, their share price fell off a cliff and was down 37% due to the pandemic market crash, reduced consumer spending and fears of international payment segment impact. However, by August 2020, the share price had risen substantially, up 73% from the lows, but since then it has been moving sideways and uncharacteristically volatile. The company’s business model is still strong and they have been expanding into the Crypto industry. Let’s dive into the business model, financials and valuation to find out more.

Mastercard share price (created by author)

Business Model

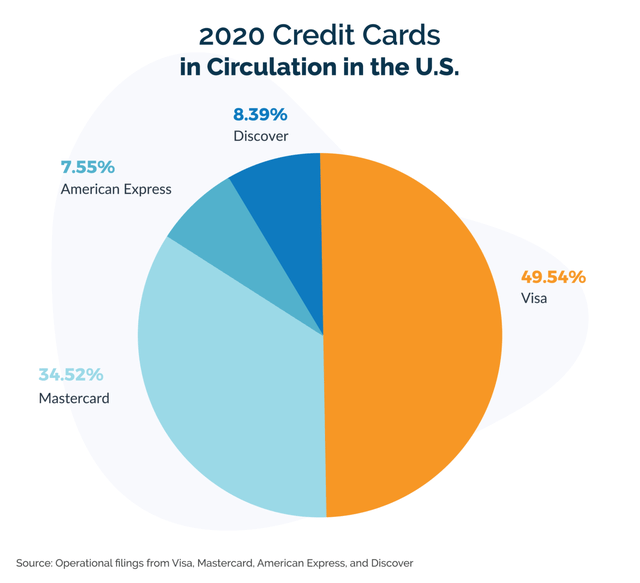

Mastercard is one of the leading credit card providers globally, in the US they have a 34% market share which is 2nd only to their rival Visa at 49% market share.

Mastercard market share (SEC data )

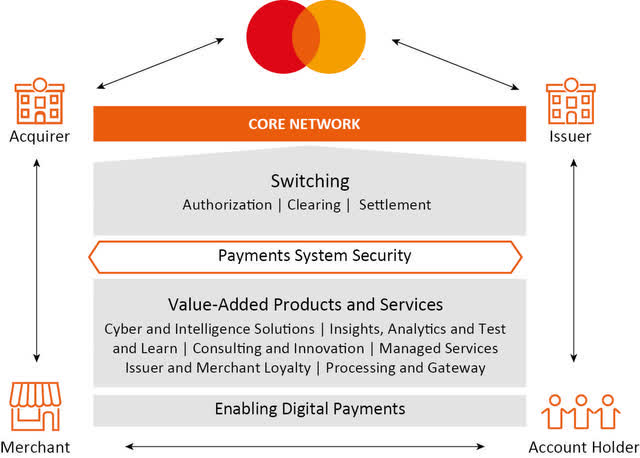

The company is a payment facilitator which acts as a middle man between buyers and merchants. They assist with the authorization, clearing and settlement of transactions, similar to Visa. For their services they charge an interchange fee (“swipe fee”) to merchants, while an account holder is charged the transaction cost minus a merchant discount fee, which helps to cover the costs for the acquirer bank. Mastercard generates revenue by charging banks that issue Mastercard branded payment products a fee based on gross dollar volume.

Mastercard Model (10k Investor presentation)

The company believes it has an advantage over new “fintech” payment disruptors with their “multi rail network” which covers domestic, cross border, card based and account to account transactions. Despite being around since the late 1950’s Mastercard still has options to grow market share internationally. For example, in the UK Mastercard makes up just 14% of cards issued compared to the dominant player Visa at 84%. To help remedy this the company launched a “Pay by Bank” service in the UK in 2016, it was slow to get off the ground, but they believe it will have significant adoption. The service is a game changer as it enables UK consumers to pay for goods & services directly from their bank account at a merchant checkout, via mobile banking apps. The beautiful thing about this service is no payment details or password is required, you can even view your balance while checking out and see it update instantly. For merchants, adoption of a “Pay by Bank” system means there is less friction at the checkout which ultimately boosts conversions. I believe this app has major potential and Mastercard plans to roll it out internationally after testing in the UK. Mastercard can also leverage the faster payments network in the UK, which is operated by Vocalink, which Mastercard acquired in 2016.

To further diversify their revenue, the company plans to launch a “Buy Now Pay later” service in 2022. This is a smart move by Mastercard but late to the party compared to Fintech disruptors such as Affirm (founded in 2012) which have recently scored a major partnership with Amazon. The industry is also very competitive with companies such as Klarna in Europe and Afterpay already well established.

Embracing Crypto

Mastercard is embracing Crypto & NFT’s extensively, they have recently filed 15 trademarks related to the Metaverse and blockchain technology. The company made a payment deal with leading crypto exchange Coinbase in January to become its payments partner for NFT’s. They also have set up an integration with OpenSea, the leading NFT marketplace.

The goal of Mastercard is to simplify the crypto experience for end-users. Mastercard’s Global Head of Crypto explained in an interview:

“This is not about a crypto native going and buying an NFT…

it’s really about enabling every artist and every creator to be able to have a large market for them to sell their artwork, and it’s really powering the creator economy. And how can we do that if we don’t enable common consumers to be able to purchase and hold the NFT using a simple consumer experience?”

Nexo has also launched a payments card backed by a Crypto credit line with Mastercard and Dipocket. This allows cardholders to use their crypto assets as collateral rather than having to sell them.

Strong Financials

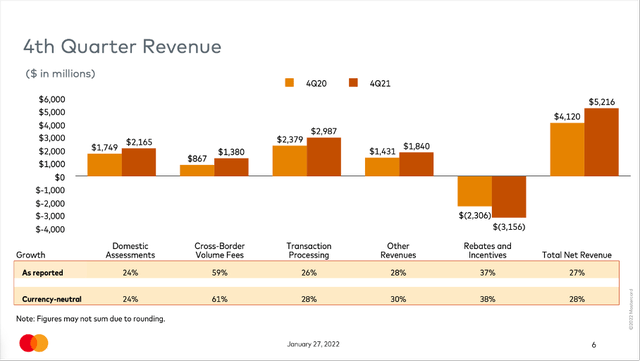

Mastercard reported strong financials, they grew revenue by a substantial 23.4% to $18.8 billion, up from just $15.3 billion in 2020. The company’s cross border payments business saw declining revenues in 2020, which is why we are seeing such a high bounce back.

Revenue Mastercard (Created by author) Mastercard Revenue (Q42021 report)

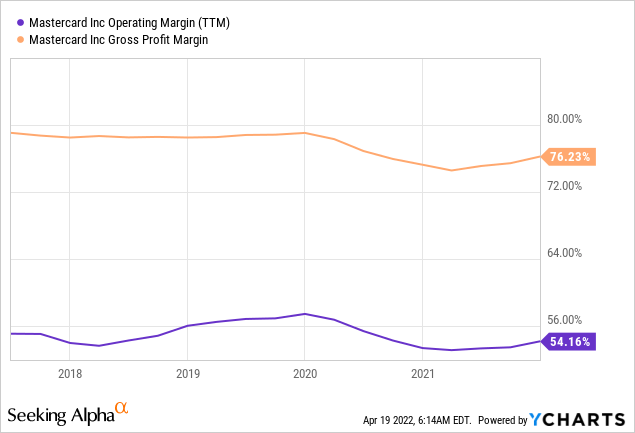

Operating income also grew a substantial 39.6% in 2021 to $10 billion, up from $7.2 billion for FY2020. In addition the company has maintained it’s strong operating margin above 54% and high gross margin of 76%.

Mastercard Margins (Created by author)

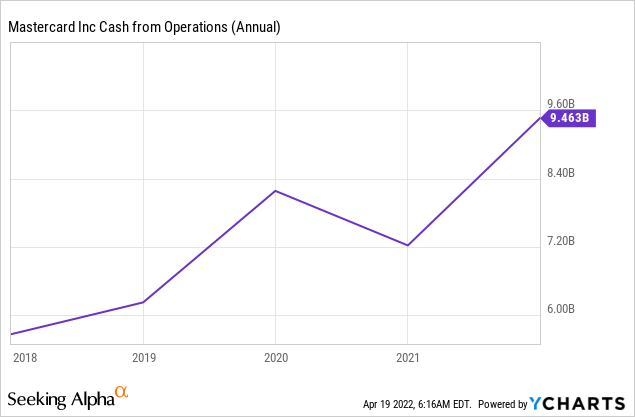

Cash flow from operations also grew substantially to $9.4 billion for FY2021, up 30% from $7.4 billion in FY2020 and up 16% from $8.1 in FY2019. As mentioned prior the dip in 2020 was mainly due to a decline in international payments. In addition, Consumers actually made less payments overall in 2020, with a 34 payment average per person in October 2020, down from 39 in October 2019. When consumers did make payments, more of these purchases were done online than in person. According to one study, in 2020 72% of consumers reported an in person purchase during a three day window, down from 91% in 2019.

Cash from operations (Created by author)

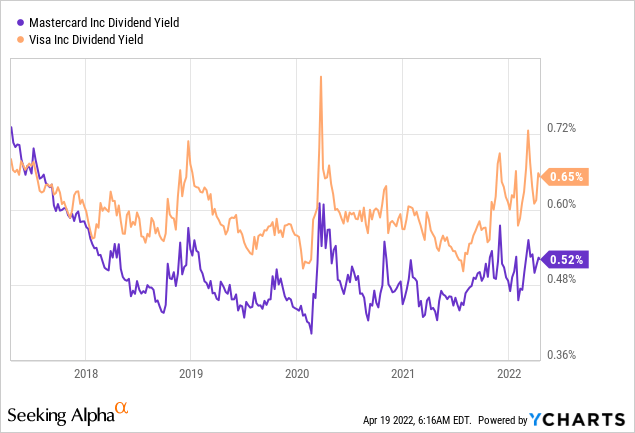

The company also paid a $1.7 billion dividend (0.55% yield) and repurchased a staggering $5.9 billion worth of shares in 2021.

Mastercard Dividends (Created by author)

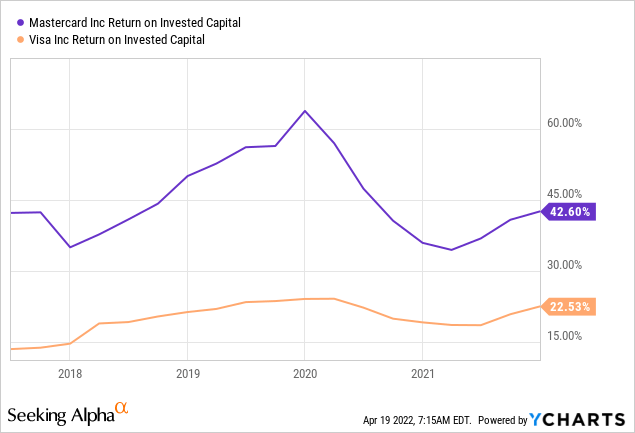

Mastercard has generated exceptional Returns on Capital above 42% over the past number of years, which is higher than their main rival Visa which as “only” a 22% return on capital.

Return on Capital (created by author)

Valuation

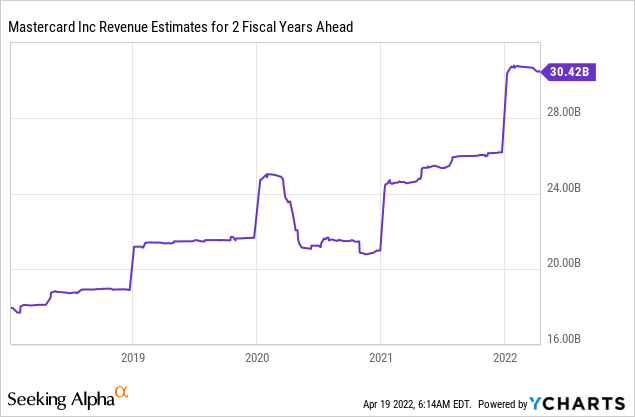

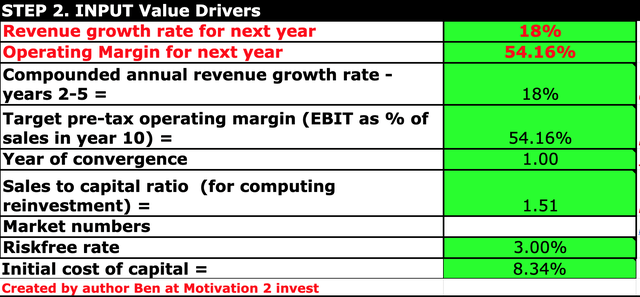

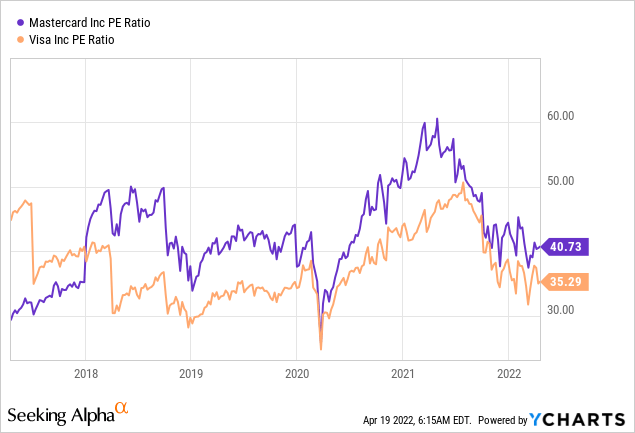

In order to value Mastercard I plugged the latest financial data into my discounted cash flow valuation model. I have estimated revenue to grow at an 18% CAGR for the next 5 years, which is the top end of the company’s own guidance. I have also expected margins to maintain stable at 54%.

Mastercard Stock Valuation (Created by author Ben at Motivation 2 Invest) Mastercard stock valuation (Created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $270 per share which means the stock is 30% overvalued relative to the current share price of $356 per share.

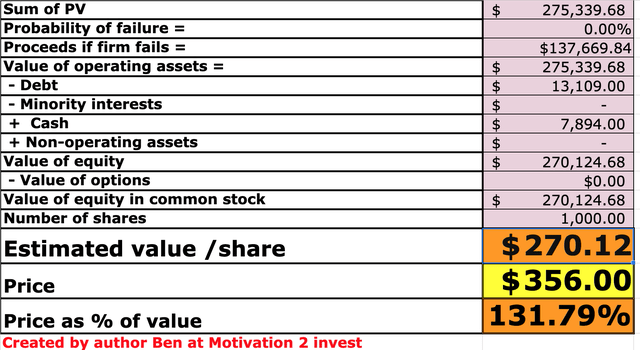

Mastercard is an exceptional company with a solid business model and thus has had a high valuation for many years. Their average PE ratio has been around 40 with a high of 58 and pandemic low of 28. Mastercard breaks convention when it comes to valuation, with a PE of 28 being “cheap” for the company. The valuation tracks their rival Visa very closely but Visa tends to trade at a discount relative to Mastercard historically. This could be due to Mastercard’s higher Return on invested capital mentioned prior.

Mastercard and Visa PE Ratio (Created by author)

Risks

Insider Selling

It should be noted a range of insiders were selling their Mastercard shares throughout 2021 and 2022. The biggest trades were Edward McLaughlin (President of operations) who sold 77% of his shares in Q12021 at the current price of $360/share and the CEO Michael Miebach who sold 38% of his position in Q42021. This number of sales could indicate that management believes the stock is overvalued at the current price.

Government Regulation

As a dominant payments player Mastercard is a prime target for anti-monopoly regulation and law suits. For example, Mastercard raised its interchange fee from 0.3% to 1.5% for UK card holders in Q12021 after the UK left the EU. However, now a £10 billion ($13 Billion) class action lawsuit has been launched against the company on behalf of 46 million consumers. The lawsuit claims the higher interchange fee broke EU competition law.

Fintech Disruptors

Although Mastercard is embracing the world of crypto, there is still the risk that blockchain and fintech disruptors such as Revolut, Stripe, and Square could render Mastercard obsolete. Today physical payment cards aren’t essential as a large portion of payments are processed by “Virtual Cards” (Google pay, Apple Pay). Companies such as Revolut and Transferwise also offer rapid, low cost international transfers and thus the “need” for Mastercard is reducing.

Final Thoughts

Mastercard is a tremendous company with a high quality business and solid financial performance. The company is aware of the threats from blockchain technology and thus have invested into the space and filed a series of trademarks, which is a smart strategic move.

Mastercard is also poised to leverage it’s partnerships with incumbent banks and the “Pay by Bank” app could be a real game changer and help them to maintain their competitive advantage. The main negative with this quality company is the high valuation, which has been consistently high for many years. The insider selling acts as an additional red flag, which indicates a high valuation. Relative to historically high valuation multiples the stock is trading close to it’s average PE ratio of 40, thus for me the stock is a hold at this time.

Be the first to comment