lcva2/iStock Editorial via Getty Images

The Investment Thesis

While the payment network business still remains the core of Mastercard (NYSE:MA), the “other revenues” segment is becoming an increasingly larger portion of total revenue every year. The “other revenues” segment is often overlooked on a company’s income statement as it is considered insignificant, but, interestingly for Mastercard, this will be the main growth driver for the future. Now is an excellent moment to jump on the growth train as the stock is attractively priced.

Beyond the core business of Mastercard

Mastercard is a well-known technology company in the global payments industry offering a broad variety of payment solutions under the Mastercard, Maestro, and Cirrus brands. The core network of Mastercard essentially links issuers and acquirers of credit and debit cards to facilitate the authorization, clearing, and settlement of payment transactions. Revenue generated from payments can be divided into two categories:

- Volume-based revenue: This includes domestic assessments and cross-border volume fees, for which the leading metric is Gross Dollar Volume (or GDV). Domestic assessments are fees charged based on dollar volume of activity on cards where the merchant’s country and card issuer’s country are the same, while for cross-border volume fees the merchant’s and card issuer’s country are different.

- Transaction-based revenue: This revenue is primarily based on the number and type of transactions and recognized for both domestic and cross-border transactions.

As these revenue sources still make up for the largest portion of net revenue, investors naturally focus on the development of switched volume, switched transactions and cross-border volume with international travel restrictions mostly lifted and a recession ahead.

But there is more than payments alone…

I believe that investors should also pay attention to the “other revenue” segment. This segment consists of all value-added services which are often sold together with the payment network offerings. In the following, I will show how the services segment has grown from a minor part of net revenue (typically for ‘other revenue’) to the growth engine it is today.

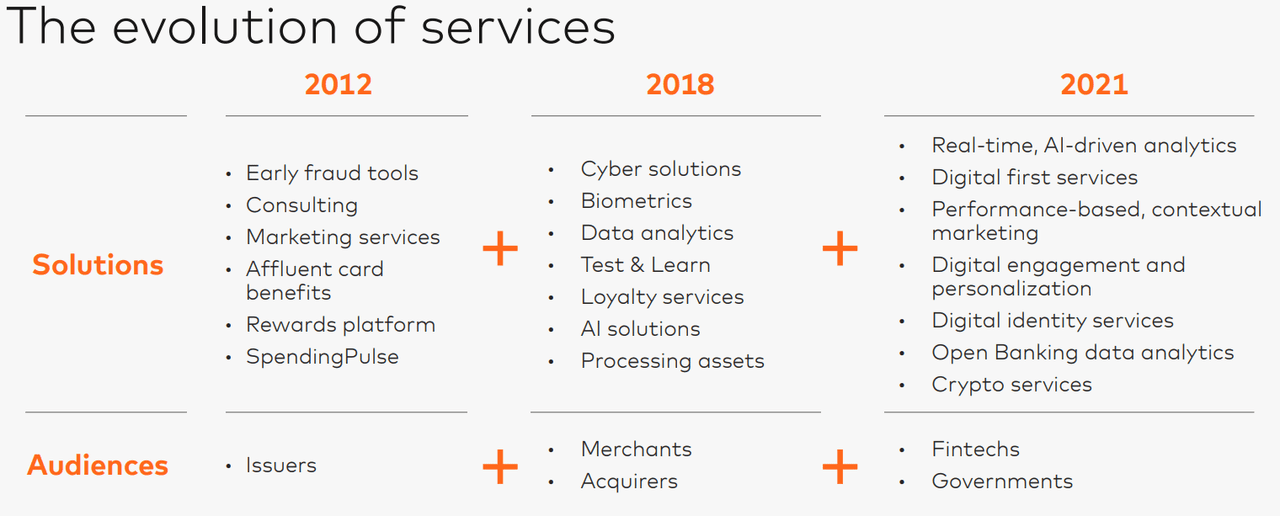

I will start with breaking down the services segment. If we go back in time to fiscal year 2011, other revenues included the early-day fraud detection services, cardholder service fees for benefits offered through cards, consulting and research, and program management services provided to prepaid card issuers. Fast-forwarding to the most recent fiscal year 2021, numerous services have been added, such as cyber and intelligence solutions, data analytics and insights, loyalty services, batch and real-time account-based payment services, open banking, digital identity solutions, and crypto services. The figure below from Mastercard’s most recent investment community meeting nicely shows the evolution of services, and also how the target audience has expanded.

Evolution of services (Mastercard Investment Community Meeting)

While Mastercard develops many of these services in-house, acquisitions play a major role in the growth of value-added services. The table below gives an overview of some acquisitions in recent years and how they complemented Mastercard’s business.

|

Year |

Company name |

Added value to the business |

|

2022 |

Dynamic Yield |

Consumer engagement and loyalty services |

|

2021 |

Aiia |

Open-banking |

|

2021 |

CipherTrace |

Cybersecurity and fraud monitoring activities for crypto-related programs |

|

2021 |

Ekata, Inc. |

Digital identity verification |

|

2020 |

Finicity |

Open-banking |

|

2019 |

RiskRecon |

Artificial Intelligence and data analytics solutions to enhance cybersecurity capabilities |

|

2019 |

SessionM |

Merchant loyalty and marketing services |

|

2019 |

Ethoca |

Identifying and resolving fraud in digital commerce |

|

2017 |

Brighterion Inc. |

Artificial Intelligence capabilities |

|

2017 |

NuData Security Inc. |

Security of Internet of Things |

One of management’s three key priorities is to keep expanding into new services and use cases, so it is very likely that more acquisitions will follow in the coming years. This is obviously beneficial for Mastercard’s financial performance, but it also increases the safety, security, and efficiency of the payment network part of the business.

Financial performance of services

Mastercard’s services have expanded rapidly in the last decade. Let us take a look at its financial performance. The following table shows the development of other revenue, net revenue, and the percentage of other revenue from net Mastercard revenue during the last ten fiscal years. It can be seen that on average, revenue from services has been growing nearly twice as much as net revenue (20.0% versus 10.9%). Consequently, the services revenue share of net Mastercard revenue has been growing nearly every year. And it is not that the services segment is slowing down – between fiscal year 2017 and 2021, other revenues grew 20.9%, and during the most recent Q2 of FY2022, other revenues grew 18% YoY on a Non-GAAP basis and 23% YoY on a currency-neutral basis.

|

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

CAGR |

|

|

Other revenue ($ billion) |

$1.0 |

$1.2 |

$1.3 |

$1.7 |

$2.0 |

$2.4 |

$2.9 |

$3.3 |

$4.1 |

$4.7 |

$6.2 |

20.0% |

|

Net revenue ($ billion) |

$6.7 |

$7.4 |

$8.3 |

$9.4 |

$9.7 |

$10.8 |

$12.5 |

$15.0 |

$16.9 |

$15.3 |

$18.9 |

10.9% |

|

Percentage of net revenue (%) |

14.9% |

16.2% |

15.7% |

18.1% |

20.6% |

22.2% |

23.2% |

22.0% |

24.3% |

30.7% |

32.8% |

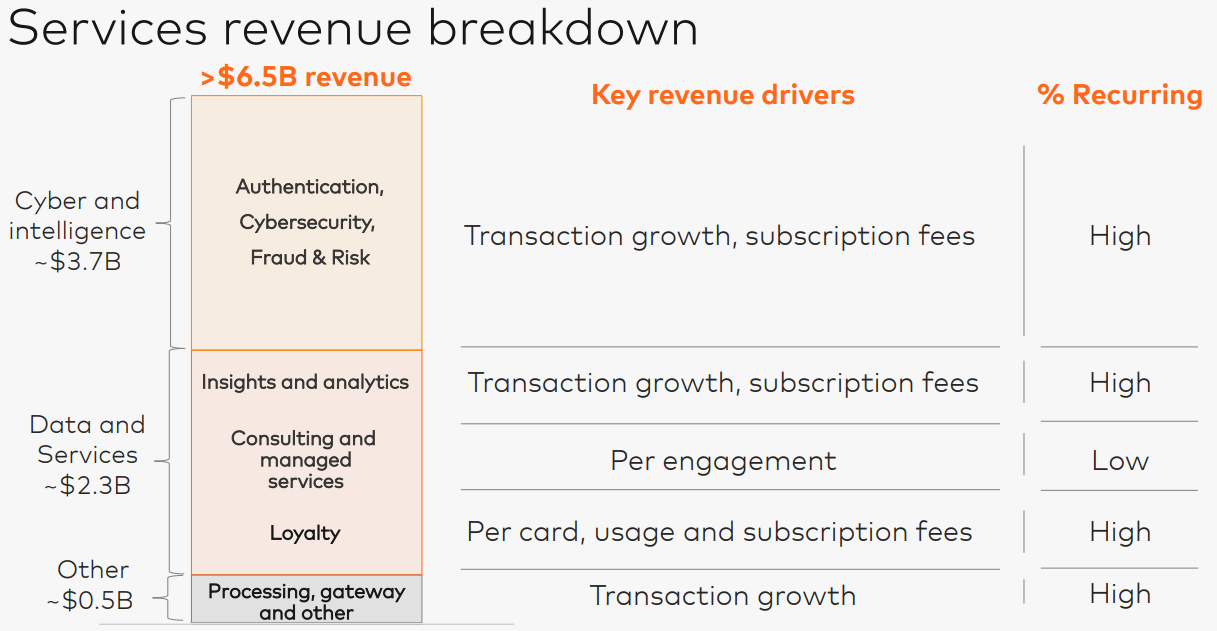

The great thing about revenue from services is that it is partly recurring, as shown in the figure below from last year’s investment community meeting. During the event, management explained that roughly 50% of services revenue is driven by transaction growth resulting from the underlying payments growth. But another substantial part of services revenue is generated from subscription models.

Services revenue breakdown (Mastercard Investment Community Meeting)

Looking into the near future, management expects services revenue to keep delivering 20%+ growth annually through FY2024. For the long-term I think services will keep outperforming Mastercard’s core payment network business, becoming an even more substantial part of net revenue.

Mastercard and its moats

As the payment industry is changing rapidly, I believe it is crucial to address the moats protecting the core payment network and thus value-added services from Mastercard. In my view, the main moats are networking effects and scale.

- Networking effects: The more consumers use the payment network of Mastercard, the more attractive the payment network becomes for merchants to join, which makes it again more attractive for consumers etc. – this is the flywheel principle. As a result, there are currently only a handful of dominant players, from which Mastercard and Visa (V) are the largest players outside China.

- Scale: The payment processing business is very scalable by nature. Because players like Mastercard and Visa have obtained such a large size, they benefit from cost advantages which in turn increases their competitive advantage. Moreover, I believe that building a payment network with Mastercard’s or Visa’s scale is not realistic for other players in the foreseeable future.

Overall financials

Mastercard has grown its revenue by low-teens on average over the past four years, despite the COVID-19 pandemic affected the underlying results. This shows the strength and resilience of the business. Because Mastercard has such a dominant market position in the payment industry, it has achieved an EBITDA margin of almost 60%. Only a handful of companies in the S&P 500 index (SPY) has managed to achieve greater margins than Mastercard.

Earnings per share have grown at a significantly higher rate than EBITDA in the considered period, due to share repurchases, a major tax expense in FY2017, and changes in income tax rates.

|

2017 |

2018 |

2019 |

2020 |

2021 |

4Y CAGR |

|

|

Sales ($ billion) |

$12.5 |

$15.0 |

$16.9 |

$15.3 |

$18.9 |

10.9% |

|

EBITDA ($ billion) |

$7.2 |

$8.9 |

$10.2 |

$8.7 |

$11.0 |

11.2% |

|

EBITDA margin (%) |

57.6% |

59.3% |

60.4% |

56.9% |

58.2% |

|

|

EPS ($) |

$3.65 |

$5.60 |

$7.94 |

$6.37 |

$8.76 |

24.5% |

Balance sheet

I find it always important to check the balance sheet of a company, as it tells me more about the financial health of the business. Prudent capital allocation is particularly important for Mastercard, as its future growth is partly dependent on the ability to keep expanding through acquisitions. For Mastercard, leverage has been trending upwards over the past four years (mainly due to the increase in long-term debt) which I generally do not like. Still, Mastercard has a very low leverage and long growth runway, which allows them to continue buy back shares, increase dividends, and acquire new companies. Therefore, S&P Global Inc. (SPGI) rewarded Mastercard with an A+ credit rating.

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Cash & Cash equivalents ($ billion) |

$7.8 |

$8.4 |

$7.7 |

$10.6 |

$7.9 |

|

Short-term & current debt ($ billion) |

– |

$0.5 |

– |

$0.6 |

$0.8 |

|

Long term debt ($ billion) |

$5.4 |

$5.8 |

$8.5 |

$12.0 |

$13.1 |

|

Net debt ($ billion) |

$-2.4 |

$-2.1 |

$0.8 |

$2.0 |

$6.0 |

|

EBITDA ($ billion) |

$7.2 |

$8.9 |

$10.2 |

$8.7 |

$11.0 |

|

Net leverage |

-0.3x |

-0.2x |

0.1x |

0.2x |

0.5x |

Valuation of Mastercard

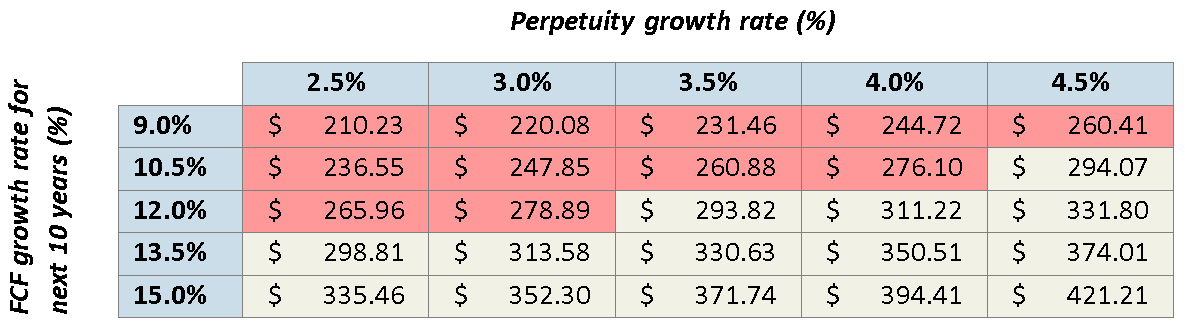

I already mentioned at the beginning of this article that Mastercard is currently trading at attractive prices. I often use the Discounted Cash Flow Analysis, a well-known method to calculate the intrinsic value of a business. Because it is very hard to predict the exact growth rates, I use different values in a sensitivity analysis.

To come up with realistic free cash flow growth rates, I will consider the historical financial performance and guidance provided by management during the investing community meeting.

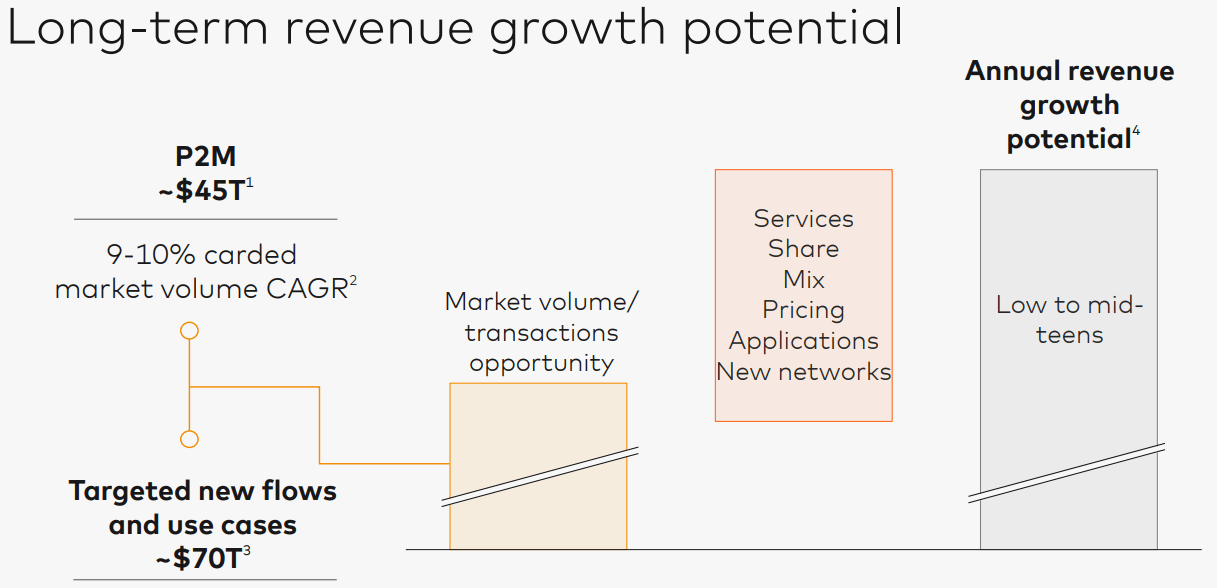

During the period FY2011-FY2021 net revenue grew with 10.9% annually on average. We should keep in mind that revenue decreased in FY2020 due to the pandemic. If we take the pre-COVID period FY2011-2019, revenue grew with a 12.2% CAGR. Looking into the future, management guides a high-teens net revenue CAGR through FY2024. For the longer term, management guides a low to mid-teens net revenue CAGR, fueled by 9-10% carded market volume CAGR, capturing new payment flows, new use cases, further growth in services, and others (see figure below). Assuming that margins will stay the same, I believe that a 12.0% free cash flow growth rate is a reasonable base case scenario. For the bear case I will assume a 9.0% free cash flow CAGR (Mastercard will simply grow with the P2M market and is not able to access new payment flows, use cases, services, etc.), and for the bull case a 15.0% free cash flow CAGR (high-end of management guidance).

Long-term outlook (Mastercard Investment Community Meeting)

The perpetuity growth rate is typically between historical inflation (2-3%) and historical GDP growth rate (4-5%). Assuming that through the ongoing shift to digital payments Mastercard will outperform historical inflation, I believe the 2.5%-4.5% range is a suitable assumption for the perpetuity growth rate.

This results in the following inputs:

|

Input |

Value |

|

First year of projections |

2022 |

|

Personal Required rate of Return |

10.0% |

|

Number of shares outstanding |

0.966 billion |

|

Net borrowings |

$6.0 billion |

|

Base free cash flow (fiscal year 2022) |

$9.1 |

|

Free cash flow growth rate for next 10 years |

9.0% / 10.5% / 12.0% / 13.5% / 15.0% |

|

Growth rate in perpetuity |

2.5% / 3.0% / 3.5% / 4.0% / 4.5% |

As shown in the table below, Mastercard stock ($293.58 at the time of writing) is currently trading at a reasonable price for a 10.0% return on investment. I even think that a 13.5% free cash flow CAGR may be achievable, as through FY2024 management guides high-teens revenue growth. Obviously, this requires revenue performance according to management guidance, so I always try to lean towards the conservative side with my assumptions.

Sensitivity analysis for Mastercard (Author)

Bearish arguments to consider

Mastercard is still in growth mode and has great long-term potential. Although the outlook is rosy, unforeseen events such as a pandemic could always occur. In the following I will briefly discuss some bearish arguments against Mastercard:

- Geopolitical events could cause Mastercard to suspend operations in a certain country. This happened recently in Russia as Mastercard joined other Western firms to withdraw from the Russian market. This creates opportunities for other payment processors, in this case Union Pay and payment system Mir. Apart from events, governments could favour local networks and exclude Mastercard from their markets.

- Because Mastercard has such a dominant market position, the company is a target for regulators. For example, in 2019 Mastercard was fined with 571 million EUR by the European Commission for breaking EU antitrust rules.

- Merchants can choose to exclude Mastercard credit and debit cards from their payment methods. Earlier this year, Amazon had plans to stop accepting Visa credit cards in Britain, following the pressure on Visa to lower its fees. Luckily, Amazon dropped the plans but such actions could also happen to Mastercard. If payment network companies are forced to lower fees, this could decrease long-term margins.

Final thoughts

Mastercard is a growth company that has performed remarkably well over the last decade. As a company grows bigger and bigger, a slowdown in revenue growth becomes inevitable. However, based on the current outlook I believe that Mastercard will continue its streak of posting double-digit growth every year. The “other revenues” or services segment will be the main growth engine going into the future, and could potentially even overtake revenues from payment transactions.

Nobody knows how long the current bear market will last. The only thing we can control is buying great businesses at great prices. I think that now is a good moment to add some growth to your portfolio by picking up shares of Mastercard.

Be the first to comment