Hispanolistic/E+ via Getty Images

Whether it be a home or some sort of commercial property, the fact of the matter is that real estate these days is often incredibly complex. Although requirements vary from property to property, most require some sort of plumbing and many utilize paints, stains, primers, and other related products. One company that specializes in these sorts of offerings is Masco (NYSE:MAS), with perhaps its most popular brands being Easy Drain and Behr. In prior years, the general trajectory for the company had been positive. And even into the current fiscal year, some data has been quite nice. Shares of the company are also not overly priced at this moment. But this doesn’t mean that the company makes for a strong investment opportunity. All things considered, you still want shares of the firm to be more or less fairly valued, especially if you believe that everything related to real estate is going to pull back or slow down because of recessionary fears and the prospect of further interest rate increases. Overall, I would say that the company makes for a solid ‘hold’ prospect at this time.

Painting a picture

Back in February of this year, I wrote an article about the investment worthiness of Masco. In that article, I acknowledged that the company had done well to grow both its top and bottom lines in recent years, even though performance had been hurt on the bottom line in 2021. On the whole, I felt that the company was set up for long-term success, but relative to similar firms, shares of the enterprise look to be a bit lofty and, on an absolute basis, were either fairly valued or slightly below that point. At the end of the day, I ended up rating the company a ‘hold’. When I do this, it is my way of saying that the company should more or less match the broader market for the foreseeable future. So far, my call has not been that far off. While the S&P 500 has dropped by 4.5%, shares of Masco have generated a decline of 7.4%. This is still worse than I would have anticipated based on my rating, but not by much.

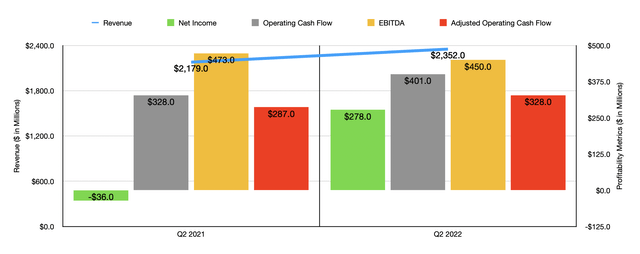

Author – SEC EDGAR Data

Given this return disparity, you might think that the fundamental condition of Masco has worsened. For the most part, however, that has not been the case. To see what I mean, we need only look at the most recent financial performance available. In the second quarter of its 2022 fiscal year, the company generated a revenue of $2.35 billion. That’s 7.9% higher than the $2.18 billion generated the same time one year earlier. According to management, this increase was driven pretty much entirely by two factors. First and foremost, higher net selling prices across the entire company increased sales by 10% for the quarter. The company also benefited from higher sales volume for its plumbing products and paints, as well as other coating products, the increased sales to the tune of 2%. On the other hand, foreign currency fluctuations hit the firm and the company suffered from lower sales volume of lighting and builders’ hardware products. A small divestiture also impacted sales, but only marginally so. Performance in the second quarter followed even stronger growth in the first quarter that, when combined, resulted in sales for the first half of the year of $4.56 billion. That’s 9.7% above the $4.15 billion generated in the first half of 2021.

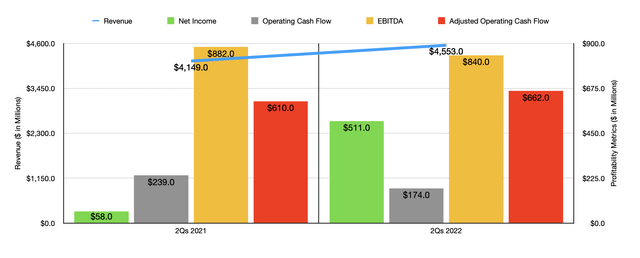

Although the company has been plagued by inflation and supply chain issues just like many other firms, it has successfully passed along most of its increased costs to its customers. This can be seen by looking at recent profitability figures. Net income in the second quarter of this year, as an example, came in at $278 million. That compares to the $36 million loss the company reported one year earlier. This is slightly misleading, however. I say this because, in the second quarter of 2021, the company incurred a settlement loss of $406 million. This involved pretax actuarial losses that were reclassified out of accumulated other comprehensive income associated with the termination of the company’s qualified domestic defined benefit pension plans. Without this, profits in the second quarter of 2021 would have been higher than they were the same time this year. Naturally, this has had the impact of harming earnings last year for the full six-month window we are looking at compared to the same window of time this year. Net income of $58 million that year pales in comparison to the $511 million experienced so far in 2022.

Author – SEC EDGAR Data

Of course, we should also pay attention to other profitability metrics. In the latest quarter, for instance, operating cash flow came in at $401 million. That’s up from $328 million reported the same time last year. If we adjust for changes in working capital, it still would have risen, climbing from $287 million to $328 million. At the same time, however, EBITDA fell from $473 million to $450 million. When it comes to the first half of the year, operating cash flow is weaker than it was one year earlier, falling from $239 million in the first half of 2021 to $174 million this year. If we adjust for changes in working capital, it would have risen modestly from $610 million to $662 million. At the same time, EBITDA fell from $882 million to $840 million.

For the 2022 fiscal year as a whole, management has not provided very much in the way of guidance. They do think that earnings per share will be between $4.19 and $4.29, with adjusted earnings per share coming in slightly lower at between $4.15 and $4.25. If we take the midpoint of expectations here for the adjusted earnings, we should anticipate net income of $947.2 million. No guidance was given when it came to the other profitability metrics. But if we assume that those would change to the same degree that earnings should, then we should anticipate operating cash flow of $737.3 million and EBITDA of $1.11 billion.

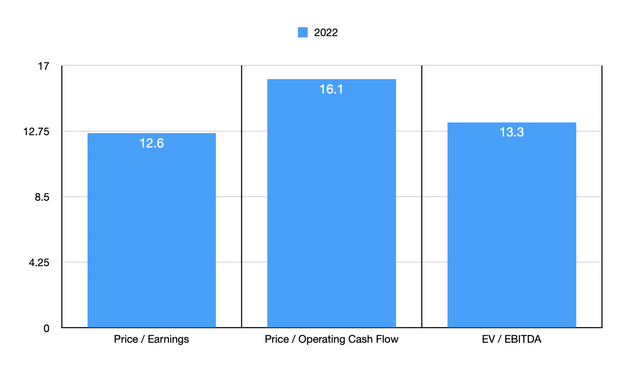

Author – SEC EDGAR Data

Taking this data, it’s pretty easy to value the company. On a forward basis, the firm is trading at a price-to-earnings multiple of 12.6. The price to operating cash flow multiple is 16.1, while the EV to EBITDA multiple should come in at 13.3. To put this in perspective, I compared the company to five similar firms. On a price-to-earnings basis, these companies ranged between a low of 4.3 and a high of 21.3. Using the price to operating cash flow approach, the range was between 3.2 and 29.6. In both cases, three of the five companies were cheaper than Masco. Using the EV to EBITDA approach, the range was from 2.7 to 14. In this case, four of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Masco | 12.6 | 16.1 | 13.3 |

| Advanced Drainage Systems (WMS) | 21.3 | 27.8 | 14.0 |

| Builders FirstSource (BLDR) | 4.4 | 3.5 | 3.8 |

| Simpson Manufacturing (SSD) | 13.9 | 3.2 | 9.7 |

| Owens Corning (OC) | 7.0 | 4.6 | 4.7 |

| Insteel Industries (IIIN) | 4.3 | 29.6 | 2.7 |

Takeaway

All things considered, the picture for Masco doesn’t look as favorable for the long run. Shares are not exactly cheap but they aren’t expensive either. I can certainly understand why investors would buy into the company. But given where it’s priced relative to similar players and considering the difficulties that might face the infrastructure market, I do think that there might be better opportunities to be had elsewhere. This is even in spite of the fact that management recently engaged in a $500 million accelerated share repurchase program under its $2 billion share buyback program from 2021. This alone is a great move for shareholders, but the stock is not yet cheap enough given current market conditions and I feel that there could be better opportunities to be had on the market as a result.

Be the first to comment