Hispanolistic/E+ via Getty Images

Published on the Value Lab 12/6/22

Masco (NYSE:MAS) is a pretty easy to understand company for anyone that does DIY. Silicones, paints, varnishes and finishings for things in the house, but also plumbing products like sinks and showers, are all pretty non-discretionary parts of the house. If you need to touch up the grouts with silicone, or the waterproof paints are chipping, or if there something wrong with your sink, you’ll get these fixed rather urgently. We like the remodeling and renovation market, as well as the focus on end-of-cycle building in the newbuild housing markets. Yes, there’s a slowdown coming, one that’s mostly already here, but Masco looks alright with even negative FX effects likely to see some reversals. Still, it’s not super exciting – a hold.

Q3 Comments

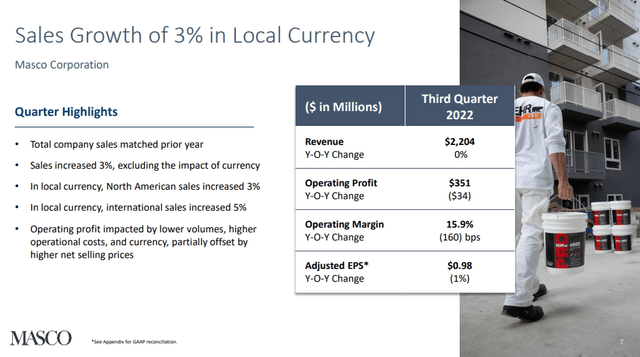

The story of Masco is currently one of declining volumes. Consumer spending is contracting a little on these products, while revenues still manage to grow thanks to the effect of pricing initiatives. Headwinds on the topline in addition to volumes were pressures from FX effects. The appreciation of the dollar impacted the intake in dollar terms from European markets. There was -3% pressure from FX alone, and overall growth was around 3% excluding those effects. Volume declines of 6% were the issue, and pricing of 9% was what saved the company from revenue declines.

Headline Figures (Q3 Pres)

Revenue in Europe was flat, but despite this the local currency growth in the international segment was about 5%. This was coming from emerging geographies like India and the Middle East, but also China despite their economic woes. Operational cost inflation was mostly in material costs but also in freight. Both should see some declines in Q4, especially freight, which may help operating profit figures withstand more order slowdowns that the company expects to proceed into Q4.

POS and incoming orders slowed more than expected late in the third quarter across most of our product categories, and we anticipate this slowdown to continue into the fourth quarter. In the third quarter, we also experienced higher operational costs, mostly in plumbing that will continue into the fourth quarter.

Once scale is recovered in volumes, the picture should markedly improve as MAS is subject to meaningful operating leverage.

Bottom Line

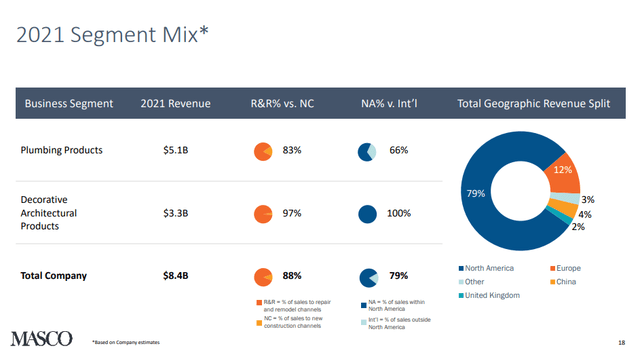

What a lot of companies are focusing on nowadays is their R&R exposure, or exposure to remodeling and renovation markets, because these are generally seen as more resilient. In the case of MAS, their exposure is pretty significant.

R&R Exposure (Q3 Pres)

This is good because housing starts are not doing very great at all, and while unfinished inventories were very high at the beginning of the year, sustaining demand for finishings, that pent-up demand will be exhausted. R&R exposure is a good thing, and the relatively non-discretionary nature of some of their products is satisfying for the prudent investor.

MAS isn’t commodified with a 15.9% operating margin, and we don’t expect free-fall of profits, but we do agree with the analysts saying about MAS: it’s not a question of quality, but one of momentum. There are things with real secular tailwinds that are cheap right now, and a relatively less cyclical company at a reasonable multiple of a little below 10x EV/EBITDA isn’t top priority for the intrepid allocator. It’s a hold for now.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment