South_agency/E+ via Getty Images

Investment Thesis

MRVL 5Y Stock Price

Marvell Technology, Inc. (NASDAQ:MRVL) has been absolutely destroyed in the past year, with it falling by -51.47%, losing an eye-watering sum of $36.87B in Enterprise Value YTD. Its current levels marked its previous support level over the past two years as well, potentially testing the bottom over the next week.

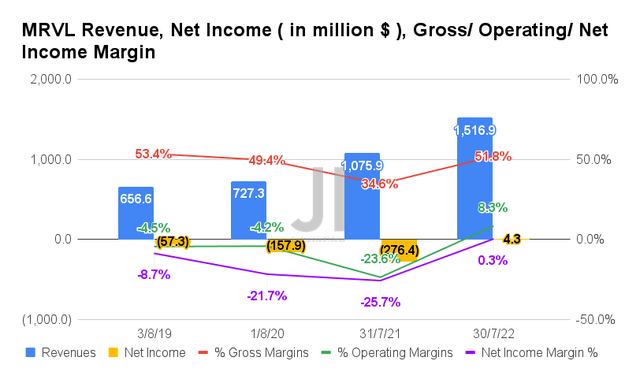

S&P 500 Index 5Y Performance

Assuming that most of the pessimism is already baked in, we may see MRVL recovering from current levels, with the S&P plunge somewhat moderating by now. Only time will tell, since the latter has tragically plunged by -23.96% YTD, breaking a new bottom from previous June lows. Thereby, erasing much of its pandemic gains, to Mr. Market’s chagrin.

The upcoming September CPI by early October would also provide the key indicator for the stock market’s recovery, given the Fed’s projected terminal rate of 4.6% by 2023. This indicates a potential 75 basis point hike in November, with January 2023 possibly bringing a more moderate 50 basis point hike. Therefore, we may speculatively assume that the winds of positive change are soon here. Let’s see.

MRVL’s Aggressive Investments Will Pay Off By H2’23

In FQ2’23, MRVL reported revenues of $1.51B, gross margins of 51.8%, and operating margins of 8.3%, representing tremendous YoY growth of 40.98%, 17.2, and 31.9 percentage points, respectively, despite the global inflationary issues. Naturally, the company reported improved profitability, with net incomes of $4.3M and net income margins of 0.3% in the latest quarter, indicating an impressive increase of 98.46% and 26 percentage points YoY, respectively.

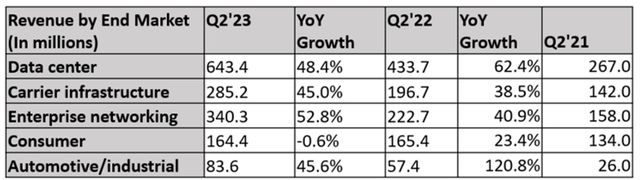

MRVL Revenue By End Market

If we were to study its revenues further, it is evident that MRVL reported tremendous growth across most of its end markets, notably in the data center segment accounting for the lion’s share of its sales at 42.41% in FQ2’23. Other end markets, such as carrier infrastructure and enterprise networking, continued to report accelerating YoY growth at 45% and 52.8% in the latest quarter, respectively.

Naturally, MRVL’s automotive/ industrial segment has reported an inevitable deceleration, given the global supply chain issues impacting multiple automakers’ outputs thus far. There is still chronic chip tightness reported by General Motors (GM) in FQ2’22, with 95K vehicles valued at approximately $5.7B undelivered due to missing components. Ford (F) is similarly impacted, with 45K vehicles delayed worth up to $2.25B during its early FQ3’22 report.

With the consumer segment experiencing a demand destruction, we may expect an easing of manufacturing capacity, potentially triggering improved delivery numbers for MRVL’s automotive segment over the next two quarters. That end market may also be revealed as a strong revenue driver in the intermediate term, since the global EV market is projected to grow tremendously from $246.7B in 2020 to $1.31T by 2028 at a CAGR of 24.3%.

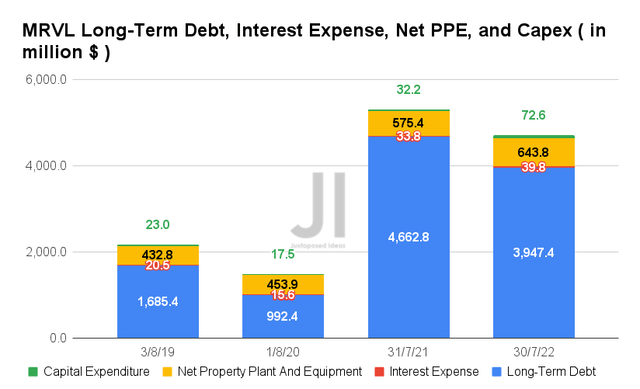

In the meantime, it is evident that MRVL is aggressively ramping up its capabilities, with $225.15M of capital expenditure reported in the last twelve months (LTM). It indicates a massive increase of 209.01% sequentially. Naturally, this has boosted the growth of its net PPE assets by 11.88% YoY to $643.8M in the latest quarter. There will also be additional capacity coming on board, given its aggressive $3B commitment over the next few years, indicating an immense growth of 15-fold from the management’s previous guidance of $200M in FY2022.

Thereby, ensuring MRVL’s continued relevance through 2026, as the global data center market size grows by $615.96B at a CAGR of 21.98%, significantly aided by North America’s insatiable demand accounting for 35% of the market’s growth over the same period. Impressive indeed, no matter the temporarily worsening macroeconomics, with the 5G market is also expected to surpass $1.87T in market value by 2030 at an accelerated CAGR of 44.63%. Naturally, these aggressive investments would eventually be top and bottom lines accretive to MRVL’s performance.

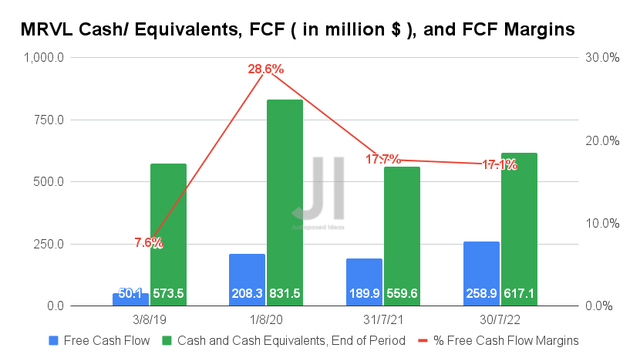

In the meantime, approximately $653.50M of MRVL’s long-term debts will be maturing within the year. However, we are not overly concerned, given the robust Free Cash Flow (FCF) generation reported in the LTM at $912.14M.

Furthermore, MRVL continues to impress with improved FCF generation of $258.9M and an FCF margin of 17.1% in FQ2’23, representing a remarkable increase of 36.33% and relatively in line YoY, respectively. With a war chest of $617.1M of cash and equivalents on its balance sheet, the company appears well poised for sustained growth and expansion once the macroeconomics improves by H2’23.

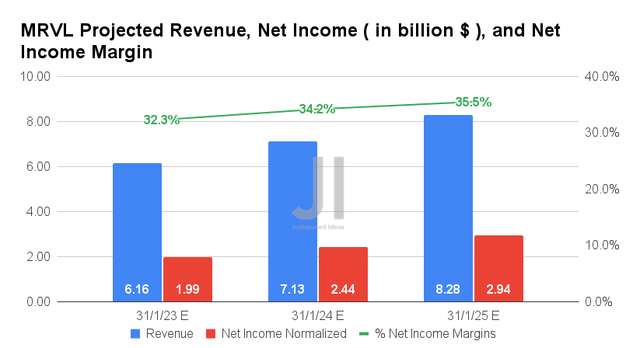

Over the next three years, MRVL is expected to report revenue growth at an impressive CAGR of 22.9%, while reporting sustained profitability from FY2023 onwards. It is evident that Mr. Market is very optimistic about its forward execution, given the massive improvement in its net income margins from -9.4% in FY2022 to 35.5% by FY2025. We shall see.

Meanwhile, MRVL is expected to report revenues of $6.16B, net incomes of $1.99B, and net income margins of 32.3% for FY2023, indicating tremendous growth from 38.11%, 573.8%, and 41.7 percentage points YoY, respectively. Nonetheless, since their FQ3’23 guidance was slightly shy of estimates’ expectations, the stock had plunged by -21.21% in the weeks post Q2 earnings. This sentiment is ridiculous indeed, given the impressive projected YoY growth. However, we cannot ignore the significance of Mr. Market’s pessimistic outlook as well, due to the Fed’s hawkish commentary and worsening geopolitical issues pulling down the stock market as a whole. Oh well.

So, Is MRVL Stock A Buy, Sell, or Hold?

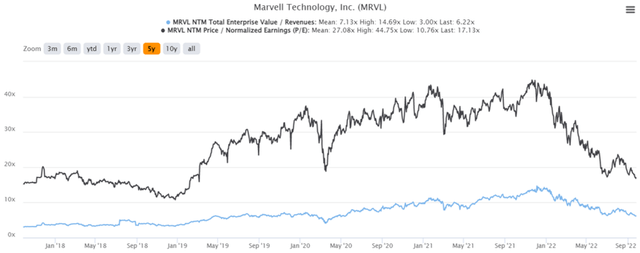

MRVL 5Y EV/Revenue and P/E Valuations

MRVL is currently trading at an EV/NTM Revenue of 6.22x and NTM P/E of 17.13x, lower than its 5Y mean of 7.13x and 27.08x, respectively. The stock is also trading at $43.40, down -53.75% from its 52 weeks high of $93.85, nearing its 52 weeks low of $41.07. Nonetheless, consensus estimates remain bullish about MRVL’s prospects, given their price target of $73.33 and a 68.96% upside from current prices.

We are cautiously optimistic that adding at current levels looks attractive enough for those with a long-term trajectory. Naturally, only suitable for those with higher risk tolerance and a resilient stomach for more volatility over the next few months. Otherwise, conservative investors may potentially wait a little longer, with the risk of missing these near-bottom levels.

Be the first to comment