ArtistGNDphotography/E+ via Getty Images

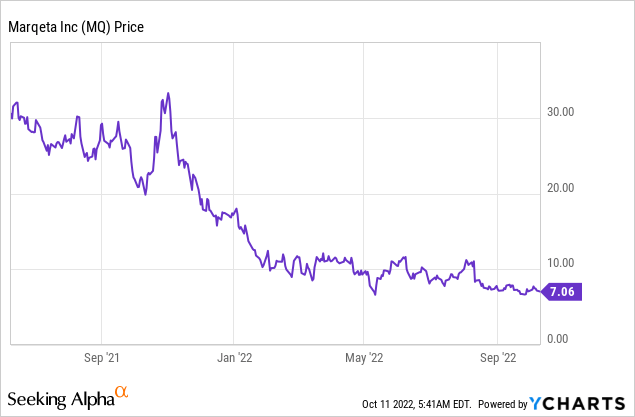

Marqeta (NASDAQ:MQ) is a leading fintech disrupter that specializes in card issuing. The company had a fanfare IPO in June 2021 and its share price reached a peak of $31 per share. But since that point the stock price has plunged but over 76%. This decline was mainly driven by high inflation and rising interest rate environment which has compressed the valuation multiples of all growth stocks. From a fundamental perspective, Marqeta has continued to perform well beating both top and bottom-line financial estimates in the second quarter of 2022. Marqeta has won new customer accounts such as Western Union and continued to grow its existing customer accounts with businesses such as Uber. In addition, the company is poised to benefit from the growth in the fintech industry which is forecasted to grow at a rapid 19.8% compound annual growth rate [CAGR], reaching a value $332.5 Billion by 2028. In this post I’m going to breakdown the business model, financials and valuation, let’s dive in.

Business Model

In my previous post on Marqeta I covered its business model in great detail, here is a brief overview, with new updates. Marqeta is a modern card issuing and processing platform. Traditional card programs can be time-consuming to create, rigid and expensive. Marqeta solves these problems with its Open API (Application Programming Interface) platform which allows fintechs to customize and granularly control how their card-issuing program works. A key example is the “Red Card” used by “Dashers” at DoorDash who are a Marqeta customer. These delivery drivers can have their virtual cards loaded up with Just in Time [J.I.T] funding tailored to a specific location or Merchant ID. So let’s say a customer orders a delivery from Restaurant A for $30. The card can be tailored to load up the card with funds and enable payment “just in time” at Restaurant A only. This has many benefits which include; reducing fraud (delivery drivers can’t go and buy a 6 pack of beer), Improved business cash flow, and greater user experience. Other well-known customers of Marqeta include Fintech giant Square now Block, Coinbase, Klarna, JP Morgan and more.

Marqeta (Investor Presentation)

Recently (October 2022) Marqeta has announced a deeper partnership with Uber for its Uber Pro Card. Working with Mastercard and Branch, the Uber Pro card offers a loyalty program tailored to drivers and couriers. The program offers up to 10% cashback on fuel and up to 12% on EV charging. The card also comes with a business checking account, which enables drivers to keep their cash in the ecosystem.

Marqeta makes its money with a “usage based” model which takes a small fee from the payment processing volume. The company also charges platform access fees, Tokenization and Fraud detection services. The company has recently expanded its credit platform to include over 40 new credit APIs, these enable customers to design, test and launch credit card experiences.

Growing Financials

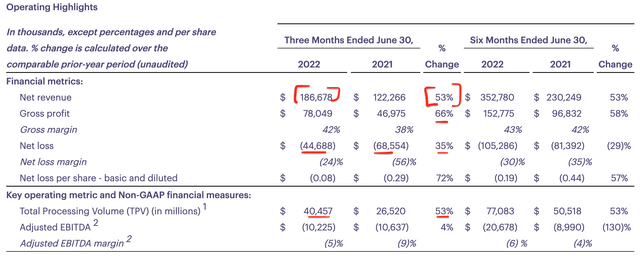

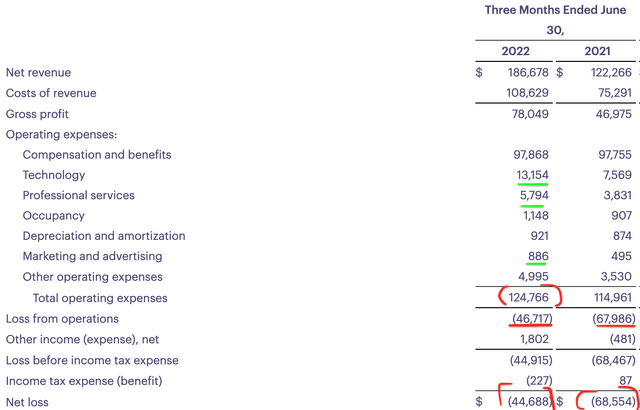

Marqeta generated strong financial results for the second quarter of 2022. Revenue was $186.68 million, which beat analyst estimates by $6.53 million and increased by a blistering 53% year over year.

This was driven by a vast increase in Total Processing Volume [TPV] which rose to $40 billion, up 53% from the $27 billion in the equivalent quarter last year.

Marqeta Financials (Q2 Earnings Report)

The company scored a few major wins in the second quarter which included a partnership with international payment transfer giant Western Union in Europe. This partnership involves integration with Western Union’s new multi-currency, multi-platform digital wallet. Marqeta will offer physical and virtual debit cards to connect with this. Western Union has a $5 billion market capitalization and thus this is a significant account win for the company.

Marqeta was also named as the payment processor of choice by Mastercard for a transit program in New South Wales, Australia. This enables customers to plan, book and pay for this transport directly via mobile. The use case opens up a range of new possibilities for the company to move into alternative verticals, expanding the business’s Total Addressable Market.

Back to the financials, Gross Profit popped by a rapid 66% year over year to $78 million, up from $47 million in the equivalent quarter last year, driven by the aforementioned tailwinds. The company did report an operating loss of $46.7 million, but this was an improvement over the negative 68 million generated in the second quarter of 2022. Losses can worry many traditional valuation investors, but in this case, I don’t believe it is an issue as the company is in scale-up mode. The business had a 9% increase in operating expenses, but this was mainly driven by increased investments in its technology and marketing, which isn’t a bad sign in my eyes. The company’s largest expense is $97.9 million in compensation and benefits. But again I don’t believe this is a major issue, as the company proudly invests in its people.

Adjusted EBITDA was negative $10 million in the second quarter of 2022, which was pretty much flat year over year.

Management believes the current valuation has been disconnected from the long-term opportunity the business has. Therefore the board has recently authorized share buybacks of up to $100 million. The business has a fortress balance sheet with $1.7 billion in liquidity and total debt of just $14 million, thus is in a strong position moving forward.

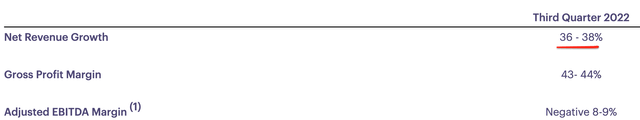

Moving forward management is guiding for healthy net revenue growth of between 36-38% in the third quarter of 2022. With a gross profit margin of between 43-44%.

Advanced Valuation

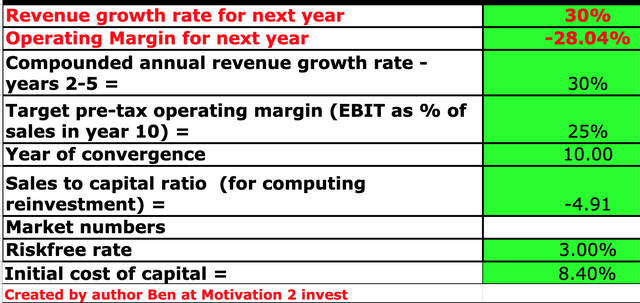

In order to value Marqeta, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 30% revenue growth for next year and 30% per year over the next 2 to 5 years.

Marqeta stock valuation 1 (created by author Ben at Motivation 2 Invest)

As Marqeta scales, I forecast the business’s technology investments to pay off and signs operating leverage to start to show up. Therefore I forecast the business to see its operating margin jump substantially from -28% to +25% over the next 10 years. In the world of technology, 10 years is a long time, for example, Marqeta was founded in 2010, so is just 12 years old. In order to improve the accuracy of the valuation, I have capitalized the business’s R&D expenses.

Marqeta stock valuation 2 (created by author Ben at Motivation 2 Invest)

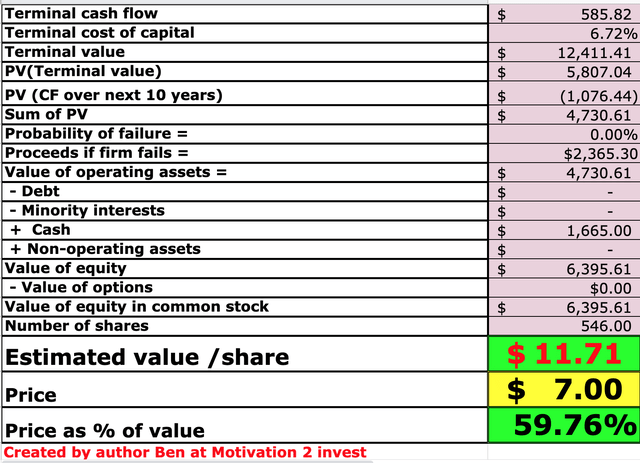

Given these factors, I get a fair value of $11.71 per share, the stock is trading at just $7 per share at the time of writing and thus is ~40% undervalued.

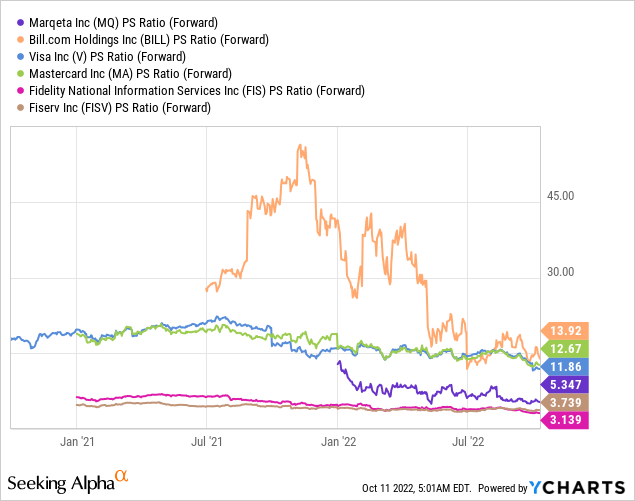

As an extra data point, Marqeta trades at approximately 2.4 times its cash or liquidity position which is fairly cheap. The business also trades at a Price to Sales ratio = 5.35 which is cheaper than historic levels. Compared to fintech peers, Marqeta trades at the low end of the valuation spectrum. It is much cheaper than incumbent financial network providers such as Visa and Mastercard. However, it is slightly more expensive than fintech companies such as Fiserv, which trades at a PS ratio = 3.7.

Risks

Recession/Lower Consumer Spending

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. This makes complete sense given high inflation increases the input costs for businesses and often price increases are passed onto shareholders. In addition, inflation of energy, food, and mortgage servicing costs squeeze the average consumer and often drive down discretionary spending. Most fintech payments companies make their money from total payment volume, therefore less volume equals less profits.

Competition

Marqeta is a provider of virtual card programs but they are not the only player in this market. Payments giant Stripe also offers virtual card issuing, as does Adyen the Netherlands-based fintech company. Marqeta is known as not the cheapest provider, but I believe the fact the company specializes in this service could be a key selling point. In addition to its ability to scale programs internationally rapidly.

Final Thoughts

Marqeta is a fast-growing fintech company that is poised to help businesses evolve their business model. The company has a large total addressable market and is trading at a cheap valuation both intrinsically and relative to history. I do expect some pain in the short term as macroeconomic conditions act as a headwind against the business. But long term I forecast the company to benefit from the secular growth trends in fintech and payments.

Be the first to comment