cemagraphics

So far, the 2022 fiscal year has been rather awful for MarketWise (NASDAQ:MKTW). While the broader market is down considerably, shares of this enterprise have plunged by nearly 75%, driven not only by economic concerns but also by true pain the company is experiencing on both its top and bottom lines. Some investors may view this as an opportunity to buy into the company. But with no end in sight and its extremely volatile financial history making it difficult to value, the best rating that I can assign the company at this time is a highly speculative ‘hold’. The upside here could be tremendous. At the same time, however, the amount of upside associated with this investment is certainly commensurate with the risk that investors in the firm are assuming.

MarketWise – A niche business

To view MarketWise as a single enterprise would be a mistake. Instead, investors should view the firm as a holding company for multiple other businesses that are dedicated to the premium financial research, software, education, and self-directed investment tools space. One thing that holds all of these companies together though it’s the fact that they largely rely on subscriptions in order to generate revenue. Collectively, the company does this through the 12 primary customer-facing brands at its disposal that collectively offer 42 free products and 135 different paid products. There are a number of examples I can point to.

For instance, the TradeSmith brand offers its customers a full suite of portfolio management software tools that help individual investors to manage their portfolios using algorithms to backtest results. Under the Altimeter brand name, the company provides a user-friendly database that shows uniform, accounting-based financial summaries on more than 5,400 companies. Chaikin Analytics, a more recent acquisition, provides a portfolio of software and analytical tools for those in the registered investment advisor market. Some of the company’s other offerings focus on alternative investments, such as cryptocurrencies and options. Financial research companies that the firm owns also include Casey Research, Palm Beach Research Group, and more.

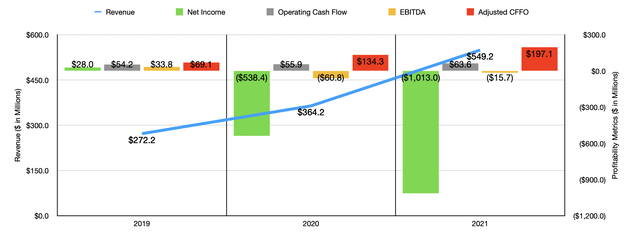

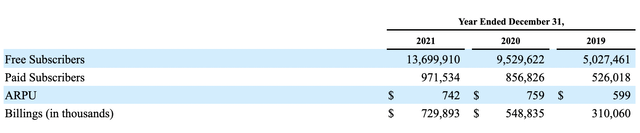

Over the years, MarketWise has done pretty well for itself from a revenue perspective. To see what I mean, we need only look at results over the last three fiscal years. Back in 2019, revenue for the company came in at $272.2 million. This jumped to $364.2 million in 2020 before rising further to $549.2 million in 2021. Substantially all of this revenue growth during this window of time was, according to management, organic. That’s great to see because it demonstrates just how strong demand for the company’s core offerings happened to be. This rise in revenue came as a result of two key factors. For starters, the number of paid subscribers on the company’s platform shot up from 526,018 to 971,534. The second driver was an increase in ARPU from $599 to $742. It’s also worth to note by the way that during this three-year window the number of free subscribers on the platform also increased, surging from 5.03 million to 13.70 million. And on top of that, billings for the company increased nicely, climbing from $310.1 million to $729.9 million. This is indicative of stronger demand as time goes on, acting essentially as a leading indicator for investors.

Although the revenue trajectory for the company has been positive through 2021, profits for the firm have been problematic. Due in large part to significant amounts of stock-based compensation, the company went from generating a profit of $28 million in 2019 to generating a loss of $1 billion last year. Fortunately, there are other profitability metrics that we could pay attention to. For instance, during that same three-year window, operating cash flow for the company went from $54.2 million to $63.6 million. There’s also another measure that management uses called adjusted CFFO (cash flow from operations). The difference between this and traditional operating cash flow is that the company adds back profits distributions to certain unit holders included in stock-based compensation and they also add back non-recurring expenses. Using this approach, the company went from generating cash flow of $69.1 million to $197.1 million. At the same time, however, other metrics worsened. For instance, EBITDA went from $33.8 million in 2019 to negative $60.8 million in 2020. Then, in 2021, it still came in negative, but this time to the tune of $15.7 million.

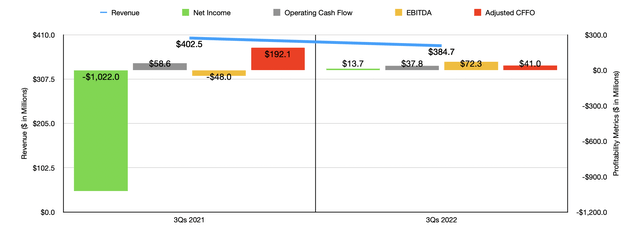

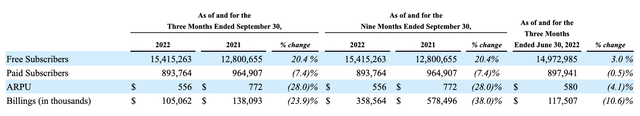

If this bottom line uncertainty were the only problem, I would probably find myself incredibly attracted to the company. But data since the end of 2021 has not looked so favorable. In the first three quarters of this year, revenue came in at $384.7 million. That’s down from the $402.5 million reported the same time one year earlier. Although this 4.4% drop on its own is bad to see, the biggest pain for the company came in the third quarter that management just reported. Sales that are dropped by 14.8% year over year, declining from $140.7 million to $119.9 million. While the drop in the latest quarter was painful, it was in line with what analysts were anticipating. Although the company saw the number of free subscribers on its platform climb from 12.8 million in the third quarter of 2021 to 15.4 million the same time this year, the number of paid subscribers actually dropped from 964,907 to 893,764. On top of this, the ARPU for the company also suffered, plunging from $772 to $556. And on top of that, billings for the company plunged from $138.1 million to $105.1 million in the third quarter, with billings in the first nine months of the year as a whole coming in at $358.6 million compared to the $578.5 million one year earlier. The billings are particularly painful because they are a sign of future revenue for the business.

Management attributed these pains to a few different factors. For instance, the reduction in total paid subscribers was driven by a combination of decreased overall consumer engagement as the economy reopened in the middle of 2021 and to an outsized new subscriber cohort from the first quarter of 2021 yielding additional churned subscribers the same time this year. General economic malaise also played a role, with some of that pain being offset by 16,000 additional paid subscribers that joined the company’s list as a result of the Winans Media transaction the company completed in the third quarter of this year. Pricing, meanwhile, weakened thanks to lower billings caused by economic concerns and the fact that any new subscribers coming on to the platform largely gravitated toward lower price point, entry-level offerings.

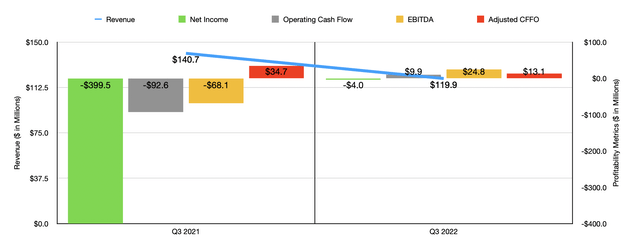

Profits for the company have also been volatile during this time. Yes, the firm’s bottom line went from a loss of $399.5 million in the third quarter of 2021 to a loss of only $4 million at the same time this year. But for the first nine months as a whole, the company’s profit of $13.7 million beats out the $1.02 billion lost in the first three quarters of last year. Although the results seen in the third quarter did mark a significant improvement, the loss per share that the company generated of $0.17 missed the $0.09 per share profit that analysts anticipated. As the charts in this article demonstrate, other profitability metrics have been all over the place. In the latest quarter, for instance, operating cash flow of $9.9 million beat out the $92.6 million cash outflow experienced the same time last year. But using management’s adjusted figure, cash flow dropped from $34.7 million to $13.1 million.

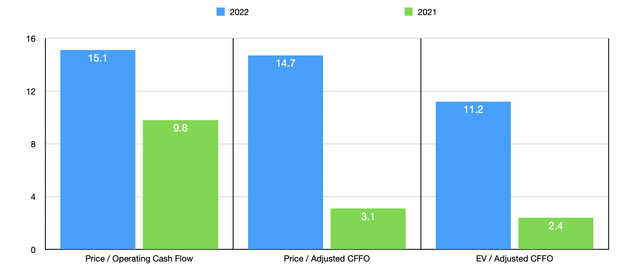

Truth be told, valuing a company like MarketWise is no easy task. The extreme volatility experienced by the company makes any sort of realistic assessment unreliable. What we do know is that overall risk for shareholders in the near term is low. I say this because the firm has no debt on hand. But it does have cash and cash equivalents of $147.2 million. If we were to take the few metrics that are positive, shares don’t look ridiculously priced at least. The price to operating cash flow multiple for the company, using data from 2021, comes in at 9.8. Though if we annualize results experienced so far this year, our forward estimate would come in at 15.1. Following this same approach, the price to adjusted CFFO that management calculates should be 14.7. That’s up from the 3.1 reading that we get using data from last year. And finally, the EV to CFFO multiple for the company, used because EBITDA itself is negative, should be 11.2 compared to the 2.5 reading that we get using data from last year.

Takeaway

Truth be told, MarketWise is one of the more volatile companies I have seen in a while. There is no real trend when it comes to profitability outside of operating cash flow and management’s modified version of it. Using this data, the company does not look unreasonably priced whatsoever. And because of that, a return to growth could lead to some really attractive results for shareholders. But this does not come without risk. While the company’s cash position gives it something to work with, in effect drastically reducing risk in the near term, the firm is experiencing pain because of broader economic concerns and the absence of stability in the past makes the future even more uncertain. Because I recognize the turnaround potential here, I cannot in good faith rate the company any lower than a ‘hold’. But at the same time, any sort of upside will be on the back of significant volatility and operational risk to shareholders.

Be the first to comment