Are we out of the Woods? gremlin/E+ via Getty Images

Brian Dress, CFA — Director of Research, Investment Advisor.

For most of 2022, investors of all types have been under siege and there’s been really nowhere in the market to hide. However, in the month of July, markets appear to be firming up and investor sentiment is beginning to improve.

We are now squarely into earnings season, which we always tell you is our favorite time of the investing calendar. We heard this week from Netflix (NFLX), Tesla (TSLA), Bank of America (BAC), and Goldman Sachs (GS), among many others. In last earnings season, we saw monumental pullbacks in many stocks, especially those forced to guide down expectations for future quarters. In the early days of this earnings season, we have started to see a slightly different pattern emerge. In today’s letter, we will examine whether this change is durable and what that means for investors in the second half of 2022. Put simply, we will seek to answer the question: “Are We Out of the Woods?”

The last week of trading has been one of the strongest for the year, with the S&P 500 advancing by more than 5% on the week, along with the tech-heavy NASDAQ and the small-cap Russell 2000 both advancing by more than 7% in the last five days of trading. This is not the first time we have seen a rally this year and the ones previously turned out to be false dawns. However things do feel slightly different now than they did before.

At Left Brain we are beginning to come out of our defensive crouch just slightly, as we think we are nearing the peak in a number of negative indicators like inflation and pessimistic investor sentiment. By no means are we jumping in to the market with both feet, but we do think it is becoming more favorable for investors to put some of their cash back to work.

If we accept the premise that markets are starting to find footing, the question then becomes “what stocks are the right ones to purchase?” This week we watched some of the most downtrodden shares, especially the pre-profit hypergrowth type stocks, outperform the broader market. There is certainly a temptation for investors to try to play catch up by buying the high flying top performers of 2020 and 2021 at what appear to be “bargain” prices. We think this is not the best course of action for a sustainable portfolio recovery. In the section entitled “Our Bounce Back List”, we will propose to you a general concept of how to position over the coming few years, while highlighting a particular stock that we think fits the criteria.

With that all being said, let’s get into it!

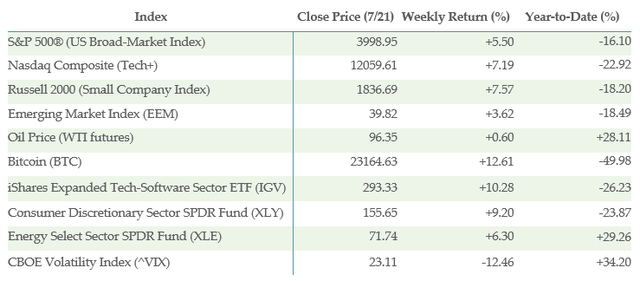

Below is the performance data of key indices, exchange-traded funds (“ETFs”) for the five trading days between 7/14/22 and 7/21/22:

Left Brain Investment Research, Yahoo! Finance

What is/is not Working?

Ten of the S&P 500’s 11 sectors advanced for the last 5 days of trading, which shouldn’t be surprising, considering that the overall market was so strong. The leadership came from two of the weakest sectors of 2022: Consumer Discretionary (Retail) and Information Technology. Additionally, we saw similar strength from the energy sector, which has been the best performing sector of 2022, but has been profoundly weak over the past 2 months. We view these as “risk on” market moves.

On the other hand, the one sector that fell over the past week was the Utility sector, which fell nearly 2% for the week. We also saw significant underperformance from the Consumer Staples sector, which gained just 0.1%, compared to the 5%+ for the S&P 500. This is a rough indicator that investor sentiment is shifting away from the “safe” sectors toward riskier assets, at least for this week.

Those investors who have interest in cryptocurrency will know that 2022 has been an absolute disaster in that space. As we take a look at our list of best performing ETFs this week, it is absolutely dominated by crypto-related funds, including First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT), Bitwise Crypto Industry Innovators ETF (BITQ), and Grayscale Ethereum Trust (ETH), all of which were up by 20%+ over the five days covered by this letter. We continue to monitor developments in the crypto space, but we are, by no means, proponents of that asset class, especially given the extreme volatility.

The main “risk on” indicators were the big winners this week, including ARK Innovation ETF (ARKK), Invesco NASDAQ Internet ETF (PNQI), Renaissance IPO ETF (IPO), and First Trust Cloud Computing ETF (SKYY). It is good to see that these “risk on” indicators are doing well and that development is a positive for the overall market and investor sentiment. However, we caution investors and remind them that we have seen similarly sharp rallies in these indicators earlier in 2022, all of which were eventually erased. In fact, as we write this letter on Friday, we are already seeing downside reversals in many of these same ETFs, which gives a bit more credence to our thought that investors should be cautious chasing upticks in these types of stocks.

Before we move to the worst performing ETFs, we want to point out one other strong performer this week. The United States Natural Gas Fund, LP (UNG) increased in value by more than 11% over the past week.

Among the worst performing ETFs this week were mostly the inverse/hedging ETFs that bet against the market, which is to be expected given how strong the market was this week.

Some of the weakest performance came from the high-quality bond space, especially in the municipal bond arena. We saw a more than 2% drop in the Pimco Municipal Income Fund (PMF) and we note that among our worst 20 performing ETFs, four were in that munis category.

One other most dropped ETF that we found interesting was the appearance of the Invesco DB US Dollar Index Bullish Fund (UUP). The U.S. dollar has been profoundly strong over the last couple months, driven by a hawkish Federal Reserve board and relative weakness of other economies around the globe. This has weighed heavily on commodity-related sectors, as those commodities are all denominated in U.S. dollars in global markets. We will continue to monitor the direction of the US dollar as it relates to other global currencies. A weaker dollar could actually provide support to U.S. multinational equities. As we have heard in the early days of earnings season, many U.S.-based multinationals have faced headwinds to their profitability due to the rise in the value of the U.S. Dollar.

Earnings Review

Earnings season is the most important time in the investing calendar, as it provides us with the opportunity to hear directly from corporate management about the direction of their businesses. It is especially important now in this time of great economic turmoil, as we need to learn how companies are coping with inflation and other challenges, and whether they are able to retain pricing power to maintain profitability in the face of rising costs.

This week, earnings season began in earnest as it usually does, with the financials. Reporting this week were Bank of America (BAC), Charles Schwab (SCHW), and Goldman Sachs (GS). The general tenor from these banks was that they are continuing to brace for potential recession on the horizon, but that this has not yet translated into significant credit losses. As a result, we saw mostly positive action in the financials as a whole, which were ahead by roughly 7% in the five days covered by this letter. Especially positive was the reaction to the Goldman report, in which CEO David Solomon communicated that profits were higher for the business, particularly driven by growth in the firm’s Global Markets division. GS shares were as much as 25% higher this week. Predictably, with the markets sharply lower in 2022, the investment banking business is slow at all of these institutions. We don’t expect that trend to change much until the market for IPOs, mergers and acquisitions, and the like, improves.

We did get to hear from Tesla (TSLA) this week. Supply chain challenges are still something they are working through over at Tesla, but they seem to be coping much more effectively with them than almost any other industrial manufacturer. We continue to be impressed at the ability for this company to overcome challenges and continue growing at a marvelous pace. Shares were up by 10% in Thursday’s session, but we remain cautious on this company, mainly due to the drama that surrounds superstar CEO Elon Musk and the still quite high valuation on shares of the business.

In earnings season, we are always looking for trends that jump out at us. In last quarter, we saw a number of extremely negative reactions to earnings reports, with some stocks falling by 25%+ after reporting their earnings releases. One memorable example of this phenomenon is Netflix (NFLX), whose shares dropped nearly 50% in the weeks after releasing earnings in April 2022. So far (it’s still early), we have seen fewer of these dramatic drops, with the most obvious exception being the drop in Snap (SNAP) shares in the after-hours on Thursday evening.

We are seeing a slightly different response to earnings so far this quarter. Take, for instance, Bath & Body Works (BBWI), which pre-announced a downward revision to both second quarter and full year sales and profit guidance. This was clearly very bad news for the struggling retailer, however the stock has rallied by more than 15% in the few days since the announcement.

Take also the example of Netflix (NFLX), which reported its earnings on Tuesday. CEO Reed Hastings reported a loss of 1 million subscribers, which seems like very negative news. However, this did come in above the extremely pessimistic guidance for a loss of 2 million subscribers. The stock has rallied sharply since this report was filed and the company held its conference call.

Our takeaway, particularly from the market’s reactions to bad news from both BBWI and NFLX, is that we may be approaching a bottom in investor sentiment. Investors are beginning to look past bad news and purchase presumably heavily discounted shares. Let me emphasize, we are not calling a bottom in anything, but when we see stocks respond positively to negative news, we think we are on the horizon of better days ahead. We will see if the trend continues as the earnings season continues to unfold.

Our “Bounce Back” List

We speak with investors on a daily basis. The main theme that comes through to us is that they are ready to put money to work and find a way to catch up after a horrible first half of the year. We understand that sentiment and we are sympathetic to the desire to get account statements back to their highs as quickly as possible. We do think that is a potential recipe for disaster. After all, we want to be long-term investors, so the right play now is to look for stocks we think have the potential to outperform over the next 3-5 years, not the next 3-6 months.

There are a few characteristics we are looking for in our “bounce back” list, which we have been developing in house over the past few weeks. As always, we want to be looking for companies that have accelerating fundamentals, both in their sales and in their profits. Relatedly, we are looking for companies that are actually delivering profits and free cash flow, as we think the market will continue to shun companies that lose money, particularly if the economy falls into recession. Finally, and we think most importantly, is that we think investors are likely to make most of their returns from multiple expansion in the medium term, especially if economic growth proves to be sluggish. This means we are looking for companies with price/earnings multiples less than 20.

We wanted to share with you one company that fits the bill for us and that is InMode Ltd. (INMD). InMode is an Israel-based healthcare company that sells products for minimally invasive cosmetic medical procedures. These procedures tend to be less dangerous than conventional plastic surgery and have shorter recovery times associated. One of our analysts, Madhu Chaudhry, gave this stock the “green light” all the way back in Summer 2021, when the stock was trading in excess of $110/share.

Fast forward to today and the shares trade just below $30/share and at a market cap of just over $2 billion. However, the company is still growing quite rapidly, with sales growth in excess of 60% annually. InMode delivered nearly $200 million in Free Cash Flow over the last 12 months, so the company is solidly profitable. We also like the state of the balance sheet, as the company has virtually no debt and has more than $400 million in cash on hand. Finally, the cherry on this sundae is the fact that the shares trade at a trailing price/earnings multiple of just under 14x at the current stock price.

We continue building a list of stocks like INMD, the types of businesses that we think can benefit both from profit growth and multiple expansion, as we seek to reposition portfolios for potential outperformance over the coming 3-5 years.

Takeaways from this Week

Markets are beginning to show signs that they are near a bottom, but we remain cautious. We think there is a specific profile of business that is likely to do well over the coming 3-5 years. We encourage investors to try and think past just the next few months and trying to play catch up and, rather, reorient their thinking to take advantage of low stock prices, to purchase stocks that can outperforming in the long run.

Earnings season is upon us and we are heartened in the early days that investors are starting to respond more favorably to earnings releases, even when the news isn’t so great. The strength we saw in both BBWI and NFLX shares is strong evidence of this. We will be watching in the next few weeks if the pattern continues, in which case we will become more constructive on the direction of this market.

Be the first to comment