Market Intro

SA: 12:40PM EST

For those hoping that the worst of the volatility is behind them, then Wednesday’s follow through in global equities (ACWI) leaves more room for encouragement than yesterday’s throttle higher.

Major US indexes (SPY, DIA, QQQ, IWM) are up between around 1.5 – 4.7 percentage points. Ultimately the surest cure for high vol levels is a gradual diminishing of daily reads, and not simply days that happen to feature large gains rather than large losses.

Major European indexes (EWG, EWQ, EWU, VGK) enjoyed gains of between 1.5 and 3.75 percent.

Thoughts on Volatility

One of last week’s great financial casualties were the mortgage REITs.

To some extent, the recent demise of the mREITs is a highly accelerated version of how brick-and-mortar stores were going to find themselves out of business due to the rise of the internet.

Of course, to some extent that has happened; who would have guessed that companies such as Macy’s (M) would be pushed to the brink of bankruptcy while book-sellers like Amazon (AMZN) would trade at $1T valuations?

Segments of the market such as mREITs become an “experts-only” sector in circumstances such as those we currently find ourselves:

- The sector makes considerable use of leverage

- Government aid, direct and/or indirect, may or may not be on the way

- Investors need to have some sense of how they are going to bow out if losses become too intense – huge volatility levels require more disciplined risk management

The larger point is to not simply trade headlines – be they positive or negative in nature. Furthermore, taking on heightened sector risk in known high-risk categories requires more than a little advanced planning. Simply buying something because it is cheap and/or it’s going up is likely to end in tears in this market.

Huge market gains are not repudiations of high vol levels, but rather verify that such readings are well justified.

Implied vol relates to the pricing on options. Massive launches higher, and the prospects for more of the same, make call options quite valuable to buy and quite dangerous to sell.

VIX futures may also float with an augmented sense of independence in relation to the spot VIX, which is priced on SPX options. As such, vol products may exhibit non-intuitive behavior in relation to what is happening directly in the S&P index.

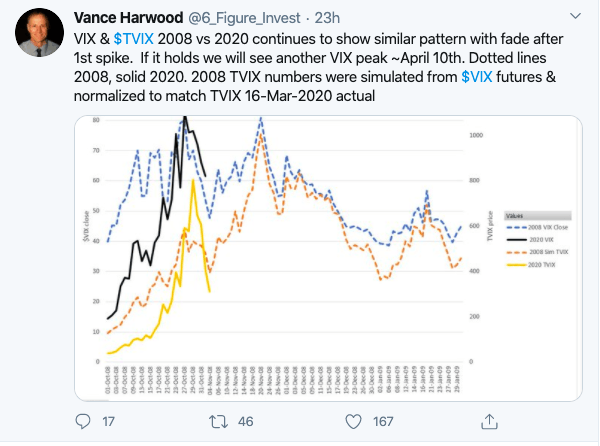

I appreciate visuals like this. We do need to take into account that the cause of this crisis is largely different from the GFC of 2008. Beyond that, the stimulus has been larger, more coordinated between nations, and more immediate. So there is a case to be made that this bounce in equities (and perhaps decline in the VIX) is going to be more accentuated than observed patterns from the prior existential crisis to capital markets.

Still, my heartfelt appreciation goes to Vance for posting this visual, because it should remind capital participants to not get too caught up in the “worst-is-behind-us” narrative that is starting to enjoy some prominence.

Term Structure

Thank you MM.

The comment speaks to the reality that we’re going to get some economic data soon enough. Earnings season should be an eye opener. Investors will be looking for hard figures that are cash-flow and economic in nature, rather than anecdotal accounts and projections about how long the virus will continue to take its human, emotional, and economic toll.

There simply is more uncertainty facing the global economy today than there was two months ago. No amount of stimulus makes that go away. The dynamics of what caused the VIX to hit some particular level (such as 80) can of course come into play in the short run.

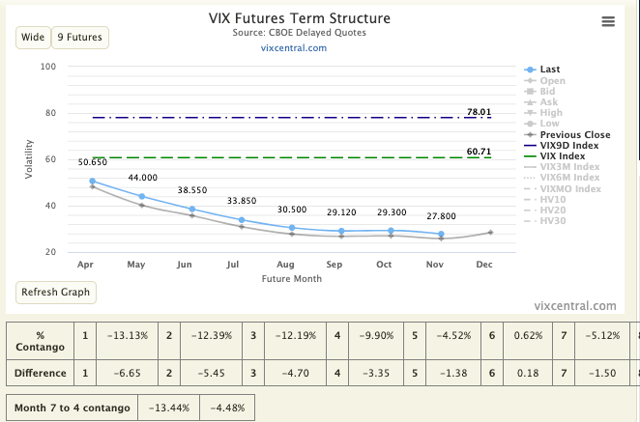

I want to draw attention to the fact that the VX futures curve is mildly declining. As discussed yesterday, vol shorts are facing a strong headwind in the form of roll decay here (about 16% or so).

VIX9D is actually not that far off from the 80’s levels posted by the 30-day VIX measure as described by Market Mechanic in his post cited above.

For those looking for a vol drop-off, there’s definitely room to hold that view. But the vols are still on the high end, and we need to consider the (encouraging) “low” levels on the VX front-month contract with the obscenely high prints on the short-term VIX9D measure.

Wrap Up

If this is your first time reading Market Volatility Bulletin, thanks for giving it a try. If you’re a regular, I thank you for your ongoing contributions in the comments section.

Thank you for reading. Please consider following.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment